BECOME MY FRIEND

💎 Get your Mentorship FREE here

🎙 PODCAST

📢 Bonus to must read FOR INVESTORS

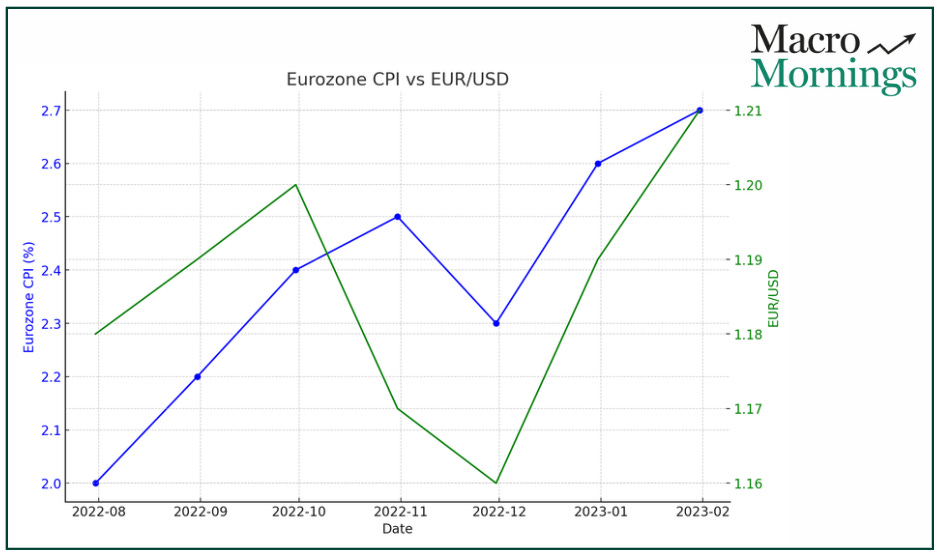

⚡ Eurozone CPI (YoY) for July

The inflation rate came in at 2.6%, matching market expectations and slightly up from the previous 2.5%.

When Eurozone CPI has seen such upticks, the EUR/USD currency pair has often strengthened in the short term due to increased expectations of ECB tightening.

In July 2022, a similar rise in CPI led to a 1.5% appreciation of the euro against the dollar within a week.

On the equity front, European stocks, as measured by the Euro Stoxx 50 Index, typically face pressure with rising inflation; the index declined by approximately 3% over the same period last year.

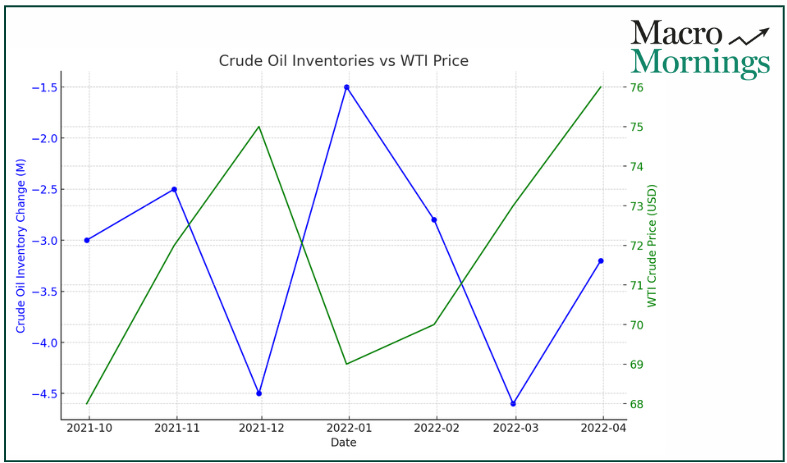

🧠 US Crude Oil Inventories

The reported drawdown of -4.649M barrels was significantly larger than expected.

Substantial decreases in inventories have led to a corresponding rise in oil prices.

For example, following a similar report in September 2021, WTI crude prices increased by over 4% in the subsequent three days.

Additionally, energy sector stocks within the S&P 500 tend to benefit, with the Energy Select Sector SPDR Fund (XLE) gaining 2.8% in the week following comparable inventory data.

💎 FOMC Meeting Minutes

While specific details from this meeting are pending, dovish signals from the FOMC have led to declines in US Treasury yields.

