🤯 Record Broken: This Index Has Never Been Here Before

August 28, 2025 >> The Silent Crisis No One Sees

💡 New on Macro Mornings? Start here

🎯 This is part of a series designed for PRO investors who want real-time updates on macroeconomic news through my advanced insights. Feel free to catch up on previous emails here if you'd like to start from the beginning!

Dear all,

This past week I have been following the numbers as if I were retracing a familiar path through history.

Each chart, each auction result, and each shift in global reserves reminded me of earlier turning points when markets whispered clues before shouting them.

What I see today feels like one of those moments - a moment when the calm on the surface hides turbulence underneath, and where the smallest shifts in confidence may lead to waves that move across the entire financial system.

📉 The Treasury Auction That Wasn’t a Disaster

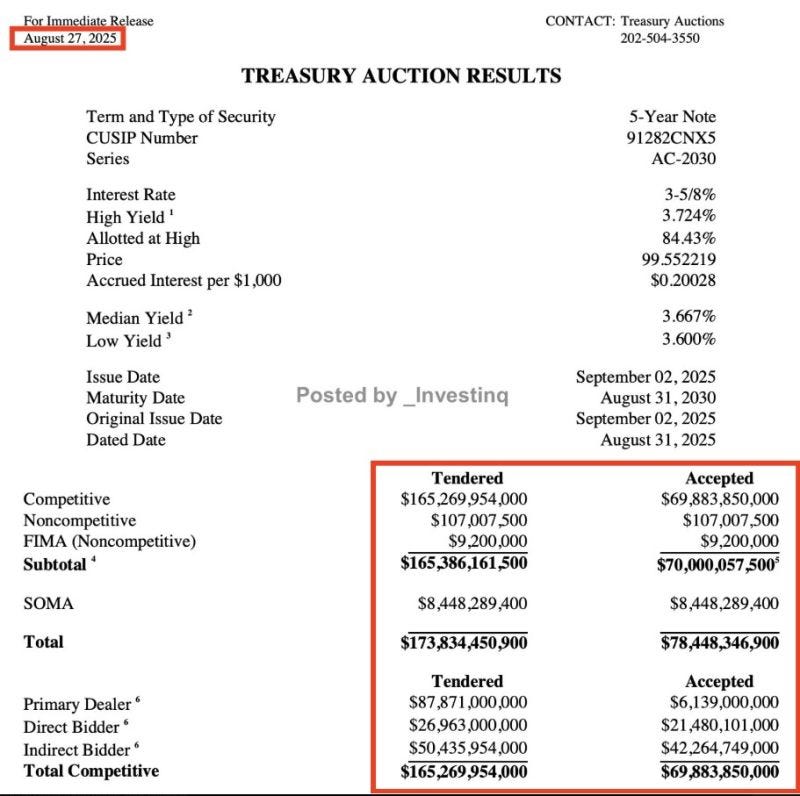

When the U.S. Treasury brought $70 billion of 5-year notes to the market, many expected weakness, and they got it.

The bid-to-cover ratio came in at 2.36, hardly a stellar sign of demand.

Dealers - the backstop everyone counts on - took just 8.8%, their lowest allocation ever.

It could have sparked alarm.

But what happened was the opposite: yields fell, bonds rallied, and fear gave way to relief.

The market had braced for something catastrophic, and when that catastrophe did not materialize, demand surged.

I remember watching something similar unfold in 2011 during the debt ceiling drama.

Back then, after a poor 10-year auction, yields fell by 45bps in two weeks as investors rushed into safety.

Expectations, more than the raw results, were the true driver.

The details tell their own story.

Foreign buyers took 60.5% of the auction.

U.S. institutions, starved for yield and increasingly nervous about alternatives, took 30.7%, the largest ever.

That juxtaposition - the caution of global players and the hunger of domestic buyers - echoes past cycles.

It reminds me that auctions are not just about numbers, but about trust, about where money feels safest in moments of uncertainty.

Beneath the official results is a message about fear and faith, a message markets never ignore for long.

🥇 The Return of Gold and the Waning of Trust

Even more striking is what is happening on the reserve side of the ledger.

