🔔 Macro Thoughts in 23 Charts

Unemployment Rate, Household, Warren Buffett, Valuations, Investing, Treasury, FED, Earnings, ETF, GDP, S&P 500, Performance, Germany, Market expectations, Jobs Report, Insurance, Cina, Recession...

New here? This is part of a series designed for those who enjoy a critical approach to macro charts. Here, I analyze each chart and share my thoughts. Feel free to catch up on previous emails here if you'd like to start from the beginning!

Dear all,

Welcome to "Macro Thoughts," your essential guide to navigating the financial markets.

Each week, I gather the most insightful and visually compelling charts, breaking down key trends and providing my critical thoughts, all in one email.

By distilling the most important data, I save you time while delivering unparalleled value that helps you stay ahead of market movements.

If you find this work valuable and it enhances your ability to understand and anticipate market shifts, consider supporting Macro Mornings with a donation.

As well, some of you asked how can one support my work which is really kind of you 💖!. Therefore, it would highly appreciated if you would support the Macro Mornings research. A donation/tip can be done via the following button:

The structure with the table of contents and key highlights can be enjoyed already. Feel free to jump to your favorite section as each has at least one dedicated take-away, yet I recommend following this order 👇👇👇

🔔 Restaurant Performance Index

🔔 Tightest turn in years

🔔 Oil prices surge back above $70/barrel

🔔 Chinese liquidity developments

🔔 French political risk

🔔 Household debt to disposable income

🔔 Avg. monthly equity performance of S&P 500 vs. Euro stoxx 50

🔔 S&P 500 returns after five month win streaks

🔔 China large-cap ETF

🔔 Warning sign again

🔔 US Unemployment Rate moved down to 4.1% in September

🔔 Job postings have been steadily declining

