**PRO** Macro Investors (BONUS SECTION)

October 04, 2024 BONUS >> Unemployment Rate, S&P500, ISM Manufacturing Prices, Oil Prices, Nonfarm, Employment Change, Russell 2000

New here? This is part of a series designed for PRO investors who want real-time updates on macroeconomic news through my advanced insights. Feel free to catch up on previous emails here if you'd like to start from the beginning!

📢 Macro Investors (BONUS SECTION AT THE END)

⚡ U.S. Manufacturing PMI (Sep)

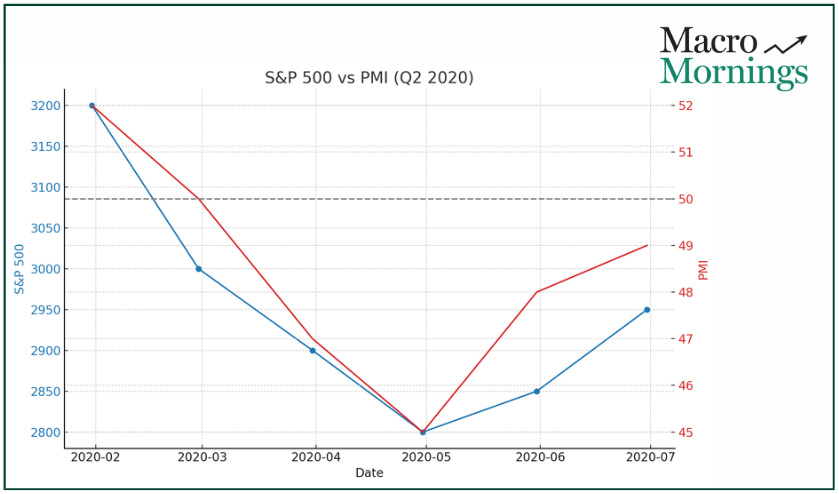

With a reading of 47.3, we’re still in contraction territory, just slightly above the expected 47.0.

Manufacturing remains weak, and historically, when the PMI falls below 50, as we saw in Q2 2020, the S&P 500 has typically pulled back by around -2.5% over the next three months.

Not surprisingly, bonds have often been the refuge during these times, with the 10-year U.S. Treasury yield dropping by 10-15 basis points, much like what we saw in July 2019, when yields fell from 2.07% to 1.55%.

Manufacturing’s weakness often drives this flight to safety, and we could see something similar play out if this trend persists.

🧠 ISM Manufacturing Prices (Sep)

