**PRO** Macro Investors (BONUS SECTION)

October 27, 2024 BONUS >> Rate Decision, Existing Home Sales, Crude Oil Inventories, Initial Jobless Claims, Global Manufacturing and Services, Durable Goods Orders

💡 New on Macro Mornings? Start here

🎯 This is part of a series designed for PRO investors who want real-time updates on macroeconomic news through my advanced insights. Feel free to catch up on previous emails here if you'd like to start from the beginning!

📢 Macro Investors (BONUS SECTION AT THE END)

⚡ BoC Rate Decision (Canada)

The Bank of Canada kept rates at 3.75% this week, down from the previous 4.25%. This pause is more than just a number; it signals a subtle shift toward caution.

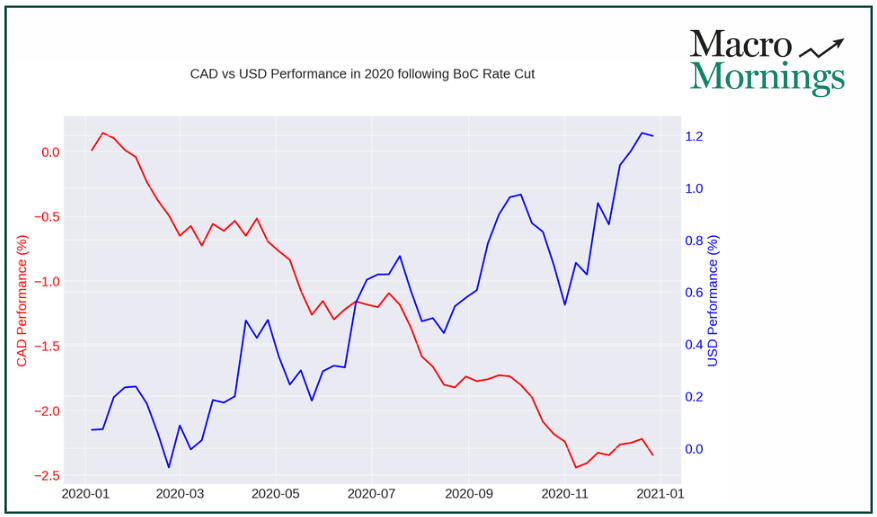

In similar cases, like in 2020, we saw the Canadian dollar weaken, losing about 5% against the USD over six months as markets adjusted to a dovish stance.

We might see something similar now, with bond yields following suit.

In fact, 2-year yields have dropped by 0.15% on average over three months in similar rate holds, offering us a glimpse into what could lie ahead for fixed-income investments.

🧠 U.S. Existing Home Sales

In the housing market, September’s existing home sales data came in slightly lower at 3.84 million.

Now, it’s easy to overlook these declines as just minor adjustments, but history tells us otherwise.

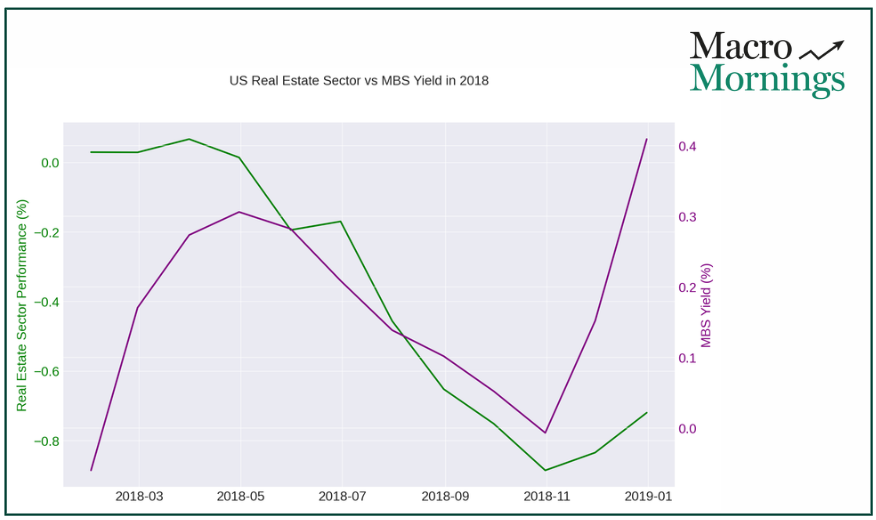

Back in 2018, a similar dip in sales led to a 7% drop in real estate stocks over the next quarter.