🔔 US jobs report

🔔 Warren Buffet has sold over $2 billion dollars worth of bank of america

🔔 Silver is making another strong move

🔔 German pension system in one chart

🔔 High Valuations on Stocks and/or Bonds

🔔 Big move in Fed Funds Futures

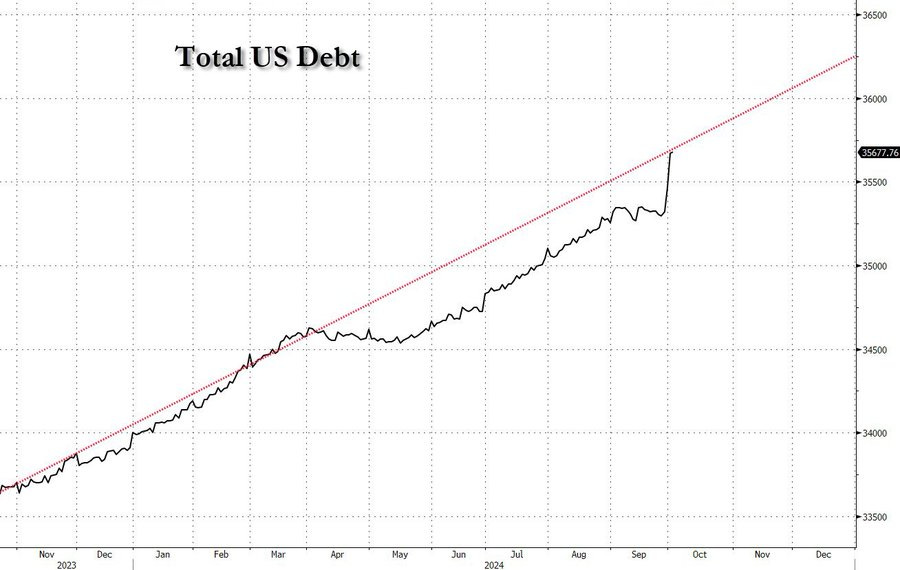

🔔 Total US Debt

🔔 Eurozone manufacturing without recession since 1991

🔔 September Nonfarm Payrolls rise by 254,000

🔔 Gold has hit new all-time highs

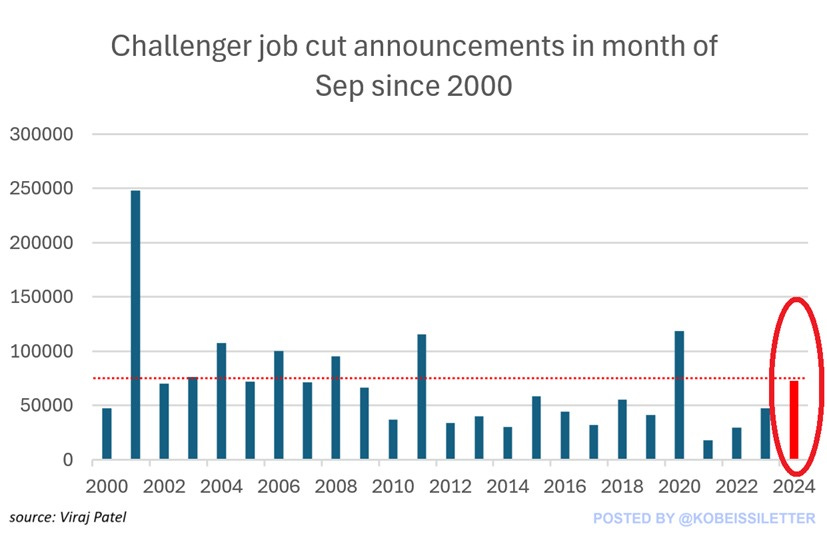

🔔 US job cut announcements are rising

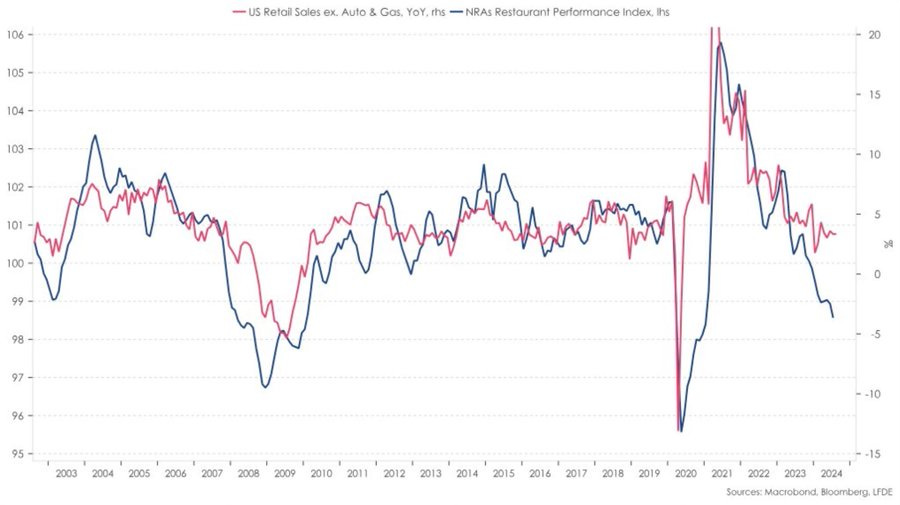

🔔 Restaurant Performance Index

If going out to restaurants is a reliable indicator of consumer strength, then something is brewing similar to the onset of last recessions.

👉 Macro Mornings Thoughts: With inflationary pressures continuing and interest rates at their highest since 2001, we’re seeing some warning signs again.

While consumer spending has been resilient, there are reports of softening in discretionary spending, with some restaurant chains reporting a 3-4% decline in foot traffic over the past quarter.

If this trend continues, it could be another sign that consumers are preparing for tougher economic times, just as they did in previous downturns.

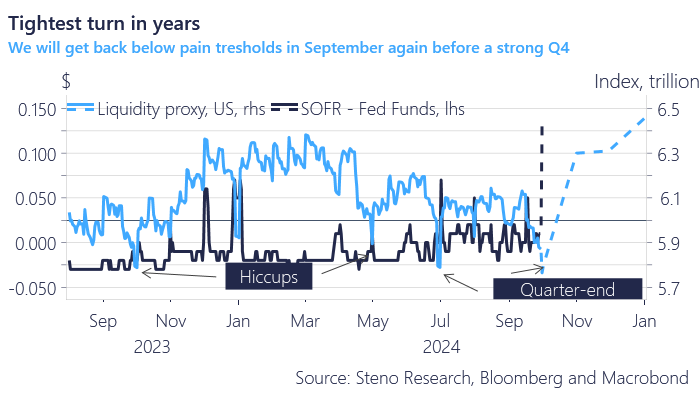

🔔 Tightest turn in years

We had the tightest quarter-turn in AGES yesterday.

The Fed is painfully aware that we have reached a limit in the financial system and they will 1) stop QT and 2) add liquidity SOON

👉 Macro Mornings Thoughts: Given the Fed’s historical response to financial stress and the clear strain in the system, it wouldn’t be surprising to see them stop QT and inject liquidity, possibly before year-end, to avoid a market disruption.

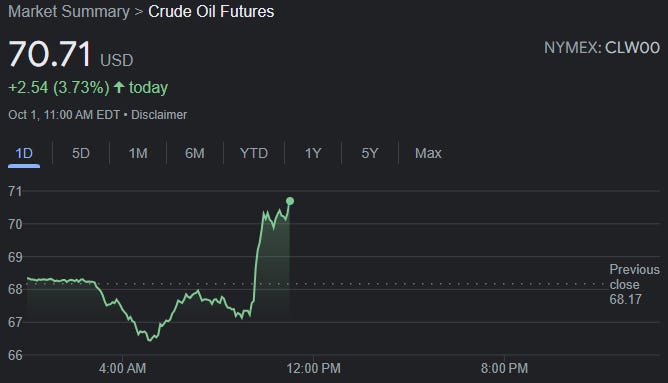

🔔 Oil prices surge back above $70/barrel

Oil prices surge back above $70/barrel as investors begin pricing-in potential supply disruptions in the Middle East.

