🚨 When Iran Moves, Energy Reacts

June 22, 2025 >> What history tells us about oil shocks, market rotations, and regional escalation.

💡 New on Macro Mornings? Start here

🎯 This is part of a series designed for PRO investors who want real-time updates on macroeconomic news through my advanced insights. Feel free to catch up on previous emails here if you'd like to start from the beginning!

Dear all,

Something doesn’t feel right.

Not in the headlines. Not in the economic surprises. Not even in the VIX. But in the deeper flows, in the sudden dislocations beneath the surface. Capital is quietly shifting. Consensus feels too settled. And conviction, rather than confidence, seems harder to find.

We’re witnessing a divergence between what the market is showing us on the screen and what the macro story is telling us underneath. U.S. equities are showing their largest underperformance against global peers in over three decades. At the same time, tech indices keep making new highs, seemingly immune to rates, earnings pressure, or even geopolitics.

Bond yields are quietly creeping higher in countries with alarming debt burden - but there’s no sign of panic. And the U.S. dollar? It looks strong in places, yet beneath the surface, central banks are already moving away.

This letter isn’t about reacting to volatility. It’s about sensing pressure before it breaks. About reading the imbalances before they spill. It’s about noticing when markets become fragile not because of noise, but because of silence.

And right now, the silence is deafening.

Over the past 24 hours, I’ve seen too many signals aligning. The Strait of Hormuz. The gold accumulation by central banks. The U.S. deficit trajectory. The underweight in energy. The bounce off the 200-week moving average. These aren’t separate stories - they’re fragments of a much larger narrative taking shape.

So let me walk you through what I’m tracking - and why I believe we may be entering a rare kind of macro inflection point. The kind that doesn't just surprise the market.

⭐️⭐️⭐️⭐️⭐️ Join Macro Mornings Premium

🔸 You’ll receive Exclusive, high-quality macro investment opportunities that focus on long-term growth, diversified risk, and the potential to outperform during various economic cycles.

There are moments in the market when you can feel a pulse quicken.

Not just from the volatility on the screen, but from the alignment of narratives, numbers, and behaviors that all start pointing in the same direction.

Over the last 24 hours, that pulse has grown stronger, more urgent - and unmistakably real.

What’s unfolding isn’t just a confluence of events.

It’s a convergence of macro tension, strategic realignment, and underappreciated risks that could reshape the investment landscape far faster than consensus expects.

Let me take you inside the signals I’m tracking - and why I believe we’re approaching one of those pivotal macro moments that don’t just shift trends, but redefine them.

🚨 The Strait of Hormuz is whispering louder now (Polymarket’s reaction)

It started, as these things often do, with whispers in the headlines.

But those whispers quickly turned into hard data and sudden, coordinated behavior.

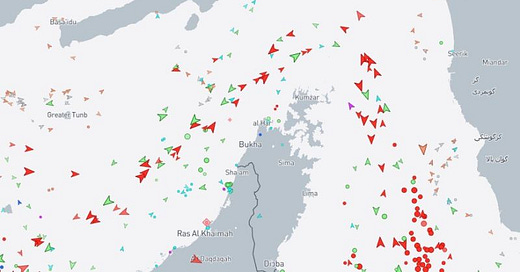

Right now, nearly 50 oil tankers are actively leaving the Strait of Hormuz - a region through which 20% of global oil supply flows.

And while physical flows tell a story, market odds confirm it: Polymarket participants have pushed the probability of Iran closing the strait in 2025 to 57%.

That’s up from 18% just weeks ago. That’s not volatility. That’s repricing risk in real time.

The last time the strait was this politically charged was in 2011.

Back then, Brent crude spiked 25% in less than two months, the MSCI EM index lost 9%, and the USD/JPY jumped 4% as capital flooded into safe havens.

These aren’t small moves.

They’re the kind of dominoes that set entire portfolios off-balance.

If you remember the playbook - or lived through it - you know how quickly the game can change when chokepoints become front-page news.

🌋 Oil power, deficit gravity, and a market that refuses to blink

Zoom out and the pressure intensifies.

