💡 New on Macro Mornings? Start here

🚦 This is part of a 52-week series on Macro Mistakes - Designed for those who want to learn from history.

🧠 7 TOP READINGS - May 2025 Macro Intelligence Report

👉 The complete PDF edition with insider macro strategy - grab it now for just $23.

May 1, 2025 - First Negative GDP Since 2022

May 3, 2025 - $2 Trillion Safety Net Just Vanished

May 6, 2025 - Why the Next Big Global Shift Could Start Now

May 11, 2025 - The Illusion of Calm

May 15, 2025 - When Smart Money Panics

May 20, 2025 - The Rally No One Understands

May 22, 2025 - The Illusion of Safety

Dear all,

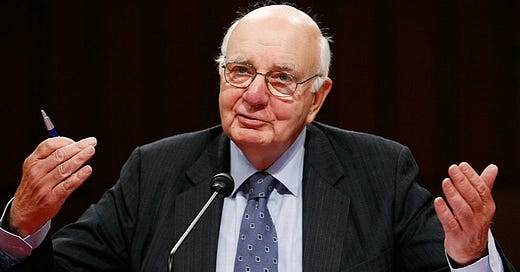

In today’s edition of "Macro Mistakes," we examine the Volcker Shock of 1979, a bold and controversial move by the U.S. Federal Reserve to combat runaway inflation.

While the policy was ultimately successful in reducing inflation, it came at a high cost - triggering a deep recession and widespread economic pain.

The Volcker Shock offers valuable lessons about the delicate balance between monetary policy and economic growth.

✍ The Story

By the late 1970s, the U.S. was grappling with double-digit inflation, driven by a combination of loose monetary policies, rising energy prices, and wage pressures.

Inflation had reached 13% by 1979, threatening the stability of the U.S. economy.

In response, newly appointed Federal Reserve Chairman Paul Volcker took aggressive action.

Volcker shifted the Fed’s focus from controlling interest rates to targeting money supply growth, which led to a dramatic rise in interest rates.

The federal funds rate soared from 11% in 1979 to a peak of nearly 20% in 1981.

This policy shift, known as the Volcker Shock, succeeded in bringing inflation under control, but it also triggered a severe recession.

Unemployment spiked to 10.8% by 1982, and the U.S. economy contracted for two consecutive years.

While the Volcker Shock tamed inflation, it also caused widespread economic hardship.

❌🚫 The Macro Mistake

The Volcker Shock highlights the trade-offs involved in using monetary policy to combat inflation:

Aggressive rate hikes: The sharp rise in interest rates was necessary to reduce inflation but came at the cost of a deep recession. The rapid tightening of monetary policy caused businesses to scale back investment, and consumer spending plummeted.

Lagged effects of monetary policy: The impact of monetary policy changes often takes time to materialize. In Volcker’s case, the delayed effects of rate hikes led to prolonged economic pain, even as inflation started to fall.

Global consequences: The Volcker Shock had global repercussions, as rising U.S. interest rates contributed to debt crises in emerging markets, particularly in Latin America, where countries struggled to service their dollar-denominated debts.

👨🎓 The Macro Lesson

The Volcker Shock offers several important macroeconomic lessons:

Monetary policy trade-offs: Using monetary policy to combat inflation often requires difficult trade-offs. While raising interest rates can reduce inflation, it can also slow economic growth and increase unemployment.

Inflation must be addressed early: Allowing inflation to spiral out of control makes it more painful to correct. Volcker’s aggressive rate hikes were necessary because inflation had become deeply entrenched in the U.S. economy.

Global spillover effects: U.S. monetary policy has far-reaching effects on the global economy. Rising U.S. interest rates can create financial challenges for countries with high levels of dollar-denominated debt, leading to broader economic instability.

By 1983, inflation in the U.S. had fallen to 3.2%, and the economy began to recover.

However, the deep recession caused by the Volcker Shock left lasting scars, with unemployment remaining high for several years.

On the global stage, the Volcker Shock contributed to debt crises in Latin America, where countries like Mexico and Brazil struggled to repay their debts amid soaring U.S. interest rates.

The crisis forced many countries to seek bailouts from the International Monetary Fund (IMF) and restructure their debt.

🔒 Macro Bonus

Investors who understood the implications of Volcker’s policy shift were able to adjust their portfolios to mitigate risk.

Those who anticipated rising interest rates could have reduced exposure to interest-rate-sensitive sectors like housing and increased allocations to safer assets, such as U.S. Treasuries.

The lessons from the Volcker Shock are still relevant, particularly in periods of high inflation.

The Volcker Shock serves as a powerful reminder of the trade-offs involved in using monetary policy to combat inflation.

While aggressive rate hikes can successfully tame inflation, they can also cause significant economic pain.

Next time, we’ll explore another macro mistake: The 2015 Swiss Franc Crisis and how the removal of the currency peg shocked global markets.

Alessandro

Founder of Macro Mornings

⭐️⭐️⭐️⭐️⭐️

What You’ll Get by Joining Macro Mornings Premium

🔸 Regular deep dives into economic indicators and geopolitical developments shaping today’s markets.

🔸 Exclusive, high-quality macro investment opportunities that focus on long-term growth, diversified risk, and the potential to outperform during various economic cycles.

🎁 Exclusive Offer: 30% OFF for Life!

Becoming a Macro Investor Premium, You’ll Gain Access to:

Well-researched insights help you make smarter and more informed decisions .

All the tools you need right at your fingertips to build, track, and grow a resilient portfolio - helping you retire earlier and live life on your own terms.

Stop guessing, start investing with confidence, and enjoy a life free from financial constraints.

👋 Read my Financial Story

✍ FREE

📚 Get your E-book FREE 👉 10 Simplified Strategies for Investors

🎁 Get your Mentorship FREE here

🏆 PRO

🔏 Become a Macro Investor here | 💰 30% Off for Life - [🔥 Only 6 Spots Left! 🔥]

🔑 Get your Mentorship PRO here

📚 The Art of Financial Freedom 👉 51 Macro Lessons to Success Your Future

💻 SOCIAL

🎙 PODCAST

🙏 YOUR VOICE MATTERS - Help me

📝 TrustPilot - Leave a review and share your experience - I’d be truly grateful!

📣 Feedback Form - Help me improve Macro Mornings by sharing suggestions!

Disclosure

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. This material has been prepared for informational purposes only. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.