💡 New on Macro Mornings? Start here

🎯 This is part of a series designed for PRO investors who want real-time updates on macroeconomic news through my advanced insights. Feel free to catch up on previous emails here if you'd like to start from the beginning!

Dear all,

Something didn’t sit right with me this week.

It wasn’t just the headlines. It was what they didn’t say. I started noticing fractures. The kind of subtle misalignments that whisper before they shout. Oil prices collapsing while tech rallies. Geopolitical events sparking relief instead of fear. The dollar weakening, quietly, persistently - even as bond yields creep up and central banks step away. And everywhere I look, capital is moving - not loudly, but deliberately.

It feels like we’re standing at one of those rare macro thresholds. Where what we see on the screen doesn’t quite match the story forming underneath. Where a confluence of disconnected events is starting to tell a much larger, more coherent narrative. And the more I connect the dots - from oil’s crash to the dollar’s slide, from flows into EM to gold’s resurgence - the clearer the signal becomes.

This letter isn’t about chasing volatility. It’s about sensing pressure before it breaks. It’s about reading between the candles - and preparing, not reacting.

So let me take you inside the shift I’m seeing. One that’s happening quietly now, but could soon reshape how we think about risk, assets, and opportunity.

⭐️⭐️⭐️⭐️⭐️ Join Macro Mornings Premium

🔸 You’ll receive Exclusive, high-quality macro investment opportunities that focus on long-term growth, diversified risk, and the potential to outperform during various economic cycles.

If someone had told me, just a few days ago, that the United States would bomb Iran over the weekend, I probably would’ve bet on oil spiking above $90, the dollar surging on flight-to-safety demand, and equities pulling back in classic risk-off fashion.

But markets - beautifully irrational, often counterintuitive - had a different plan in mind.

And for those of us who live and breathe macro, what happened is far more than just a price move.

It’s a full-blown shift in how we interpret risk.

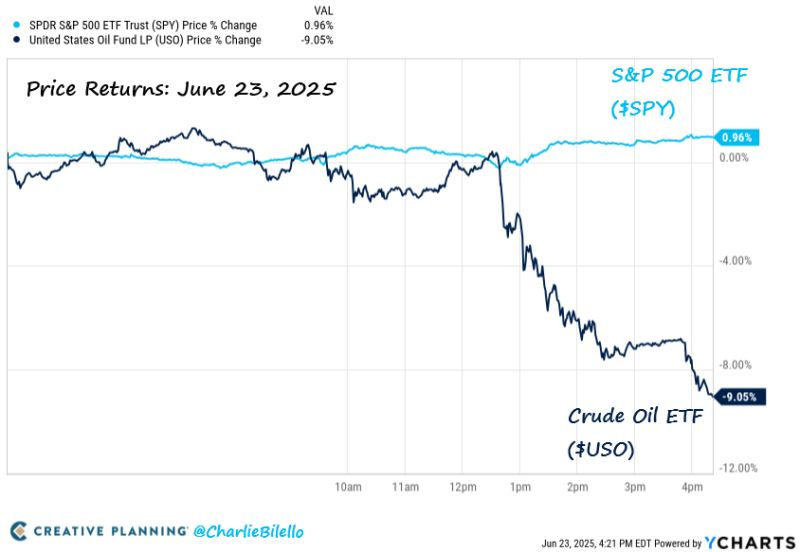

Instead of rallying, crude oil plunged more than 9% in a single session, crashing through its 200-day moving average as if it were paper.

A level that had acted as resistance for months simply evaporated, and price action flipped into capitulation mode.

What drove this wasn’t the escalation, but the lack of escalation.

Tehran’s strike on the Al Udeid U.S. air base in Qatar turned out to be more symbolic than strategic - a message of resolve, not of provocation.

In fact, reports quickly circulated that Iran gave advance warning to U.S. forces.

And just like that, what looked like a headline built for volatility suddenly turned into a de-escalatory signal.

In the hours that followed, geopolitical risk premiums evaporated.