We now have a port strike, rising oil prices, and aggressive Fed rate cuts. Is this not the perfect recipe for inflation?

👉 Macro Mornings Thoughts: Oil price shocks have been a key driver of inflation, as seen in the 1970s, when oil surged by over 400%, leading to double-digit inflation in the U.S.

This mix of supply-side shocks and monetary easing is definitely a recipe that could reignite inflationary concerns, even if recent trends showed a moderation.

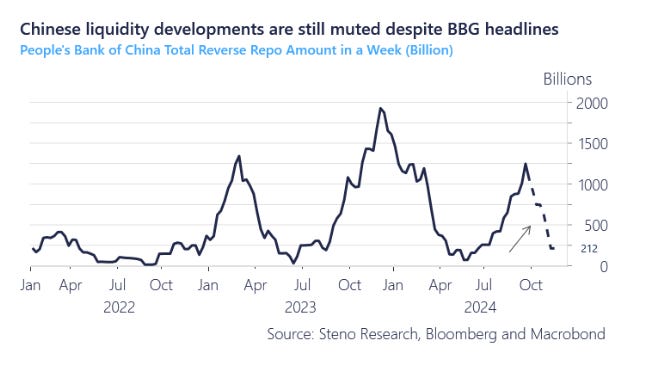

🔔 Chinese liquidity developments

Cramer calling to buy China today, but it seems like liquidity will actually dwindle in China for the remainder of October.

Peak in? I like USD Tech + Crypto more the next 1-2 months

👉 Macro Mornings Thoughts: During the 2018 Q4 selloff in Chinese equities, the NASDAQ rallied by 6% in the following two months.

With the DXY hovering near its recent highs and continued institutional inflows into tech, we could see USD strength continue to boost tech, when both sectors outperformed by over 25% in the post-crisis liquidity environment.

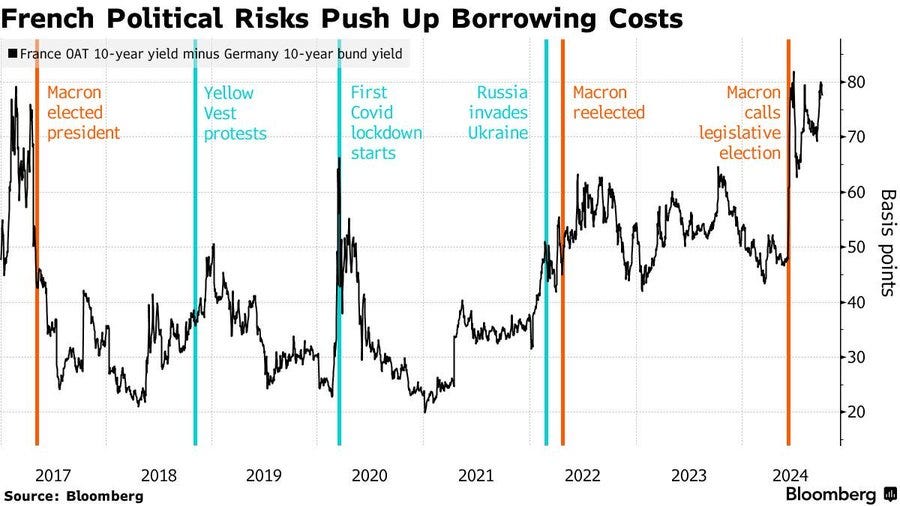

🔔 French political risk

It’s not only French political risk. France is running 6% fiscal deficit during good times despite the highest tax burden in Europe.

It’s state and unions heavy business model reached its natural limit. Without deep structural reforms France will be hit by sovereign debt crisis.

👉 Macro Mornings Thoughts: Without significant structural changes, such as pension reform or labor market liberalization, France risks following a similar trajectory, potentially leading to a sovereign debt crisis, particularly in a higher interest rate environment.

