🌪️ This has never happened in the history of financial markets

September 1, 2025 >> A Collapse Greater Than 2008 Could Be Coming

💡 New on Macro Mornings? Start here

🎯 This is part of a series designed for PRO investors who want real-time updates on macroeconomic news through my advanced insights. Feel free to catch up on previous emails here if you'd like to start from the beginning!

Dear all,

Every time I sit down to review the latest market data, I feel as though the past is whispering in my ear.

Numbers are never just numbers - they tell stories of confidence and fear, of excess and collapse, of how societies navigate prosperity and hardship.

Today, those whispers sound louder than usual, and they carry echoes of some of the most dramatic chapters in financial history.

And as I let these numbers sink in, I cannot help but feel a mixture of fascination and unease.

Because what lies in front of us is not just a snapshot of today’s markets, but a mirror reflecting the cycles that have come before.

📊 A Split Economy, Familiar Patterns

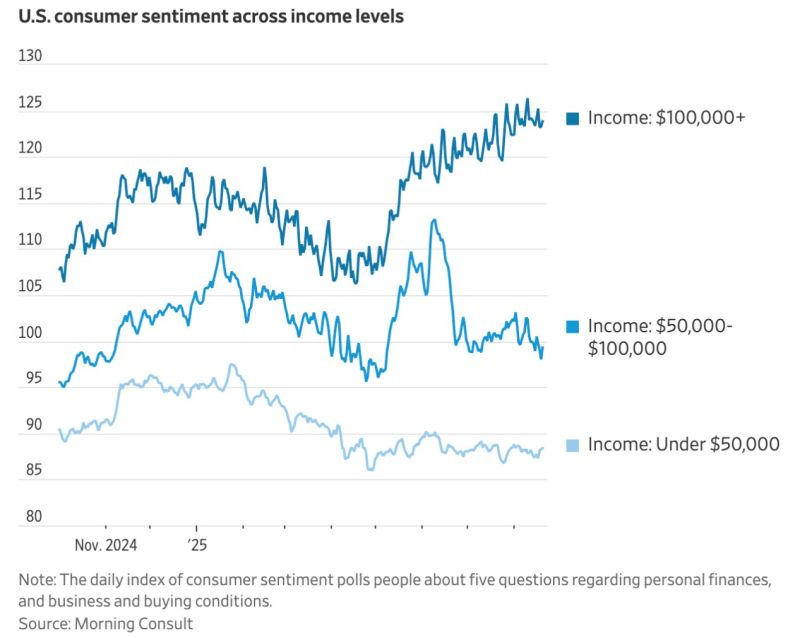

Right now, the US economy feels like two parallel worlds running side by side.

For households earning above $100k, sentiment is surging, with confidence readings comfortably above 120.

It’s as if this group has managed to detach itself from the concerns of rising prices, their optimism fuelling both consumption and investment.

But move down the ladder, and the picture looks different.

Middle-income families, those earning between $50k and $100k, are treading water around 100, neither thriving nor collapsing.

And those at the lower end, under $50k, remain below 90, weighed down by the daily reality of persistent prices.

The split could not be clearer: a two-speed America, where optimism flows in one lane, while caution and restraint dominate the other.

This reminds me of the years following the 2008 crisis.

Back then, the wealthiest households led the recovery, their confidence pulling markets into a powerful rally.

Between 2009 and 2014, the S&P 500 rose by more than 180%, creating enormous wealth for those invested.

But beneath that headline growth, the broader population was left behind.

Consumption among the bottom 50% lagged by more than three percentage points annually, leaving a gaping hole between financial markets and real economic life.

Today, as I watch this new divergence emerge, I wonder if we are replaying that same script: strong markets supported at the top, even as the broader foundation weakens.

And when the foundation weakens, history tells us that stability never lasts as long as we’d hope.

