💡 New on Macro Mornings? Start here

🎯 This is part of a series designed for PRO investors who want real-time updates on macroeconomic news through my advanced insights. Feel free to catch up on previous emails here if you'd like to start from the beginning!

🎁 Got a macro topic you've been meaning to understand better? Something that could really impact your portfolio?

You can now book a FREE 30-minute call with me - focused entirely on your most important questions.

It’s not a generic session. It’s your chance to get personalized, research-backed insight on what matters to you. No cost, no pressure.

Let’s connect, talk openly, and help make your next move a smarter one.

Dear all,

Over the past week, I deliberately carved out time to retreat from the noise - to escape the rhythm of rapid-fire headlines and social media soundbites, and instead focus on what really matters: the deeper macro signals that often go unnoticed until it’s too late.

I immersed myself in historical comparisons, flows, asset correlations, and structural trends. And what I discovered wasn’t just a few interesting data points - it was a story, rich and layered, that I feel compelled to share with you. Not as a report. Not as a bullet-point memo.

But as a narrative - a journey into the forces shaping our present and likely determining our future. This letter is that story.

⭐️⭐️⭐️⭐️⭐️ Join Macro Mornings Premium

🔸 You’ll receive Exclusive, high-quality macro investment opportunities that focus on long-term growth, diversified risk, and the potential to outperform during various economic cycles.

🔥 Only 3 Spots Left - Lock in Your Lifetime Discount Now 🔥 [30% OFF for Life]

📝 Excellent score on TrustPilot

You can still start your 7-day FREE trial and explore everything Premium has to offer - full access.

📉 The Decline of Money as We Knew It

It’s hard to overstate how drastically the concept of money has shifted in the past two decades.

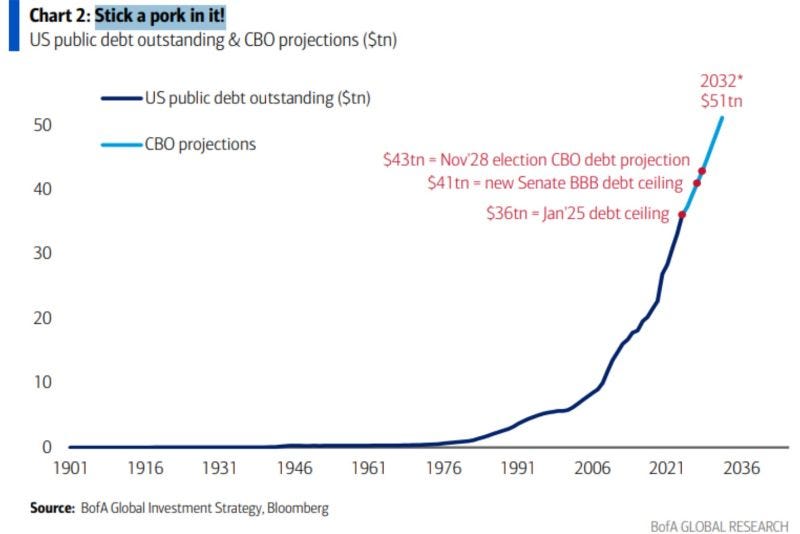

When I first started following the numbers closely in the early 2000s, the U.S. debt load seemed like a challenge we could manage - around $6 trillion at the time.

Today? We’re staring at nearly $35 trillion in federal debt, with projections indicating we might surpass $50 trillion before the decade is out.

The sheer scale of that shift is mind-boggling.

But the numbers, as always, only tell part of the story.

Behind those trillions lies something even more unsettling: the silent erosion of trust in fiat currency.

Since 1970, the dollar has lost almost 90% of its purchasing power. What cost $1 back then now demands nearly $9.

For the average family, this doesn’t show up in theory - it shows up at the grocery store, at the gas station, in their rent, and their children’s education.

In the face of this, certain assets have been quietly screaming the truth.

Gold has risen from below $300 to over $2,300 per ounce.

Real yields have dipped below zero.

The U.S. Dollar Index no longer acts as a pillar of strength but more like a pressure gauge.

And the correlations? They’re no longer coincidences - they’re evidence. Rising debt pushes the dollar down. Rising debt pushes gold higher.

As macro investors, we don’t need to chase every trade - we need to recognize when the macro backdrop becomes the trade itself.

🏠 A Home, But at What Cost?