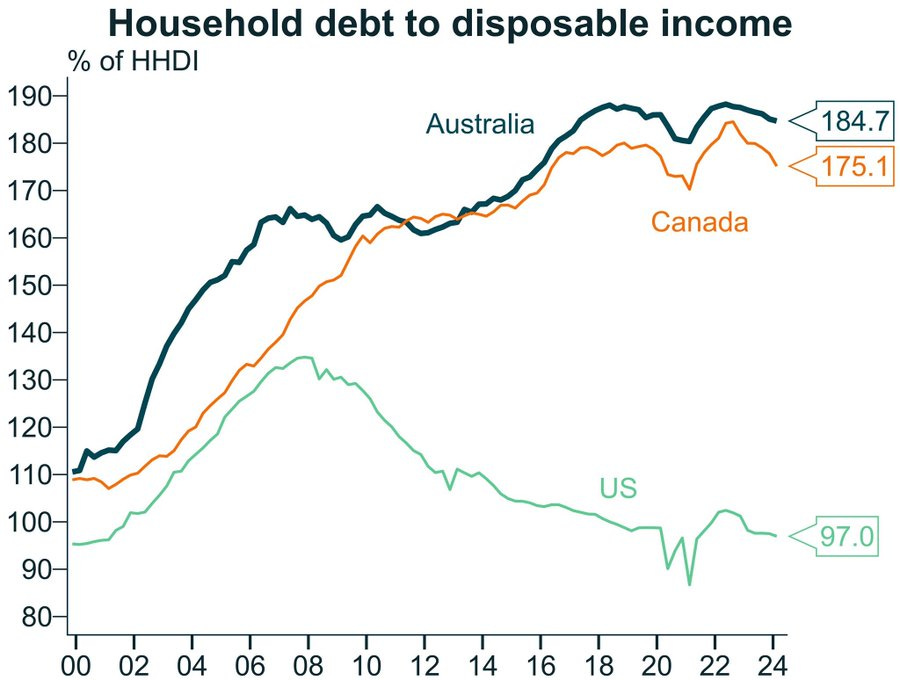

🔔 Household debt to disposable income

WTF is going on in Canada and Australia? Real estate debt bubble in the US in 2007 looks almost cute in this chart.

👉 Macro Mornings Thoughts: U.S. home prices increased by 60% leading up to the 2007 crash.

The vulnerability is strikingly similar to the U.S. subprime bubble, with mortgage rates rising sharply in both countries.

In 2022 alone, Canada's housing market lost $1 trillion in value, echoing the rapid devaluation in U.S. housing during 2008.

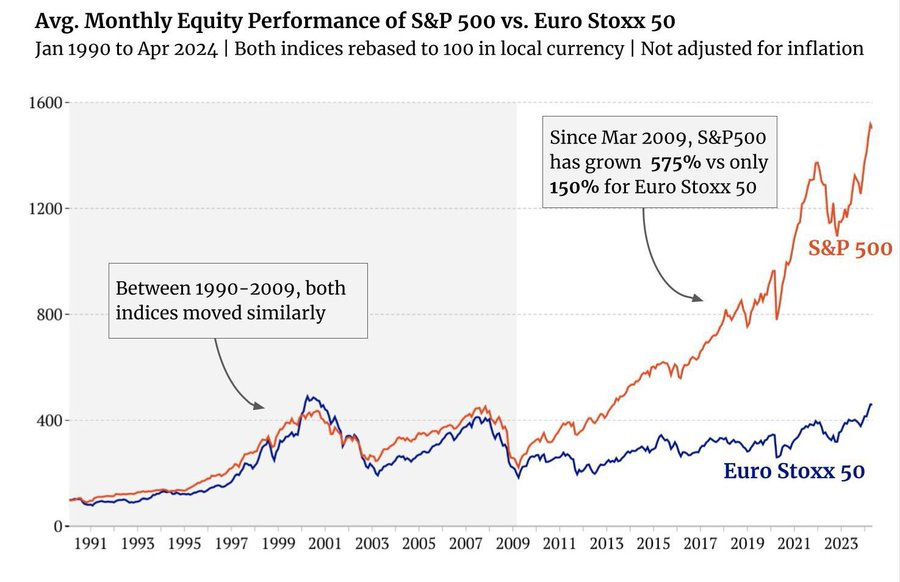

🔔 Avg. monthly equity performance of S&P 500 vs. Euro stoxx 50

25 years ago each major US company had a German and/or French equivalent.

Today equivalents of US tech giants are in China and Europe is on its way to become an open-air museum. What happened?

👉 Macro Mornings Thoughts: In the late 1990s, Europe had industrial giants like Siemens, Alcatel, and Nokia competing head-to-head with U.S. tech firms.

But today, out of the world’s top 10 tech companies by market cap, 7 are American and 3 are Chinese - none are European.