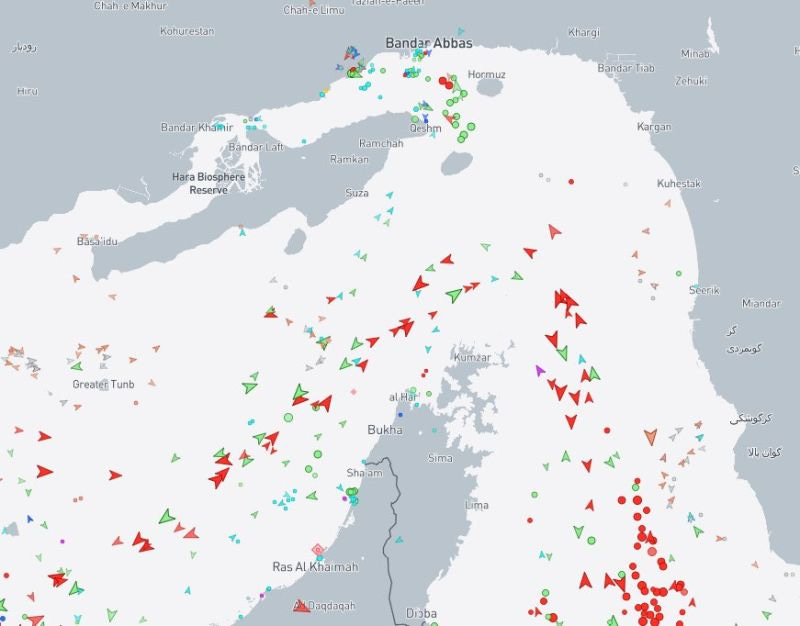

Iran has now reached its highest share of OPEC oil production on record: 15.5% as of June 2025. This isn’t bluff.

It’s leverage in its purest macro form.

With Iran reshaping global supply while simultaneously holding a strategic strait hostage, it is no longer just a geopolitical irritant.

It’s a systemically important player in the energy matrix.

And yet, despite this, something extraordinary happened: the Tel Aviv Stock Exchange rallied nearly 5% in a single day, hitting fresh all-time highs.

During the 2014 Gaza conflict, we saw a similar pattern - markets dipped just 3.2%, then rebounded 6.5% shortly after.

Once again, local sentiment is diverging from global anxiety.

Maybe they know something we don’t. Or maybe they’ve seen this movie before.

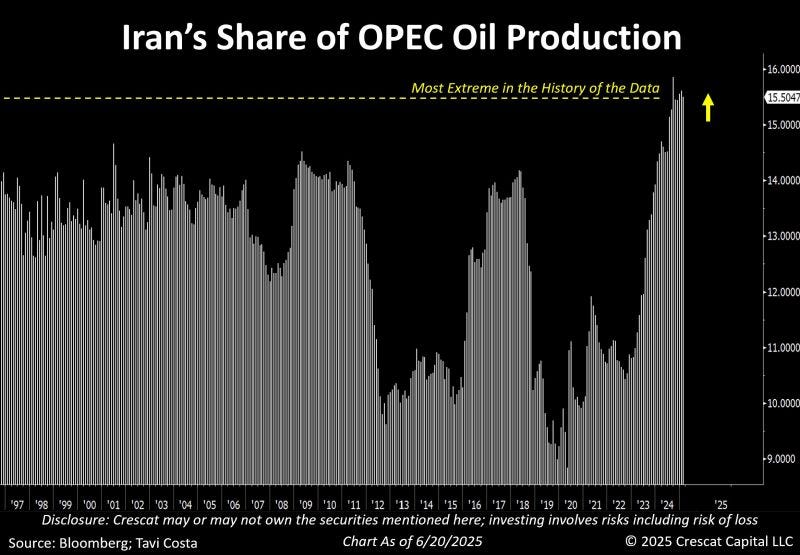

At the same time, we’re seeing massive dislocations in market positioning.