For example, after the June 2023 minutes hinted at a pause in rate hikes, the yield on the 10-year US Treasury note fell by 15 basis points over the following week.

Meanwhile, the S&P 500 typically reacts positively, often gaining between 1.5% and 2% in the week following dovish minutes.

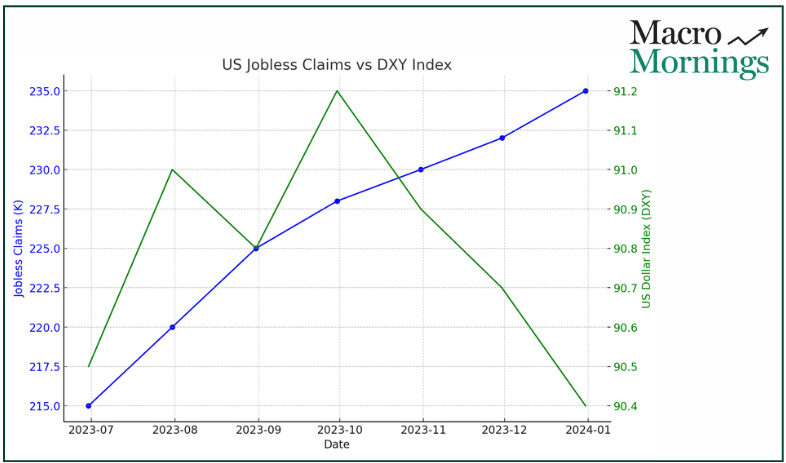

🔔 US Initial Jobless Claims

The figure of 232K was in line with expectations but slightly above the previous 228K.

Rising jobless claims have a negative impact on the US Dollar Index (DXY).

In July 2023, when claims rose similarly, the DXY fell by 0.8% over the subsequent week.

Conversely, bond prices tend to rise as investors seek safety, with the iShares 20+ Year Treasury Bond ETF (TLT) typically seeing gains of around 1.2% in similar scenarios.

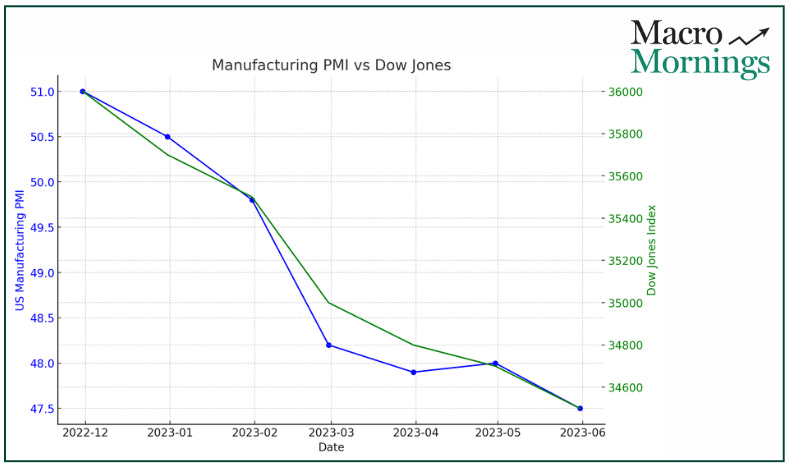

💥 S&P Global US Manufacturing PMI

The contraction in this index to 48.0 points to a weakening manufacturing sector.

Such declines have led to underperformance in industrial stocks.

For example, the Dow Jones Industrial Average fell by 2.3% in the week following a similar drop in PMI in November 2022.

Additionally, the USD/JPY pair often weakens in response to poor US manufacturing data, as seen last year when it declined by 1.7% after a comparable report.

