🔔 Macro Thoughts in 25 Charts

Investing, Treasury, FED, Earnings, GDP, S&P 500, Performance, Germany, Market expectations, Small Caps, Insurance, India, Recession...

Dear all,

Welcome to "Macro Thoughts," your essential guide to navigating the financial markets.

Each week, I gather the most insightful and visually compelling charts, breaking down key trends and providing my critical thoughts, all in one email.

By distilling the most important data, I save you time while delivering unparalleled value that helps you stay ahead of market movements.

If you find this work valuable and it enhances your ability to understand and anticipate market shifts, consider supporting Macro Mornings with a donation.

As well, some of you asked how can one support my work which is really kind of you 💖!. Therefore, it would highly appreciated if you would support the Macro Mornings research. A donation/tip can be done via the following button:

The structure with the table of contents and key highlights can be enjoyed already. Feel free to jump to your favorite section as each has at least one dedicated take-away, yet I recommend following this order 👇👇👇

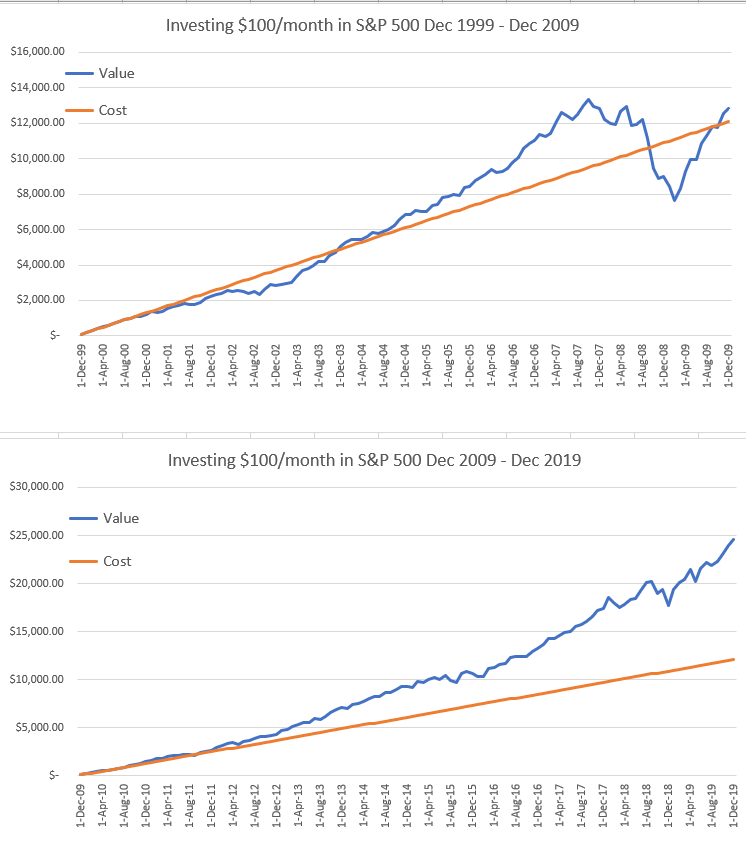

🔔 Investing $100/month in S&P 500 Dec 1999 - Dec 2009

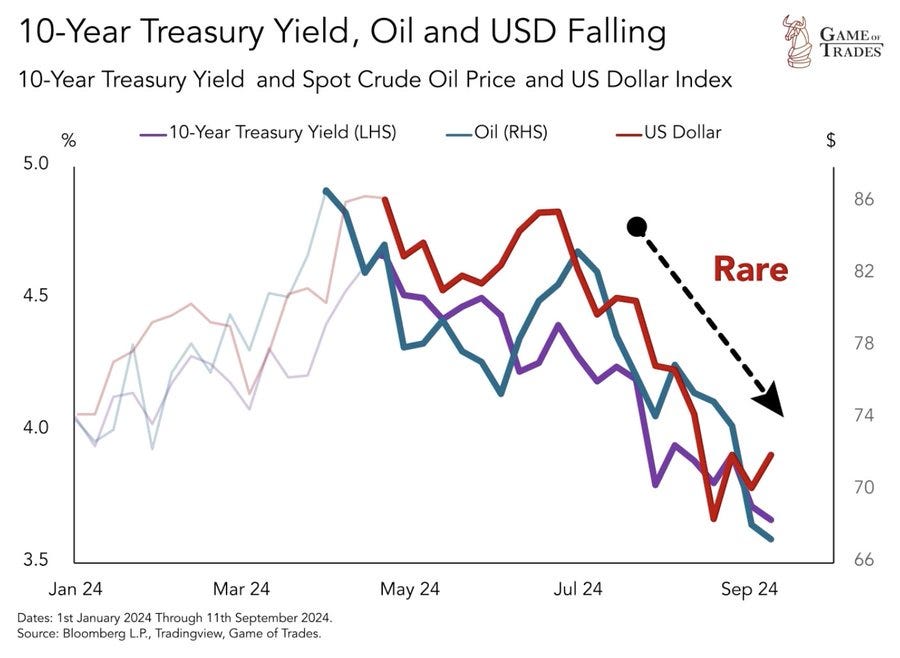

🔔 10-Year Treasury Yield, Oil and USD Falling