Rising mortgage rates are clearly biting into demand-a trend worth noting if you’re eyeing the real estate sector.

Mortgage-backed securities (MBS) yields often rise in such times, reflecting higher credit risk.

It's a subtle but important shift that real estate-focused investors may want to watch closely.

💥 Crude Oil Inventories

In the oil markets, an unexpected surge in inventories-up 5.474 million barrels this week-came as a surprise, especially given the forecast of only 0.800 million.

After a similar build-up in April 2019, WTI crude prices dropped by around 4% within two weeks.

We might see a similar downward pull in prices, impacting energy stocks that typically underperform by 2-3% in these situations.

For those of you watching currency markets, take note: when inventories spike, the USD tends to strengthen as oil imports decline, reducing the U.S. trade deficit.

A subtle yet impactful correlation worth considering.

💡 U.S. Initial Jobless Claims

In labor market news, jobless claims came in lower than expected at 227K against a forecast of 243K.

This signals a resilient workforce, which could mean the FED feels less pressure to cut rates in the short term.

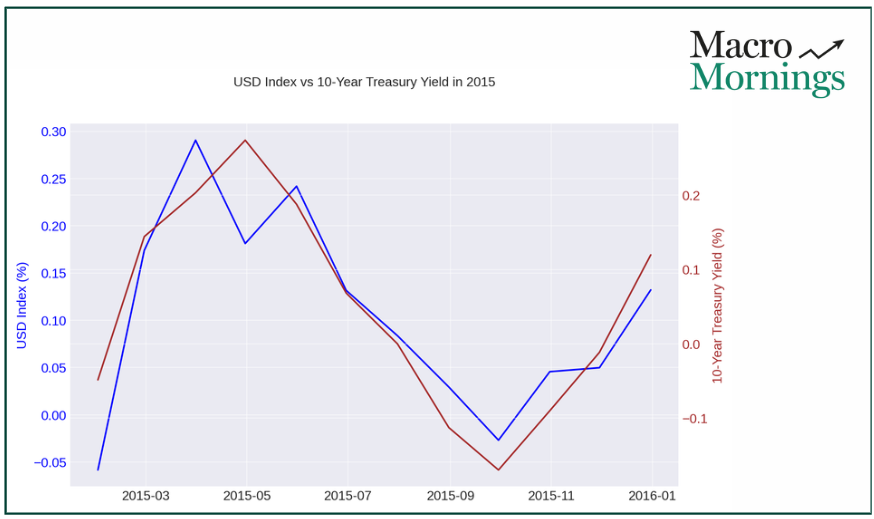

When we’ve seen labor strength like this, the USD index tends to climb-back in 2015, we saw a 0.5% increase in the USD index over the following month under similar conditions.

Treasury yields also tend to tick up in response, as confidence in economic stability grows.

Just something to keep in mind as we navigate interest rate expectations.

🔥 S&P Global Manufacturing and Services PMI

The latest PMI data reveals an intriguing divergence.

Manufacturing PMI, though up slightly to 47.8, remains in contraction, while the Services PMI rose to 55.3.

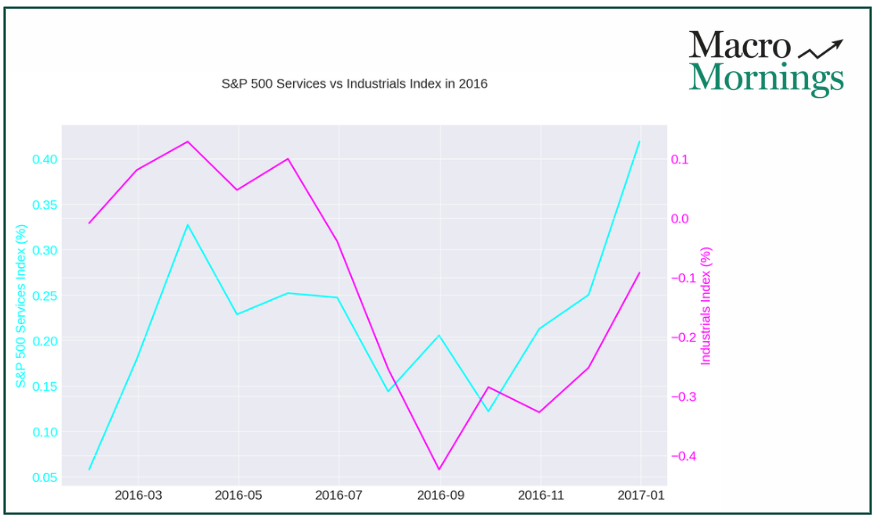

This divide reminds me of 2016, when services outpaced manufacturing, driving the S&P 500 Services Index up by 3.5% over the quarter.