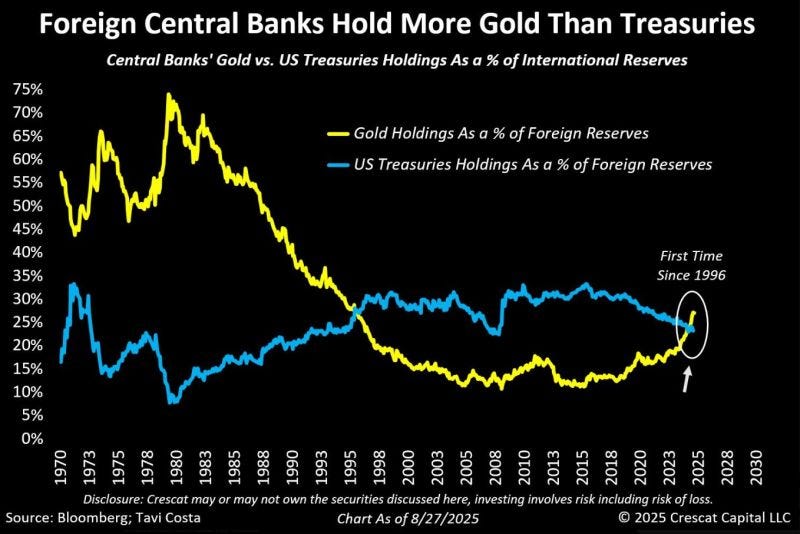

For the first time since 1996, foreign central banks now hold more gold than U.S. Treasuries as a share of their reserves.

Gold has climbed above 30%, while Treasuries have slipped below.

This is not simply a tactical decision.

It is a declaration about confidence.

The last time this happened, gold went on to outperform Treasuries by over 40% in the following three years.

And I cannot forget the great gold bull run between 2000 and 2011: an increase of 600%, while Treasuries delivered less than 80%.

Central banks are not momentum traders.

They shift reserves slowly, deliberately, with the weight of history behind every move.

By increasing their exposure to gold, they are signaling something profound: that their faith in the durability of U.S. debt is eroding.

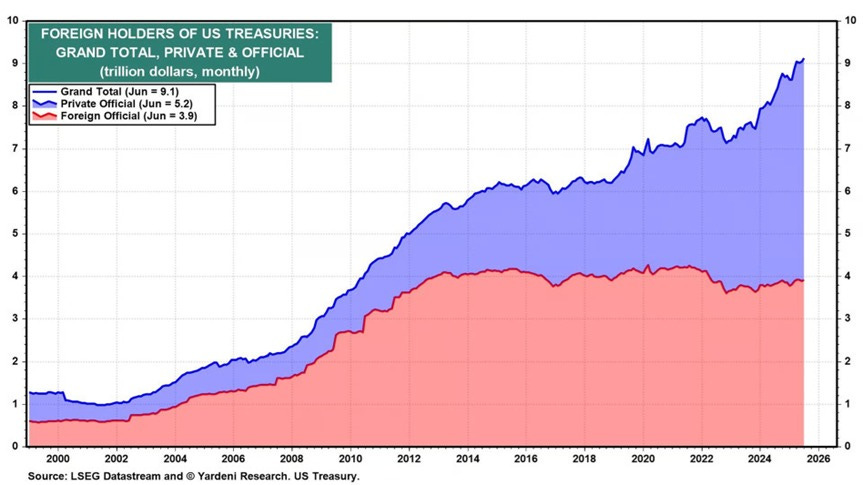

And yet, paradoxically, foreign holdings of Treasuries have reached a record $9.13 trillion.

Japan increased its exposure by $12.6 billion, the UK by almost $49 billion.

But China stood still at $756 billion, the lowest since 2009, content to watch from the sidelines.

To me, this duality - gold rising in importance even as Treasuries still find demand - captures the transition we are living through.

The old order still holds sway, but the cracks are spreading, and trust is shifting toward assets that cannot be printed at will.

💵 Liquidity, Complacency, and the Illusion of Stability

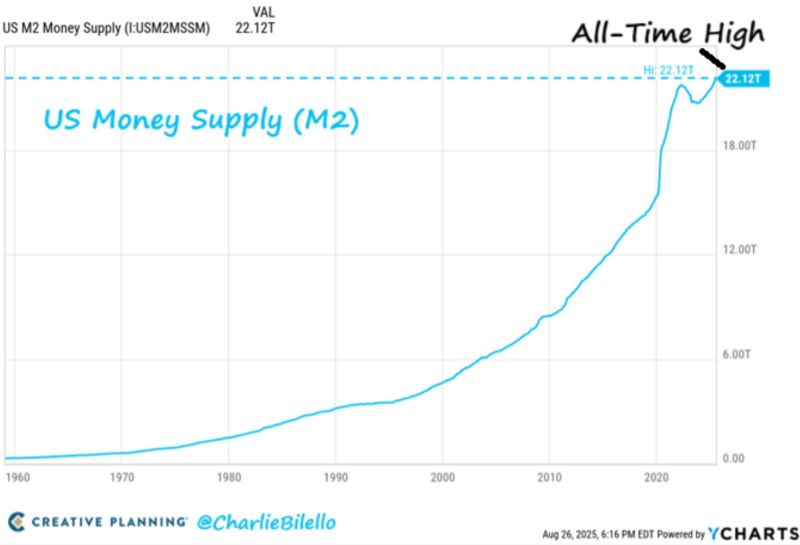

Liquidity is flooding the system again.