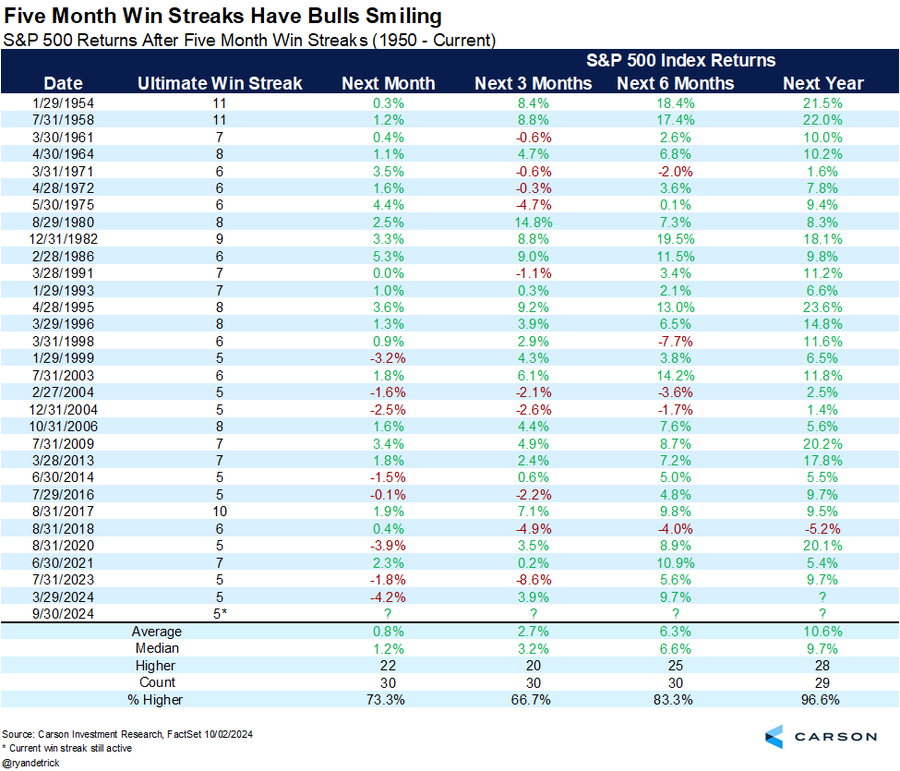

🔔 S&P 500 returns after five month win streaks

The S&P 500 is currently up five months in a row.

Looking at the previous 29 times it did this shows stocks were higher a year later 28 times.

Yes, this is just one small piece to the puzzle, but it does little to change the narrative that we are still in a bull market.

👉 Macro Mornings Thoughts: This pattern held true even during volatile periods, like in 2009 after the financial crisis, when a similar streak saw the S&P gain over 35% in the following 12 months.

While it's not a guarantee, the data heavily leans toward continued upside, reinforcing the current bull market narrative.

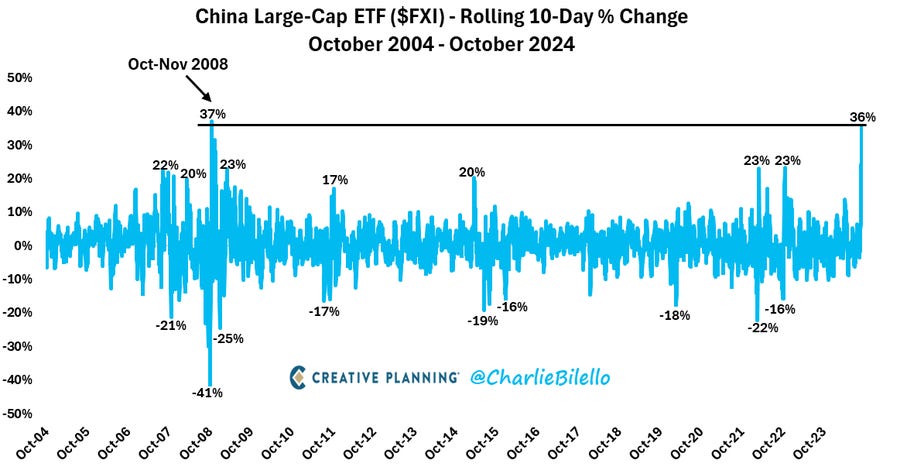

🔔 China large-cap ETF

Chinese stocks have gained 36% over the last 10 trading days, their 2nd biggest 10-day gain ever.

👉 Macro Mornings Thoughts: While this current rally may be fueled by optimism over economic stimulus and regulatory easing, it’s crucial to remember that Chinese stocks remain down nearly 30% from their 2021 highs, signaling there could still be turbulence ahead despite the recent gains.

