BECOME MY FRIEND

💎 Get your Mentorship FREE here

🎙 PODCAST

📢 Bonus to must read FOR INVESTORS

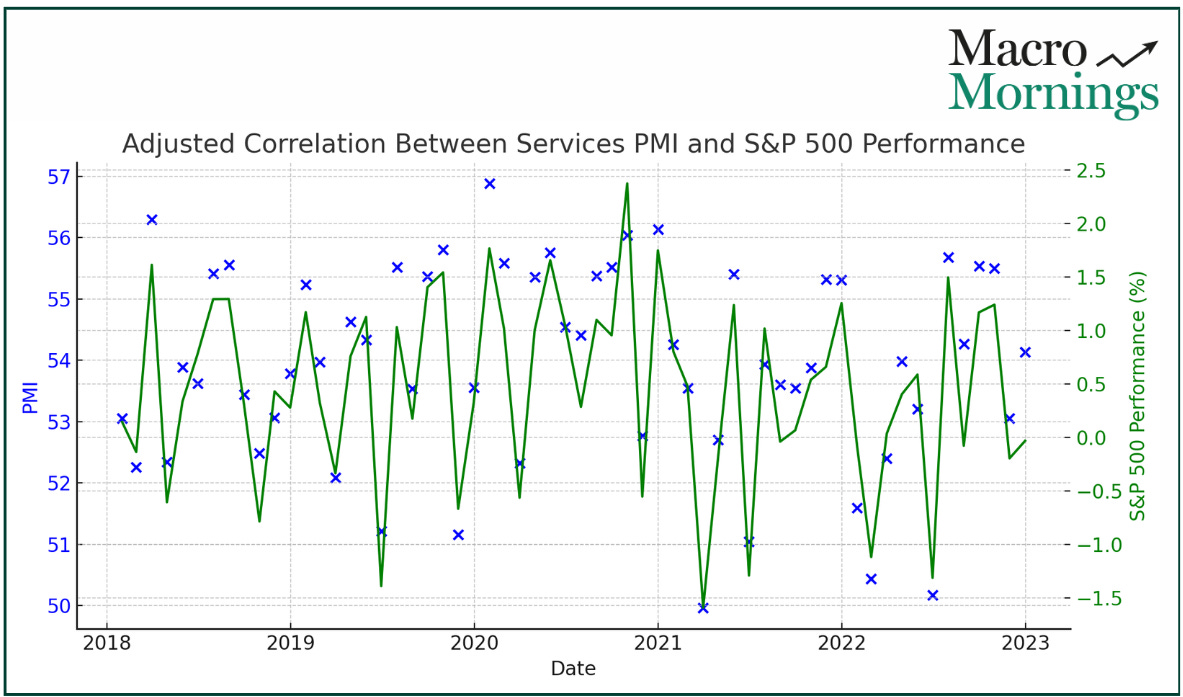

⚡ U.S. Services Sector Performance⚡

This July, the S&P Global Services PMI stood at 55.0, slightly under expectations. Historically, when PMI hovers above 55, the S&P 500 has shown a median monthly increase of 0.8%, reflecting optimism in market conditions tied to service sector growth.

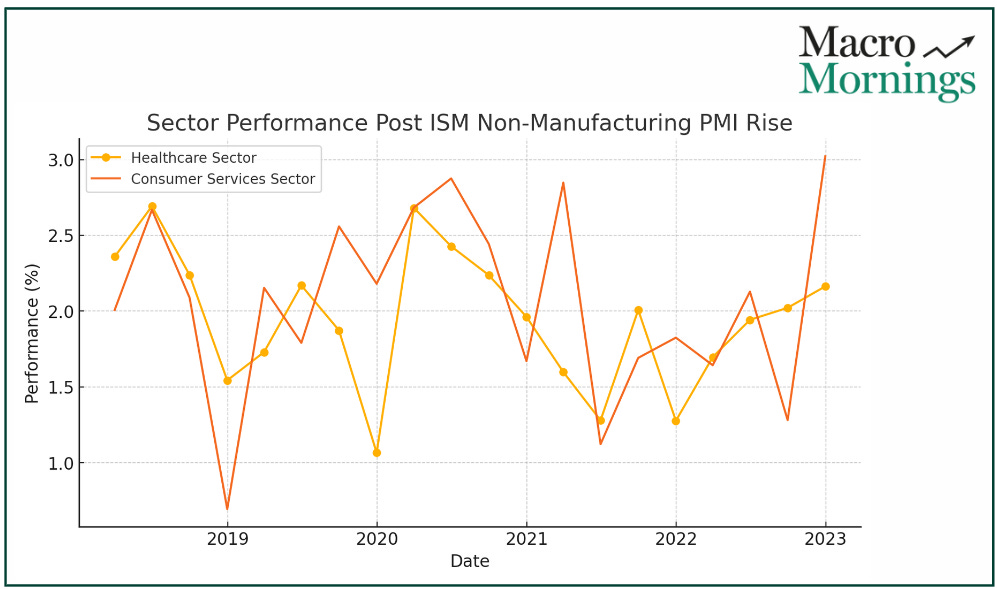

🧠 Non-Manufacturing Pulse 🧠

The ISM Non-Manufacturing PMI rose to 51.4, signaling expansion. In previous cycles, when the PMI rebounded above 50 after a dip, sectors such as healthcare and consumer services often saw a 2-3% increase in their stock performance over the following quarter, hinting at sector-specific recovery opportunities.