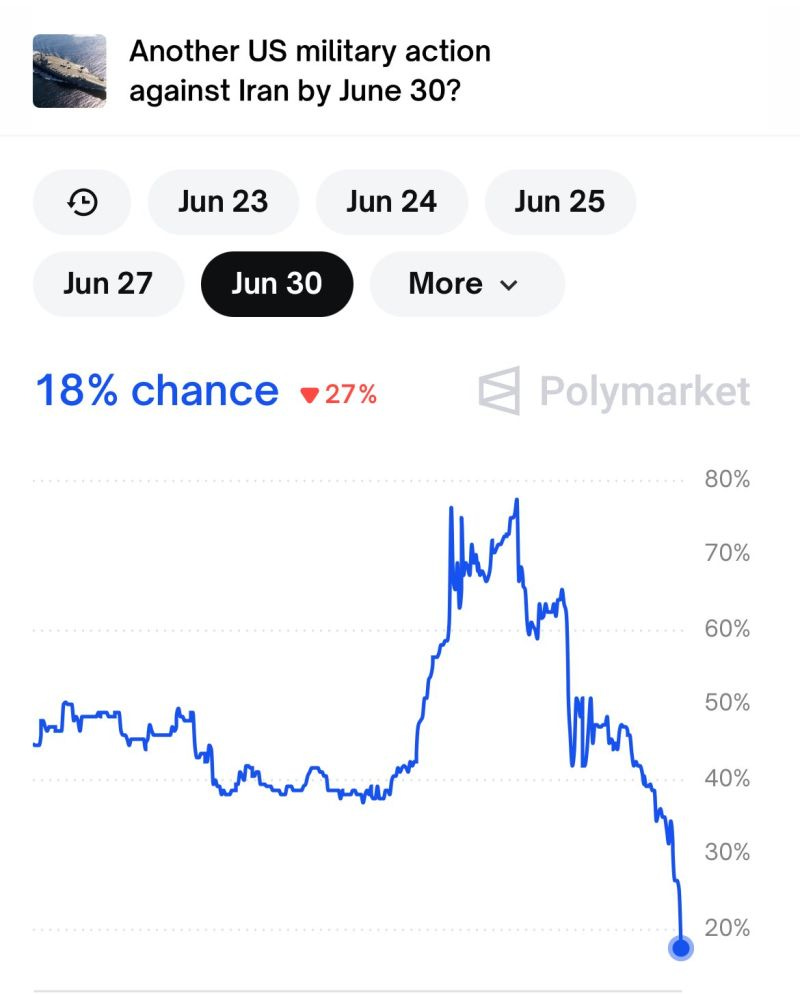

👉 Polymarket’s prediction

Polymarket’s prediction of a U.S. military response by June 30 dropped from over 70% to just 18% in less than a day.

Investors, who had been positioning for higher crude on fears of war, found themselves forced to unwind in one of the fastest reversals in recent memory.

Futures contracts (CLQ25) that had flirted with multi-month trendline resistance and hovered near the critical $76 mark were rejected decisively - triggering stop-losses, liquidations, and cascading sell pressure.

📉 Oil crashes, stocks rally

As oil tumbled, the S&P 500 closed the day up nearly +1%.

Now, think about that.

A violent move in one of the most geopolitically sensitive commodities, and risk assets didn’t flinch.

Large drops in crude oil tend to coincide with fears around demand destruction - a slowing economy, tightening conditions, or credit stress.

In July 2008, WTI fell from $145 to $99 in just six weeks, and equities sank in tandem.

But this wasn’t July 2008.

This was more like September 2019, when drone strikes temporarily disrupted Saudi oil production.

Then too, oil fell sharply - around 6% in two days - but stocks actually rose.

Why? Because the market understood the event was a shock absorber, not a destabilizer.

And that’s exactly what we saw again.

This tells me that we’re dealing with a market that is starting to treat geopolitical shocks differently.

Not as systemic threats, but as short-term events - filtered and repriced with a longer-term growth bias.

The equity market, in short, is telling us that the macro foundation is stronger than the headlines suggest.

💵 A weak dollar reshaping the playbook

Meanwhile, quietly in the background, the dollar continues to lose altitude.

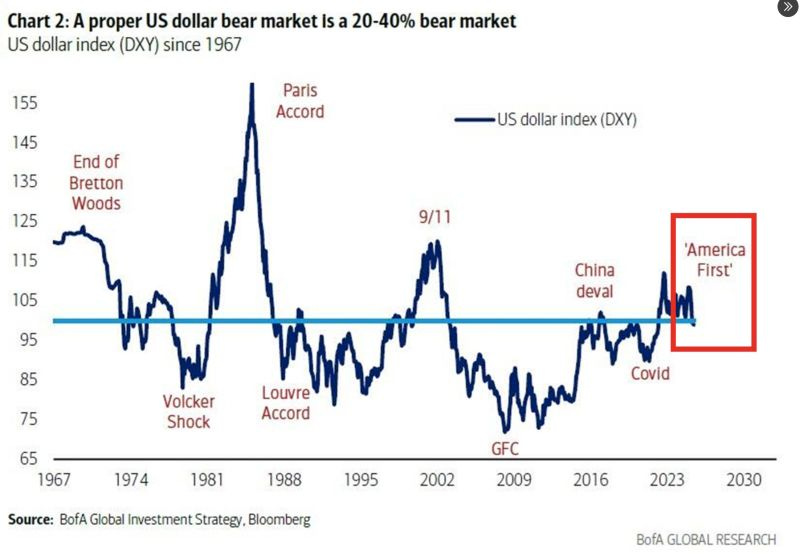

The DXY index is down 9% YTD, teetering just above the key 97.5 level - a support band that, if broken, could open the floodgates to a much broader dollar bear market.

