Thanks for reading!!!

📌 As my subscriber you get totally FREE my Exclusive Premium Insights that I do and share only with you.

You won't find these materials shared by me on any other platform.

By subscribing you’ll join with thousands of Investors, Economic Professors and Aspiring Finance Student

Stocks have rallied sharply of late, with the S&P 500 gaining 20% in the last three months.

Directionally, the market has this right, with the recent rally powered by expectations for the Fed to pivot toward looser monetary policy, which has historically been a tailwind for market returns.

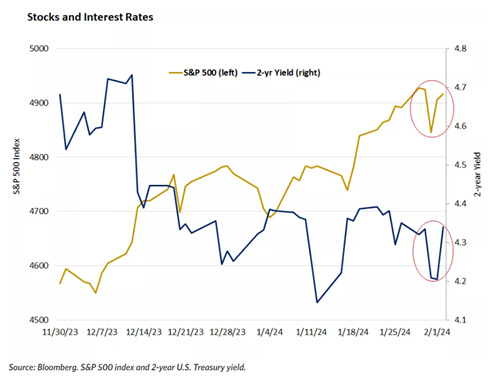

Stocks and interest rates swung widely, as markets digested the Fed and employment news.

RATE CUTS ARE A QUESTION OF WHEN, NOT IF

The market's focus was centered squarely on future meetings, seeking any signals around when a rate cut may come.

Markets have been pricing in a cut as early as March

MOVIE ALREADY SEEN?

When the Fed declaring victory too early in the 1970s, which sowed the seeds of the inflation spike that produced a rather severe recession in 1980-1982.

Monetary-policy settings are set to get less restrictive this year, and that's good news for the economy and the stock and bond markets.

The consternation really revolves around timing. The first rate cut probably won’t come until June, at the earliest, but surely, it's coming.

When it comes to the first rate cut, Edward Jones doubts a matter of a few months will be the sole determining factor in the broader path for the economy and stock market.

🔍 READ THE FULL PAPER (DOWNLOAD)

💌 Sign up to my weekly email newsletter

🎙 PODCAST

Best regards,

Ale

Disclosure

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. This material has been prepared for informational purposes only. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.