BECOME MY FRIEND

💎 Get your Mentorship FREE here

🎙 PODCAST

📢 Bonus to must read FOR INVESTORS

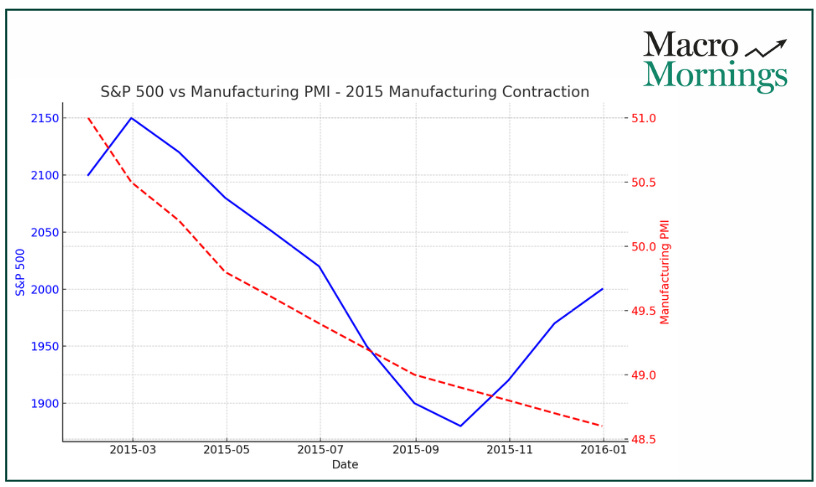

⚡ Manufacturing PMI: A Warning for Industrial Output?

This month’s S&P Global Manufacturing PMI for the U.S. slipped to 47.0, well below expectations of 48.6 and indicating a continued contraction.

The story here is clear: the manufacturing sector is struggling.

When this index falls below the 50 mark, markets often react with caution. Just look back to 2015 - similar numbers led to a 12% drop in the S&P 500 from May to September.

On the flip side, government bonds tend to rally during these periods, as investors seek safety.

The 10-year U.S. Treasury yield typically falls by 30-50 basis points when manufacturing weakens, offering an interesting dynamic for fixed income portfolios.

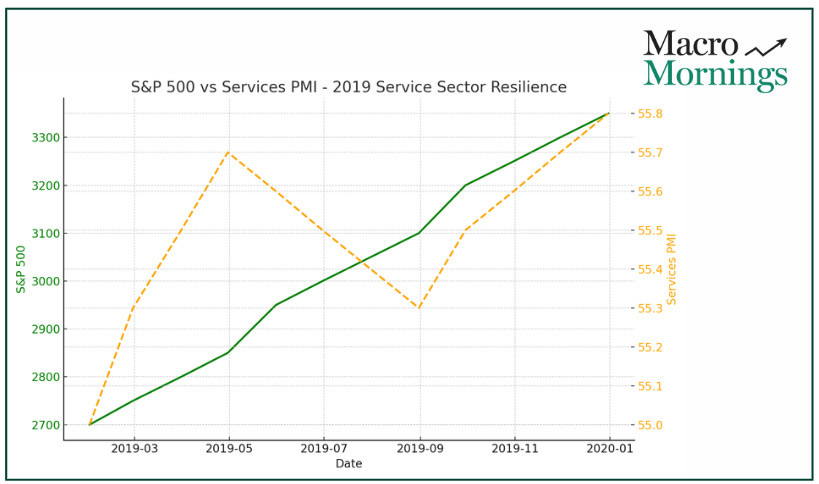

🧠 Services PMI: Still a Bright Spot

Not all sectors are struggling, though. The Services PMI for September hit 55.4, just slightly ahead of forecasts.

While it’s a dip from last month’s 55.7, this reading still suggests expansion.

Strong services data often supports stock market resilience, and we’ve seen this before - in 2019, with a PMI above 55, the S&P 500 gained 9% over the next quarter.

Currency traders take note: the strength in services has historically supported the USD, as we saw in 2020 when the USD/EUR strengthened by 4% over six months during similar conditions.

