**PRO** Macro Investors (BONUS SECTION)

November 22, 2024 BONUS >> 4 Investment Opportunities >> UK Inflation Surprises Markets, US Labor Market Remains Resilient, Housing Market Shows Stability, European Economy Stagnates

💡 New on Macro Mornings? Start here

🎯 This is part of a series designed for PRO investors who want real-time updates on macroeconomic news through my advanced insights. Feel free to catch up on previous emails here if you'd like to start from the beginning!

📢 Macro Investors (BONUS SECTION AT THE END)

⚡ UK Inflation Surprises Markets

The UK CPI (YoY) for October came in at 2.3%, higher than the forecast of 2.2% and far above the previous 1.7%.

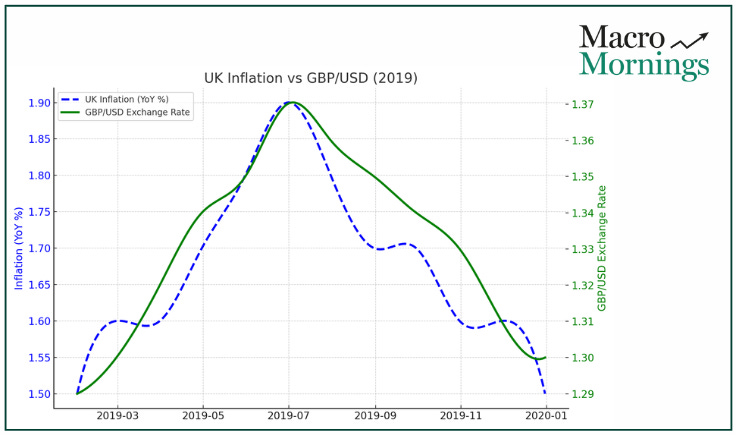

Back in 2019, a similar inflationary jump - from 1.5% to 1.8% - saw the GBP/USD strengthen by 3.2% within a month.

At the same time, UK 10-year Gilt yields rose by 25 basis points, reflecting growing market expectations for a policy shift.

Today’s numbers could lead us down a familiar path, with sterling gaining momentum and bond yields reacting to the potential for tighter monetary policy.

But the real question is: will the Bank of England step in, or allow inflation to breathe a little longer?

🧠 U.S. Labor Market Remains Resilient

The latest jobless claims data surprised to the downside again, with 213K reported against a forecast of 220K.

This marks yet another week of strength in the U.S. labor market.

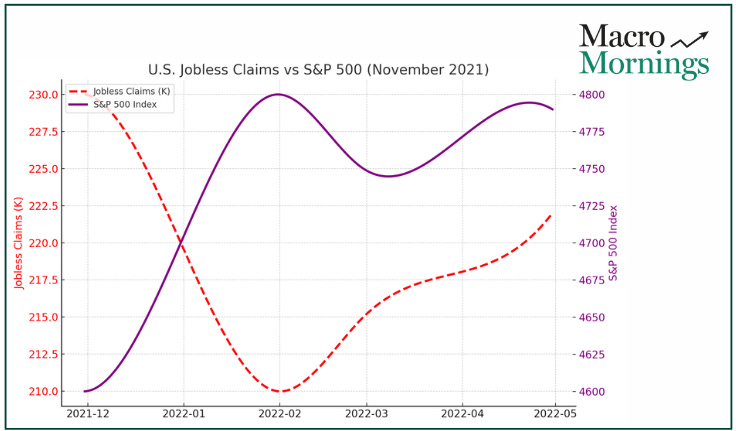

Remember November 2021?

When claims hit a similar low of 210K, the S&P 500 surged 4.5% over the following two weeks, led by consumer discretionary and industrial sectors.

But labor market resilience has its complexities. Back then, U.S. Treasury 10-year yields dropped by 12 basis points, signaling mixed market expectations.

This time, with inflation still elevated, could we see a different reaction?

💥 Philadelphia Fed Index Sends Warning Signals

The Philadelphia Fed Manufacturing Index delivered a disappointing -5.5, missing expectations of 7.4 and plunging from the prior 10.3.