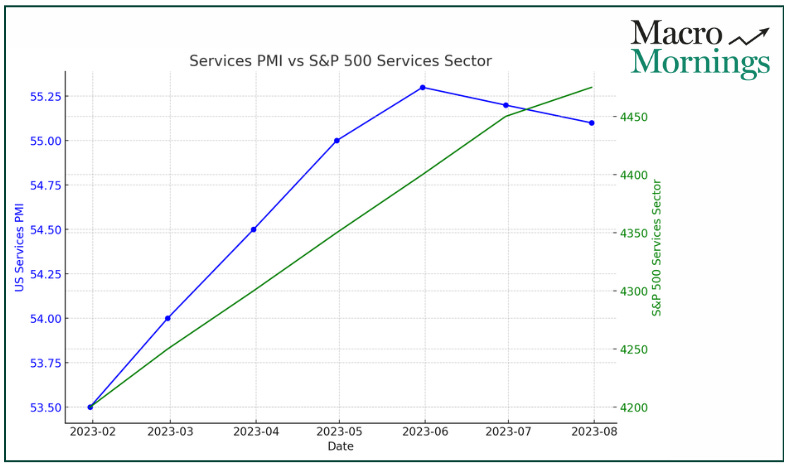

💡 S&P Global US Services PMI

The services sector, however, showed resilience with a PMI of 55.2.

Strong service sector data tends to support equity markets, particularly those with a high exposure to domestic services.

The S&P 500 services sector index typically outperforms during such periods, with gains of around 2% following similar reports in early 2023.

The GBP/USD pair often strengthens on positive US services data, reflecting increased investor confidence in the US economy.

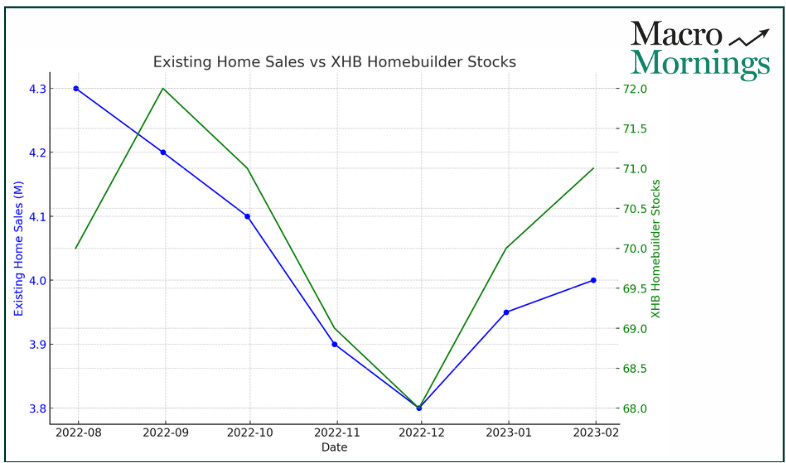

🔥 US Existing Home Sales

The stable figure of 3.95M homes sold indicates resilience in the housing market.

Steady or increasing home sales have been a positive signal for homebuilder stocks, with the SPDR S&P Homebuilders ETF (XHB) gaining an average of 1.5% in the week following similar reports.

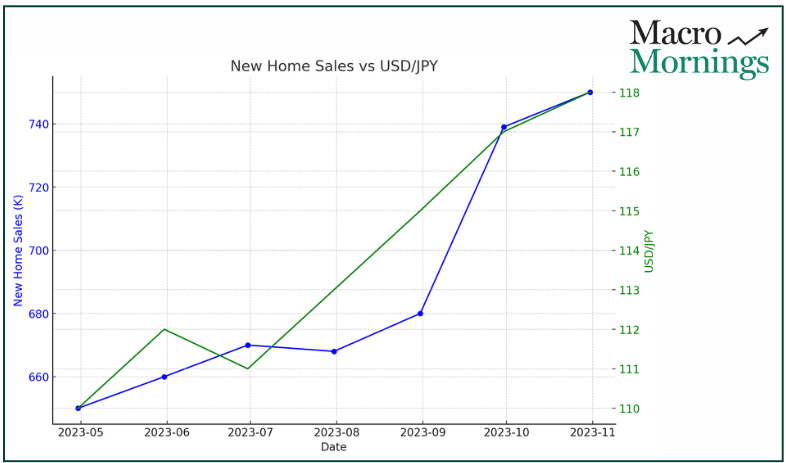

🌍 US New Home Sales

The surprising increase to 739K new homes sold is a strong positive indicator.

Such robust data leads to rallies in the US dollar, particularly against the yen; the USD/JPY pair appreciated by 1.3% following a similar report in April 2023.

In addition, homebuilder stocks like Lennar Corporation (LEN) often see gains, with an average increase of 2.7% in the days following such positive sales data.

Best regards,

Alessandro

Founder of Macro Mornings

Disclosure

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. This material has been prepared for informational purposes only. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.