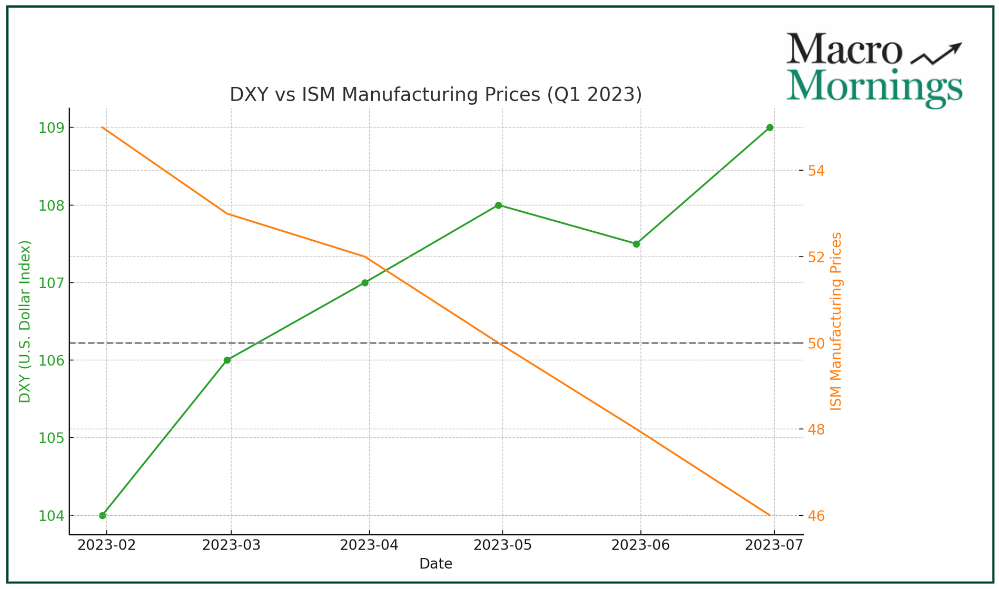

The prices index took a sharp dive to 48.3, missing the forecast of 53.5.

Lower price pressures can ease inflation fears, and historically, that has been good news for the U.S. dollar.

Back in Q1 2023, when we saw a similar drop, the DXY (U.S. Dollar Index) appreciated by 2.7% over the following months.

As inflation concerns cool off, we could see the dollar continue to strengthen, much like it did back then.

💥 JOLTs Job Openings (Aug)

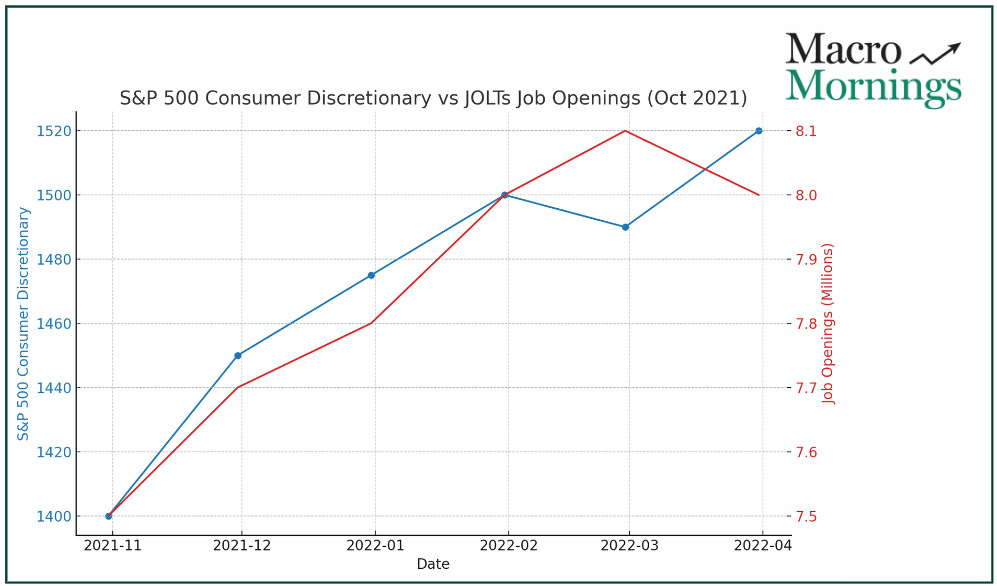

The labor market remains strong, with job openings surging to 8.040M, above the expected 7.640M.

If we look back to October 2021, a similar spike in job openings helped the S&P 500 Consumer Discretionary Index rise by 6.3% in the following month.

When job demand is high, consumer spending tends to follow, which can boost consumer-facing sectors.

Interestingly, we also saw a similar jump in the USD/JPY pair in 2022, when the U.S. labor market surprised to the upside, pushing the dollar 5.8% higher against the yen.

We might see that same dynamic play out again in the coming weeks.

