🚨 [Stagflation???] Something never seen before

September 18, 2025 >> A situation almost never seen before

💡 New on Macro Mornings? Start here

🎯 This is part of a series designed for PRO investors who want real-time updates on macroeconomic news through my advanced insights. Feel free to catch up on previous emails here if you'd like to start from the beginning!

Dear all,

This week felt like one of those rare and extraordinary moments in financial history when you can feel the atmosphere change and the rules begin to shift.

The Federal Reserve cut interest rates by 25bps even as Core PCE inflation remains above 2.9%.

Think about that for a moment - it has been more than three decades since the Fed last dared to cut rates with inflation this elevated.

In my years of studying markets, I cannot recall anything quite like this.

It tells me something fundamental: the labor market is showing cracks so severe that Powell and his colleagues were compelled to move, even if it risks reigniting inflationary pressures.

This is not business as usual.

It is a clear sign that priorities are shifting, and with those shifts come opportunities, risks, and the unmistakable birth of a new market cycle.

📈 An Economy That Refuses to Slow

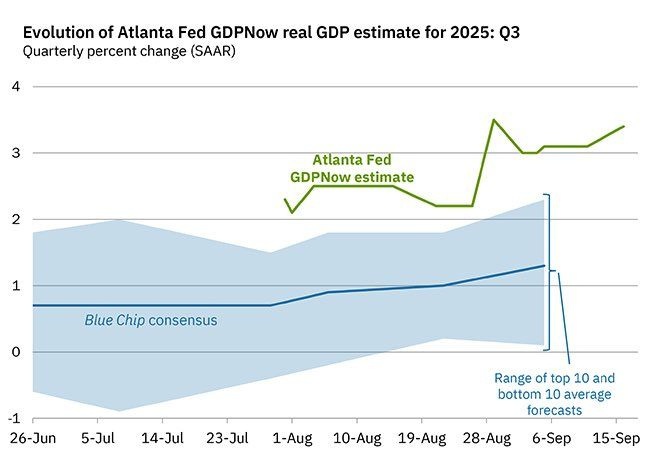

The Atlanta Fed’s GDPNow model is flashing +3.4% in Q3 2025, an eye-popping figure that stands in stark contrast to the average of just 2.3% in the decade before the pandemic.

Such growth tells us the U.S. economy is still pulsing with energy, even as parts of the labor market weaken.

I can’t help but recall 2006, another period when growth defied expectations.

Then, the S&P 500 rose more than +13% over the following year, a powerful reminder that equities can thrive in moments of strength.

But there was another side to that story - 10-year Treasury yields climbed nearly +80bps, tightening financial conditions and sowing the seeds of fragility.

Markets thrive on growth, but they are also disciplined by rising yields, and that balance defines whether we’re entering a boom or setting up the conditions for something more dangerous.

The paradox of growth is that it can be both fuel and fire.

💵 The Dollar on the Edge

The dollar, meanwhile, is whispering its own warning.

The DXY index hovers near 96.6, clinging desperately to a fourteen-year support line. If that line breaks, the implications could be seismic.

I remember the last time the dollar truly entered a downcycle, from 2001 to 2008.

In those years, the dollar lost about -40% of its value, unleashing a torrent of capital flows into commodities and emerging markets.

Gold surged +220%, oil roared +300%, and emerging market equities delivered a breathtaking +270%.

That wasn’t a coincidence - it was a generational shift in how capital was allocated, and it reshaped the investment landscape for nearly a decade.

If history rhymes, then we may be on the cusp of a similar transformation.

The winners of the next era could be very different from those of the last ten years, and positioning ahead of such changes is what defines long-term success in this game.

🔥 Stagflation and Valuations

The specter of stagflation also looms large.

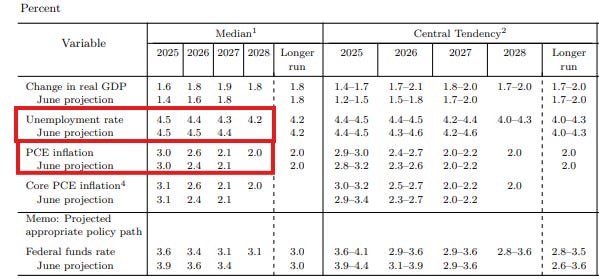

The Fed itself now projects unemployment around 4.4 - 4.5% while PCE inflation is expected to hold stubbornly at 3.0% in 2025 and 2.6% in 2026.

For me, that brings back memories of the 1970s, when growth slowed to about +2.5% while inflation ran red-hot at +7.5%.

Equities stagnated in real terms for nearly a decade, but commodities became the shining stars.

Gold advanced an unbelievable +1,200%, and oil prices surged +900%.

Those were years that taught investors to respect inflationary cycles and to understand that wealth preservation often looks very different from wealth creation.

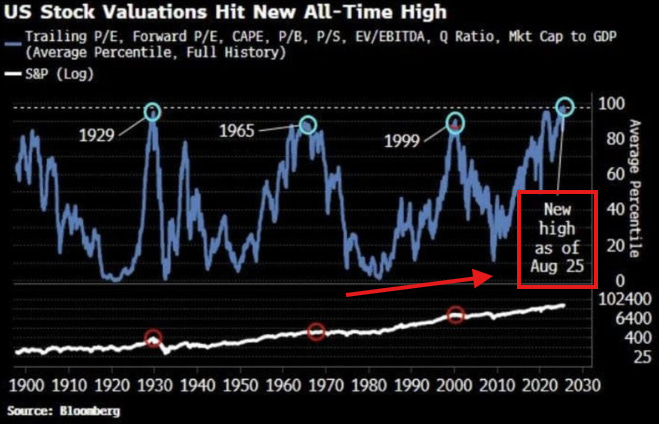

Adding complexity today is the issue of valuations.

U.S. equities now sit at levels more expensive than in 1929, 1965, or 1999.

Each of those peaks ended painfully: the Great Depression saw stocks fall -86%, the 1960s peak was followed by 17 years of flat real returns, and the dot-com bust wiped out -49% before recovery began.

Yet here lies the paradox: even after those devastating resets, compounding resumed, and patient investors reaped extraordinary rewards over time.

History warns us of danger, but it also whispers that opportunity always returns to those who endure.

⭐️ This is a paid content, so scroll to read it…

If you're a PRO subscriber, make sure you're logged in to access the full piece.

If you're still a FREE reader, you have two exclusive options to unlock this special edition and all past PRO content:

1. 👉 Pro Membership from 30% to 40% OFF - forever. Only while spots last:

🎁 PRO Member - $268/year or $22/month (Regularly $447) [Click here]

🎁 Lifetime - $621 one time only or $10/month (Regularly $887) [Click here]

These prices it’s locked forever.

2. 👉 Or start your 7-day FREE Trial - explore everything without any risk.

If you're serious about understanding what comes next - and acting before the crowd - this email is your edge.

Keep reading with a 7-day free trial

Subscribe to Macro Mornings 💡 to keep reading this post and get 7 days of free access to the full post archives.