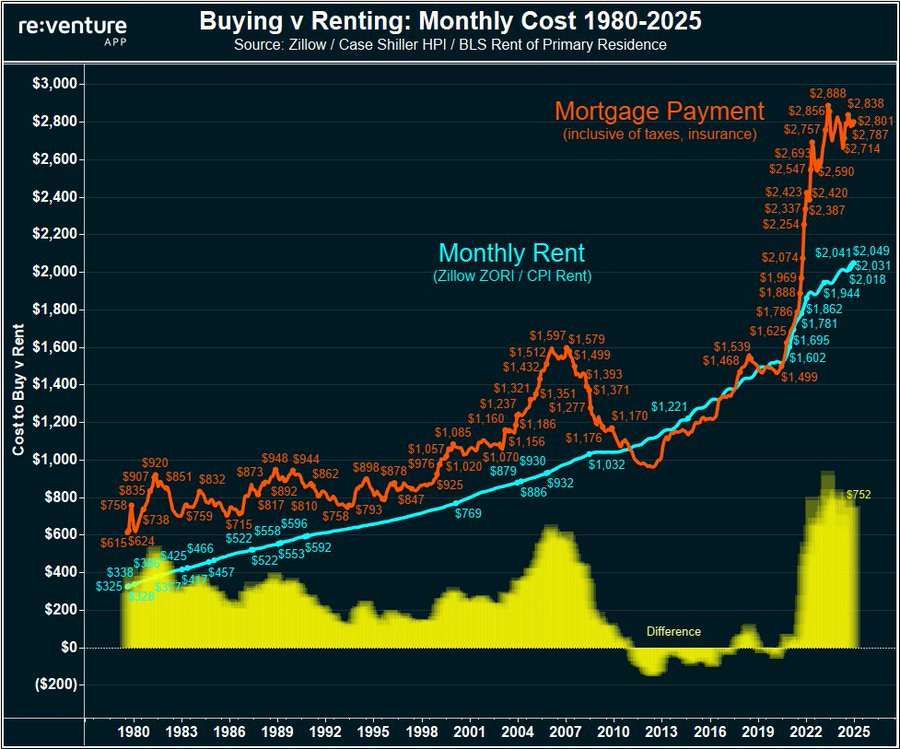

If you told someone in 2012 that by 2025 the monthly cost of a mortgage would nearly triple, they’d have laughed.

And yet, here we are.

Mortgage rates hovering around 7%, average monthly payments pushing $2,900, and a rent-versus-own gap of $750 per month - the largest in recorded history.

When we examine housing through a macro lens, we see more than prices - we see pressure points.

The Case-Shiller Index, now approaching 300, tells us this isn’t just another cycle. It’s something more fragile.

Incomes haven’t kept pace. Down payments stretch family budgets to breaking points.

And the affordability crisis is not about scarcity anymore. It’s about access to credit.

In the 2000s, we feared subprime mortgages and speculative flipping.

Today, the enemy is more insidious: policy-induced distortion.

A decade of ultra-low rates encouraged a generation of buyers to enter at peak prices with minimal buffer.

Now, with financing costs elevated, that structure is cracking.

The housing market is no longer the safe store of value it once was.

It has become a high-beta macro asset.

And while prices may not collapse overnight, the data shows clearly that this level of divergence - between mortgage costs and median household rent - is historically unsustainable.

Something must adjust. And history teaches us that prices tend to respond more swiftly than interest rates.

💸 The Cut That Everyone Sees Coming - Polymarket

The most telegraphed monetary pivot in recent memory is now unfolding.

Markets are already pricing in an 86% probability that the Fed will begin cutting rates this year.

👉 Polymarket - The World's Largest Prediction Market

Swap curves suggest we’ll see up to 60bps of easing by December. It feels inevitable.

Because if we study past easing cycles, we realize that most of the performance in risk assets comes not after the first cut, but in anticipation of it.

High-yield credit typically rallies 6-7% in the six months leading up to a cut.

Gold shines with 8-10% gains.

And USD/JPY weakens as carry trades reverse.

This time, markets are once again trying to front-run the pivot.

But the question I ask myself is not will the Fed cut-but how much has already been priced in?

If the forward guidance holds, then we’re already in the middle of the trade.

That makes timing not just relevant-but everything.

As a macro investor, I’m positioning now.

Waiting for Powell’s press conference or the next FOMC statement would be a luxury I can’t afford.

Monetary pivots are like tides.

You don’t wait to move once the wave has arrived-you position your boat as you see the water shifting beneath you.

