🔴 [NEGATIVE REAL RETURNS] What’s Really Happening

December 14, 2025 >> Has the US economy fallen into A RECESSION?

🎟️Markets are changing faster than most investors can react

🎄Get Today Your 2 FREE Tickets Pass🎄

Join me for a private 45m strategy session where you’ll gain a crystal-clear view of the macro forces driving 2026 - and learn how to turn uncertainty into opportunity.

👉 Book your Macro Advisory Session with the Founder [Totally Free here]

👉 LIVE Mastermind Session - January 17th, 2026 - [Get Your Free Access]

Dear Investor,

This morning I did what I always do when the market feels “too calm”: I stopped looking for the next headline and started reading the sequence of signals.

I laid into the charts in front of me in the exact order you are seeing it, like pages of the same story, and I asked myself one simple question: If I had to explain this cycle to my future self, what would I say?

What follows is that story - told in one breath, in first person, without changing a single number, because the numbers are already saying enough.

🧠 The Wall of Worry Never Ends - and That’s the Point

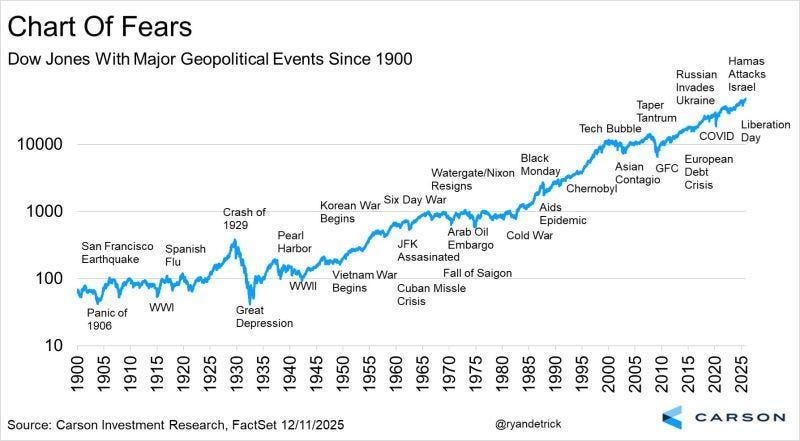

The Dow started trading on May 26, 1896.

The last week it closed at the highest level ever.

I keep repeating that sentence because it has a strange effect on the mind: it shrinks the loudness of today’s fear and enlarges the power of long-term compounding.

When I look at the “Chart of Fears,” I don’t see a motivational poster.

I see a timeline of moments when investors felt completely justified in panicking.

Earthquakes, world wars, pandemics, assassinations, oil embargoes, crises of confidence, bubbles, crashes, contagion, credit events, geopolitical escalations - the list doesn’t end because history doesn’t stop.

And yet the line keeps climbing, not because the world becomes safer, but because fear is permanent while cash flows are persistent.

That’s why I believe the real advantage has never been “predicting the next scary event.”

The advantage is building a structure that can endure the event without forcing me into bad decisions.

The market doesn’t punish fear because fear is wrong; it punishes fear because fear usually shows up at the wrong time, when prices already absorbed the shock and liquidity is about to turn.

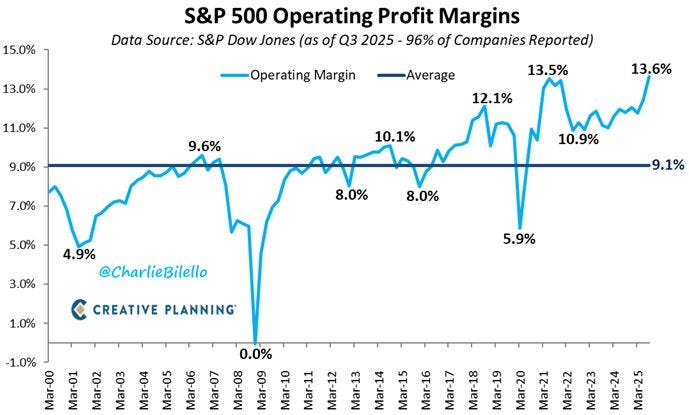

And then your second chart hits me like a cold shower, because it tells me something far more important than fear: it tells me how much “perfection” is currently embedded inside corporate America.

S&P 500 operating profit margins printed 13.6% in Q3 2025, the highest level on record, with the long-run average sitting around 9.1%.

When I see 13.6%, I don’t feel comfort. I feel late-cycle tension.

Record margins are not a stable state - they’re a peak condition. They can remain elevated for a while, yes, but they also turn earnings into a fragile object: when profitability is already stretched, the next move is rarely “even better,” it’s usually “less good.”

