Thanks for reading!!!

📌 As my subscriber you get totally FREE my Exclusive Premium Insights that I do and share only with you.

By subscribing you’ll join with thousands of Investors, Economic Professors and Aspiring Finance Student

1. The unemployment rate ticked down slightly to 3.8%, its 26th consecutive month below 4%.

2. This is the longest such streak since the 27-month stretch between 1967 and 1970.

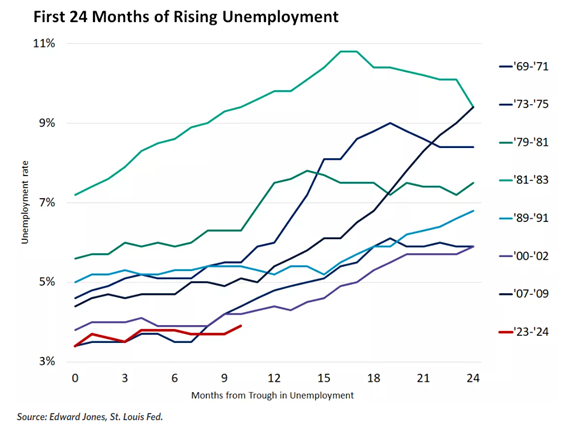

3. Analysts expects unemployment has to rise, but more modestly than historical recessionary increases in joblessness.

4. Excluding the 2020 pandemic experience, in the previous seven recessions since 1970, the unemployment rate rose by an average of 3.4%, with an average peak of 8.3%.

5. In 2024 the unemployment rate would tick higher but remain below 5% this year.

6. After a quarter of the way through 2024, it's looking increasingly likely that unemployment can remain somewhat comfortably below that threshold, which bodes well for both the economy and markets.

7. Post-WWII, the stock market has seen strong gains during the periods when the unemployment rate is below 4.5%.

8. Moreover, during the first 24 months of the jobless rate rising from its bottom, those cycles in which unemployment rose by less than 3% (1969-1971, 1979-1981, 1989-1991) saw the stock market gain an average of 29% in those two years.

9. For perspective, the S&P 500 has returned 27% since the unemployment rate bottomed at 3.4% last April.

🔍 READ THE FULL PAPER (DOWNLOAD)

💌 Sign up to my weekly email newsletter

🎙 PODCAST

Best regards,

Ale

Disclosure

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. This material has been prepared for informational purposes only. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.