🔔 The S&P 500 is officially up a whopping 19.5% year-to-date

🔔 India has officially surpassed China

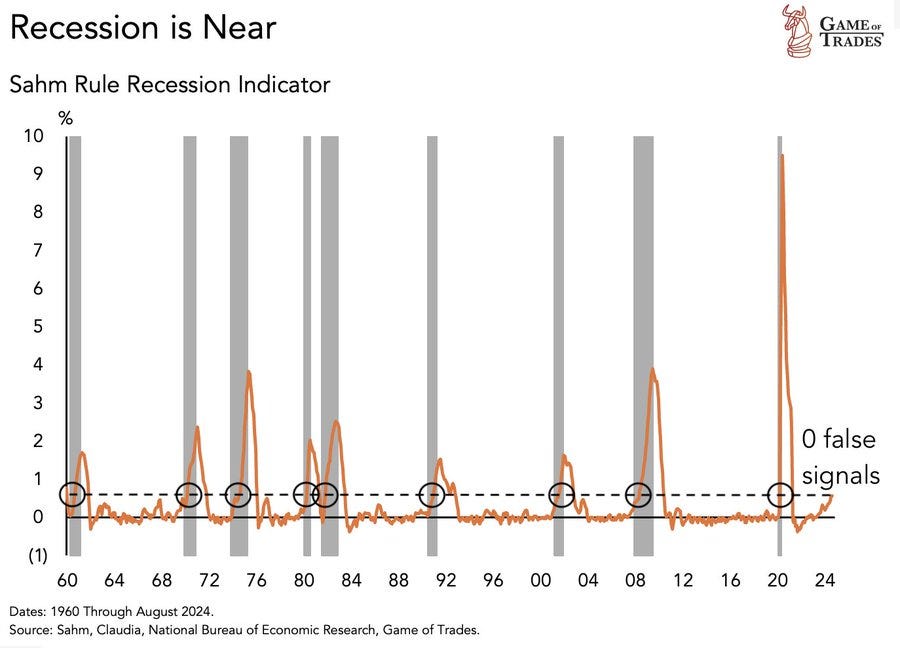

🔔 The Sahm Rule has been triggered

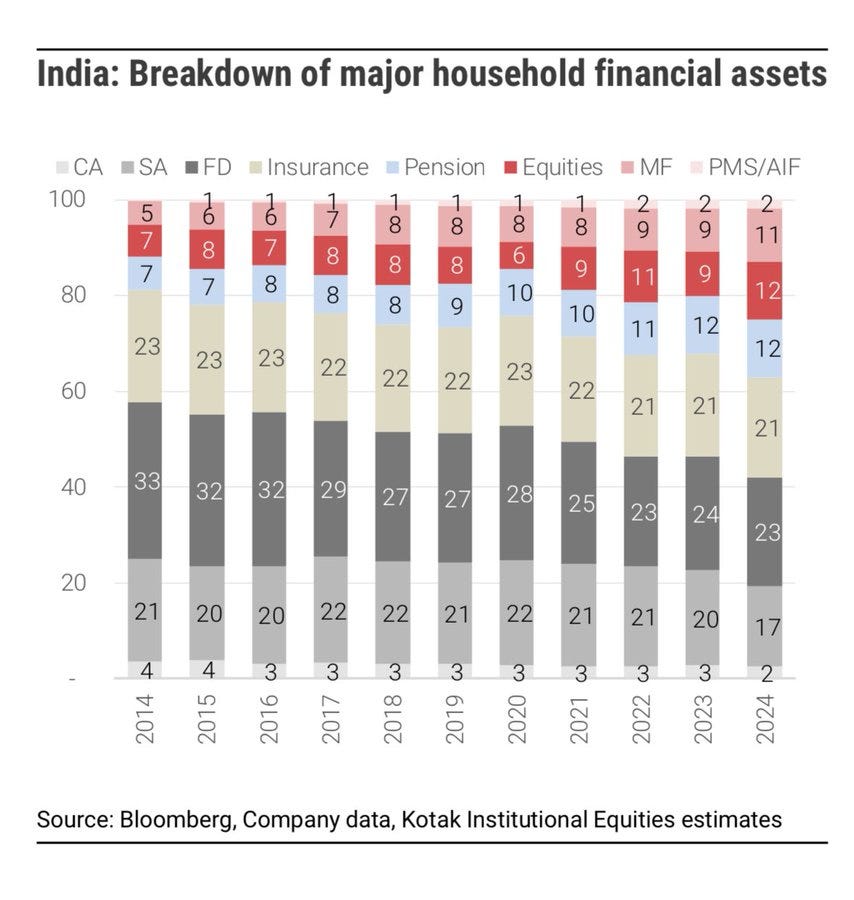

🔔 India: Breakdown of major household financial assets

🔔 Historical FED Rate Cut Cycles

🔔 Credit card defaults are rising at record levels

🔔 Earnings expectations for AI stocks now lag the market

🔔 FED is coming down the mountain

🔔 Its NOT just a Mag-7 stock market anymore

🔔 US car insurance costs spiked by 15% in the first half of 2024 to $2,329

🔔 GDPNow “nowcast” model from AtlantaFed down to +2.9% for 3Q2024

🔔 Current tech labor market is horrible

🔔 Small Caps Spike Post FED Cut

🔔 US government debt market collapse has started

🔔 The federal government has a huge spending problem

🔔 The S&P 500 just crossed above 5,700 for the first time

🔔 Recession is coming

🔔 Atlanta Fed's GDPNow forecast is now nearly 3%

🔔 Number of All Time Highs

🔔 S&P Performance After Cuts Within 2% Of ATH

🔔 Germany Consensus GDP Forecast

🔔 Remarkable price action in US rates after a surprise 50 bps cut

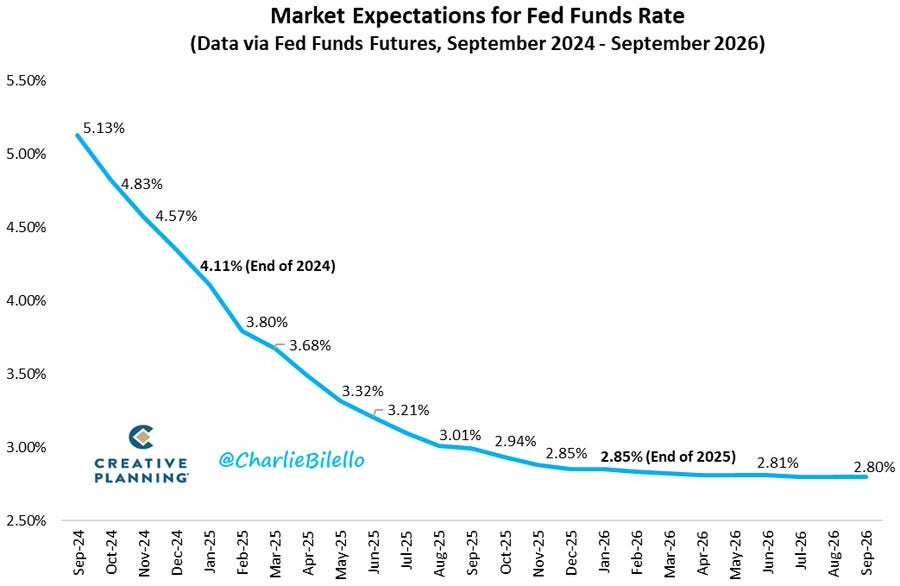

🔔 Current Market expectations for Fed Rate Cuts

🔔 Investing $100/month in S&P 500 Dec 1999 - Dec 2009

An investor who put $100/month into S&P 500 starting in Dec 1999 every month Would have been worth $12,842 by Dec 2009.