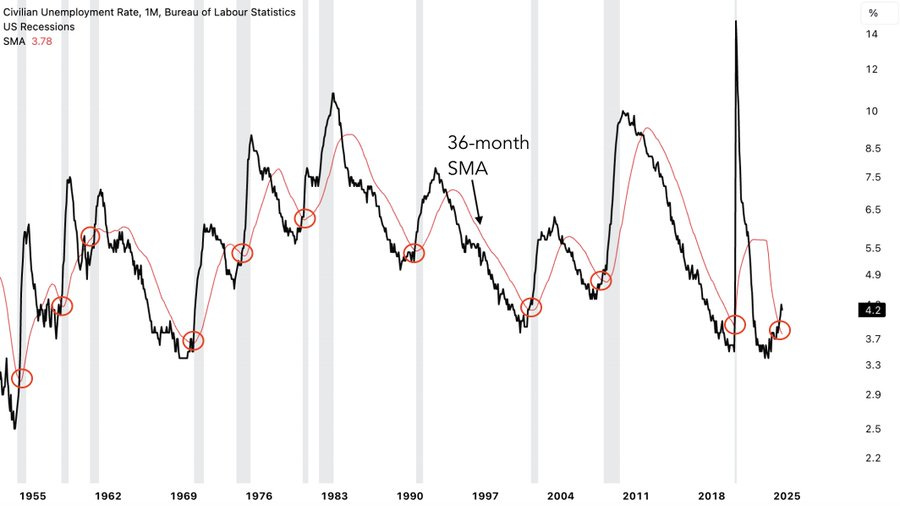

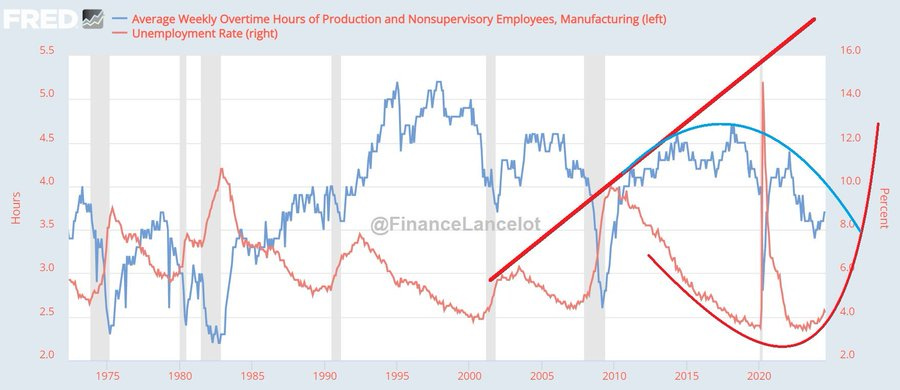

🔔 Warning sign again

This signal has a 100% record for anticipating recessions And it has just flashed a WARNING sign again

👉 Macro Mornings Thoughts: Prior to the 2008 financial crisis, this signal inverted by 1 percentage point in 2006, giving a two-year warning before the economy plunged.

Similarly, in July 2019, the yield curve inverted again, just months before the 2020 recession caused by the COVID-19 pandemic.

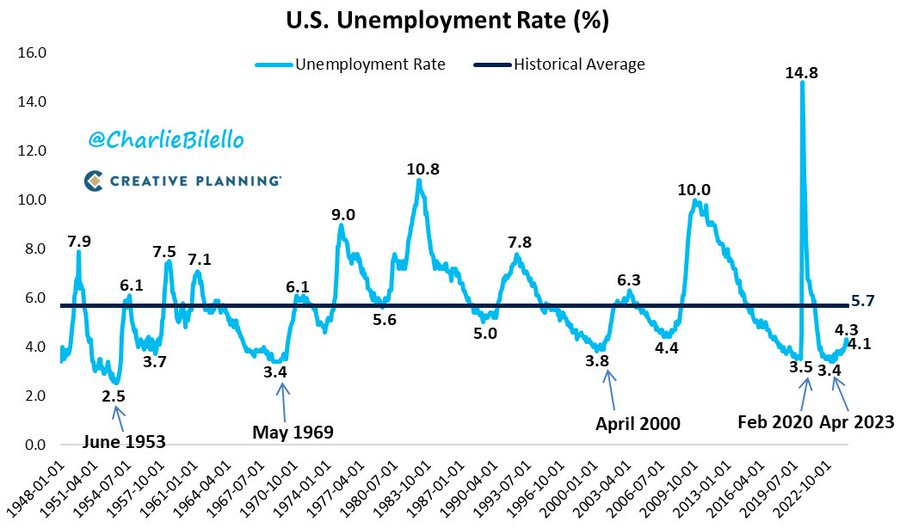

🔔 US Unemployment Rate moved down to 4.1% in September

The US Unemployment Rate moved down to 4.1% in September from 4.2% in August and 4.3% in July.

Remains well below the historical average of 5.7%.

👉 Macro Mornings Thoughts: While today's numbers seem healthy on the surface, it's important to also watch other indicators like labor force participation and wage growth - both of which are crucial to understanding the broader economic health beyond the headline rate.

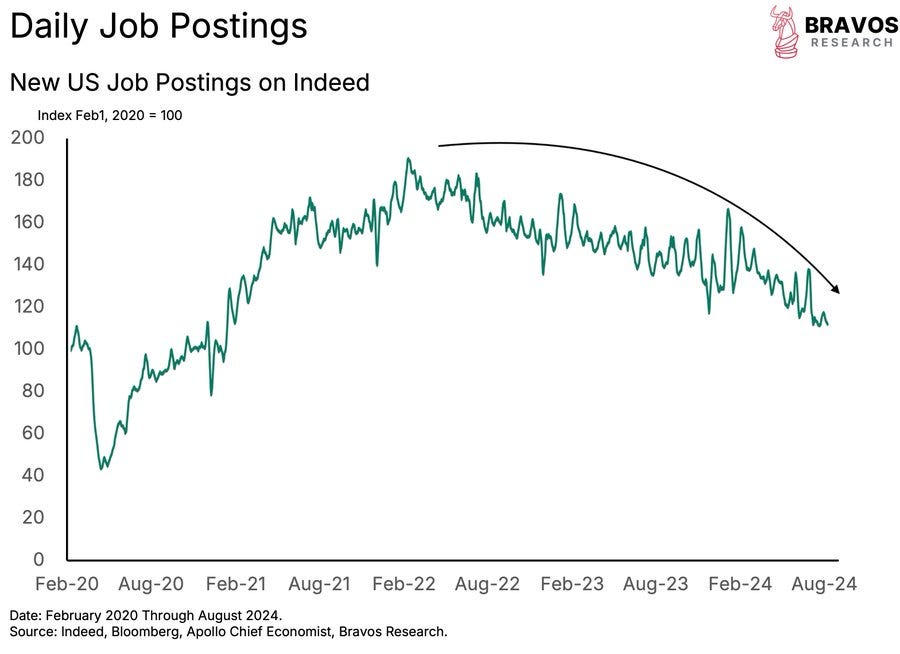

🔔 Job postings have been steadily declining

Job postings have been steadily declining At this rate, it’s not long before the labor market cracks

