**PRO** Macro Investors (BONUS SECTION)

November 2, 2024 BONUS >> 6 Investment Opportunities >> Consumer Confidence Surges, Job Openings Are Declining, U.S. GDP Growth Slows Slightly, European Inflation Steadies at 2%

💡 New on Macro Mornings? Start here

🎯 This is part of a series designed for PRO investors who want real-time updates on macroeconomic news through my advanced insights. Feel free to catch up on previous emails here if you'd like to start from the beginning!

📢 Macro Investors (BONUS SECTION AT THE END)

⚡ Consumer Confidence Surges – A Potential Driver for Holiday Season Spending?

On October 29th, the Consumer Confidence Index surged to 108.7, a level we hadn’t seen in quite some time.

This unexpected boost above the forecasted 99.5 isn’t just a number - it’s a sentiment, a sense of optimism coming directly from U.S. consumers.

When confidence hits these levels, as we saw in 2018 and early 2020, it often translates into increased spending, which can fuel market rallies, particularly in retail and consumer goods sectors.

Back then, this surge in confidence drove quarterly returns in the S&P 500’s consumer discretionary stocks up by an impressive 5-6%.

If this sentiment carries through to the holiday season, we might see a similar trend, offering intriguing potential for stocks like those in the Consumer Discretionary ETF (XLY).

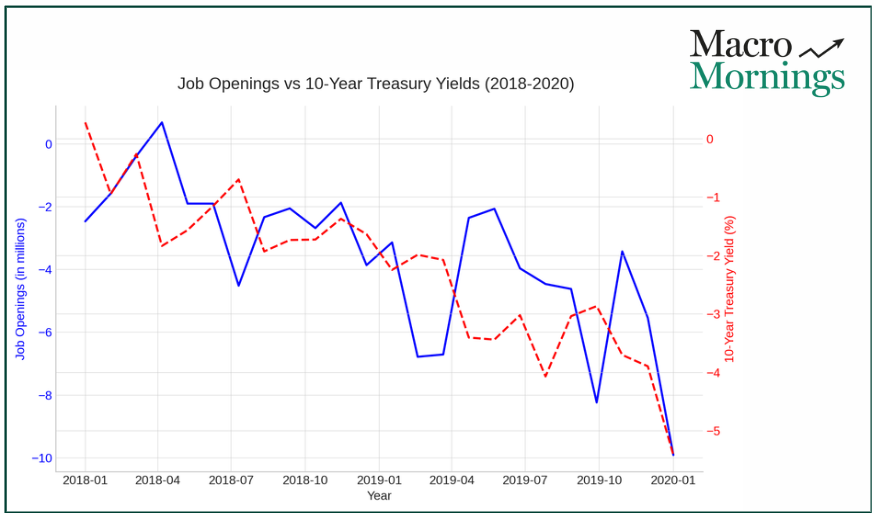

🧠 Job Openings Are Declining – Is the Labor Market Cooling Off?

At the same time, the latest JOLTS report tells a different story.

Job openings dropped to 7.443 million, well below both last month’s 7.861 million and the 7.980 million forecast.

This drop could be an early sign that the labor market is cooling, potentially setting the stage for a slowdown in wage pressures.

Interestingly, the last time we saw job openings slip like this back in 2019 the bond market reacted by pulling down long-term yields as investors anticipated a more cautious Fed.

The 10-year Treasury yield, for example, fell by around 30 basis points over the next quarter as the market began pricing in a softer labor outlook.

If this trend continues, we may see similar moves in bond prices and yields, particularly as the Fed evaluates its next steps.

💥 U.S. GDP Growth Slows Slightly – A Hint of Deceleration

This week’s GDP report showed a growth rate of 2.8% for Q3, slightly under the anticipated 3.0% and down from Q2’s 3.0%.

While this isn’t a dramatic slowdown, it’s enough to catch the attention of investors who remember similar scenarios in 2019.

Back then, quarterly growth slowed to around 2.8% as well, and the S&P 500 reacted by posting more modest gains about 1.5% in the following quarter particularly in cyclical sectors like manufacturing and construction.

