⚡ What kind of surprise may we have in 2024? - (Stock Markets Update)

Premium Exclusive Insights

Thanks for reading!!!

📌 As my subscriber you get totally FREE my Exclusive Premium Insights that I do and share only with you.

You won't find these materials shared by me on any other platform.

By subscribing you’ll join with +15,000s Investors, Economic Professors and aspiring Finance Student

A soft landing is priced into the bond market much more than the stock market.

We expect global equities to surpass all-time highs in 2024, and to outperform government bonds.

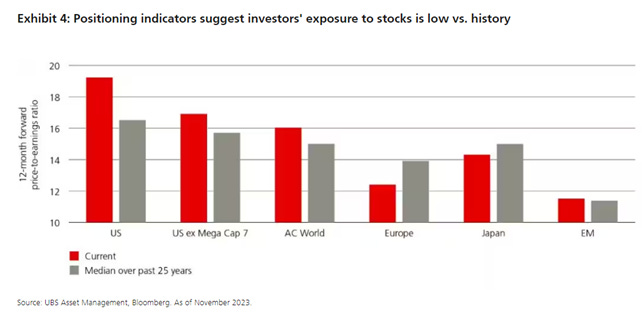

We anticipate that stocks will meaningfully outperform bonds if the US economy achieves a soft landing. In our view, pricing in the bond market is already much more consistent with this positive economic outcome than the stock market.

In a soft-landing scenario, we believe global equities will comfortably ascend to new all-time highs in 2024 while it is unclear whether longer-term bond yields have much further to fall.

INTEREST RATE CUTS IN 2024

To be clear, the FED is still likely to deliver some interest rate cuts in 2024 even if price pressures fail to decelerate further from their recent trend - but, in our view, not as much as markets are currently pricing.

Substantial uncertainty remains as to whether inflation will allow for the 125 basis points in easing from the Federal Reserve in 2024 currently embedded in short-term interest rate markets.

Separately, there is the risk that, as economic data continue to cool, more metrics will occasionally appear to be more consistent with a recession than a soft landing.

We have seen in 2023 how quickly economic narratives can change and expect the path to a soft landing to be a bumpy one.

In general, we believe there will be opportunities in 2024 to address extremes in valuations by adjusting positioning whenever markets lurch too far towards pricing in either persistently sticky inflation, an imminent recession or a soft landing.

ASSET ALLOCATION

We believe the surprise in markets for 2024 will be an equity rally without much of a decline in bond yields, only a decrease in bond market volatility. Consensus expectations are for the outperformance of bonds vs. stocks.

Importantly, there is a record USD 6 trillion in money market funds. As cash rates begin to decline and recession concerns dissipate, we suspect a good portion of these assets will be redeployed in search of higher returns.

Return-seeking flows into stocks and credit could catalyze much stronger performance in risk assets than consensus expects.

WHAT ABOUT US DOLLAR INDEX?

The US dollar is poised to perform well vs. other G10 currencies due to relative growth and rate differentials.

The dollar is also a broad-based hedge that offers protection against the risk that inflation and growth are too high for the Federal Reserve to ease policy as much as is priced in, or if global economic conditions deteriorate more sharply than we anticipate.

🔍 READ THE FULL PAPER (DOWNLOAD)

💌 Sign up to my weekly email newsletter

🎙 PODCAST

Best regards,

Ale

Disclosure

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. This material has been prepared for informational purposes only. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.