Sharp declines in this index have rarely gone unnoticed by the markets.

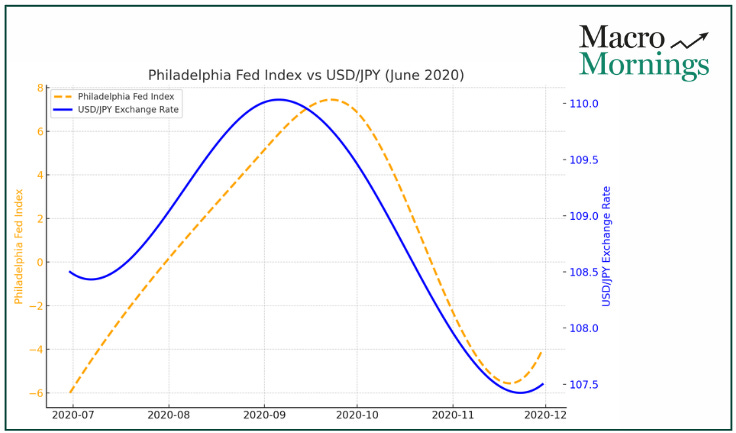

In June 2020, when the index hit -6.0, the Dow Jones Industrial Average fell 3.8% over the following two weeks, while the USD weakened by 2.4% against the JPY as risk sentiment shifted.

The correlation is clear: a weakening manufacturing sector often dampens equity performance while encouraging safe-haven flows.

Is this the beginning of a broader slowdown, or just a bump in the road?

💡 U.S. Housing Market Shows Stability

Despite elevated mortgage rates, existing home sales for October rose to 3.96M, edging past expectations of 3.95M and higher than September’s 3.83M.

The housing market has proven remarkably resilient in recent months.

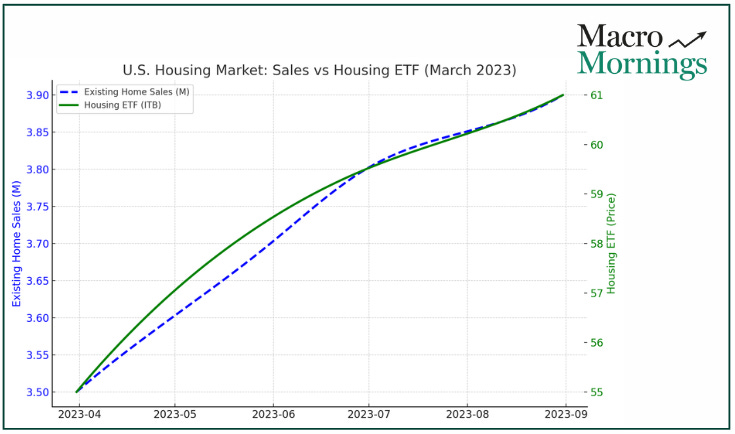

Consider March 2023, when a similar 3.5% rise in home sales drove the iShares U.S. Home Construction ETF (ITB) to a 5.7% gain in just one month.

This time, the data could again point to underlying demand, even in the face of higher financing costs.

Will this momentum be enough to keep housing-related equities attractive to investors?

🚨 European Economy Stagnates

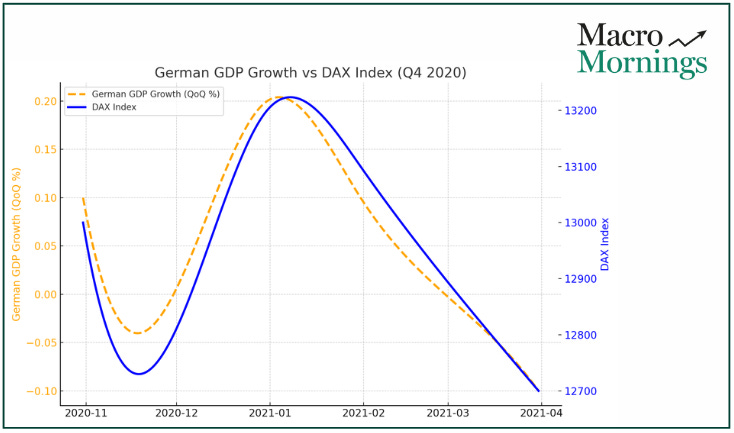

Germany’s GDP growth for Q3 came in at a modest 0.1%, right in line with expectations but lower than the prior quarter’s 0.2%.