Another investor who put $100/month into S&P 500 starting in Dec 2009 every month Would have been worth $24,605 by Dec 2019.

👉 Macro Mornings Thoughts: Dollar-cost averaging is powerful, but market context plays a decisive role in the returns we see.

This example reminds us that while long-term investing is key, the entry point can make a significant difference.

It’s also a clear reflection of how market cycles, like those of the 70s or the post-Great Depression years, heavily influence outcomes.

🔔 10-Year Treasury Yield, Oil and USD Falling

US Dollar, Oil price, Bond yields are all crashing together

👉 Macro Mornings Thoughts: During the 2008 financial crisis, we saw similar movements as global demand collapsed, forcing oil prices down by nearly 70%, while bond yields plummeted as investors sought safety, and the US Dollar weakened amid aggressive monetary easing.

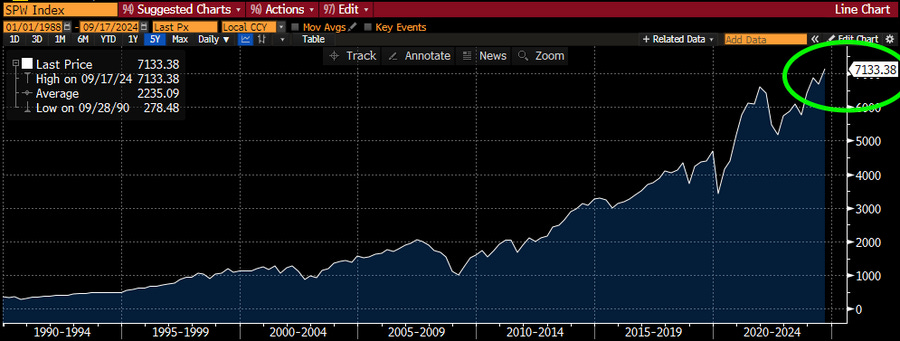

🔔 The S&P 500 is officially up a whopping 19.5% year-to-date

The S&P 500 has officially hit a new all time high and is now up 10.7% since the August 5th low.

👉 Macro Mornings Thoughts: This type of upward momentum can often indicate optimism for continued growth, signaling confidence in earnings and economic stability, as we saw in previous bull runs.

🔔 India has officially surpassed China in the weighting of the MSCI World Index

So India has officially surpassed China in the weighting of the MSCI World Index.

👉 Macro Mornings Thoughts: India’s GDP growth has consistently outpaced China’s, with India's economy growing at an average of 6-7% annually compared to China’s recent slowdown to around 3%.

This shift in MSCI weighting echoes the trend we saw in the early 2000s when China began its rise and replaced Japan as the dominant Asian economy in global indices.

🔔 The Sahm Rule has been triggered

It's predicted the last 9 recessions, With 0 false signals yet, This won’t end well.

👉 Macro Mornings Thoughts: The Sahm Rule looks at a rise in the unemployment rate, which tends to indicate underlying weakness, and when it’s triggered, markets usually follow with significant downturns.

In the past, the S&P 500 saw declines of up to 40% during recessions, while sectors like consumer discretionary and financials took the hardest hits.

🔔 India: Breakdown of major household financial assets

Saver turns investor in a rebalance of household financial assets. Bank deposits move from 53% to 42% between 2020 and 2024. Future is a holistic approach to financial services. Time for mindset change.

👉 Macro Mornings Thoughts: The era of merely holding cash is fading, and the future belongs to those embracing a broader financial strategy.

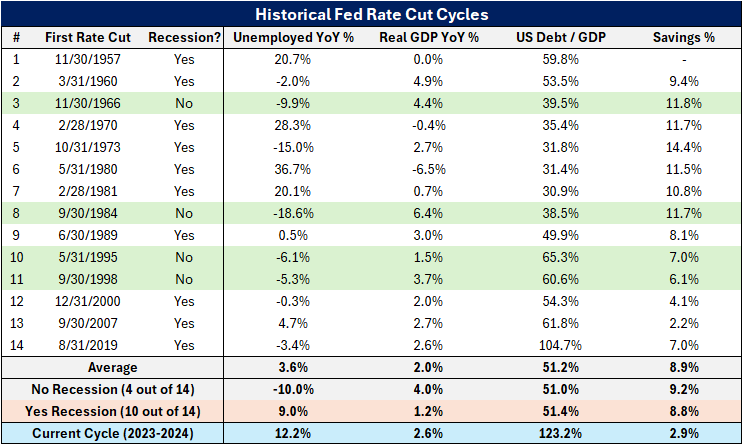

🔔 Historical FED Rate Cut Cycles

The current savings rate for US adults is below levels seen in any other rate cut cycle in HISTORY.

The current savings rate of 2.9% less than ONE THIRD of the historical average of 8.9% seen in previous rate cut cycles, according to Reventure.

Furthermore, we have not had a Fed rate cut cycle without a recession since 1998. In fact, 10 of the last 14 rate cut cycles have resulted in a recession, according to Reventure.

Meanwhile, US debt to GDP stands at 123.2%, nearly 2.5 TIMES the historical average during rate cut cycles.

👉 Macro Mornings Thoughts: Today's low savings rate in the face of economic headwinds points to a serious vulnerability in household finances, particularly as inflation erodes purchasing power.