I can’t help remembering what happens when the margin cycle breaks and expectations refuse to adjust gracefully.

In 2008-09, the S&P 500 fell roughly -57% from peak to trough.

I’m not suggesting we’re repeating 2008 - history doesn’t photocopy itself.

But it rhymes in one key way: the most dangerous moment in a cycle is often when the fundamentals look best and the narrative feels safest.

So if margins are at record highs, why is the market still pushing higher?

That question leads directly to the next chapters - the ones most investors still underestimate because they happen quietly, in the plumbing, not in the headlines.

💧 Liquidity Is Returning Through the Back Door

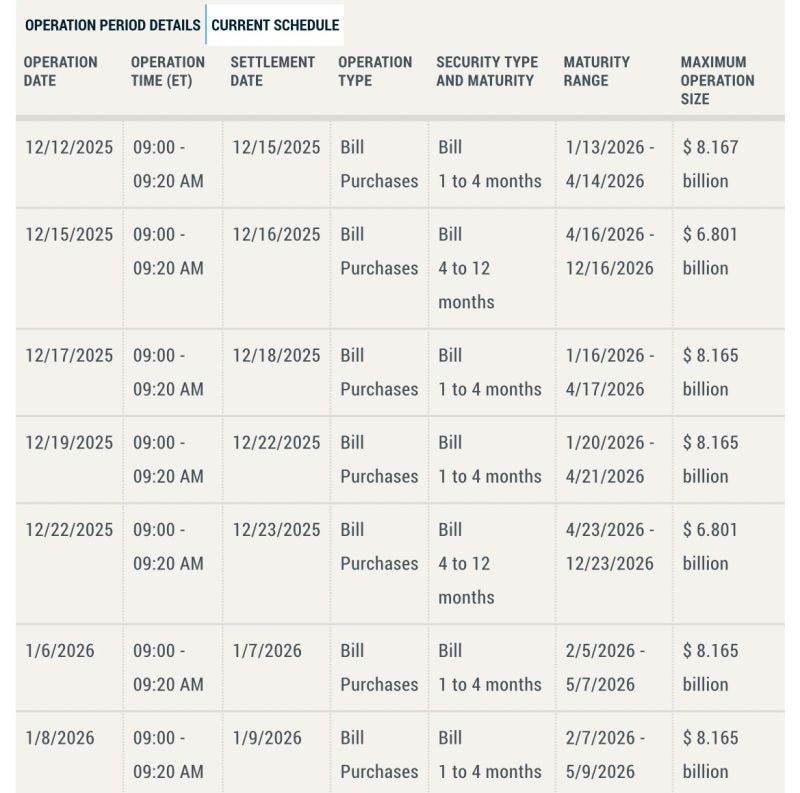

Then I arrive at the chart that changes the mood entirely: the Fed’s first month of T-bill purchases. $40 billion over the next month. Starts at 9am.

I’ve learned that markets don’t ultimately trade labels - they trade mechanics.

We can call it “Reserve Management Purchases,” we can insist it’s “not-QE,” we can dress it up in technical language, but the reality is straightforward: when the Fed buys bills, reserves enter the system, and system liquidity improves.

That matters because liquidity is the oxygen that keeps valuations elevated when the growth story starts to wobble.

In your commentary you framed the broader context sharply: Powell openly acknowledged a weakening labor market, dismissed the possibility of hikes, moved forward with another cut, and expanded the balance sheet while inviting everyone to pretend it’s not what it is.

That’s a central bank signaling constraint. Not weakness in character - constraint in the system.

When labor weakens, the Fed’s room to stay restrictive narrows.

And when the Fed’s room narrows, the market begins to lean on a new assumption: dovishness is not a choice, it’s the path of least damage.

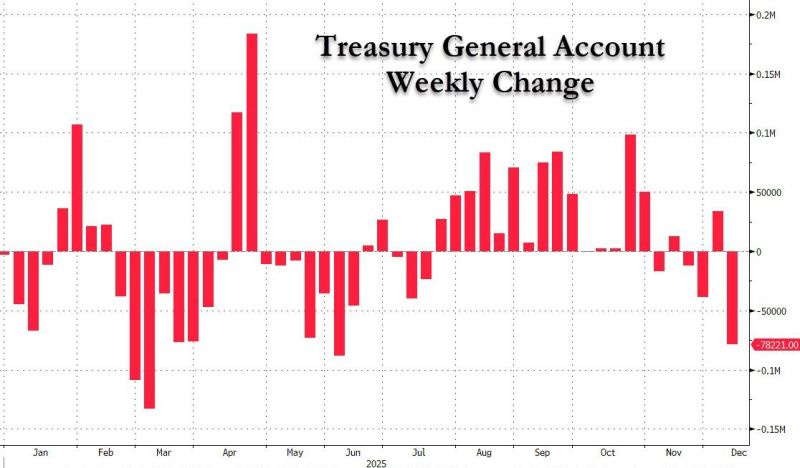

And just as I’m digesting the Fed’s move, your next chart adds a second liquidity impulse that is even more visceral in its effect: the Treasury cash flood.