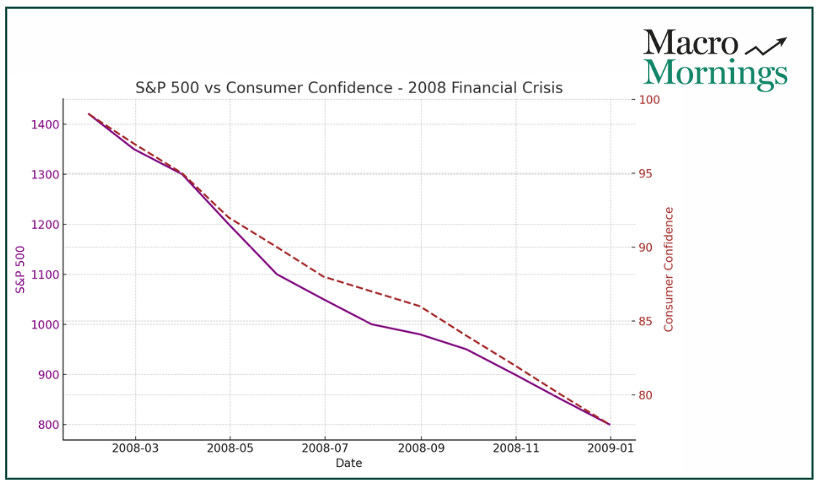

💥 Consumer Confidence: Cracks in the Foundation?

A steep drop in U.S. Consumer Confidence to 98.7 - down from last month’s 105.6 paints a worrying picture.

It reminds me of early 2008, when a similar dip foreshadowed broader market volatility.

Back then, confidence fell from 99 to 87, and soon after, the S&P 500 tumbled by 15% over six months.

This kind of uncertainty typically benefits bonds, pushing the 10-year Treasury yield down by 50-70 bps.

Meanwhile, in currency markets, the USD/JPY often weakens - just like in 2022, when a drop in confidence saw the dollar lose 5% against the yen in just two months.

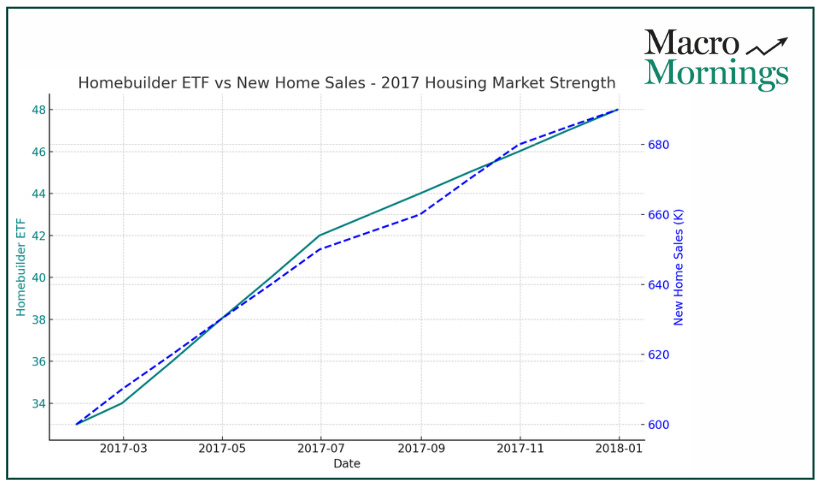

💡 Housing: A Mixed Picture in New Home Sales

On a brighter note, U.S. New Home Sales came in at 716K for August, beating expectations.

Though slightly lower than last month’s 751K, this still suggests a robust housing market, especially given today’s higher mortgage rates.

In fact, in similar scenarios in 2017 and 2020, homebuilder stocks, measured by the Homebuilder ETF (XHB), rallied 12% in the months following strong sales data.

However, there’s a potential downside: rising home sales often lead to higher mortgage rates, which could push 30-year mortgage rates up by 0.2-0.3%, impacting affordability down the road.

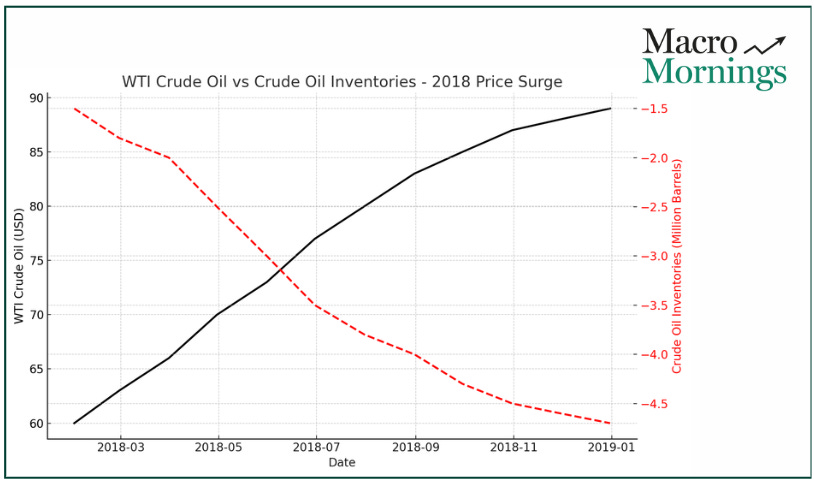

🔥 Crude Oil Inventories: A Supply Squeeze?