M2 money supply has risen to $22.1 trillion, a record high.

Every time I have seen liquidity expand at this pace, risk assets have followed.

Between 2009 and 2014, M2 grew by 35%, and the S&P 500 rewarded investors with 177%.

During the pandemic, liquidity surged 27% and the Nasdaq soared 126%.

Liquidity is gasoline for markets - it ignites rallies with explosive power.

But I have also seen how quickly that gasoline can set fire to stability.

U.S. debt is now at 120% of GDP, a line that history rarely forgives.

Countries that cross it either default, inflate their obligations away, or languish in decades of stagnation.

Japan is the sole exception, and it achieved that exception by trading growth for survival.

At the same time, investors seem to be lulled by an illusion of safety.

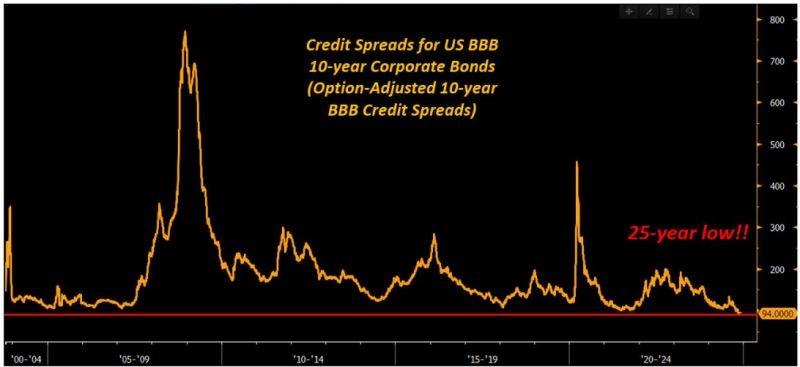

BBB corporate spreads are sitting at 94bps, their tightest in 25 years.

The last time spreads compressed to this level was in 2006 - 2007, when investors convinced themselves that risk was minimal.

Within months, spreads exploded wider and the S&P 500 collapsed by 57%.

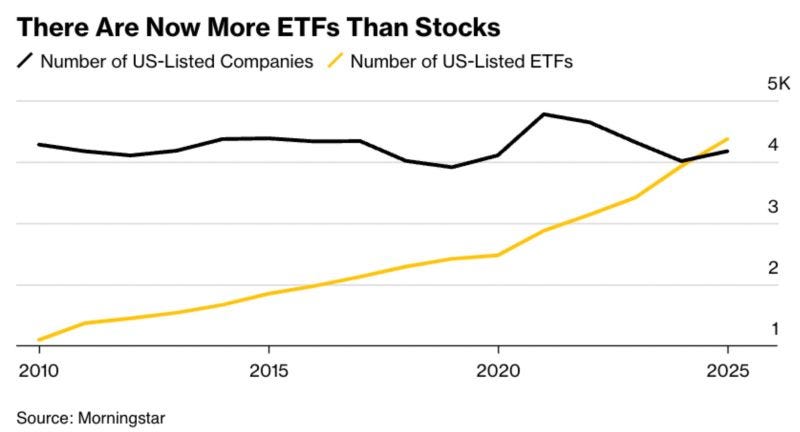

And I cannot ignore the ETF explosion: today, the U.S. has more ETFs (4,300) than listed companies (4,200).

Passive flows dominate, and fundamentals are too often drowned out by the sheer force of money pouring into indexes.

I have watched this happen before, and I know it can magnify both euphoria and despair.

What looks like stability is sometimes only calm before the storm.

⭐️ This is a paid content, so scroll to read it…

If you're a PRO subscriber, make sure you're logged in to access the full piece.

If you're still a FREE reader, you have two exclusive options to unlock this special edition and all past PRO content:

1. 👉 Pro Membership from 30% to 40% OFF - forever. Only while spots last:

🎁 PRO Member - $268/year or $22/month (Regularly $447) [Click here]

🎁 Lifetime - $621 one time only or $10/month (Regularly $887) [Click here]

These prices it’s locked forever.

2. 👉 Or start your 7-day FREE Trial - explore everything without any risk.

If you're serious about understanding what comes next - and acting before the crowd - this email is your edge.

Keep reading with a 7-day free trial

Subscribe to Macro Mornings 💡 to keep reading this post and get 7 days of free access to the full post archives.