This deceleration suggests we could see some cooling in these sectors, with investors potentially reassessing their exposure to more economically sensitive areas of the market.

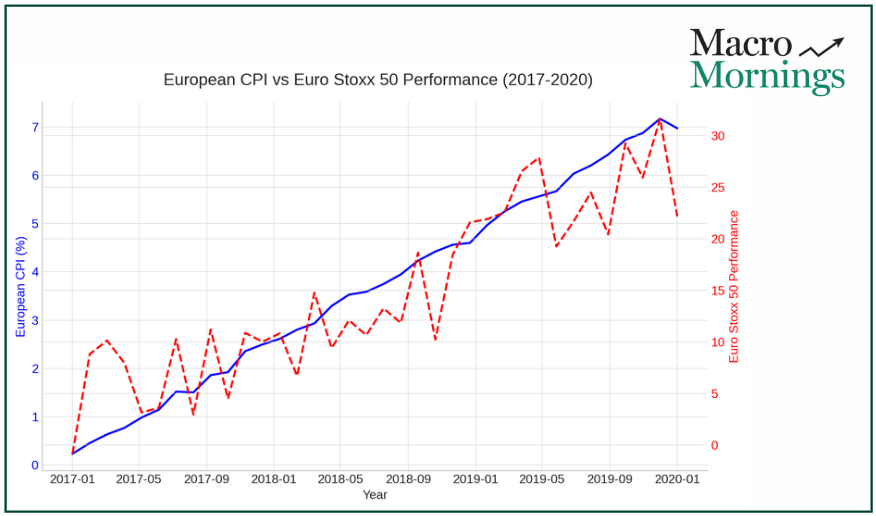

💡 European Inflation Steadies at 2% – A Positive Signal for the Eurozone

In Europe, inflation data for October showed the CPI at 2.0%, just above forecasts.

While modest, this figure is an encouraging sign of stability for the Eurozone economy, especially compared to the more volatile inflation rates we’ve seen over the past few years.

When inflation steadies around this level, as it did back in 2018 and 2021, European equities have historically benefited.

The Euro Stoxx 50, for example, posted average returns of 3-4% per quarter during similar periods.

Additionally, the euro itself has tended to strengthen against the dollar, reflecting renewed confidence in the European economy.

We might see the same dynamic play out if inflation remains stable, offering a potential tailwind for euro-denominated assets.

🔥 Core PCE Holds Steady in the U.S. – A Signal for the Fed?

The Core PCE Price Index rose by 0.3% M/M in September, bringing the Y/Y rate to 2.7% a stable reading that aligns closely with the Fed’s target.

This level of inflation, while moderate, echoes similar conditions seen in 2020 when the Core PCE hovered around 2.5-3%.

During that period, growth stocks thrived, with the NASDAQ Composite delivering quarterly gains of 5-6% as investors anticipated lower-for-longer interest rates.

If the Core PCE remains stable, it could provide ongoing support for equities, particularly in tech and growth sectors that benefit from a stable inflation outlook and steady monetary policy.

🚨 Initial Jobless Claims Dip – Strength in the Labor Market?

This week, initial jobless claims fell to 216K, a surprising show of strength that stands in contrast to the decline in job openings.

When jobless claims remain low, it’s a sign of resilience in the labor market, as seen in 2019 when claims hovered near similar levels.

Back then, this strength supported a strong dollar, with the U.S. Dollar Index (DXY) rising by around 2% over the quarter as investors felt confident in the U.S. economy.

At the same time, low claims typically signal more spending power, which can boost sectors like consumer discretionary and housing.

🔔 Manufacturing Data Sends Mixed Signals – Rising Costs Amidst Contraction

Manufacturing data this week was a mixed bag.

The ISM Manufacturing PMI came in at 46.5, indicating contraction, while the Prices Index jumped to 54.8, signaling rising input costs.

When manufacturing shows signs of contraction like this, as it did in 2015 and 2019, it often leads to underperformance in industrial stocks, with the S&P 500 Industrials sector returning only around 1% quarterly on average.

Additionally, these conditions often drive down commodity prices, particularly oil, as a weaker manufacturing sector typically signals softer demand.