💡 ADP Nonfarm Employment Change (Sep)

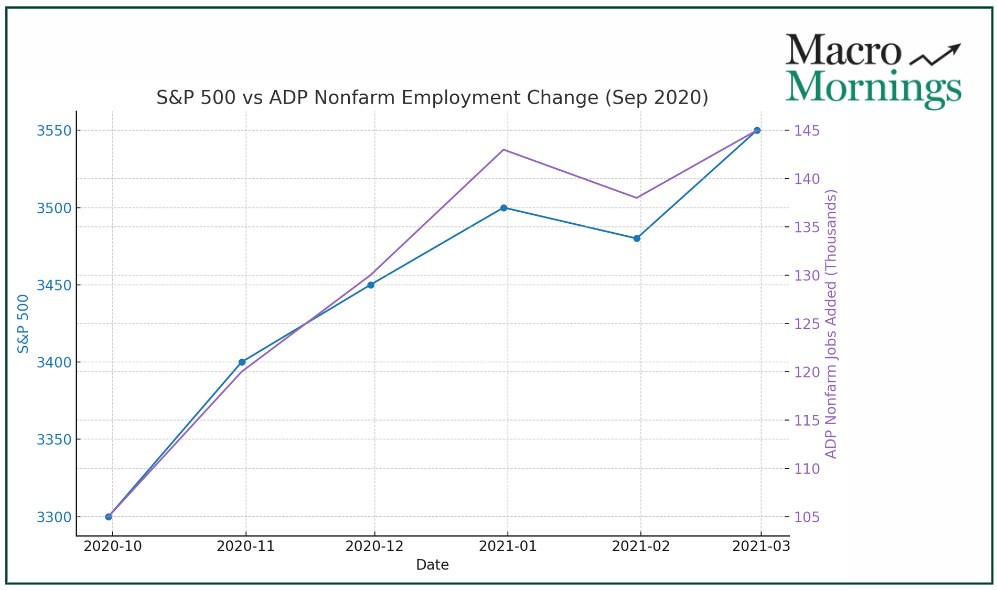

With 143K jobs added, slightly surpassing the forecast of 124K, the labor market continues to show resilience.

When we see such positive surprises, equity markets tend to react positively.

For example, after a strong labor market surprise in September 2020, the S&P 500 rallied 4.1% over the following month.

On the flip side, higher employment often pushes bond yields up, as investors anticipate tighter monetary policy.

A good reference is Q3 2018, when strong employment data pushed the 10-year Treasury yield up by 20 basis points.

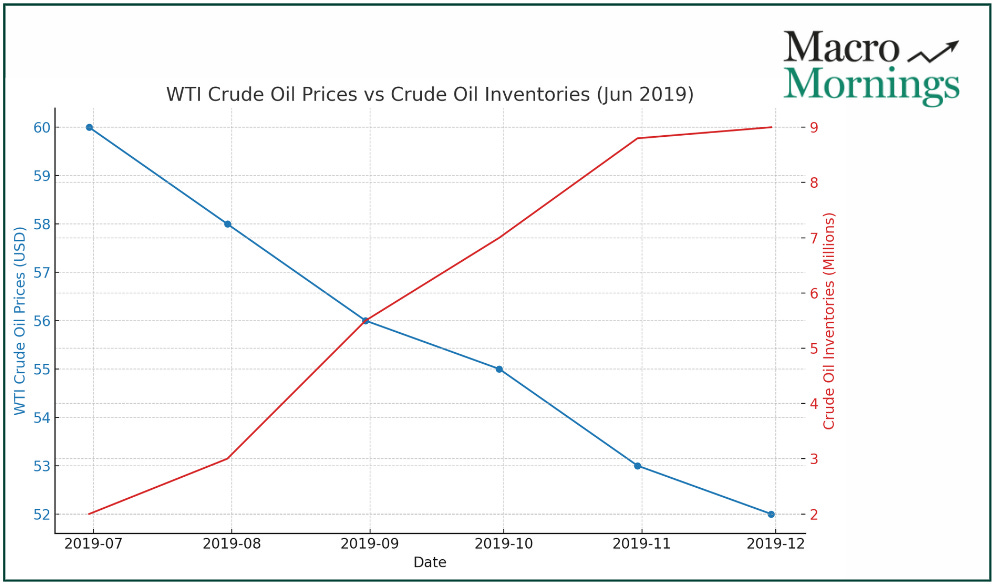

🔥 Crude Oil Inventories (Sep)

This month’s data showed a substantial build in oil inventories at 3.889M barrels, much larger than the forecasted drawdown of 1.500M.

