Hi all, and welcome back to The Macro & Business Insights!

What you’ll find in this episode:

Why institutional reports are bullish on the yen?

Japans monetary policy is different with yield curve control actions

How new Japanese consumers can change

My complete research covered another important points (totally free) to the same field:

Macro trend on Asian currencies

But I invite you if interest in it to go to my website, which you can find a deeper research and analysis in a few weeks.

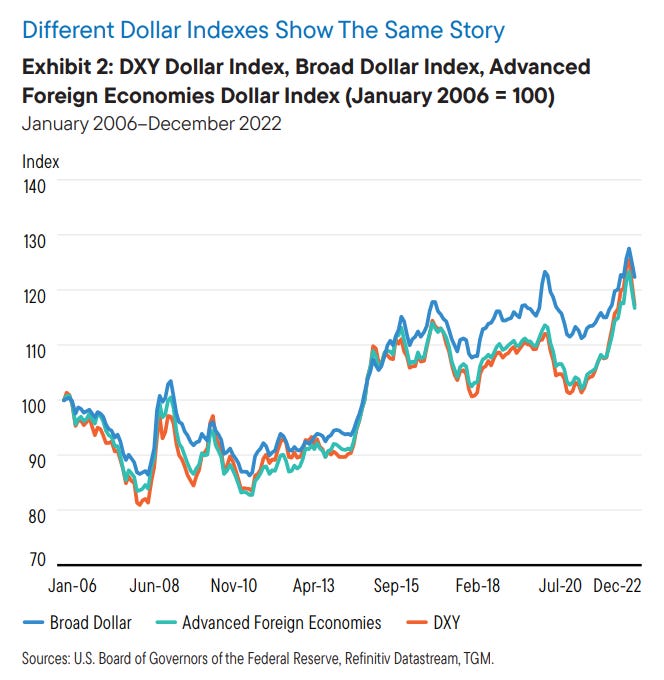

The US dollar displayed a strong bull market from mid-2021 to around the end of 2022, driven by a number of factors.

Growth differentials favored the US, particularly as longer lockdowns around COVID in Asia and, from early 2022, effects from the Russia-Ukraine war disadvantaged growth in other regions.

Interest-rate differentials also worked to benefit the dollar, especially as 2022 was characterized by continued hawkish reassessment around the path of the fed funds rate.

Some perceived safe - haven flows due to the Russia Ukraine war also benefited the greenback.

While these factors explain support for the dollar, Franklin Templeton believes the currency overshot and reached extreme valuation levels - even recording multi-decade highs against some currencies - by end-2022.

Asian currencies

The bullishness of the Japanese Yen

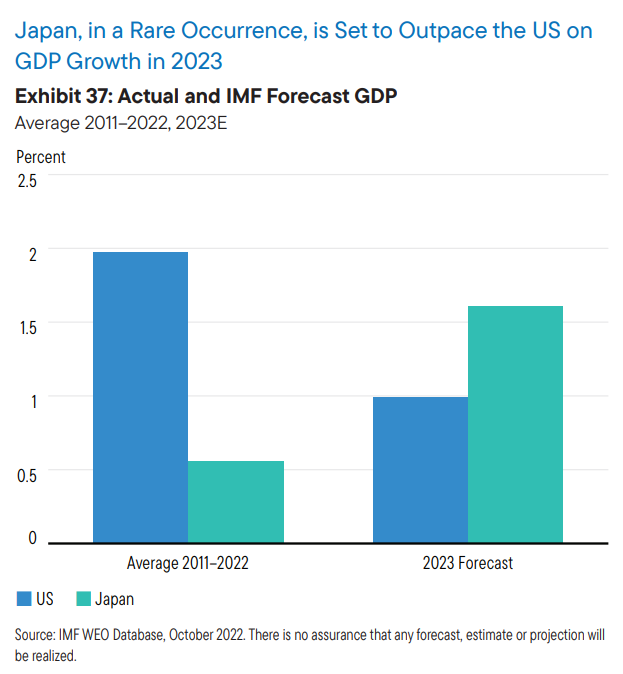

Franklin Templeton expects the Japanese economy to grow faster than the US in 2023 - a rare occurrence.