With savings this thin, consumers have less buffer to weather downturns, which could further amplify the negative effects of any future economic shocks.

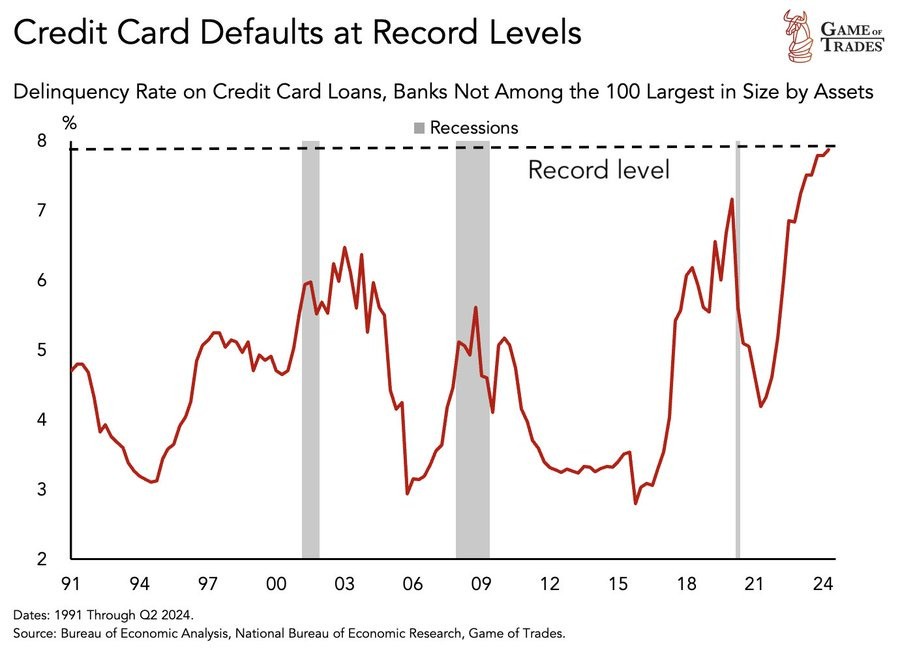

🔔 Credit card defaults are rising at record levels

This is WORSE than the 2008 Financial Crisis

👉 Macro Mornings Thoughts: This puts an immense strain on household finances, making default risk skyrocket.

The combination of rising interest rates and shrinking disposable income is creating a perfect storm for consumer debt, and the long-term consequences could be far-reaching if this trend continues unchecked.

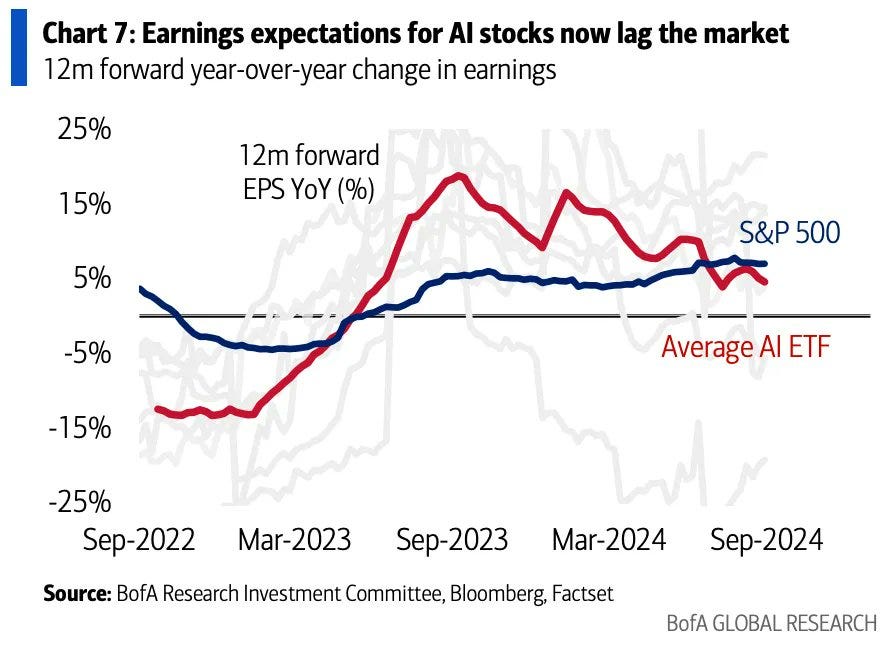

🔔 Earnings expectations for AI stocks now lag the market

Today the average EPS growth rate among AI ETF constituents has fallen from 18% to just 5%, below the S&P 500.

👉 Macro Mornings Thoughts: This mirrors what we saw during the dot-com era, where tech companies initially posted explosive growth but eventually normalized as market realities set in.

The current trend suggests that AI stocks may be undergoing a similar phase of recalibration, as lofty expectations meet the challenge of delivering sustainable profits.

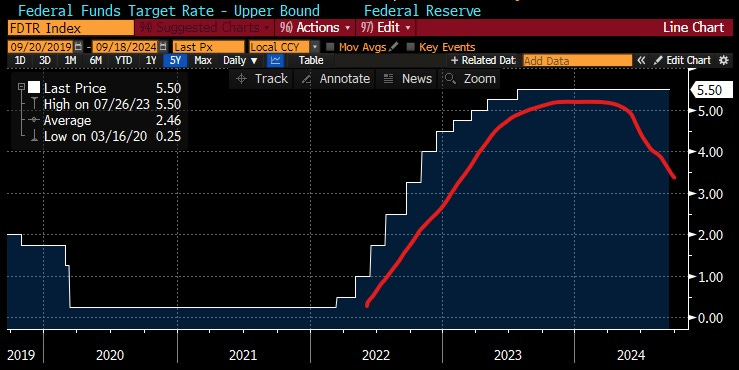

🔔 FED is coming down the mountain

After 11 rate hikes in 16 months, the FED held steady for a year. Inflation peaked at 9% in 2022 and now sits under 3%.

The new worry is JOBS. Over 1 million jobs have been revised lower over the last 24 months.

