🎯 What if There’s a Recession (And Central Banks Start Cutting Rates)? 👇

👇 Premium Exclusive Insights

Thanks for reading!!!

📌 As my subscriber you get totally FREE my Exclusive Premium Insights that I do and share only with you.

You won't find these materials shared by me on any other platform.

By subscribing you’ll join with +15,000s Investors, Economic Professors and aspiring Finance Student

As much as a rate cut will impact equity sectors to varying degrees, it could also have a differentiated effect on stocks that are characterized by certain attributes (aka factors).

In fact, based on our analysis of the past three rate-cutting cycles, defense has been a driving force of factor returns. Large cap stocks uniformly outperformed smaller ones following the U.S. Federal Reserve’s (Fed) first move, as did high-quality stocks (over low-quality), and low-beta names (over high-beta).

But as the following chart also shows, outperformance (or underperformance) among and across factors ranged widely from cycle-to-cycle and may do so again this time around.

WHAT ABOUT SECTORS?

HEALTHCARE: Healthcare stocks have a reputation for being inherently resilient in the face of a recession, largely because demand for the sector’s services and products tends to remain stable even during bitter periods of negative economic growth. But not all Healthcare stocks are created equally and the potential protection they offer may vary across subsectors in 2024.

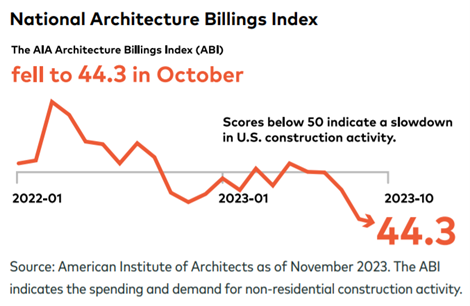

INFRASTRUCTURE: It should come as no surprise that the fastest interest rate hiking cycle in U.S. history has led to a huge decline in new construction activity and the postponement or re-evaluation of many large engineering developments.

After all, there are few sectors more impacted by higher interest rates than Infrastructure, which is associated with projects that are long in duration, require significant financing and have long gestation periods to unlock returns on investment.

REAL ESTATE: As capital-intensive businesses that rely on borrowing money to fund growth, real estate investment trusts (REITs) flourished on the back of rock-bottom interest rates that defined markets for most of the years since the Global Financial Crisis in 2008.

TECHNOLOGY: An economic downturn may not be the best of outcomes for a sector that has seen its fair share of struggles in the past few years, but there are several reasons why we remain cautiously optimistic about tech stocks moving forward despite the potential risk of a recession in 2024.

UTILITIES: The S&P 500 Utilities Index is presently trailing the S&P 500 Index by close to 30% this year and is on track for its second-worst year in the past four decades.

The underperformance can be attributed to investor preferences for higher-growth, less interest rate-sensitive sectors.

🔍 READ THE FULL PAPER (DOWNLOAD)

💌 Sign up to my weekly email newsletter

🎙 PODCAST

Best regards,

Ale

Disclosure

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. This material has been prepared for informational purposes only. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.