💡 New on Macro Mornings? Start here

🚦 This is part of a 52-week series on Macro Mistakes - Designed for those who want to learn from history.

⭐️⭐️⭐️⭐️⭐️ Join Macro Mornings Premium

🔸 You’ll receive Exclusive, high-quality macro investment opportunities that focus on long-term growth, diversified risk, and the potential to outperform during various economic cycles.

📝 Excellent score on TrustPilot

Dear all,

In today’s edition of "Macro Mistakes," we examine the 2015 Swiss Franc Crisis, when the Swiss National Bank (SNB) unexpectedly abandoned its currency peg to the euro.

This decision sent shockwaves through global markets and demonstrated the risks of currency pegs and the dangers of sudden policy shifts.

✍ The Story

In 2011, as the eurozone debt crisis intensified, the Swiss franc became a safe-haven currency.

As a result, the franc appreciated sharply against the euro, threatening Switzerland’s export-driven economy.

To prevent further appreciation, the Swiss National Bank (SNB) introduced a currency peg, setting a minimum exchange rate of 1.20 CHF per euro.

For several years, the peg helped stabilize the franc.

However, by January 2015, mounting pressure on the euro - due to the European Central Bank’s plans for quantitative easing - made it increasingly expensive for the SNB to maintain the peg.

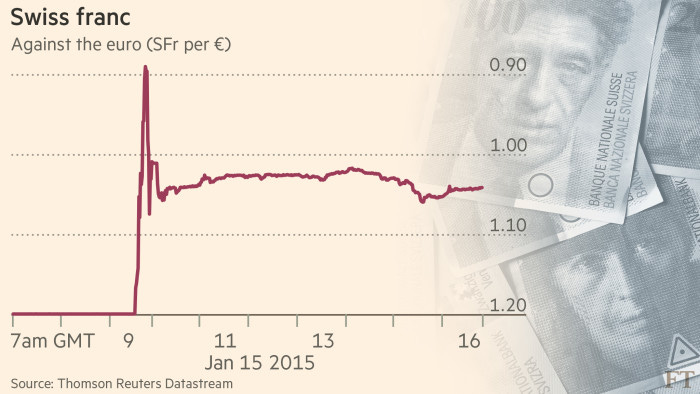

In a surprise move, the SNB announced on January 15, 2015, that it was abandoning the peg, allowing the franc to float freely.

The decision caused immediate chaos in the markets.

The Swiss franc surged by 30% against the euro in a single day, causing significant losses for investors, companies, and even individuals who had borrowed in Swiss francs.

❌🚫 The Macro Mistake

The 2015 Swiss Franc Crisis underscores the risks associated with currency pegs and the dangers of sudden policy changes:

Abandoning the peg without warning: The SNB’s decision to abandon the peg came without warning, catching markets off guard. The sudden move led to massive currency volatility and significant financial losses.

Overreliance on currency intervention: The SNB’s efforts to maintain the peg became increasingly costly as the euro weakened. Over time, the central bank accumulated large foreign exchange reserves, and the peg became unsustainable.

Unhedged currency exposure: Many borrowers, particularly in Eastern Europe, had taken out loans denominated in Swiss francs, attracted by low interest rates. When the franc appreciated sharply, these borrowers were left with much higher debt burdens.

👨🎓 The Macro Lesson

The Swiss Franc Crisis offers several critical macroeconomic lessons:

Currency pegs are risky: While currency pegs can provide short-term stability, they often become unsustainable in the face of market pressures. When pegs are abandoned, the resulting volatility can cause significant economic and financial disruption.

Policy transparency matters: Sudden and unexpected policy shifts can cause panic in the markets. Central banks should aim for greater transparency in their policy decisions to avoid unnecessary market volatility.

Hedging against currency risk is essential: Borrowers and investors who fail to hedge their currency exposure can face significant losses when exchange rates move sharply. As macro investors, it’s critical to manage currency risk carefully.

The Swiss Franc Crisis had immediate and far-reaching consequences.

Swiss exporters, who had benefited from the peg, faced significant losses as the stronger franc made their goods more expensive in foreign markets.

Many European borrowers with Swiss franc-denominated mortgages also found themselves with sharply higher debt burdens.

In the financial markets, several currency brokers went bankrupt due to the extreme volatility in the franc.

The crisis also prompted a broader reassessment of the risks associated with currency pegs and the need for more transparent central bank policies.

🔒 Macro Bonus

Investors who recognized the risks associated with the Swiss franc peg and the potential for its removal were better positioned to navigate the volatility.

Those who managed their currency risk effectively, either by hedging or diversifying their exposures, were able to avoid the worst of the financial fallout.

The lessons from the Swiss Franc Crisis are still relevant, particularly for countries that maintain currency pegs or rely heavily on currency interventions.

The 2015 Swiss Franc Crisis serves as a reminder of the risks associated with currency pegs and the importance of managing currency risk.

Next time, we’ll explore another key macro mistake: The Collapse of Northern Rock (2007) and how the first bank run in modern UK history signaled the start of the financial crisis.

Alessandro

Founder of Macro Mornings

💬 CLASSIFIEDS

⭐️⭐️⭐️⭐️⭐️

What You’ll Get by Joining Macro Mornings Premium

🔸 Regular deep dives into economic indicators and geopolitical developments shaping today’s markets.

🔸 Exclusive, high-quality macro investment opportunities that focus on long-term growth, diversified risk, and the potential to outperform during various economic cycles.

🎁 Exclusive Offer: 30% OFF for Life!

Becoming a Macro Investor Premium, You’ll Gain Access to:

Well-researched insights help you make smarter and more informed decisions .

All the tools you need right at your fingertips to build, track, and grow a resilient portfolio - helping you retire earlier and live life on your own terms.

Stop guessing, start investing with confidence, and enjoy a life free from financial constraints.

👋 Read my Financial Story

✍ FREE

📚 Get your E-book FREE 👉 10 Simplified Strategies for Investors

🎁 Get your Mentorship FREE here

🏆 PRO

🔏 Become a Macro Investor here | 💰 30% Off for Life - [🔥 Only 6 Spots Left! 🔥]

🔑 Get your Mentorship PRO here

📚 The Art of Financial Freedom 👉 51 Macro Lessons to Success Your Future

💻 SOCIAL

🎙 PODCAST

🙏 YOUR VOICE MATTERS - Help me

📝 TrustPilot - Leave a review and share your experience - I’d be truly grateful!

📣 Feedback Form - Help me improve Macro Mornings by sharing suggestions!

Disclosure

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. This material has been prepared for informational purposes only. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.