New job openings have slowed from 210,000 per month to 142,000. The unemployment rate is up from 3.5% to 4.2% since July 2023.

Rate cut incoming as the labor market cools.

👉 Macro Mornings Thoughts:

While inflation is cooling, the cracks in the job market could complicate the FED’s next move. Periods of job weakness paired with slowing inflation have been precursors to policy pivots.

🔔 Its NOT just a Mag-7 stock market anymore

The market is broadening. Yesterday, the S&P 500 Equal Weight Index hit an all-time high. Do what you will with this information.

👉 Macro Mornings Thoughts: When the broader market starts to participate in a rally, it’s a sign of a healthier and more sustainable uptrend.

In the late 1990s tech boom, gains were concentrated in a handful of tech stocks, but when the rally broadened in 2003, it led to years of growth across sectors.

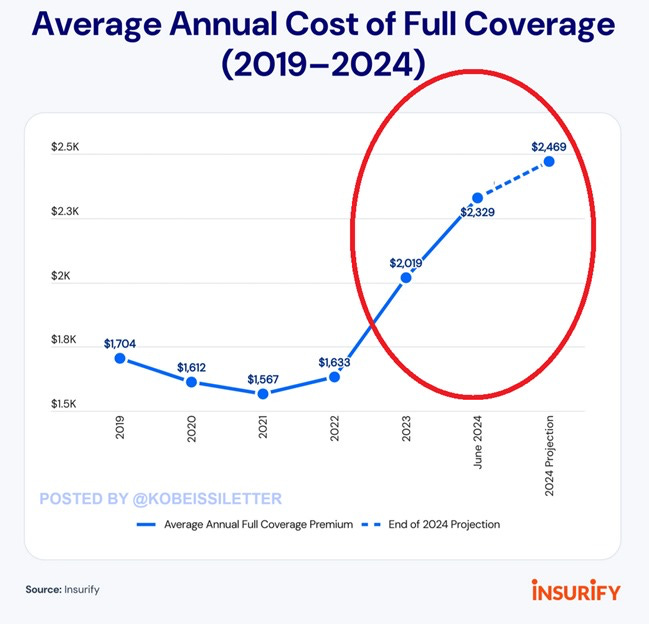

🔔 US car insurance costs spiked by 15% in the first half of 2024 to $2,329

The most on record. The average annual car insurance cost for full coverage has is up 49% since 2021.

Average premiums are set to hit $2,469 in 2024, marking an annual increase of 22%, according to Insurify.

👉 Macro Mornings Thoughts: Just a decade ago, the average annual premium was around $1,200 - meaning rates have more than doubled in just ten years.

Factors like rising repair costs, increased accident claims, and inflationary pressures are contributing to these unprecedented hikes.

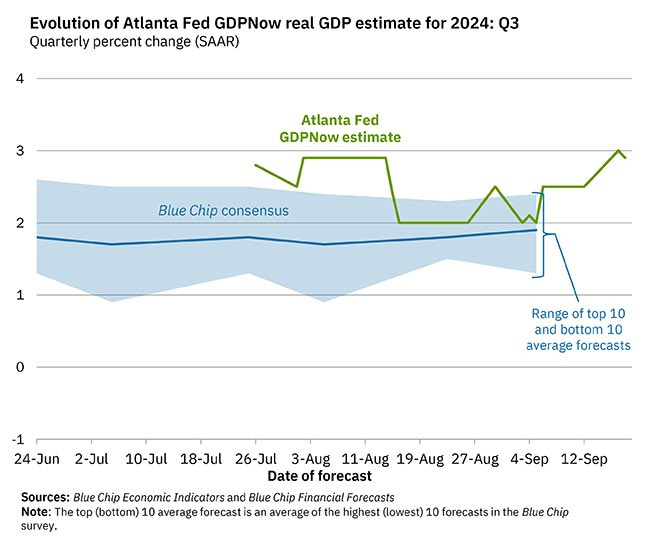

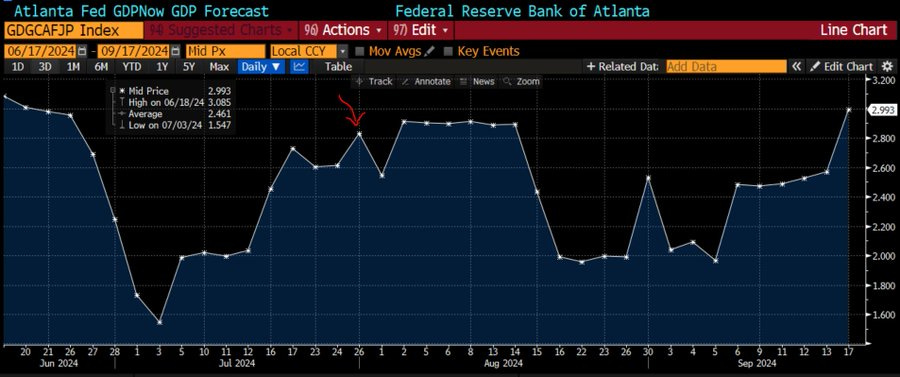

🔔 GDPNow “nowcast” model from AtlantaFed down to +2.9% (q/q ann.) for 3Q2024

Change in private inventories no longer a drag on model; consumption still a massive contributor

👉 Macro Mornings Thoughts: Even during the challenging economic periods like 2008 and 2020, consumption played a critical role in mitigating downturns.

The 2.9% forecast, though a slight reduction from earlier projections, still suggests solid growth compared to long-term averages of around 2%.