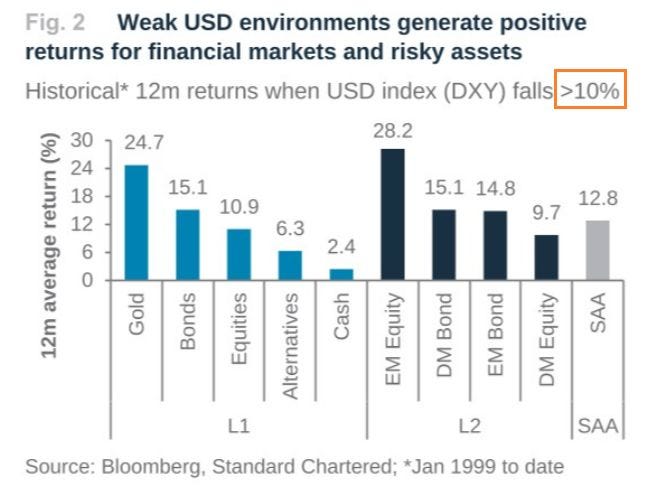

And if you’ve studied macro cycles, you’ll know that a USD drop beyond -10% is often a regime-defining moment.

Let’s rewind to 2002-2008.

During that period, the dollar lost more than 30% of its value, and the resulting impact across asset classes was dramatic:

EM equities soared +28.2%

Gold surged +24.7%

Developed Market bonds returned +15.1%

Even S&P 500 managed to return +10.9% on average

And the FX pairs responded too.

EUR/USD typically rallies around 12% in these environments.

JPY/USD? Gains of 8-10%.

Add to that the historic outperformance of EM currencies - like BRL, ZAR, and INR - which tend to gain 12-18% in weak-dollar years, and we have a scenario where the currency cycle becomes a primary driver of asset allocation.

Why does this matter?

Because a weakening dollar is more than just a DXY chart.

It’s a signal that global capital is looking elsewhere - for yield, for growth, for valuation gaps to exploit.

And that shift often brings a tailwind to global equities, real assets, and even long-duration credit.

This is what I call a stealth rotation - when capital migrates without fanfare, but the impact builds cumulatively.

🌍 Flows, foreign demand, and what comes next

Let’s not forget the structural forces at play.

Since 1991, foreign investors have accumulated over $128 trillion in U.S. financial assets.

That number still shocks me.

It speaks to the scale of trust - and the gravitational pull of U.S. markets.

But in every dollar bear cycle, that trust expands beyond U.S. borders.

In 2002-2008, foreign capital inflows surged by +18% per year, and emerging markets outpaced developed ones by a factor of 2.5.

That story could repeat.

And not just in equities - in credit, FX carry, and commodities.

When the dollar weakens, it lubricates global finance. Risk-taking returns.

And correlations between U.S. markets and foreign ones tighten - not decouple.

So when I see gold threatening to push toward $2,400, EUR/USD aiming at 1.20, and EM equity flows turning net positive, I don’t view that as noise.

I see signals.

Confirmation that the capital cycle is shifting - and that macro investors who read the signals correctly may find themselves positioned early.

🔍 So what do I see unfolding?

My base case: oil may retest the $62-64 range, especially if we see more unwinding or weak demand prints in the short term.

But unless there’s a fundamental deterioration - a demand shock or a central bank surprise - I think that range becomes an opportunity.

A place to accumulate, not to panic.

As for the dollar? I see more weakness ahead.

The policy mix (fiscal largesse + monetary pause), the valuation backdrop, and the technical setup all point to a DXY that could head lower.

If 97.5 breaks, we may be looking at a new leg in the long-term dollar cycle - and that would create tailwinds for everything from EM debt to European cyclical equities.

We’re not in a world where volatility vanishes.

But we may be moving into a world where volatility no longer threatens equity stability.

A regime where geopolitics are absorbed, not transmitted.

Where false narratives get repriced quickly.

And where clarity - not chaos - creates the best entry points.

That’s where I want to be positioned.

I hope you’ll be there with me.

Alessandro

Founder of Macro Mornings

⭐️⭐️⭐️⭐️⭐️

What You’ll Get by Joining Macro Mornings Premium

🔸 Regular deep dives into economic indicators and geopolitical developments shaping today’s markets.

🔸 Exclusive, high-quality macro investment opportunities that focus on long-term growth, diversified risk, and the potential to outperform during various economic cycles.

🎁 Exclusive Offer: 30% OFF for Life!

Becoming a Macro Investor Premium, You’ll Gain Access to:

Well-researched insights help you make smarter and more informed decisions .

All the tools you need right at your fingertips to build, track, and grow a resilient portfolio - helping you retire earlier and live life on your own terms.

Stop guessing, start investing with confidence, and enjoy a life free from financial constraints.

👋 Read my Financial Story

🙏📝 TrustPilot - Leave your review and share your experience - I’d means a lot for me!

✍ FREE

📚 Get your E-book FREE 👉 10 Simplified Strategies for Investors

🏆 PRO

🔏 Become a Macro Investor here | 💰 30% Off for Life - [🔥 Only 6 Spots Left! 🔥]

📚 The Art of Financial Freedom 👉 51 Macro Lessons to Success Your Future

💻 SOCIAL

🎙 PODCAST

Disclosure

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. This material has been prepared for informational purposes only. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Any 🇺🇸 investor who blindly buys EM debt or equities due to a planned $ weakening deserves what they get!