In the past, periods of stagnation in Germany have had ripple effects on broader European markets.

In Q4 2020, when GDP growth hovered at 0.1%, the DAX Index underperformed global equities, falling 2.1% over the following month.

At the same time, the EUR/USD weakened by 1.8%, as investors looked for growth opportunities outside the Eurozone.

Today’s data underscores the ongoing structural challenges Europe faces - challenges that could further pressure the ECB in the months ahead.

BONUS SECTION: 4 Investment Opportunities

As I analyzed the numbers this week, I couldn’t help but connect the dots between these macroeconomic developments and potential market opportunities. The data is speaking, and if we listen closely, it’s telling us where to look. Let me walk you through some ideas.

1️⃣👉 With UK inflation surprising to the upside, it’s clear the Bank of England might face renewed pressure to tighten policy.

Periods of rising inflation have favored the financial sector and UK-focused equities.

An ETF like the iShares MSCI United Kingdom ETF (EWU) might be worth considering.

It provides exposure to the UK market and could benefit from the resilience we’re seeing in key sectors.

2️⃣👉 On the other side of the Atlantic, the resilient U.S. labor market combined with a sharp decline in the Philadelphia Fed Index presents a fascinating dichotomy.

If manufacturing is indeed slowing while services hold strong, sector rotation could be key.

I’d keep an eye on the iShares U.S. Consumer Discretionary ETF (IYC), which aligns with the strong labor numbers and a healthy U.S. consumer base.

For manufacturing weakness, commodities like copper might face pressure, opening potential plays in short positions or inverse ETFs tied to industrial metals.

3️⃣👉 When it comes to housing, the improvement in Existing Home Sales shows us that demand persists despite elevated mortgage rates.

This tells me there’s still strength in the sector.

The SPDR S&P Homebuilders ETF (XHB) or the iShares Residential and Multisector Real Estate ETF (REZ) could be compelling ways to gain exposure to this narrative.

The resilience in housing isn’t just a story about homebuilders—it’s a signal of broader economic stability.

4️⃣👉 Finally, let’s look at Germany’s stagnating GDP. The data points to continued challenges for Europe’s largest economy, and that could weigh on the Eurozone equities market.

The Invesco Currency Shares Euro Trust (FXE) could be an option for those considering further EUR/USD weakness.

At the same time, diversification into global markets outside the Eurozone - like the U.S. or Asia - could be a smart move.

The beauty of macro trends is that they aren’t just data points; they’re signals. Understanding how they align with market sentiment can be a game-changer.

What stands out to me is how these developments create ripple effects across sectors, currencies, and commodities, providing opportunities for those ready to act.

🚦 These are just ideas, of course, but in a market as dynamic as this, staying nimble and reading the data can make all the difference. Let’s keep our eyes open, leverage what we know, and stay positioned to capitalize on these macro shifts as they unfold.

Best regards,

Alessandro

Founder of Macro Mornings

Discover the Trends That Matter - VIP One-on-One Session for My Insiders

📈 As a valued member of my community, gain exclusive insights and a direct discussion with me to stay ahead of market moves. This is your chance to fully utilize your knowledge!

🏆 Don’t miss this unique opportunity: let’s discuss the latest macro developments and how to leverage them. What does this mean for you? Being part of a select group turning insights into action.

🚀 Don’t miss the chance for tailored guidance. In a dedicated session, we’ll analyze the macroeconomic landscape together, highlighting what really matters for your investment decisions.

📅 Reserve your session here → https://calendar.app.google/DFNQvEkH9C6k8Wfu6

I’M EXCITED TO HAVE YOU ON BOARD, BECOME MY FRIEND

💎 Get your Mentorship FREE here

🎙 PODCAST

Disclosure

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. This material has been prepared for informational purposes only. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.