🔥 Inflation’s Shadow and the Echo of the 1970s

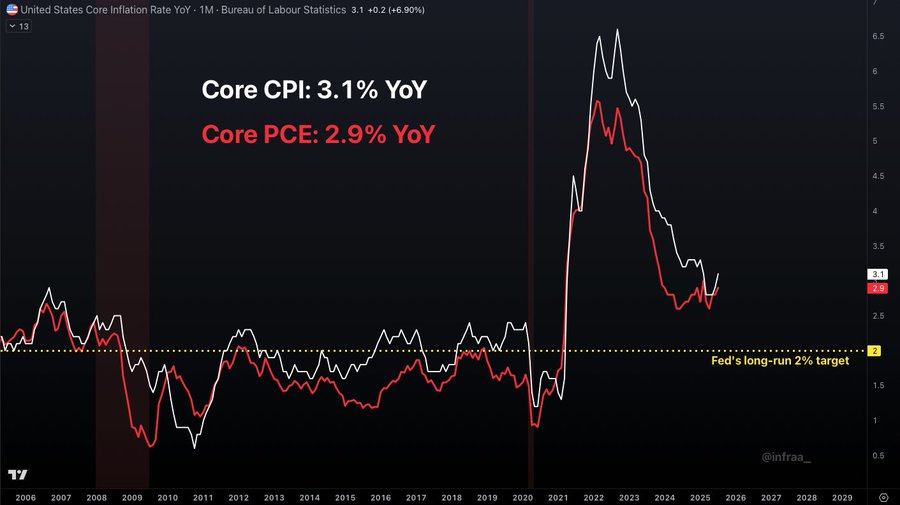

Inflation today is deceptive.

On the surface, Core CPI at 3.1% year over year and Core PCE at 2.9% don’t scream alarm bells.

But stretch those figures out across time, and the quiet devastation becomes visible: a 25.6% erosion of purchasing power over a decade.

That is the kind of creeping loss that erodes wealth invisibly, shifting the ground beneath investors’ feet without them noticing until it’s too late.

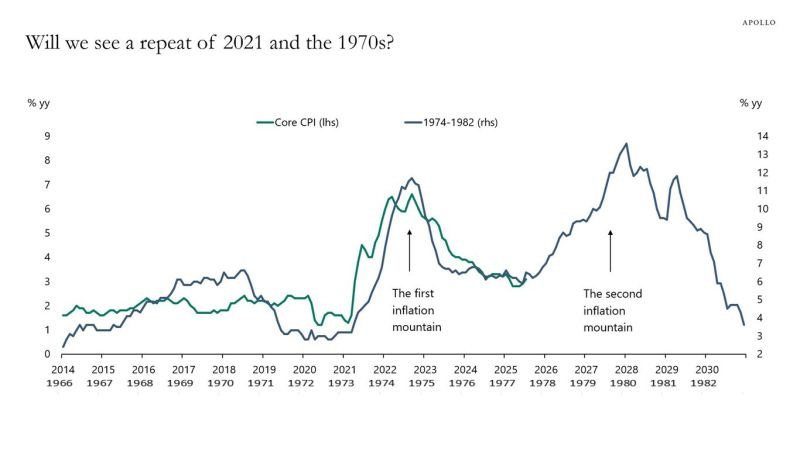

When I look at Apollo’s chart comparing today’s inflation cycle with that of the 1970s, I get chills.

The 1970s did not deliver inflation in one clean shock; it came in waves, cruelly and unexpectedly.

The first mountain arrived in 1974, with inflation hitting 12%.

Many believed that peak was the worst behind them.

But then came the second act: by 1980, inflation roared back to 14%, blindsiding those who thought the storm had passed.

Meanwhile, the dollar fell by more than 20% against the Deutsche Mark, showing just how currency weakness can magnify the pressure.

Investors were pulled back and forth like a tide: the S&P 500 collapsed by nearly half between 1973 and 1974, only to rebound by more than 120% by the end of the decade.

When I reflect on that era, the lesson is clear: inflation has a way of tricking us into complacency.

Just when it seems tame, another surge can emerge.

