🕵️♂️ [RECESSION] $300B in liquidity injection by mid-December

November 18, 2025 >> Significant change is now underway at the FED

⭐ LIVE WEBINAR - FREE REGISTRATION ⭐

🌍 Macro 2026: Lessons and Opportunities for the Future

🗓 December 6th, 2025 - ⏰ 11:00 AM EST - 📍 Online

Global trends are rewriting the rules of investing. 🌍 From inflation to central banks, discover the key macro shifts for 2026 - and how to position your portfolio before it’s too late.

🎟️ Seats are limited - secure your free spot now!

Dear all,

As I sit down to write this, with screens glowing softly in front of me, I feel the familiar electricity that comes only when the macro data begins to bend - not abruptly, but subtly, like a shift in the wind that only the most attentive notice.

Over the years I’ve learned that the real story of markets doesn’t arrive in headlines.

It arrives in quiet signals, hidden correlations, and patterns that whisper long before they ever shout.

And right now, those whispers are growing louder, carrying with them the unmistakable rhythm of past cycles - echoes of 2001, 2008, 2015, and 2020 - times when the world was moving toward a turning point before anyone dared to acknowledge it.

I want to take you with me into this unfolding landscape.

Not through bullet points, and not as a list of detached facts, but as one continuous narrative - a journey through the numbers, the intuition, the memories of past cycles, and the living reality that the markets are shaping right now.

Because this moment deserves to be explained not just with charts, but with breath, context, and the sense of urgency that only a story can deliver.

Every morning, when the terminals come alive, I ask myself a simple but powerful question: Does what I’m seeing rhyme with something I’ve seen before?

In the past weeks, that question has turned into an answer.

A firm one. A clear one. The echoes of past macro regimes are aligning in ways that I can no longer ignore.

The Fed’s fragmentation… the collapse in freight activity… the rapid acceleration in real-economy money supply… the quiet contraction in U.S. labor markets… the deep mispricing of commodities… the build-up of global fiscal engines preparing to ignite… none of these signals alone tell the full story.

But when they merge, intertwine, and reinforce each other, they form a narrative that demands attention.

Let me walk you through that narrative as I see it, piece by piece, emotion by emotion, chart by chart.

🔻 A Fed That Has Lost Its Center of Gravity

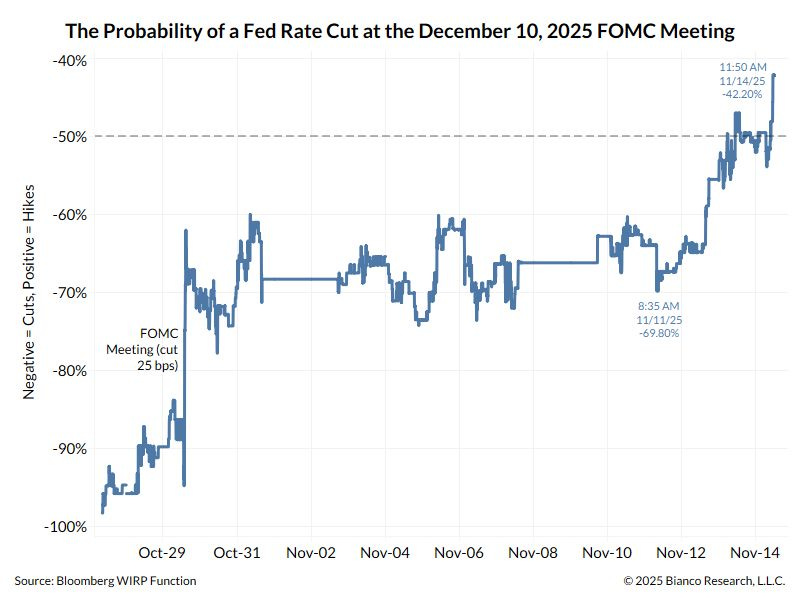

The first tremor came from the Federal Reserve - not through speeches or official releases, but through the market’s own expectations.

Just days ago, traders were assigning a 70% probability to a December rate cut.

Then, without a single major data release, that probability collapsed to 42%.

And immediately I knew something deeper was stirring beneath the surface.

For the first time in decades, the Fed is no longer a unified organism speaking with one voice.

It has fractured into competing instincts: four members pushing for cuts, one arguing for a bold 50 bps, five pushing to hold, and three - including Powell - floating in ambiguity.

It is a tableau I’ve seen only a handful of times in my career.

When the Fed fractures, the market loses its compass.

I saw it in 1994 - 95, when internal division led to a curve steepening of nearly 70 bps.

I felt it in 2004 - 06, when uncertainty around rate paths caused violent cross-asset rotations.

And I remember vividly the end of 2018, when a similar fracture contributed to a -20% equity drawdown, paired with a collapse of almost 70 bps in long-end yields.

The parallels today are striking.

And as I watch the dots on the chart drift apart, I feel the same sense of tension I’ve felt before moments of major policy misalignment - a tension that has always preceded a period of heightened volatility and significant opportunity.

This isn’t indecision. It’s the beginning of a regime shift.

🚚 When Freight Stops Moving, The Illusion of Strength Fades

Then the second tremor arrived - quiet, cold, and brutally honest.

The Cass Freight Index collapsed back to pandemic-era lows, wiping away the illusion that the real economy was still humming along beneath the surface.