When inventories build up like this, we tend to see a dip in oil prices. For example, in June 2019, a similar inventory surge led to a 7.5% drop in WTI Crude Oil prices within two weeks.

This also impacted energy stocks, with the S&P 500 Energy Index falling by 5.2%.

The current inventory levels suggest we could see similar pressures on oil prices and energy equities.

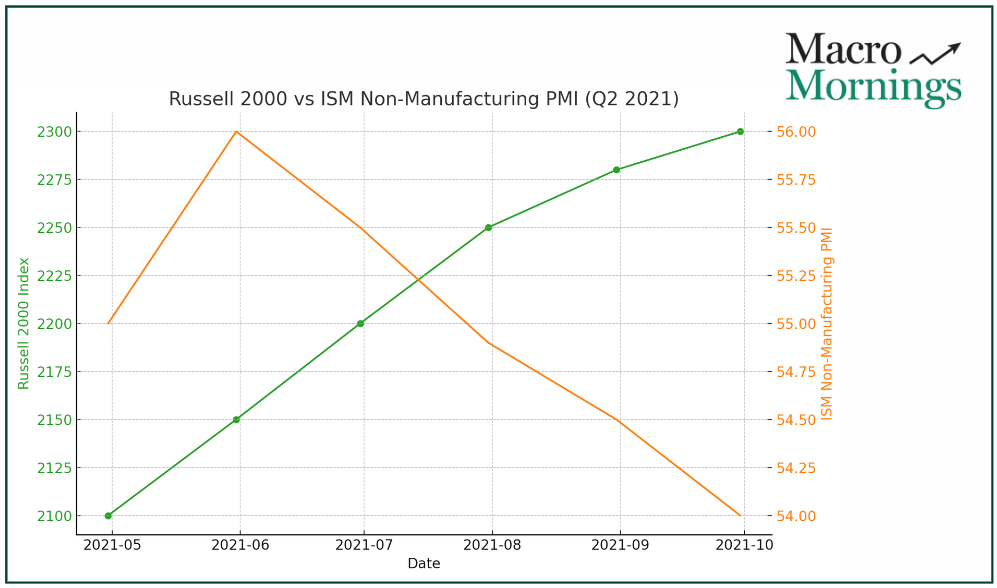

🚨 ISM Non-Manufacturing PMI (Sep)

On the bright side, the services sector remains a strong performer, with the ISM Non-Manufacturing PMI clocking in at 54.9, well above the forecast of 51.7.

In the past, such strength in the services sector has been a positive signal for small-cap stocks.

In Q2 2021, a similar PMI reading of 55.5 was followed by a 7.2% rise in the Russell 2000 Index.

Additionally, we’ve seen the EUR/USD weaken in the face of strong U.S. services data, as it did in August 2022, when the dollar appreciated 3.1% against the euro following a PMI surprise.

