Hi all, and welcome back to The Macro & Business Insights!

What you’ll find in this episode:

How can we justify a 22x S&P 500 Index P/E?

Inflation set to become more digestible

Why the rally in equities looks overdone?

What could equity investors do to limit downside risk?

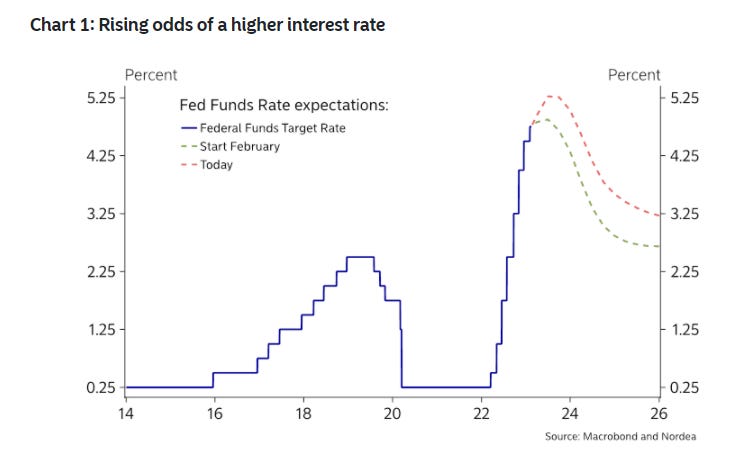

Rising odds of a higher interest rate

To maximize the email’s content, I invite you to listen the audio above and let help you with the charts below.

This newsletter is in real time, so you receive (as subscribers) immediately the summary of latest updates and reports published and disclosed by major international Investment Banks & Institutions.

Finally, in the coming weeks you’ll find the written article published on the website, which you can find other deeper analysis research.

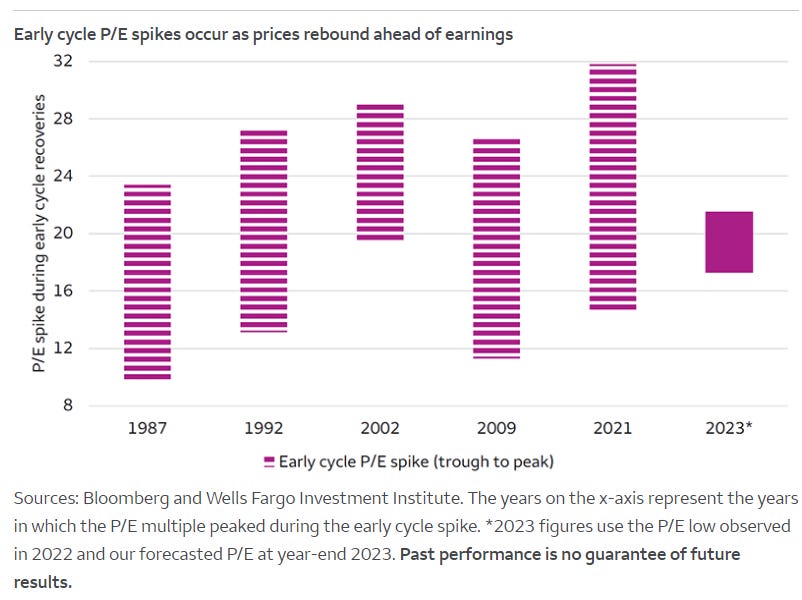

How can we justify a 22x S&P 500 Index P/E?

Our 2023 year-end S&P 500 Index target range is 4300 – 4500 on earnings of $205 for the year. This implies an end of year price-to-earnings (P/E) multiple of 21x – 22x.

Wells Fargo has received a number of inquiries regarding this outlook, and they tend to revolve around the question: “How can we justify such a high P/E?”.

They are forecasting both an earnings contraction as well as an early cycle recovery in prices this year.

In the near term, Wells Fargo expects deteriorating macro conditions and earnings outlooks to weigh on prices and produce bouts of volatility.

However, they see the stage being set for a recovery and a breakout late in 2023 and into 2024 as investors begin to look past the economic troubles to the eventual recovery.