Freight is one of those metrics I respect deeply because it doesn’t bend to narratives. It doesn’t get boosted by sentiment surveys.

It isn’t influenced by political considerations.

It simply measures movement - real, physical movement of goods across the economy.

And when movement stops, momentum dies.

In 2001, freight activity tumbled months before equities dropped -20%. In 2008, freight cratered shortly before global markets fell -35%.

Even the milder episode of 2015-16 - a slowdown few took seriously - produced back-to-back corrections of -10% to -15%, while high-yield spreads widened 200 - 300 bps.

When I overlay today’s freight collapse onto those past episodes, the correlation with future equity drawdowns is chilling - approaching 0.7 across three decades of data.

The typical lag is three to six months.

And here we stand, at the beginning of that window.

You can almost feel the air shifting.

Freight collapses have another pattern I’ve come to trust: they always force the Federal Reserve into a corner.

When the economy’s arteries constrict, the Fed must eventually respond, even if the timing is uncertain.

The freight line doesn’t just predict growth - it predicts the policy reaction that follows.

And that brings us naturally to the next part of the story.

💸 The Money Printer Has Returned - and This Time the World Is Doing It Together

As freight weakened, something else began to rise with extraordinary force: global real-economy money creation.

2025 is generating spendable money at a pace we haven’t seen since 2017 - and only surpassed by the fiscal explosion of 2020.

This isn’t the sterile liquidity of repo facilities and funding spreads.

This is real money - the kind that enters bank deposits, fuels nominal spending, lifts asset prices, and reshapes entire macro regimes.

Whenever global money growth exceeds 10% Y/Y, the world enters a phase where nominal GDP accelerates, inflation becomes persistent, and markets respond with remarkable strength.

The historical parallels are breathtaking:

In 2017, synchronized money growth powered a +20% to +23% MSCI World rally and a +35% to +40% surge in emerging markets.

In 2020-21, during the fastest money creation in modern history, the S&P 500 launched into a ~+90% rally, commodities gained +60 - 80%, and credit spreads collapsed.

Now add what awaits us in 2026: massive fiscal packages in the U.S., Germany, Korea, Sweden, Japan, and Australia.

It is hard to overstate how powerful this setup is.

A two-year global fiscal engine, paired with a fresh wave of real-economy liquidity, is the kind of alignment that markets only see once or twice in a decade.

When I look at these numbers, I don’t just see liquidity - I see ignition.

And ignition always needs a fuel source.

Which brings us to commodities.

🛢️ Commodities Are Priced for a World That Forgot What Scarcity Means

Every time I look at the Commodity Index relative to emerging markets - now sitting at a staggering 0.08× - I feel transported back to only two other moments in my career: 1999 - 2001 and 2015.

Both were times when the world believed commodities were obsolete.

When people thought technology, innovation, or monetary expansion had made raw inputs irrelevant.

Both times, the world was spectacularly wrong.

From 1999 to 2008, commodities didn’t merely rally - they surged +250% to +300%, creating one of the most powerful supercycles of the modern era.

From 2016 to 2018, even a modest recovery delivered +60% returns, outpacing emerging markets and driving resource-heavy currencies to appreciate 5% to 15% against the dollar.

The reason is simple: scarcity always returns.

And we are entering a decade where scarcity isn’t just relevant - it is structural.

Electrification, decarbonization, underinvestment, geopolitical fragmentation… all of these pressures converge on the same point: the world is about to rediscover the price of what it forgot.

When I overlay today’s 0.08× ratio onto the historical charts of previous commodity supercycles, the resemblance is uncanny - as if the past were tracing the outline of the future.

If this ratio merely moves back to the midpoint of its historical range, the upside potential becomes almost hard to believe.

And yet, here it is.

⭐️ This is a paid content, so scroll to read it…[🎁 #4 BONUS if you become a PRO today] - Only 2 spots last

If you’re a PRO subscriber, make sure you’re logged in to access the full piece. And if you’re already Annual/Lifetime member 👉 Access to 🧠 Macro Mornings Family.

If you’re still a FREE reader, you have two exclusive options to unlock this special edition, all past PRO content and the App’s Special launch:

1. 👉 Pro Membership from 30% to 50% OFF - forever. Only 2 spots last:

⭐ PRO Membership - $285/year or $24/month (Regularly $570) [Click here]

👑 Lifetime - $798 one time only or $13/month (Regularly $1,140) [Click here]

👇 Now Includes 4 High-Value Bonuses (FREE) 👇

🎁 BONUS #1 - These prices are locked forever and will never increase.

🎁 BONUS #2 - FREE access to the 🧠 Macro Mornings Family, our private community.

🎁 BONUS #3 - Full App access 📲 + all exclusive content, anytime, anywhere.

🎁 BONUS #4 - [$1,197/year] - 🕵️♂️ Join a Monthly live mastermind where we answer the community’s most pressing questions, break down real-world cases, and share strategies.

👉 After payment, you’ll receive a Welcome Kit by email with all the material and instructions to join.

2. 👉 Or start your 7-day FREE Trial - exploring only the PRO analyses without any risk.

If you’re serious about understanding what comes next - and acting before the crowd - this email is your edge.

Keep reading with a 7-day free trial

Subscribe to Macro Mornings 💡 to keep reading this post and get 7 days of free access to the full post archives.