That is why I cannot dismiss the risk that today’s seemingly controlled inflation is merely the first mountain.

If the dollar begins to slide, or if policy errs on the side of leniency, we could be staring at a repeat of that double shock.

And if history whispers, this is the part we should pay closest attention to.

💵 Safe Havens and Fragile Giants

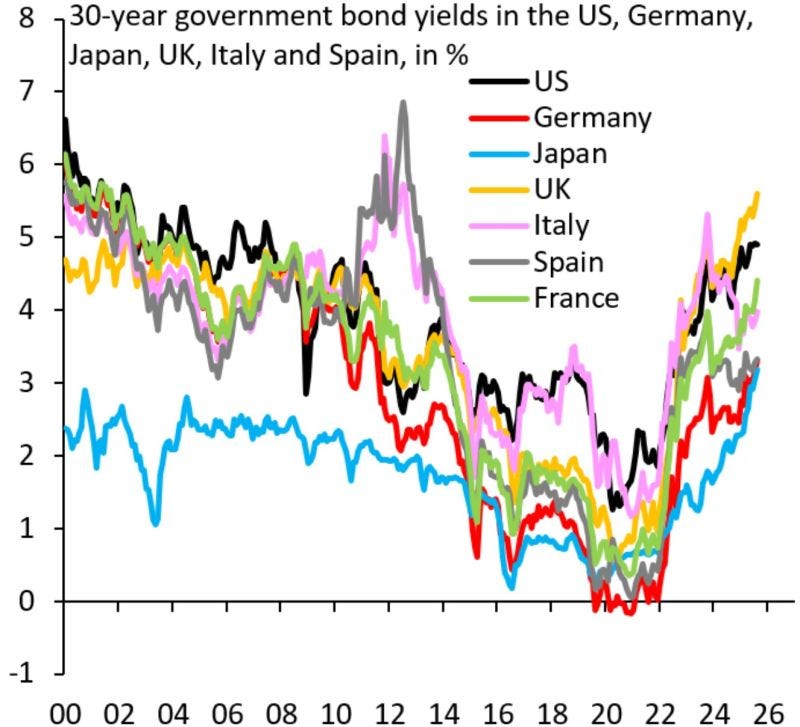

In the bond market, the story is one of contrasts.

At first glance, you’d expect US long bonds to be under intense pressure given inflation’s persistence.

Yet the numbers reveal something else: Japan’s 30-year bonds have lost 15% year-to-date, Germany’s are down 12%, France’s 9%, and Canada’s 7%.

Against this backdrop, US 30-year Treasuries are in the green with a modest 1% return.

It might not sound like much, but in a world where others are bleeding, stability is its own form of strength.

I think back to 2011 - 2012, when the European debt crisis rattled the continent.

Investors fled to safety, and US Treasuries quietly delivered 9% gains.

They weren’t flawless, but they were the least bad option in a storm of fragility.

That’s what I see again today.

The US isn’t invincible, but when compared to fragile giants like Japan or parts of Europe, it remains the anchor.

Safe havens, after all, don’t shine because they are perfect; they shine because everything else is worse.

This reality continues to drive global flows into Treasuries, reminding us of their role as the bedrock of global markets.

⭐️ This is a paid content, so scroll to read it…

If you're a PRO subscriber, make sure you're logged in to access the full piece.

If you're still a FREE reader, you have two exclusive options to unlock this special edition and all past PRO content:

1. 👉 Pro Membership from 30% to 40% OFF - forever. Only while spots last:

🎁 PRO Member - $268/year or $22/month (Regularly $447) [Click here]

🎁 Lifetime - $621 one time only or $10/month (Regularly $887) [Click here]

These prices it’s locked forever.

2. 👉 Or start your 7-day FREE Trial - explore everything without any risk.

If you're serious about understanding what comes next - and acting before the crowd - this email is your edge.

Keep reading with a 7-day free trial

Subscribe to Macro Mornings 💡 to keep reading this post and get 7 days of free access to the full post archives.