This brings us to a key dynamic to emphasize — stock prices are forward-looking while earnings are lagging.

Imagine today is December 31, 2023.

Will markets be reflecting on the $205 earnings figure in the rearview mirror?

No, they will be looking through the windshield to what lies ahead.

The time frame mismatch between forward-looking prices and backward-looking earnings causes early cycle P/E spikes.

This behavior is consistent throughout history as prices turn higher well in advance of earnings.

The chart above illustrates this point by plotting the trough to peak P/E spike during past early cycle periods.

Of note, our 21x – 22x P/E forecast is a relatively low P/E peak when compared to historical observations.

Inflation set to become more digestible

The trajectory of inflation will be a big driver of sentiment, activity and policy this year.

Barclays believes that the peak in global price pressures is now behind us and inflation will continue to moderate over the coming months.

Hikes in goods prices have now eased as a result of elevated inventory levels, the relaxation of COVID restrictions and rising capacity.

Further disinflationary pressures should emerge from weaker demand (higher interest rates), improving labour market conditions and stabilising commodity prices.

Whilst Barclays expects inflation to remain above targeted levels in many regions in 2023, the data is likely to become increasingly digestible over the next couple of years.

They forecast that the global consumer price index (CPI) will average 4.4% this year, and 2.9% in 2024, compared to the 7% surge registered in 2022.

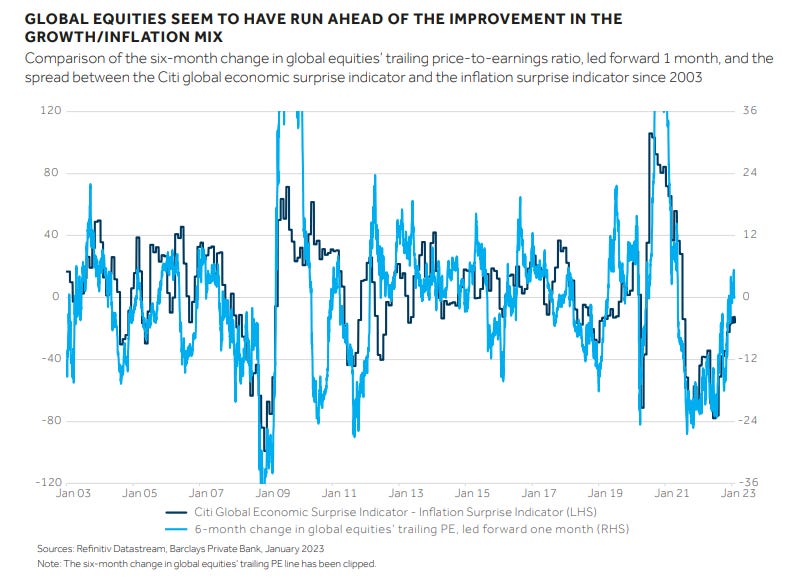

Why the rally in equities looks overdone?

Investors have been in buoyant mood early in 2023, sustaining a rally in equities and other risk assets towards the end of 2022.

While there are more positive signs on the economic front to justify their optimism, the rally appears to be overdone.

What can investors do to hedge their portfolios against downside risk in financial markets?

Equities, commodities and other risk assets, have started the year on a strong footing, extending their gains made since mid-October last year.

Global equities had already gained 19% from their October lows, outperforming bonds by 13%, by 27 January.

Non-US stocks have trounced their American peers by 7% during this period, while industrial metals have soared by 20% following the removal of China’s COVID-19 restrictions.

Meanwhile, the US dollar has depreciated by 10% against the currencies of its major trading partners.

The rally in risk assets since October has been fueled by expectations that the US Federal Reserve (Fed).

Other leading central banks would soon halt their interest-rate hiking cycles, following a general easing of inflationary pressures, thereby increasing the chances of a soft landing for the economy.