The Treasury General Account dropped $78B in one week, the 3rd biggest liquidity injection of 2025.

This is one of those details that sounds bureaucratic until you understand how it works.

The TGA is the government’s checking account.

When it falls, that money doesn’t disappear; it moves into the private sector.

It shows up in reserves, in deposits, in the bloodstream of markets.

In other words, while many investors are staring at the surface, two waves are quietly moving underneath: the Fed is injecting liquidity through bill purchases, and Treasury cash dynamics are adding liquidity through the TGA drawdown.

This is how melt-ups are born.

Not necessarily because growth is roaring, but because cash is abundant, fear fades, and the market begins to float.

But I never let myself stop there, because liquidity can lift prices and still fail to solve the deeper problem.

Liquidity can buy time. It can extend the cycle. It can delay the reckoning.

And when liquidity starts rising while the economy starts bending, I immediately look for the asset class that tends to sniff out regime change before the consensus does.

That asset class is staring at us in your next chart.

🥇 Gold Is Speaking - and Commodities Are Starting to Listen

Gold is approaching new highs again.

And I want to be precise about what that means to me: I don’t read gold as a simple “fear gauge.”

I read it as a policy-constraint gauge and a confidence gauge. It’s the market quietly asking: Can policymakers truly restrain inflation without breaking the labor market? And if unemployment rises, will they still have the stomach to keep conditions tight?

Your words here are not dramatic - they’re coherent: the Fed is cornered, and an ultra-dovish stance is becoming increasingly difficult to avoid.

You also flagged something I agree deserves more respect: how the rates market may be underestimating how determined Trump could be to reshape the Fed next year and push for substantially lower rates - especially if unemployment rises sharply over the next 6-12 months, which you view as highly probable.

That political layer matters because it changes the range of outcomes; it makes “higher for longer” harder to defend in the real world, not just on paper.

And this is where I find it almost ironic how confidently some commentators declare inflation is headed lower, while inflation-sensitive assets keep sending a different message.

Markets can be wrong, but they rarely whisper without reason.

When gold rises in a world that’s also celebrating all-time highs, it often signals that investors are quietly hedging a future where real returns become harder to protect with traditional nominal portfolios.

That’s why your next chart feels less like a technical pattern and more like an emerging macro narrative: commodities, with 2026 written across the horizon like a destination.

⭐️ This is a paid content, so scroll to read it…[🎁 #4 BONUS if you become a PRO today]

If you’re a PRO subscriber, make sure you’re logged in to access the full piece. And if you’re already Annual/Lifetime member 👉 Access to 🧠 Macro Mornings Family.

If you’re still a FREE reader, you have two exclusive options to unlock this special edition, all past PRO content and the App’s Special launch:

1. 👉 Pro Membership from 30% to 50% OFF - forever. Only 1 spots last:

⭐ PRO Membership - $399/year or $33/month (Regularly $570) [Click here]

👑 Lifetime - $798 one time only or $13/month (Regularly $1,140) [Click here]

+

🎄Today you also unlock 4 bonuses (FREE)👇

(These bonuses alone are worth more than the subscription.)

🎁 BONUS #1 - Price Locked Forever (you’ll never pay more)

🎁 BONUS #2 - Private Community Access: the Macro Mornings Family

🎁 BONUS #3 - Full App Access: all exclusive content, anytime, anywhere

🎁 BONUS #4 - Monthly Live Mastermind (value: $1,197/year)

We answer the community’s biggest questions, break down real-world cases, and share actionable macro frameworks..

👉 After payment, you’ll receive a Welcome Kit by email with all the material and instructions to join.

2. 👉 Or start your 7-day FREE Trial - exploring only the PRO analyses without any risk.

If you’re serious about understanding what comes next - and acting before the crowd - this email is your edge.

Keep reading with a 7-day free trial

Subscribe to Macro Mornings 💡 to keep reading this post and get 7 days of free access to the full post archives.