Manufacturing struggles can drag on industrial stocks, which fell by 1.8% in similar periods of contraction.

It’s a reminder of the importance of sector-specific strategies, especially if you’re leaning toward industrials or services.

🚨 U.S. Durable Goods Orders (MoM)

Finally, let’s look at durable goods orders. A 0.8% decline in September was actually better than anticipated, but it still points to caution among businesses.

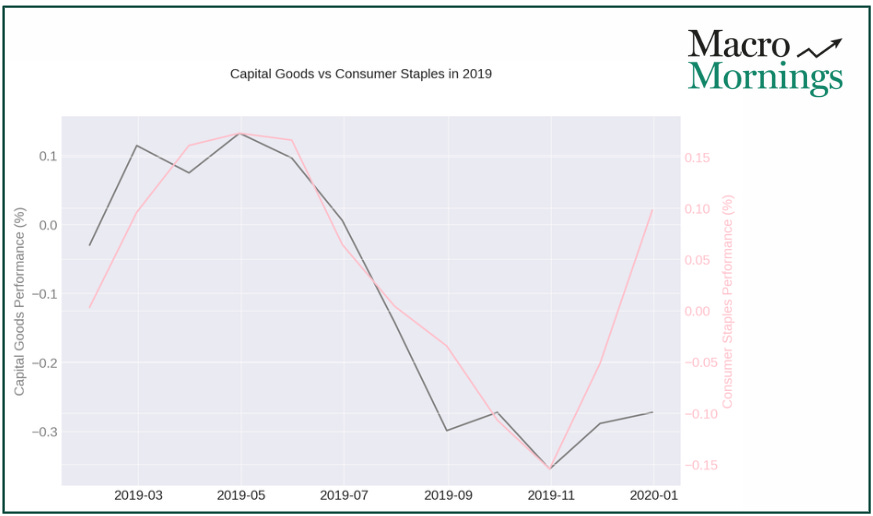

This isn’t just a small blip-back in 2019, a similar slowdown led to a 1.2% decline in capital goods stocks within a month.

This trend typically nudges investors toward more defensive assets, like consumer staples, which saw an average 0.6% gain in similar periods as investors sought stability.

BONUS SECTION

👉 The underwhelming existing home sales data and high mortgage rates suggest ongoing strain on the housing sector. However, instead of traditional real estate plays, consider REIT ETFs focused on rental properties that tend to stay resilient even in tight housing markets. The Vanguard Real Estate ETF (VNQ), with its diversified exposure, could serve as a safe haven as housing sales stumble while rents remain strong.

👉 In commodities, crude oil’s inventory build presents a short-term oversupply. This has led to temporary price corrections, a potential opening for those interested in energy ETFs. The Energy Select Sector SPDR Fund (XLE) stands out, as it gives broad access to the energy sector without the single-stock risk. For a more diversified approach, United States Oil Fund (USO) is worth considering to capture potential price rebounds in WTI.

👉 With the U.S. labor market showing resilience in jobless claims, long-duration bonds might take a hit as rate cuts become less likely. Here’s where I’d focus on short-duration bond ETFs like the iShares 1-3 Year Treasury Bond ETF (SHY). It’s a lower-risk way to capitalize on steady yields without exposing ourselves to the volatility of longer-dated bonds in an environment that’s clearly leaning toward a “higher for longer” rate stance.

👉 Finally, for those drawn to sector-specific plays, the services sector outperformance over manufacturing signals strength in consumer spending. Consider ETFs like the SPDR S&P 500 Consumer Discretionary ETF (XLY), which could benefit from this trend. This fund focuses on companies that drive consumer spending, making it a potential winner as services continue to outpace manufacturing.

🚦 These are just ideas, of course, but in a market as dynamic as this, staying nimble and reading the data can make all the difference. Let’s keep our eyes open, leverage what we know, and stay positioned to capitalize on these macro shifts as they unfold.

Best regards,

Alessandro

Founder of Macro Mornings

I’M EXCITED TO HAVE YOU ON BOARD, BECOME MY FRIEND

💎 Get your Mentorship FREE here

🎙 PODCAST

Disclosure

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. This material has been prepared for informational purposes only. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.