Hi all, and welcome back to The Macro & Business Insights!

What you’ll find in this episode:

Fed gets what it wants VS Market gets what it wants

Central banks continued raising rates

My complete research covered another important points (totally free) to the same field:

US labour market remains tight

Financial Condition have loosened

But I invite you if interest in it to go to my website, which you can find a deeper research and analysis in a few weeks.

The Fed wants to keep rates high; the market is increasingly convinced that is not going to be the case.

Expectations of rate cuts are forming, and asset prices are rallying accordingly.

In his press conference, Chair Powell delivered a relatively balanced message, recognising that the cycle is not entirely over, but that there are emerging risks to the central bank’s preferred softlanding scenario (housing market and bank lending weakening).

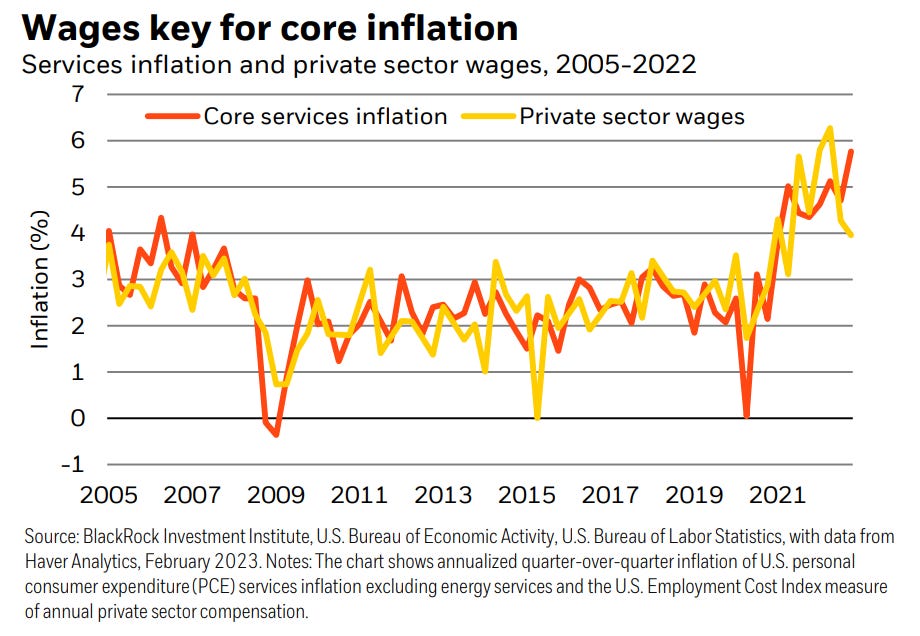

Central banks are stumbling into a nuanced phase of policy tightening after major macro events last week. Lower energy and goods prices are pulling down overall inflation.

Yet tight job markets should keep wage growth above levels needed for core inflation to fall to 2% targets, reflected in a 54-year low for unemployment in the U.S.

BlackRock sees central banks close to pausing hikes: Major economies will see mild recessions but lingering inflation. We like short-term bonds and credit.

Fed gets what it wants

This would entail annual average inflation easing to below 3% this year, but Fed officials are not convinced that it comes down to 2%.

As real interest rates rise, the labour market would soften, but only modestly.

In accordance to DBS Group Research rising real rates would also push down real GDP growth, but there would be no recession, especially as consumption gets some support from continued rise in real wages.

Money markets remain orderly even as quantitative tightening continues.

Around this benign scenario, Fed funds rate is held at 5% during 2Q to 4Q.

This scenario is not being bought by the markets presently. If this was considered seriously, long term rates would be higher, and equity markets would be under sustained pressure.

Another possibility in this scenario is that the Fed keeps the option to raise rates and tighten financial conditions again if inflation doesn’t come down to 2% and growth/jobs surprise on the upside.

This development would, without doubt, be negative for the markets.

The market gets what it wants

The deeply inverted yield curve and declining inflation expectations, based on market-based indicators, suggest a very different outlook held by market participants.

The scenario entertained is that of unemployment rising, growth falling, and inflation becoming a nonissue this year.

A sharp Fed pivot would be warranted under this scenario as the monetary authority would be compelled to counter tightening financial market conditions.

Quantitative tightening would be stopped, and policy rate cuts would begin either in 4Q23 or 1Q24. The pricing now is for over 150bps in rate cuts next year.

Central banks continued raising rates

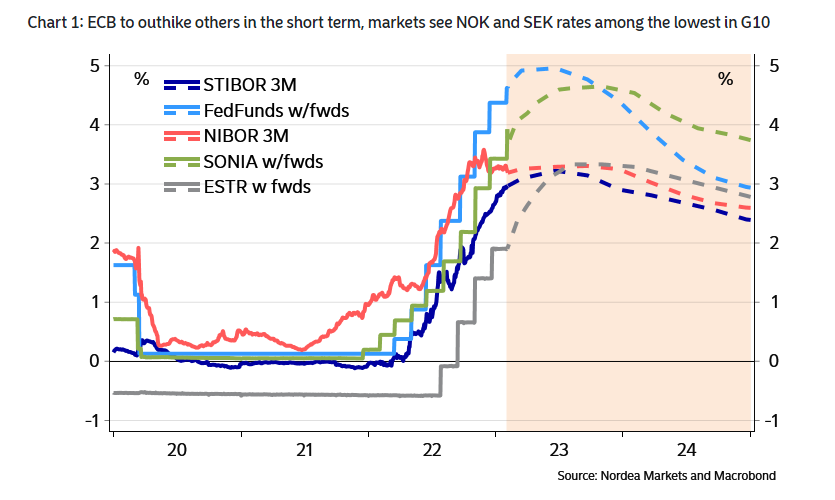

The Fed and BoE will likely continue with 25bp rate hikes ahead, while the ECB signaled at least one more 50bp rate hike in March before likely stepping down to 25bp hikes.

Fed’s Chairman Powell specified that “a couple of more interest rate hikes” are on the cards while ECB President Lagarde would not commit to forward guidance beyond the March meeting.

If you had like this piece and you want to read the whole advanced article I invite you to go on my website www.scriptamanent.blog (you can find the link button below), which you can find many more useful insights.

Best regards,

🔔 If you like my work, one simple thing that would make me very happy is if you’d bring only two friends/colleagues within our community - they might appreciate it and after all…it’s free!

Feel free to share my contents with anyone you think is might be interested with the link below!

🔍 We are a community of Macro & Business enthusiasts and lovers of Financial Markets.

💡 If you want even more free, valuable financial content you can also follow me on Twitter and visit my Website for more in deep analysis.

Disclosure

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. This material has been prepared for informational purposes only. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.