A significant drawdown in Crude Oil Inventories—down by -4.471M barrels - signals tight supply, which could send oil prices higher.

If we look back to similar inventory shocks in 2018, WTI crude oil surged by 15% in just one month.

Rising oil prices could also push inflation higher, forcing central banks to rethink their rate policies.

During previous oil price spikes, we’ve seen the 2-10 year Treasury yield spread widen by 10-15 bps, which could hint at steeper borrowing costs ahead.

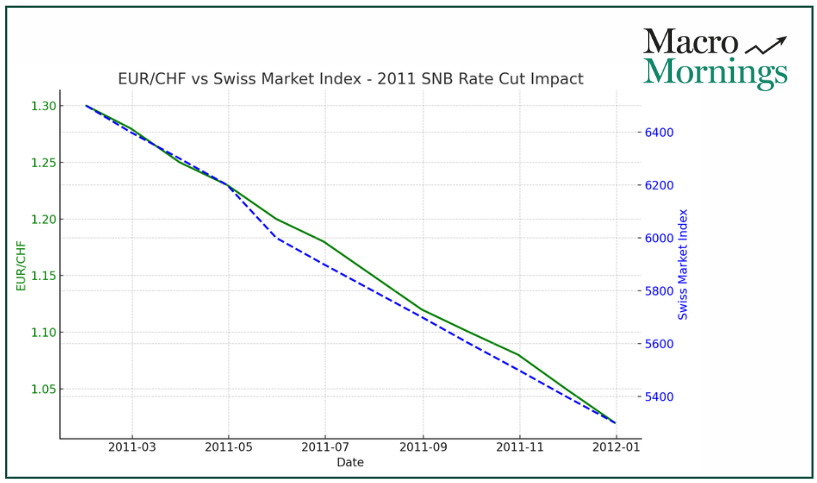

🚨 Swiss National Bank: Dovish Shift Could Impact Swiss Markets

In Switzerland, the SNB made a significant move, cutting rates to 1.00% from 1.25%.

This kind of dovish pivot reminds me of 2011, during the eurozone crisis, when the CHF gained 8% against the euro in just three months.

The stronger franc could put pressure on Swiss exporters, potentially dampening growth in Swiss equities.

After SNB cuts, the Swiss Market Index (SMI) has dropped by around 4% within a month.

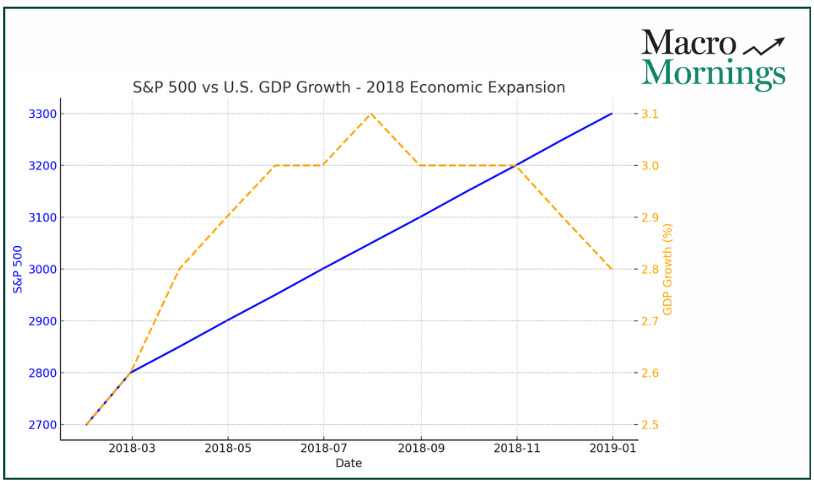

🌍 U.S. GDP Growth: Solid Ground or Temporary Lift?

Finally, the latest U.S. GDP Growth reading for Q2 held steady at 3.0%, right on target.

This echoes what we saw in Q2 of 2018, when the U.S. economy grew by 2.9%.

That period was followed by a 6% rise in the S&P 500 over the next quarter, as confidence in the economy solidified.

Meanwhile, the USD strengthened, especially against emerging market currencies, with the USD/MXN appreciating by 5% in just six months.

Investors should also be aware that rising GDP often pushes bond yields higher, with the 10-year Treasury yield typically rising by 20-30 bps as expectations for tighter monetary policy increase.

Best regards,

Alessandro

Founder of Macro Mornings

Disclosure

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. This material has been prepared for informational purposes only. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.