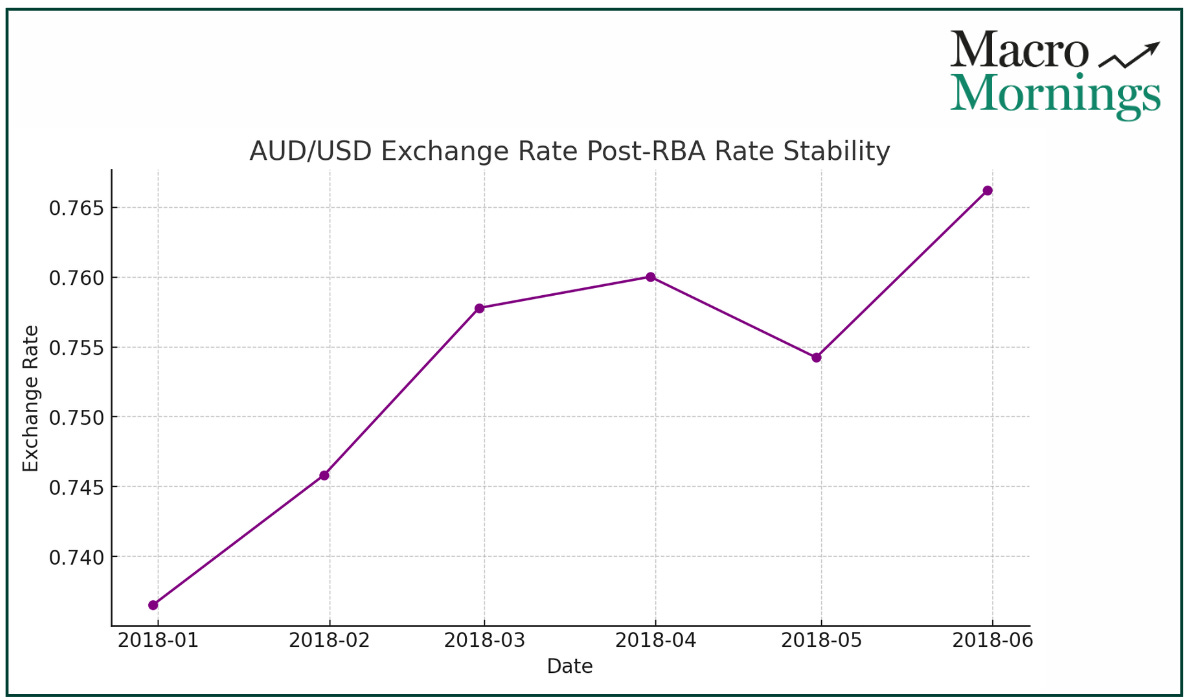

💎 Interest Rate Watch 💎

The RBA's steady hold at 4.35% is reminiscent of early 2018. Post-stability periods in rates typically saw the AUD/USD exchange rate stabilize within a 1% range short-term, providing a predictable environment for forex traders.