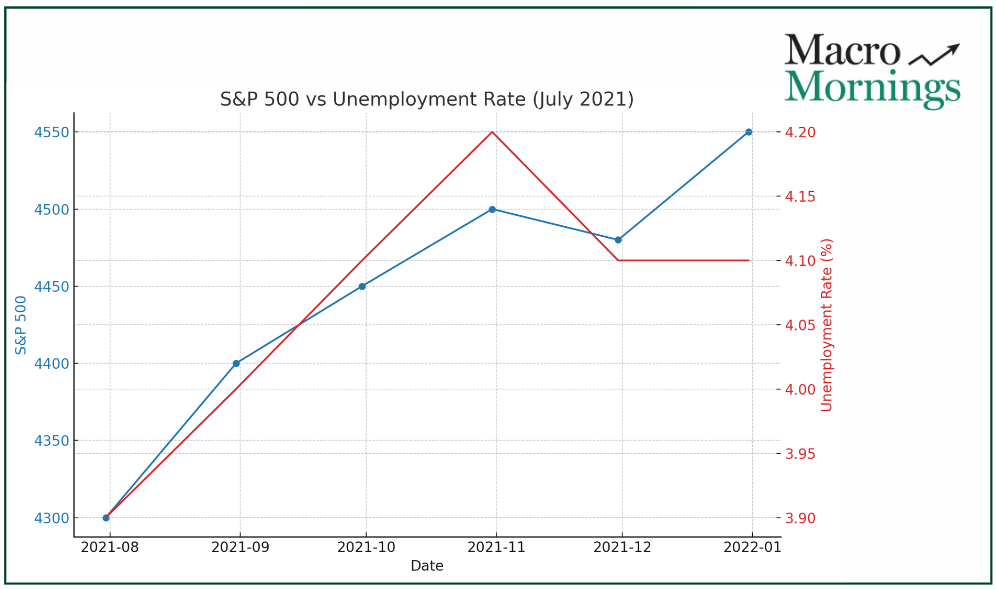

🌍 Unemployment Rate (Sep)

The unemployment rate edged up slightly to 4.1%, just above expectations of 4.2%.

A minor increase like this hasn’t always been a negative signal for the markets.

When we saw a similar uptick in July 2021, the S&P 500 still managed to post a 1.8% gain over the following month, as investors viewed the data as part of a broader economic recovery.

At the same time, the 2-year U.S. Treasury yield fell by 12 basis points, signaling that expectations for aggressive Fed rate hikes were tempered.

BONUS SECTION

Looking at the data we’ve broken down this week, there are some clear trends emerging that present solid investment opportunities.

Let me share with you what I’m thinking as I analyze the numbers.

👉 With the U.S. Manufacturing PMI still signaling contraction, it’s clear that the manufacturing sector is facing headwinds.

However, this weak manufacturing backdrop has often paved the way for stronger performance in sectors that rely less on global supply chains and are more tied to consumer behavior.

One area I’m eyeing is consumer discretionary ETFs. As labor market data continues to show strength, particularly with the recent JOLTs report, consumer spending is likely to remain robust, providing a tailwind to this sector.

If history is any guide, during past periods of manufacturing weakness, consumer-focused ETFs have shown resilience.

👉 Another standout is the U.S. dollar, which continues to show strength, especially with softer ISM Manufacturing Prices and strong labor market data reducing inflationary concerns.

This bodes well for currency trades involving pairs like USD/JPY, where the dollar could continue to appreciate against the yen.

If the dollar’s momentum continues, there’s a good chance we could see further gains here, especially as the Fed keeps its stance relatively hawkish.

👉 On the commodities front, the substantial build in crude oil inventories signals that supply is outstripping demand, which often leads to weaker oil prices.

This creates an interesting dynamic for energy ETFs or even short crude oil positions.

When inventory builds like this have occurred, oil prices have dropped, and ETFs that short energy markets or crude could become attractive as we see this trend play out.

👉 Finally, with the services sector continuing to outperform, especially with a stronger-than-expected ISM Non-Manufacturing PMI, I’m also considering small-cap ETFs.

The Russell 2000 tends to perform well in environments where services outshine manufacturing, as small companies typically benefit from the strong domestic economy we’re seeing right now.

These are just a few opportunities on my radar, and as always, it’s essential to align these ideas with your overall strategy. I’ll be watching these themes closely and keeping you updated as things evolve.

Best regards,

Alessandro

Founder of Macro Mornings

BECOME MY FRIEND

💎 Get your Mentorship FREE here

🎙 PODCAST

Disclosure

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. This material has been prepared for informational purposes only. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.