In the past, PMI contractions have led to a 5% drop in oil prices within a couple of months, a trend worth watching if manufacturing output continues to wane.

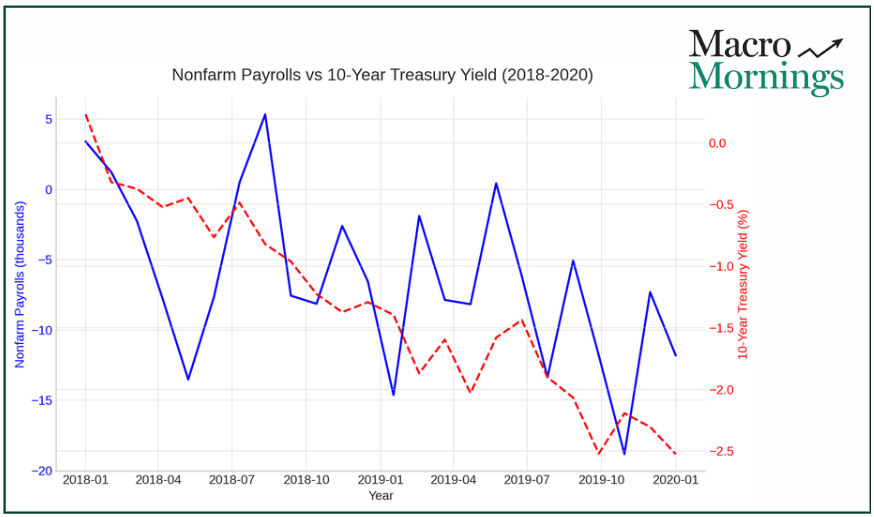

💎 Nonfarm Payrolls and Unemployment Rate – Signs of Labor Market Shifts

Nonfarm payrolls showed minimal growth at just 12K, far below last month’s 223K increase, while the unemployment rate ticked up to 4.1%.

Unemployment rates above 4.0% have often foreshadowed economic slowdowns.

In 2008 and 2019, similar increases in the unemployment rate coincided with shifts in the bond market, as investors sought safety in Treasury securities.

Following these rises, the 10-year Treasury yield typically declined by 30-40 basis points within a quarter, reflecting a cautious sentiment around economic growth.

If we continue to see signs of labor market weakness, bond prices may rise as yields decline.

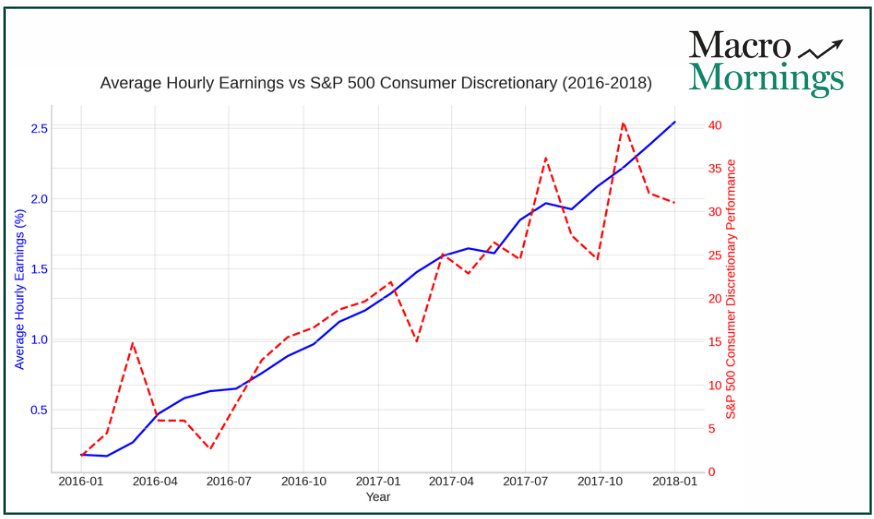

✍ Wage Growth Stagnates – A Break for Inflation?

Finally, average hourly earnings showed no growth this month, holding flat at 0.4%.

This stagnation could help alleviate some of the inflationary pressures that the Fed has been carefully monitoring.