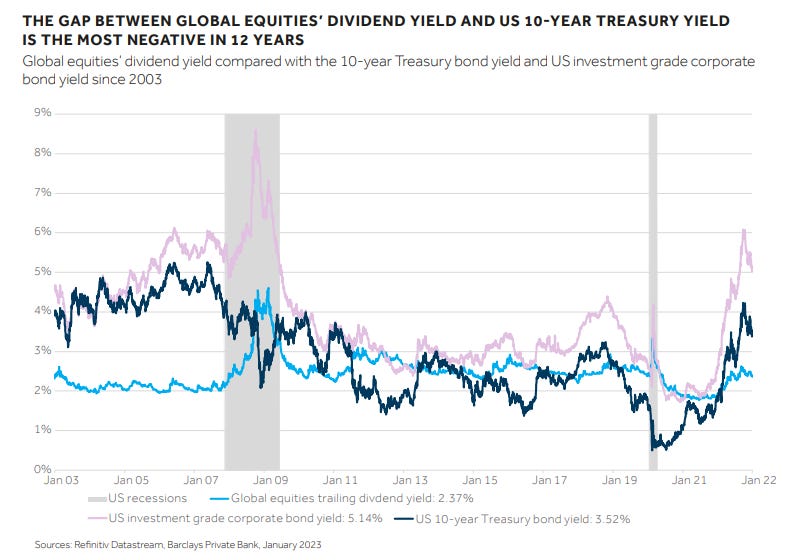

What could equity investors do to limit downside risk?

Investors willing to reduce downside risk in equity portfolios should consider rebalancing their positions towards the more defensive parts of the market, but in a very selective way, and preferably via individual stocks rather than sector indices.

At the stock level, we would focus on companies with a history of stable earnings and solid balance sheets, which have been resilient through previous economic cycles, and trade at a historical discount.

However, Barclays would shy away from global sector indices in the defensive sphere, which seem very expensive at present.

Following a substantial re-rating in recent months, such sectors now trade at an extreme valuation premium compared to valuations for cyclicals, based on forward price/earnings multiples.

This premium is equivalent to 2.4 standard deviations above its 20-year average.

Alternatively, investors can also increase defensiveness in multi-asset portfolios via investing in the fixed income market.

“Global equities’ dividend yields are at the biggest discount they’ve been to US 10-year bond yields in the past 12 years, despite higher risks”

The gap between global equities’ dividend yield and US 10-year treasury yield is the most negative in 12 years

Following the substantial increase in rates in the past few months, bonds, and credit in particular, now offer an attractive alternative to equities.

For most of the past ten years, the historically low yields on bonds pushed investors up the risk curve into equities.

However, the gap between global equities’ dividend yield and US 10-year bond yields is now the most negative it’s been in the past 12 years, despite higher risks.

And similarly, the gap between dividend yields and investment grade corporate bond yields is the most negative since 2008 (see chart above).

Finally, option strategies can be a useful tool when it comes to protecting downside risk.

Inflation and growth have surprised on the upside.

Fund managers came into this year expecting an immediate recession with inflation falling sharply and central banks slowing down and eventually shifting into a more dovish stance.

This was reflected in an asset allocation, that had an overweight of bonds and an underweight of equities. New economic data have shown exactly the opposite.

The job report in January showed that the labour market is significantly stronger than expected, while a big bounce in the ISM service indicator and retail sales figures, erase the notion that a recession is imminent.

Moreover, the US CPI January report clearly shows that inflation is running at a much too hot pace.

Markets have yet to fully accept this reality

The front-end of the US bond market is altering to this new reality by lifting its expectations to the fed funds rate and pulling back expectations of interest rate cuts, but other asset classes seem to refuse to accept this reality.

Best regards,

🔔 If you like my work, one simple thing that would make me very happy is if you’d bring only two friends/colleagues within our community - they might appreciate it and after all…it’s free!

Feel free to share my contents with anyone you think is might be interested with the link below!

🔍 We are a community of Macro & Business enthusiasts and lovers of Financial Markets.

💡 If you want even more free, valuable financial content you can also follow me on Twitter and visit my Website for more in deep analysis.

Disclosure

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. This material has been prepared for informational purposes only. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.