🌍 The Quiet Exit of Capital

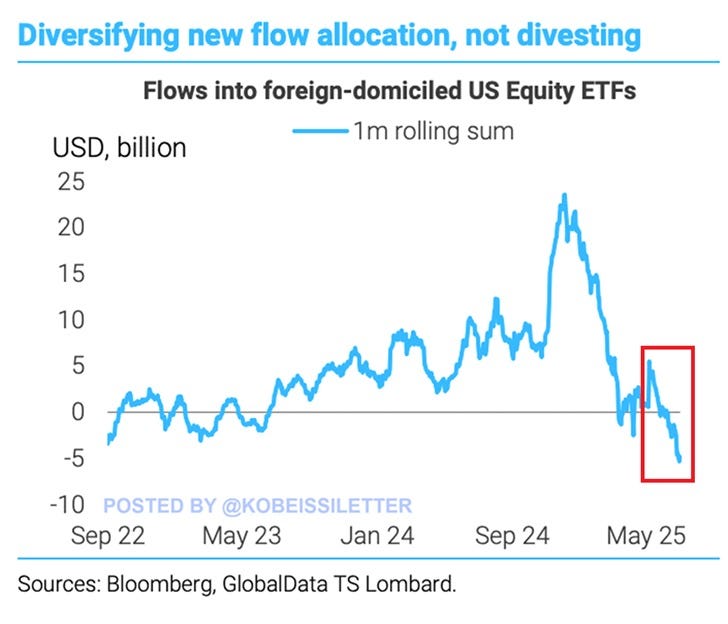

There’s something happening just beneath the surface of global markets-an undercurrent of capital rotation that’s gathering strength, but isn’t yet making the front page.

In May 2025 alone, $5 billion exited U.S. equity ETFs.

That figure might sound like a ripple, but during the past, it has been a reliable signal that something deeper is shifting.

At the same time, flows into Europe and Japan are accelerating.

Why?

Because capital doesn’t stay loyal to borders-it follows opportunity. In Japan, equities have outperformed the U.S. over the past five years.

In Europe, ROEs are rebounding, and valuations remain attractive relative to historical norms.

The old narrative of "America as the only growth engine" is fading.

The remarkable thing is how consistent this pattern has been over decades.

When ETF flows leave the U.S., relative performance almost always follows.

There’s a clear correlation between capital shifts and market leadership changes.

It may not be immediate. It may not be dramatic. But it’s reliable.

For me, this is not about abandoning the U.S. It’s about embracing optionality.

Macro isn’t just about forecasting GDP or CPI-it’s about reading the global map and knowing when the compass is pointing elsewhere.

And right now, it’s turning.

📌 Why This All Matters Now

I believe with conviction that we’re living through a regime change.

The economic backdrop of the past decade-defined by cheap money, dollar dominance, and U.S. equity leadership-is giving way to a more fractured, uncertain, and volatile environment.

And while that may feel uncomfortable, it’s also where the most asymmetric opportunities arise.

That’s why my allocation is no longer just a diversified portfolio-it’s a thesis.

I’m long gold, because it's not just a hedge-it’s a mirror to fiscal recklessness.

I’m cautious on long-dated Treasuries, because negative real yields in a debt-saturated world aren’t a margin of safety.

And I’m tactically positioned in non-U.S. equities, not because it’s trendy, but because the flows-and the fundamentals-are shifting there.

This isn’t fear speaking. It’s strategy.

And if you’ve read this far, it means you’re part of a small group of investors who want to stay ahead-not just react.

Alessandro

Founder of Macro Mornings

What You’ll Get by Joining Macro Mornings Premium

🔸 Regular deep dives into economic indicators and geopolitical developments shaping today’s markets.

🔸 Exclusive, high-quality macro investment opportunities that focus on long-term growth, diversified risk, and the potential to outperform during various economic cycles.

⭐️⭐️⭐️⭐️⭐️ Special PROMO - Almost SOLD-OUT

⏳ Only 3 Investors Can Have Access

📝 Excellent score on TrustPilot

Becoming a Macro Investor Premium, You’ll Gain Access to:

Well-researched insights help you make smarter and more informed decisions .

All the tools you need right at your fingertips to build, track, and grow a resilient portfolio - helping you retire earlier and live life on your own terms.

Stop guessing, start investing with confidence, and enjoy a life free from financial constraints.

👋 Read my Financial Story

🙏📝 TrustPilot - Leave your review and share your experience - I’d means a lot for me!

✍ FREE

📚 Get your E-book FREE 👉 10 Simplified Strategies for Investors

🏆 PRO

🔏 Become a Macro Investor here | 💰 30% Off for Life - [🔥 Only 5 Spots Left! 🔥]

📚 The Art of Financial Freedom 👉 51 Macro Lessons to Success Your Future

💻 SOCIAL

🎙 PODCAST

Disclosure

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. This material has been prepared for informational purposes only. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

The flaw in your argument is that a weak dollar makes earnings of U.S. companies stronger which drives revenues and earnings, bringing in more tax dollars. You are long gold because of a weak dollar not due to rates. You are being political. We need to cut the size of government and keep the economy strong to lower the deficit.