👉 Macro Mornings Thoughts: While the labor market still appears strong on the surface with low unemployment rates, the steady drop in job postings is often a leading indicator of weakness.

If this trend continues, it’s reminiscent of past cycles where a robust job market eventually faced cracks.

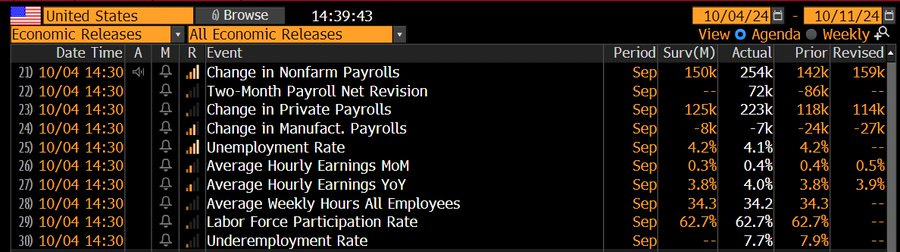

🔔 US jobs report

Blowout US jobs report: US econ created 254k jobs in Sept way above the estimated 150k, acc to Establishment survey.

Revisions were bullish as well: Jul and Aug payrolls were revised up by 72k.

Household survey was even stronger than the Establishment, showing that number of employed people shot up 430k in Sept.

So unemployment rate ticked lower to 4.1%, down from 4.2% in Aug.

👉 Macro Mornings Thoughts: If this trend holds, it could fuel further optimism about the strength of the economy, but it's important to watch how other macro indicators like inflation and consumer spending evolve alongside this labor momentum.

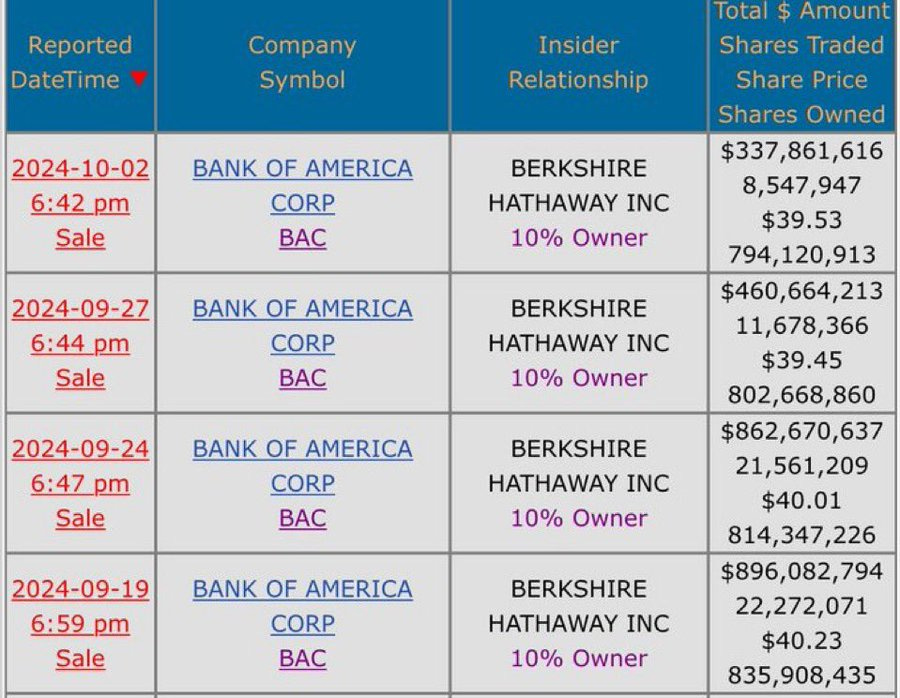

🔔 Warren Buffet has sold over $2 billion dollars worth of bank of america

Warren Buffet has sold over $2 billion dollars worth of bank of america and he is now exactly .1% away from falling below 10% BAC ownership.

Below 10% he will be required to do a immediate filling after any sale.

👉 Macro Mornings Thoughts: Buffett has held a long-term bullish view on the banking sector, but trimming his position like this could signal a shift in strategy.

In 2020, Buffett similarly reduced his holdings in Goldman Sachs amid concerns over the banking sector's vulnerability, and that proved prescient as financial stocks faced volatility soon after.