Energy continues to be the most underowned sector globally, with a net -25% underweight according to Bank of America’s Fund Manager Survey.

These are levels we haven’t seen since 2008 - right before a historic rebound.

In early 2021, energy was similarly dismissed.

By year-end, it had become the top-performing sector in the S&P 500, gaining 53%, with crude up 65%.

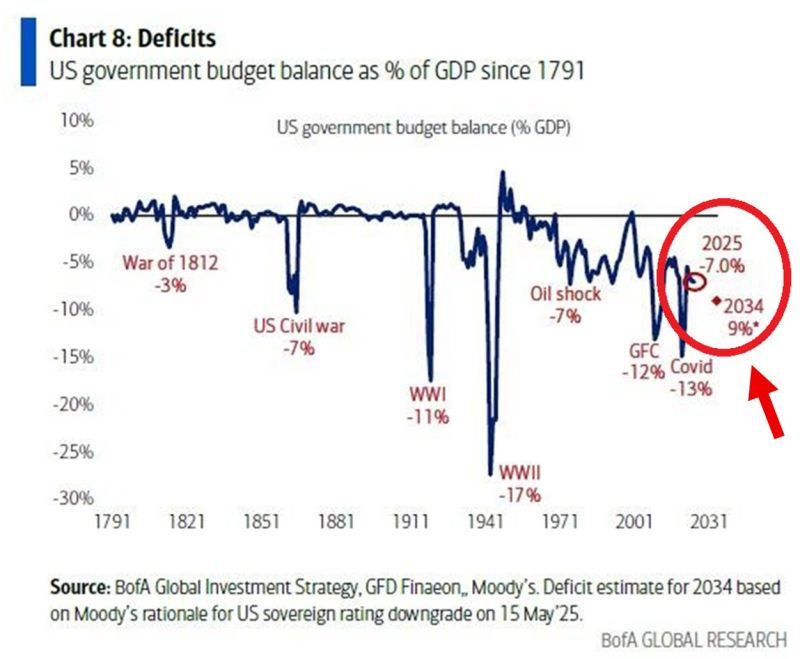

Meanwhile, across the Atlantic, the U.S. is writing its own fiscal chapter - a chapter that reads more like a budget crisis novel than an economic forecast.

The projected federal deficit? 9% of GDP by 2034, even in a base case with no recession.

That’s deeper than WWI and within breathing distance of the Global Financial Crisis.

In 2020, when the deficit hit 13%, we watched Treasury yields collapse from 1.9% to 0.6%, gold rally 25%, and the dollar drop 11% versus the euro.

You don’t need a war to feel like you’re funding one. The numbers are already doing that.