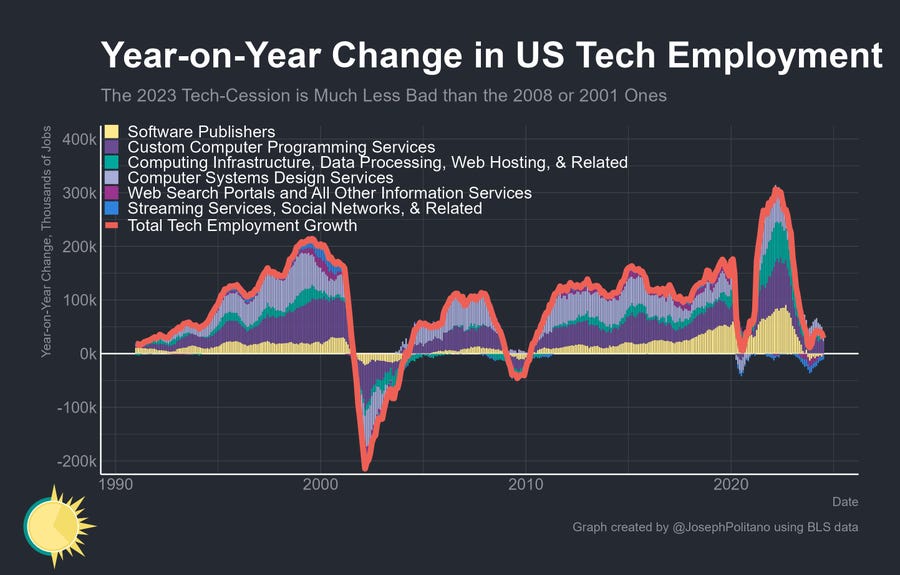

🔔 Current tech labor market is horrible

"The current tech labor market is horrible compared to basically all of the 2010s," per Joey Politano

👉 Macro Mornings Thoughts: While demand for highly specialized skills like AI and cybersecurity remains robust, the overall market has cooled significantly, leading to fewer opportunities and more competition.

The days of easy tech job placement and rapid salary growth, common throughout the 2010s, seem to have faded for now, signaling a more challenging environment for tech professionals.

🔔 Small Caps Spike Post FED Cut

TRADERS SEE 50 BPS CUT AS STIMULATING THE ECONOMY & STOCKS. RISK ON.

👉 Macro Mornings Thoughts: Small caps outperform in early recovery phases - after the 2016 rate cut, for instance, small caps surged 16% in 3 months.

With the market in "risk-on" mode, traders are banking on lower borrowing costs to fuel growth stocks.

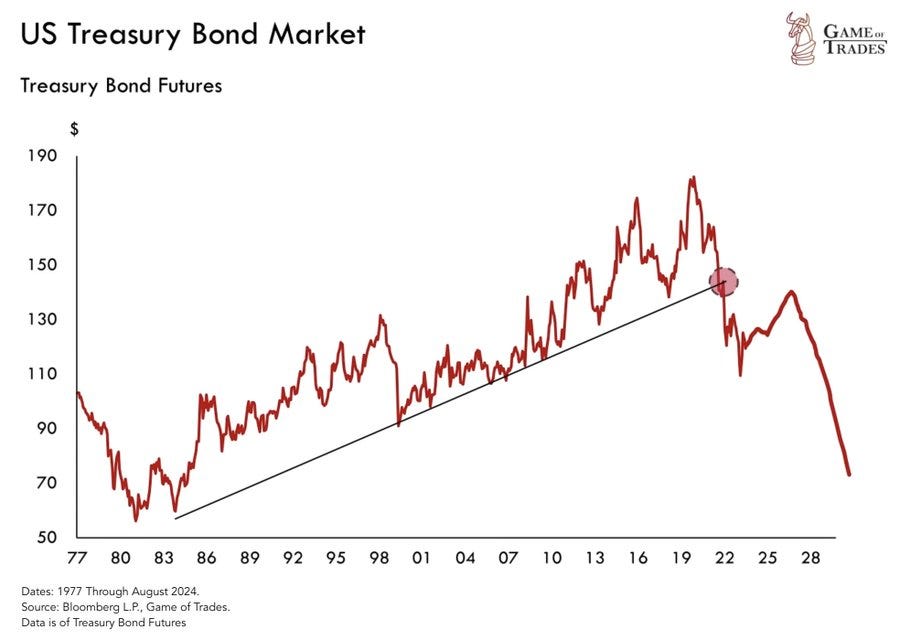

🔔 US government debt market collapse has started

This has MASSIVE implications for the economy.

👉 Macro Mornings Thoughts: If the current trajectory continues, the implications for the economy could be staggering - rising yields will tighten financial conditions, making borrowing more expensive for consumers and corporations alike.

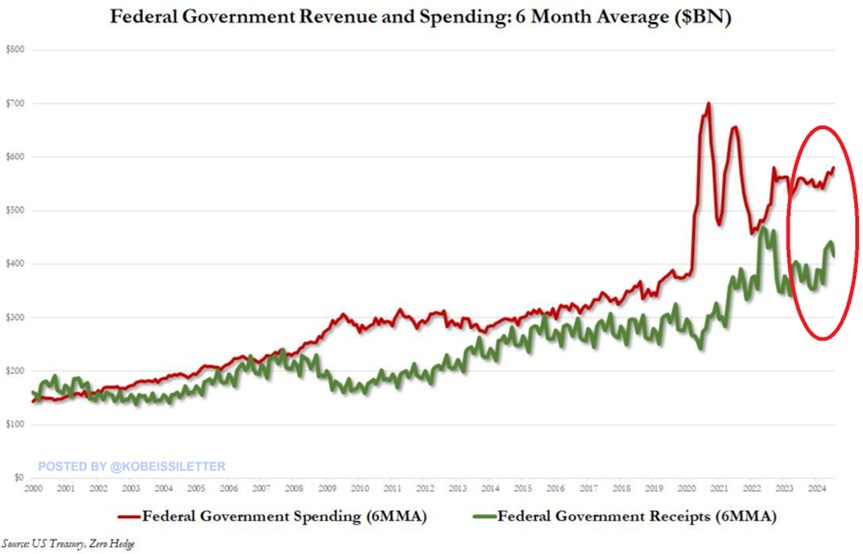

🔔 The federal government has a huge spending problem

Government spending has now exceeded government revenues for 14 years STRAIGHT.

👉 Macro Mornings Thoughts: Such spending surges led to rising national debt, which has now surpassed $33 trillion.