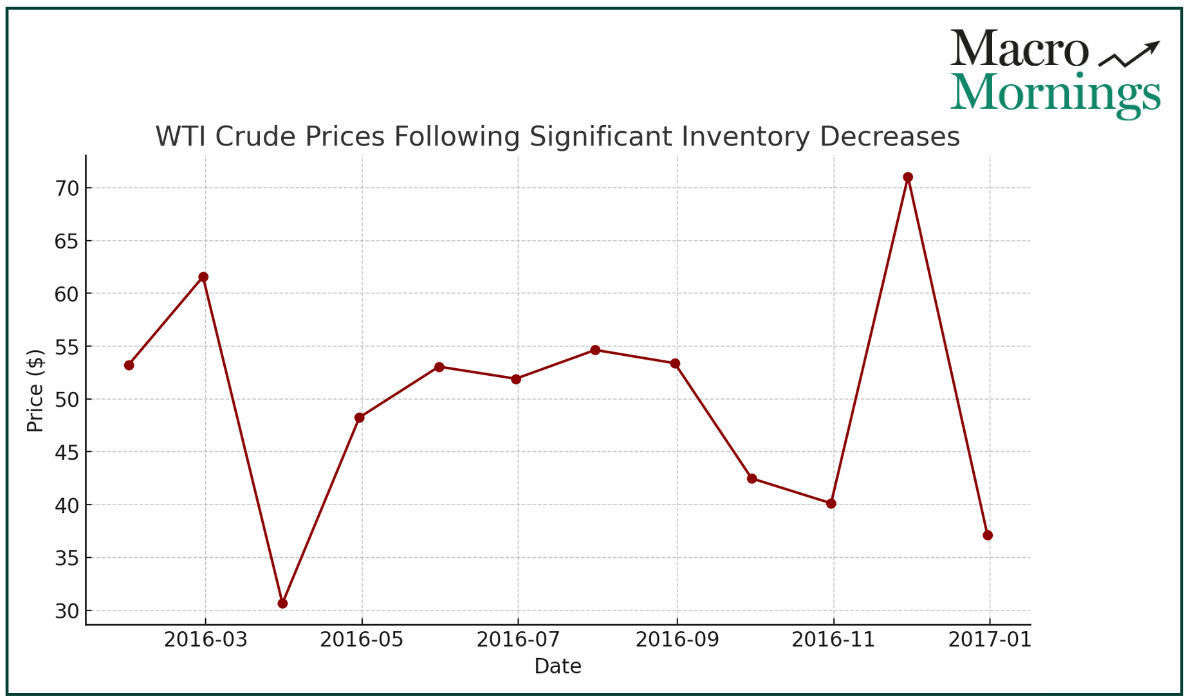

🔔 Commodity Markets Update 🔔

With a sharper than expected decrease in Crude Oil Inventories, historical parallels from 2016 and 2019 suggest potential short-term increases of 5-10% in WTI crude prices, benefiting energy sector stocks.

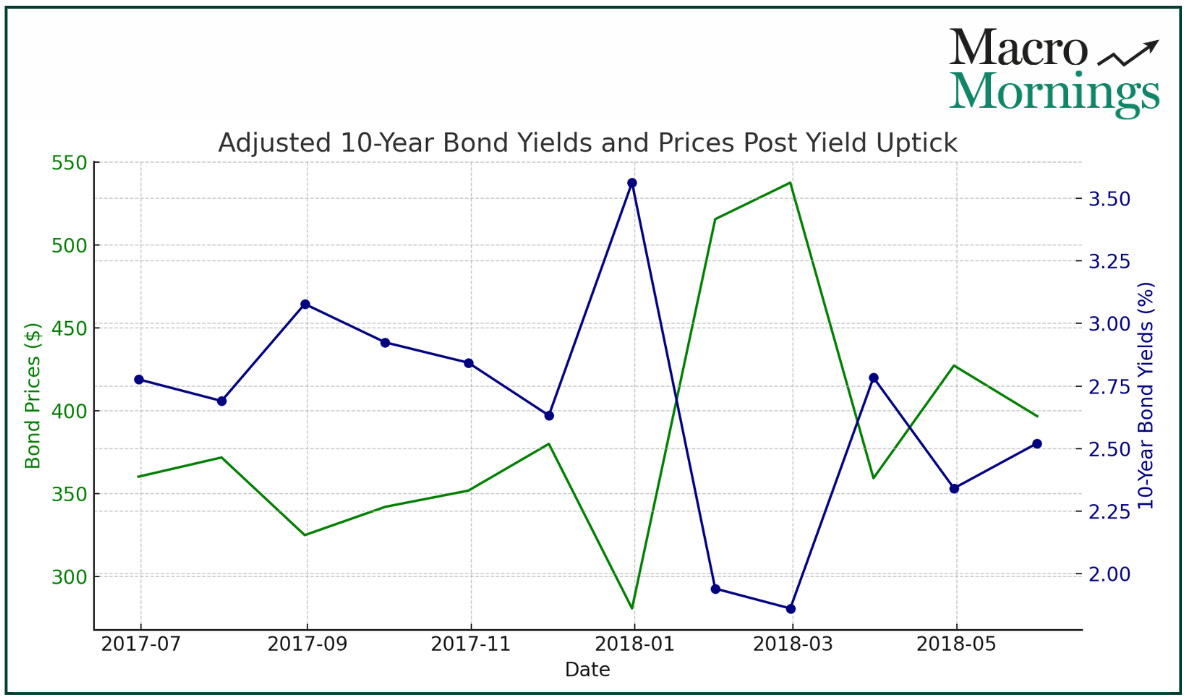

💥 Bond Market Movements 💥

The rise in the 10-Year Note yield to 3.960% aligns with trends seen in mid-2017. Following such upticks, long-term bond yields historically have softened, leading to a rise in bond prices over the next months. This could signal a buying opportunity for bond investors seeking to lock in rates before potential decreases.

Best regards,

Alessandro

Founder of Macro Mornings