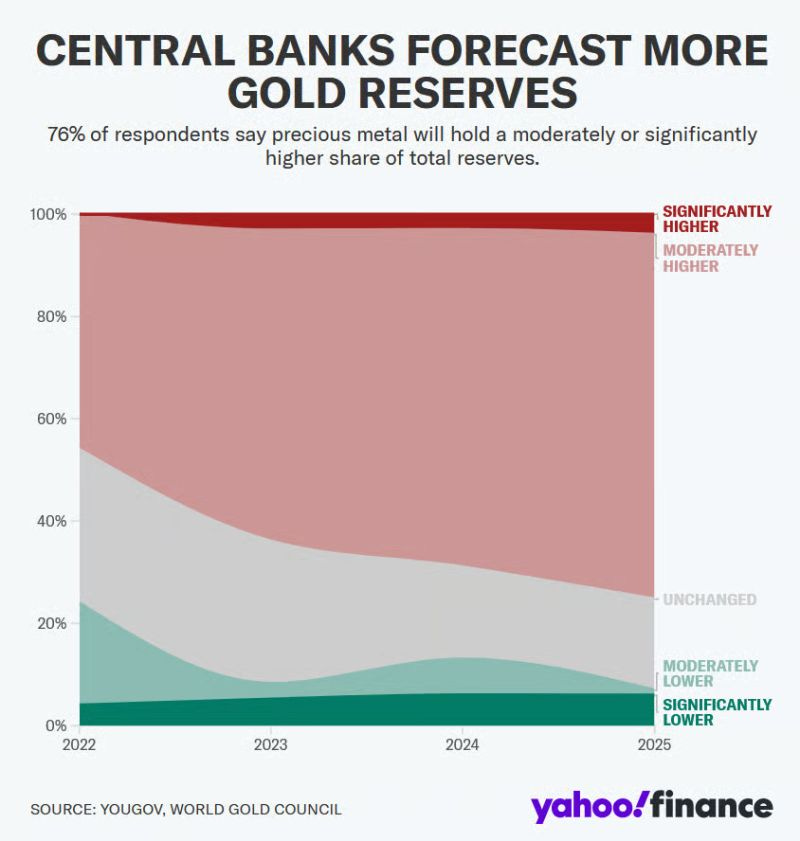

🔷 The flight to gold isn’t just a hedge. It’s a message.

That message is being heard loudest in the vaults of the world’s central banks.

The World Gold Council’s latest survey is staggering: 76% of central banks plan to increase their gold reserves by 2025.

A record 43% are actively buying, while 73% expect to reduce their exposure to U.S. dollars.

This isn’t a tactical rebalance. It’s a strategic repositioning.

In 2022, when 1,136 tonnes of gold were added to central bank holdings - the highest figure in over five decades - gold prices climbed 14% and the DXY lost 8.5%.

That wasn’t random.

It was institutional fear made visible.

The playbook is increasingly clear: when governments lose fiscal control and currency credibility wanes, gold reclaims its throne as the ultimate reserve asset.

We’re not there yet.

But we’re walking toward it.

📉 And yet, the S&P is telling a different story

With all this swirling, it’s easy to lose sight of what markets are actually doing.

But sometimes, the most obvious chart is also the most powerful.

The S&P 500 has tested and bounced from its 200-week moving average seven times in the past 15 years.

In every instance - 2011, 2016, 2020, and now again in 2025 - that level acted as a launchpad.

Average returns one year after each bounce? +39%.

Average drop in volatility? Around 20% within three months.

Markets, like people, have memory.

And when that memory is reinforced by liquidity, the bounce becomes more than just technical - it becomes reflexive.

So where does this leave us?

We stand at a juncture where oil is geopolitically critical, yet underowned.

Where central banks are dumping the dollar, and deficits are writing their own headlines.

And yet, markets are not panicking - they’re waiting.

But waiting doesn’t mean ignoring.

It means preparing. I’m watching gold, oil, defense stocks, and rate-sensitive trades with sharper focus than I’ve had in months.

Because in every macro cycle, there comes a moment when everything seems quiet... right before it isn’t.

This feels like one of those moments.

With you on the front line,

Alessandro

Founder of Macro Mornings

⭐️⭐️⭐️⭐️⭐️

What You’ll Get by Joining Macro Mornings Premium

🔸 Regular deep dives into economic indicators and geopolitical developments shaping today’s markets.

🔸 Exclusive, high-quality macro investment opportunities that focus on long-term growth, diversified risk, and the potential to outperform during various economic cycles.

🎁 Exclusive Offer: 30% OFF for Life!

Becoming a Macro Investor Premium, You’ll Gain Access to:

Well-researched insights help you make smarter and more informed decisions .

All the tools you need right at your fingertips to build, track, and grow a resilient portfolio - helping you retire earlier and live life on your own terms.

Stop guessing, start investing with confidence, and enjoy a life free from financial constraints.

👋 Read my Financial Story

🙏📝 TrustPilot - Leave your review and share your experience - I’d means a lot for me!

✍ FREE

📚 Get your E-book FREE 👉 10 Simplified Strategies for Investors

🏆 PRO

🔏 Become a Macro Investor here | 💰 30% Off for Life - [🔥 Only 6 Spots Left! 🔥]

📚 The Art of Financial Freedom 👉 51 Macro Lessons to Success Your Future

💻 SOCIAL

🎙 PODCAST

Disclosure

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. This material has been prepared for informational purposes only. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.