🛸 The Dynamics of Twin Deficits

Explore how fiscal and current account deficits influence exchange rates, interest rates, and market confidence

💡 New on Macro Mornings? Start here

🛸 Macro Deep Dives is created for those who crave in-depth understanding of macroeconomic trends.

🧠 7 TOP READINGS - May 2025 Macro Intelligence Report

👉 The complete PDF edition with insider macro strategy - grab it now for just $23.

May 1, 2025 - First Negative GDP Since 2022

May 3, 2025 - $2 Trillion Safety Net Just Vanished

May 6, 2025 - Why the Next Big Global Shift Could Start Now

May 11, 2025 - The Illusion of Calm

May 15, 2025 - When Smart Money Panics

May 20, 2025 - The Rally No One Understands

May 22, 2025 - The Illusion of Safety

Dear all,

Twin deficits-a combination of fiscal deficits and current account deficits-are a powerful force that can shape exchange rates, interest rates, and market confidence.

When a country spends more than it earns (fiscal deficit) and imports more than it exports (current account deficit), the implications for its economy and markets can be significant.

Understanding the dynamics of twin deficits helps us anticipate shifts in currency values, bond markets, and investment opportunities. 🌍💼

Let’s explore how twin deficits arise, their historical impact, and what they mean for investors today. ⏳

What Are Twin Deficits?

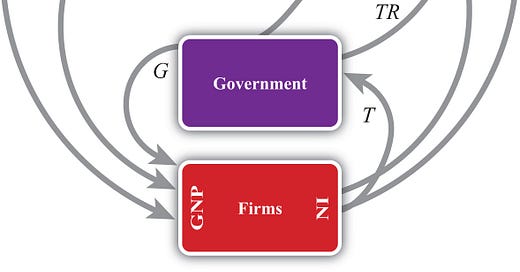

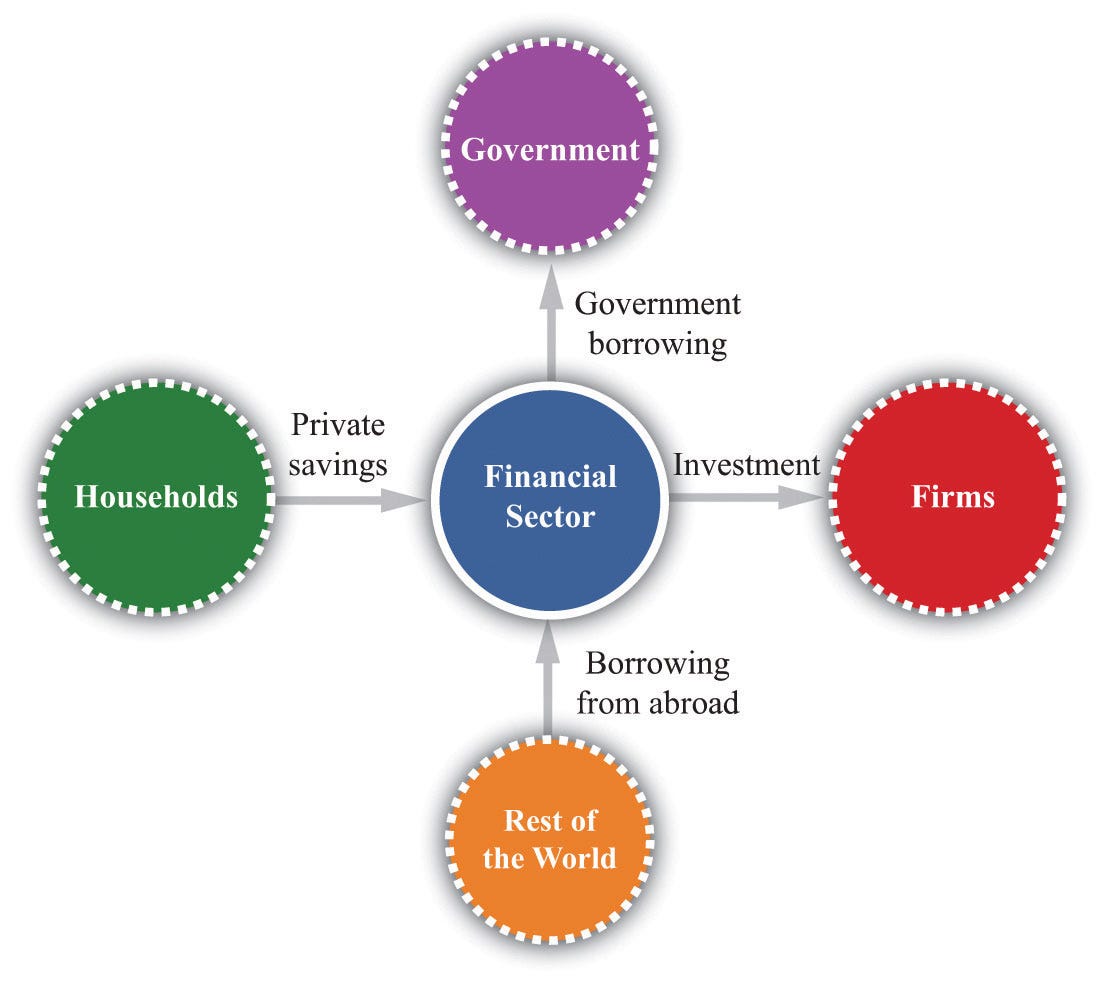

Twin deficits occur when a country runs both a fiscal deficit (government spending exceeds revenue) and a current account deficit (imports exceed exports).