According to the IMF’s October 2022 WEO, Japan is expected to grow notably faster than the US, at 1.6% versus 1.0%.

If this transpires, it would be the first time since 2010 that Japan outperformed the US on growth - and we note that the Japanese yen (JPY) also appreciated when that previously occurred.

The Japanese economy currently has two main cyclical advantages over the US economy.

First, the reopening boost post-COVID is just beginning, and this should help shift growth differentials in favor of the JPY.

Second, unlike the Fed, the Bank of Japan (BOJ) stayed accommodative throughout most of 2022, though it adjusted the band around its government bond yield target wider in December.

For Franklin Templeton the BOJ will further normalize policy during 2023. In addition to these factors, the JPY is currently at historically undervalued levels.

Japan’s monetary policy

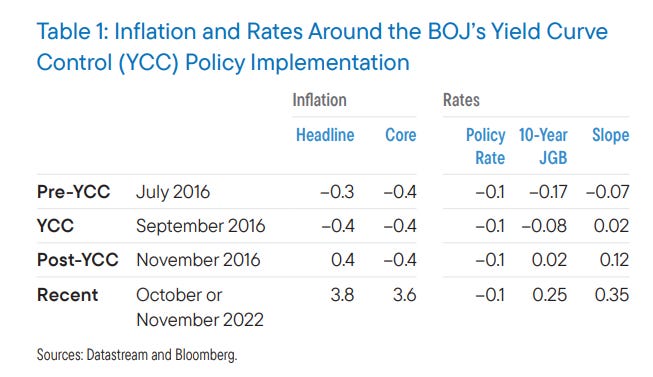

Japan’s monetary policy has been markedly different from that of the rest of the world for some years now.

Yield curve control, implemented in 2016, is one example. The original idea of yield curve control was to steepen the yield curve enough for banks to have positive margins on their business.

As the table below demonstrates, a side effect of having negative interest rates was evident in the long-term Japanese government bond (JGB) market.

At the end of July 2016, 10-year JGB yields had fallen sharply to almost negative 0.2%, which put pressure on financial markets, especially on bank net interest margins.

On the macro side, inflation has been largely short of the BOJ’s 2% inflation target throughout these policy changes.

Japanese consumers

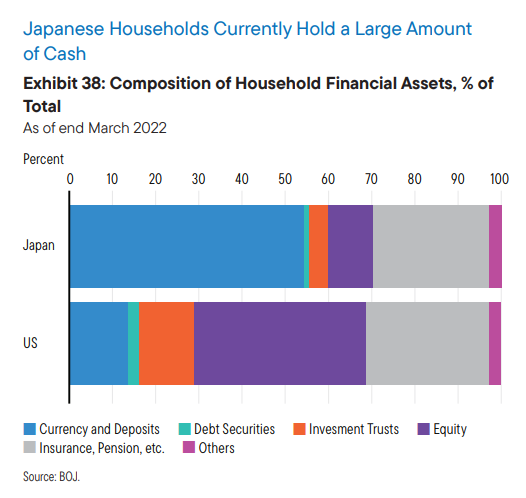

Another potential impact from the change in the inflation environment is a possible move away from the cash hoarding behavior Japanese consumers have shown until now.

As a result of Japan’s past environment of extremely low inflation or deflation, Japanese households currently hold massive amounts of non-interest-bearing cash and deposit assets.

More than half of Japanese households’ financial assets are held in terms of cash and deposits, compared to below 15% for the US (BOJ data as of end March 2022, see below).

If inflation persists above 2%, domestic investors may prefer to reallocate assets away from cash holdings toward financial assets.

If you had like this piece and you want to read the whole advanced article I invite you to go on my website www.scriptamanent.blog (you can find the link button below), which you can find many more useful insights.

Best regards,

🔔 If you like my work, one simple thing that would make me very happy is if you’d bring only two friends/colleagues within our community - they might appreciate it and after all…it’s free!

Feel free to share my contents with anyone you think is might be interested with the link below!

🔍 We are a community of Macro & Business enthusiasts and lovers of Financial Markets.

💡 If you want even more free, valuable financial content you can also follow me on Twitter and visit my Website for more in deep analysis.

Disclosure

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. This material has been prepared for informational purposes only. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.