In the 1980s, during Reagan's fiscal expansion, we saw a similar deficit trend, but it was coupled with strong GDP growth.

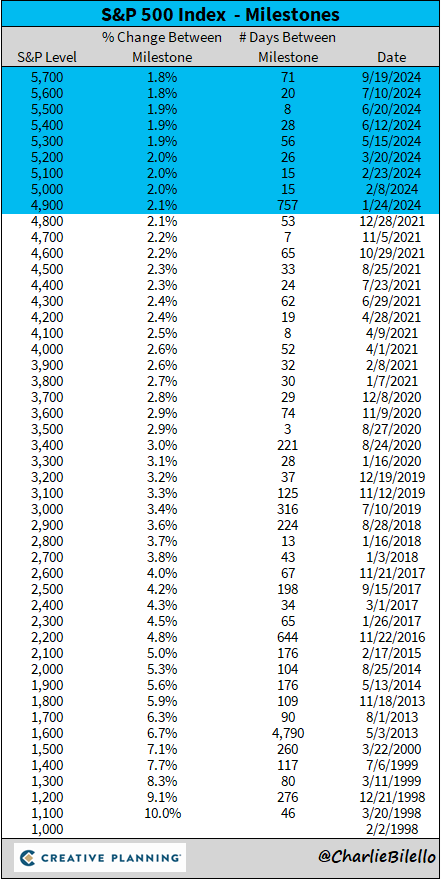

🔔 The S&P 500 just crossed above 5,700 for the first time

The S&P 500 just crossed above 5,700 for the first time, its 9th 100-point milestone of the year.

👉 Macro Mornings Thoughts:

These rapid climbs have often coincided with strong earnings growth, low unemployment, and accommodative monetary policy.

If the index maintains this pace, we could be mirroring the post-2013 bull run, where the S&P gained over 180% in just six years.

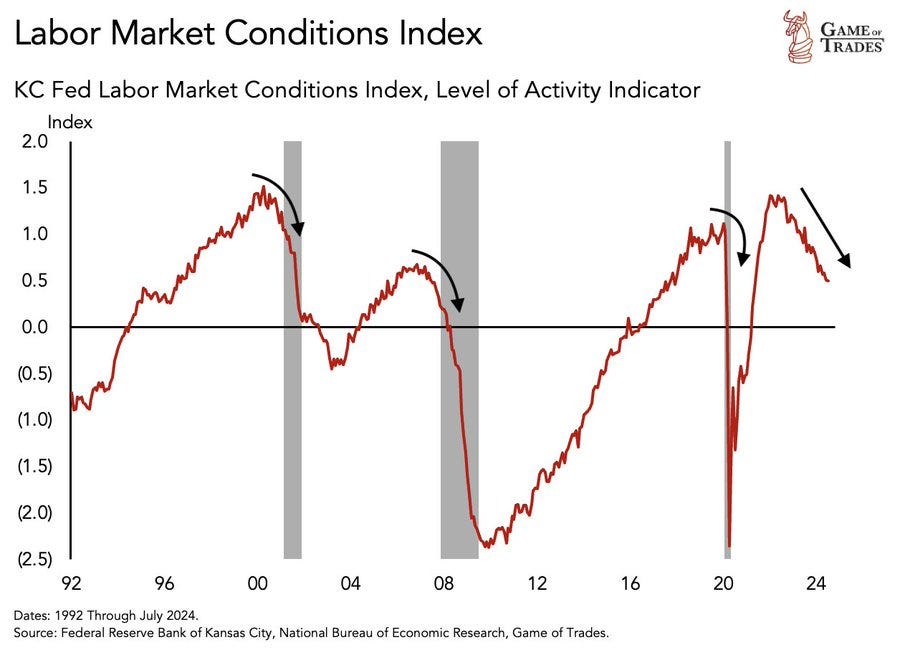

🔔 Recession is coming

But it’s not here YET

👉 Macro Mornings Thoughts: It’s a delicate balance, but with consumer confidence starting to waver and inflationary pressures persisting, the window for a soft landing is narrowing.

🔔 Atlanta Fed's GDPNow forecast is now nearly 3%

which is higher than where it was before the last Fed meeting at the end of July (see red arrow below.)

👉 Macro Mornings Thoughts: A 3% growth rate aligns with periods of robust consumer spending and resilient job markets, but it also places pressure on the Fed's inflation fight. Back in 2018, when GDP grew at similar rates, we saw rate hikes follow shortly after.

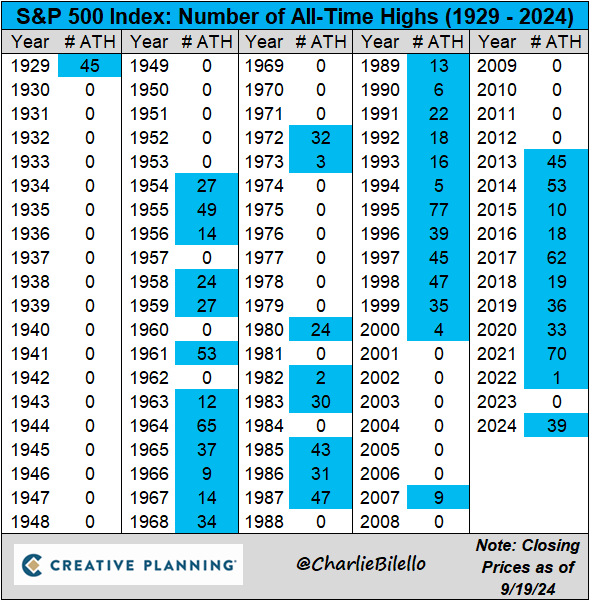

🔔 Number of All Time Highs

The S&P 500 closed at an all-time high for the 39th time this year.

👉 Macro Mornings Thoughts: In 1995, the S&P reached 77 all-time highs, only to face the turbulence of the dot-com crash a few years later.

While this current rally reflects strong earnings and resilient economic data, we're also seeing elevated P/E ratios - around 19x forward earnings - compared to historical averages of 15x.