These deficits are interconnected because increased government borrowing can boost demand for foreign goods, widening the trade gap.

When both deficits grow, they can weaken the currency, increase borrowing costs, and shake investor confidence. 📉💵

For example, in the U.S., periods of significant fiscal spending, such as the early 1980s and the aftermath of the 2008 financial crisis, led to widening current account deficits and a weaker dollar. 💵

Historical Examples of Twin Deficits

The U.S. in the 1980s 🇺🇸

During the Reagan administration, large tax cuts and increased military spending led to a fiscal deficit that peaked at 6% of GDP in 1983.

Simultaneously, the U.S. current account deficit widened, reaching 3.5% of GDP by 1987.

The twin deficits contributed to a sharp decline in the U.S. dollar, which fell by over 30% against major currencies between 1985 and 1987. 📉

The Eurozone Crisis (2010-2012) 🇪🇺

Countries like Greece, Spain, and Portugal faced severe twin deficits.

High government spending and weak export competitiveness led to large fiscal and current account imbalances.

Investor confidence collapsed, bond yields soared 📈, and these countries required massive bailouts to stabilize their economies. 💥

Impact on Exchange Rates and Interest Rates

Twin deficits can put downward pressure on a country’s currency.

When a nation imports more than it exports and runs large fiscal deficits, demand for its currency declines.

This devaluation can make imports more expensive, fueling inflation. 🔥💱

To attract foreign investors and finance these deficits, countries may have to offer higher interest rates.

However, rising rates can slow economic growth and increase the cost of servicing debt.

During the U.S. twin deficit period of the 1980s, interest rates on 10-year Treasuries reached 15%. 📊💥

Market Confidence and Investment Implications

Twin deficits can erode market confidence if investors believe a country’s debt and trade imbalances are unsustainable.

This loss of confidence can lead to capital flight, higher borrowing costs, and market volatility. 😟📉

For example, when Greece’s twin deficits became unsustainable, its 10-year bond yields spiked to over 35% in 2012, reflecting extreme investor pessimism.

Equity markets also suffered, with the Athens Stock Exchange losing over 60% of its value during the crisis. 📉💸

Current Landscape and Future Outlook

Today, several advanced economies are experiencing twin deficits.

The U.S. fiscal deficit surpassed $1.7 trillion in 2023, while the current account deficit remains around 3% of GDP.

These imbalances raise concerns about the dollar’s long-term stability and the sustainability of low interest rates. 🌐💵

Persistent twin deficits could lead to:

Weaker Currencies: The U.S. dollar, while strong now, may weaken if deficits continue to expand. 💱🔻

Higher Interest Rates: To attract investors, bond yields may rise, increasing borrowing costs. 📈

Inflationary Pressures: A weaker currency could make imports more expensive, fueling inflation. 🔥💰

How I’m Positioning for Twin Deficit Risks

I’m focusing on investments that can hedge against currency devaluation and inflation.

Gold and commodities remain key components of my portfolio, offering protection when currencies weaken and inflation rises.

Gold has performed well during periods of fiscal and trade imbalances. 💪

I’m also looking at short-term bonds to avoid the risks of rising yields on long-duration debt.

In equities, sectors like infrastructure, energy, and commodities offer potential growth as governments increase spending to boost economic competitiveness. 🌱💼

Additionally, I’m diversifying into foreign currencies and international equities to reduce exposure to potential dollar weakness.

This approach helps balance risk and capture opportunities in regions with stronger fiscal and trade positions. 🌍💱

🔒 Bonus Lesson to Remember

Twin deficits remind us that fiscal and trade imbalances have far-reaching effects on currencies, interest rates, and market confidence.

For me, understanding twin deficits helps identify risks and opportunities in a shifting global economy.

By positioning thoughtfully, we can weather market volatility and seize growth opportunities.💼📊🚀

Alessandro

Founder of Macro Mornings

⭐️⭐️⭐️⭐️⭐️

What You’ll Get by Joining Macro Mornings Premium

🔸 Regular deep dives into economic indicators and geopolitical developments shaping today’s markets.

🔸 Exclusive, high-quality macro investment opportunities that focus on long-term growth, diversified risk, and the potential to outperform during various economic cycles.

🎁 Exclusive Offer: 30% OFF for Life!

Becoming a Macro Investor Premium, You’ll Gain Access to:

Well-researched insights help you make smarter and more informed decisions .

All the tools you need right at your fingertips to build, track, and grow a resilient portfolio - helping you retire earlier and live life on your own terms.

Stop guessing, start investing with confidence, and enjoy a life free from financial constraints.

👋 Read my Financial Story

✍ FREE

📚 Get your E-book FREE 👉 10 Simplified Strategies for Investors

🎁 Get your Mentorship FREE here

🏆 PRO

🔏 Become a Macro Investor here | 💰 30% Off for Life - [🔥 Only 6 Spots Left! 🔥]

🔑 Get your Mentorship PRO here

📚 The Art of Financial Freedom 👉 51 Macro Lessons to Success Your Future

💻 SOCIAL

🎙 PODCAST

🙏 YOUR VOICE MATTERS - Help me

📝 TrustPilot - Leave a review and share your experience - I’d be truly grateful!

📣 Feedback Form - Help me improve Macro Mornings by sharing suggestions!

Disclosure

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. This material has been prepared for informational purposes only. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.