During previous periods of flat wage growth, like in 2016, we saw labor-intensive sectors such as retail and hospitality benefit, with the S&P 500 Consumer Discretionary sector posting average gains of 2.5% over the next quarter.

Meanwhile, stable wages tend to favor bond markets, as lower inflation expectations often lead to steady or declining yields.

Back in 2016, for example, flat wage growth helped push the 10-year Treasury yield down by around 15 basis points over the following month.

BONUS SECTION: 6 Investment Opportunities

As I analyze these data points, it’s clear that the markets are brimming with potential opportunities for those of us with a keen eye for macro shifts. Let's explore some sectors and assets that, given recent trends, may be primed for growth or offer solid hedging potential.

1️⃣👉 The boost in consumer confidence has me looking closely at consumer discretionary sectors.

For those who see sustained confidence as a driver for retail spending, the Consumer Discretionary Select Sector SPDR Fund (XLY) could be worth considering.

In times of high confidence, this ETF often benefits from increased consumer activity. If the trend holds, XLY might capture the potential of a stronger-than-expected holiday season.

2️⃣👉 Job openings are falling, signaling potential cooling in the labor market.

This has led to more cautious Fed policies, which in turn, affect bond yields.

For those looking to hedge against possible rate cuts or to diversify into fixed income, the iShares 20+ Year Treasury Bond ETF (TLT) could be a solid choice.

As yields fall, long-term bonds typically gain, providing both stability and growth potential in times of economic cooling.

3️⃣👉 GDP growth slowing slightly opens opportunities in non-cyclical sectors.

In moments like these, where economic expansion might moderate, the Utilities Select Sector SPDR Fund (XLU) often shines.

Utilities offer a reliable income stream and tend to hold up well during slower growth periods.

If defensive sectors are on your radar, XLU is a strong contender.

4️⃣👉 With European inflation stabilizing, I’m also paying attention to the euro.

A stronger euro could be on the horizon if inflation remains within the ECB’s comfort zone, drawing investor confidence in Eurozone assets.

This shift could make the EUR/USD pair an interesting play for those who believe in the resilience of the European economy.

Alternatively, the Invesco CurrencyShares Euro Trust (FXE) provides a direct exposure to the euro's movement against the dollar.

5️⃣👉 The manufacturing PMI data hints at weaker demand, which historically impacts oil.

For those anticipating downward pressure on energy prices, a commodity ETF like the United States Oil Fund (USO) could be a way to capitalize on lower oil prices.

If demand indeed softens, USO might see declines, making it a potential hedge for portfolios sensitive to energy prices.

6️⃣👉 Finally, stagnant wage growth could relieve some pressure on inflation, particularly for labor-intensive sectors.

This environment could benefit sectors like housing and consumer goods, which rely heavily on controlled costs.

For a broad consumer goods play, the Vanguard Consumer Staples ETF (VDC) provides exposure to companies likely to benefit from stable wage trends.

🚦 These are just ideas, of course, but in a market as dynamic as this, staying nimble and reading the data can make all the difference. Let’s keep our eyes open, leverage what we know, and stay positioned to capitalize on these macro shifts as they unfold.

Best regards,

Alessandro

Founder of Macro Mornings

Discover the Trends That Matter - VIP One-on-One Session for My Insiders

📈 As a valued member of my community, gain exclusive insights and a direct discussion with me to stay ahead of market moves. This is your chance to fully utilize your knowledge!

🏆 Don’t miss this unique opportunity: let’s discuss the latest macro developments and how to leverage them. What does this mean for you? Being part of a select group turning insights into action.

🚀 Don’t miss the chance for tailored guidance. In a dedicated session, we’ll analyze the macroeconomic landscape together, highlighting what really matters for your investment decisions.

📅 Reserve your session here → https://calendar.app.google/DFNQvEkH9C6k8Wfu6

I’M EXCITED TO HAVE YOU ON BOARD, BECOME MY FRIEND

💎 Get your Mentorship FREE here

🎙 PODCAST

Disclosure

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. This material has been prepared for informational purposes only. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

I follow Steve Miller (Ask Slim) who says that TLT is likely in a rising phase and oil will be declining over the next several weeks. XLY had a significant rally and it looks like not as good of a risk-reward entry at this point.