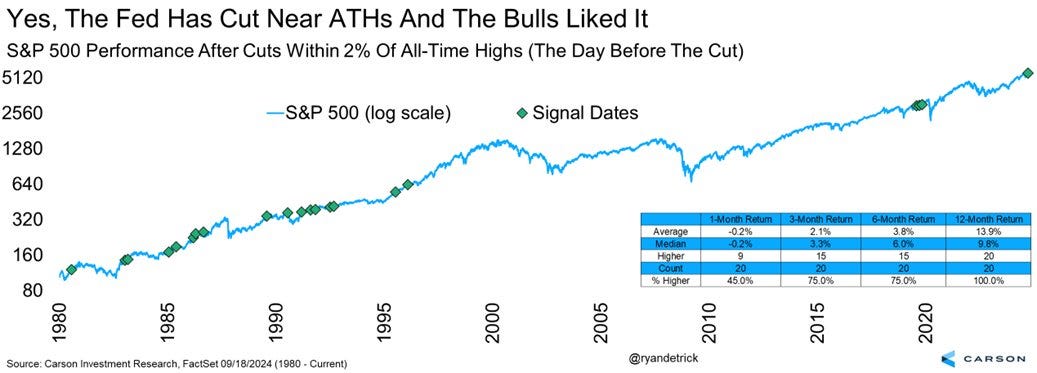

🔔 S&P Performance After Cuts Within 2% Of ATH

Here are the 20 times the Fed cut rates when the S&P 500 was within 2% of an ATH (based on the day before the cut). Higher a yr later all 20 times and up 13.9% on avg.

👉 Macro Mornings Thoughts: With marking the 21st time, the past suggests the odds of further gains remain in the market’s favor, even with ongoing concerns about inflation and economic slowdown.

However, as always, the broader macro backdrop should not be ignored, especially with elevated corporate debt levels and rising bond yields tightening financial conditions.

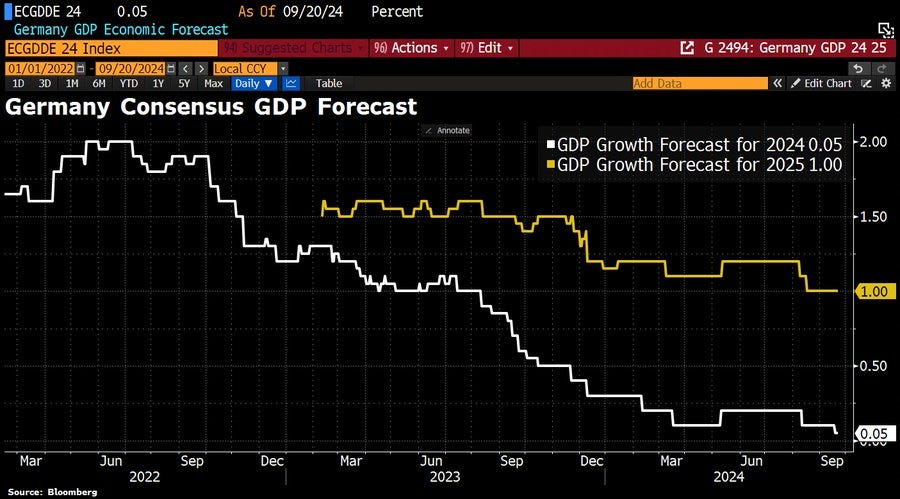

🔔 Germany Consensus GDP Forecast

The economy isn't expected to grow until at least the end of the year. Acc to a Bloomberg survey, experts predict stagnation for the three months through Sep, a downgrade from the previous forecast of 0.2% growth.

The outlook for the entire year remains flat as well.

Unfortunately, the bad news continues: Mercedes has lowered its outlook, delivering yet another setback to Germany's struggling industrial sector.

👉 Macro Mornings Thoughts: With rising energy costs, weaker global demand, and supply chain disruptions still impacting production, Germany may be in for a more prolonged period of stagnation or even a mild recession unless there's a strong policy response or a rebound in global trade.

Stagnation periods like this can be difficult to escape without structural reforms or fiscal stimulus.

🔔 Remarkable price action in US rates after a surprise 50 bps cut

Remarkable price action in US rates after a surprise 50 bps cut from the Fed. 2-year Treasury yield is now above where it was before the cut.

That in turn is powering the Dollar stronger against the Euro and the Yen.

This makes no sense and is a total fade. The Fed is dovish...

👉 Macro Mornings Thoughts: This price action suggests investors are fading the Fed’s dovish stance, possibly expecting inflation to remain sticky or a reversal of policy.

Such disconnects between Fed policy and market reaction often resolve with increased volatility, so this might be a temporary divergence before bond yields settle lower.

🔔 Current Market expectations for Fed Rate Cuts

-Nov 7, 2024: 25 bps cut to 4.50-4.75%

-Dec 18, 2024: 50 bps cut to 4.00-4.25%

-Jan 25, 2025: 25 bps cut to 3.75-4.00%

-Mar 19, 2025: 25 bps cut to 3.50-3.75%

-May 7, 2025: 25 bps cut to 3.25-3.50%

👉 Macro Mornings Thoughts: Such a sequence of cuts has provided substantial relief to equity markets and credit conditions.

After the 2019 cuts, the S&P 500 rallied by over 28% in 2020.

A 50 bps cut in December 2024 would likely be the most significant, as it mirrors past attempts by the Fed to get ahead of a more pronounced slowdown.

Did you enjoy this extensive research by finding it interesting, saving you time & getting valuable insights? What would be appreciated? Sharing it around with like-minded people and hitting the ❤️ button. This will help me bringing in more & more independent investment research: from a single individual, not a bank, fund or so!

Disclosure

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. This material has been prepared for informational purposes only. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

If we have a recession it may be from a black swan event. Or possibly, one of the many gray swans that the market is discounting, such as war, US election uncertainty, another pandemic.

If nothing bad happens, we could have a soft landing. But we need to be prepared for all outcomes.

Alessandro, that a recession is coming is a surprise for me. But I'm not predicting. Let's wait and see what happens over the next few months.