🔔 Silver is making another strong move

Silver is making another strong move, decisively breaking out of a 13-year resistance level.

A compelling approach to identifying the beginning of a new secular trend in commodities is to examine the rotational dynamics of price behavior among various resources.

👉 Macro Mornings Thoughts: Copper is up nearly 40% since 2020, and oil has seen a resurgence, testing $90 per barrel.

Often these synchronized moves in commodities often precede extended bullish trends, as seen in the early 2000s commodity supercycle.

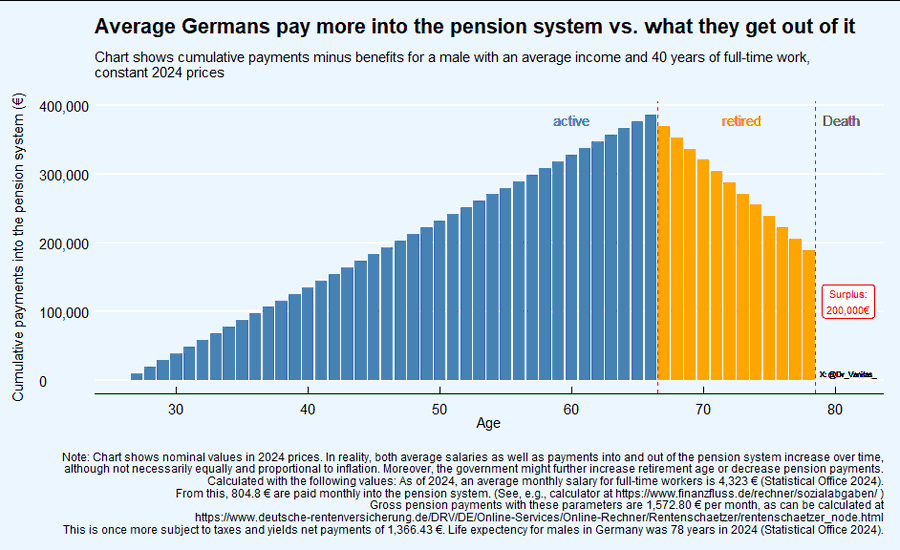

🔔 German pension system in one chart

Average worker has to pay 18.6% of their gross wage into the system. After retirement they only get a fraction of this back.

👉 Macro Mornings Thoughts: With Germany’s aging population and declining birth rates, the strain on the system is increasing.

In 1960, there were 6.4 workers for every retiree - by 2020, that number had dropped to around 2.7.

Projections suggest it could fall below 2 by 2040, which is why reforms are being discussed to ensure long-term sustainability.

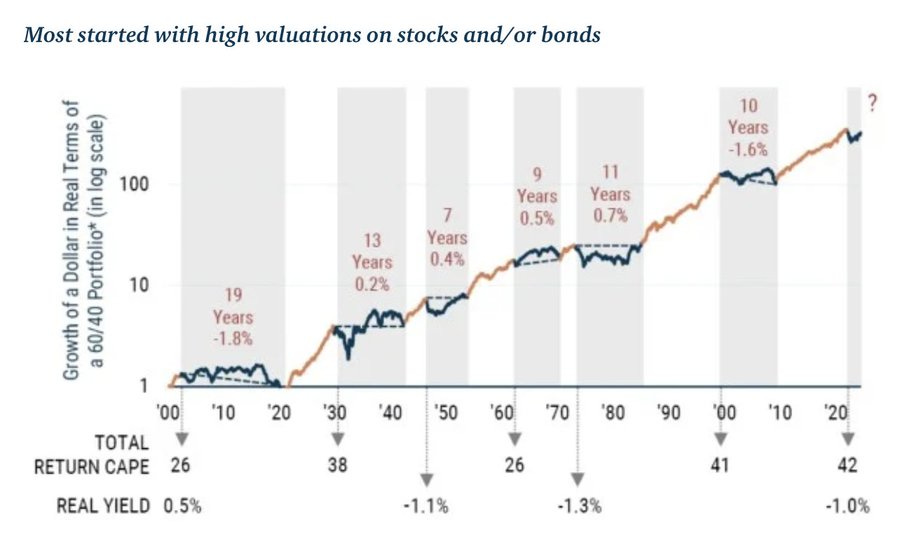

🔔 High Valuations on Stocks and/or Bonds

There have been 6 "lost decades" in which an investor in a 60/40 portfolio would have either broken even relative to inflation or lost money in real terms.

They all began when either or both stocks and bonds were trading at extremely high valuations.

👉 Macro Mornings Thoughts: Each of these six "lost decades" began at times of extreme valuation mismatches, whether it was the late 1920s, the 1970s stagflation, or the post-2008 financial crisis period.

Today, with stock P/E ratios elevated and bond yields still recovering from historical lows, it's a timely cautionary signal for investors relying on the traditional 60/40 model.

🔔 Big move in Fed Funds Futures

Big move in Fed Funds Futures after the strong jobs report.

Market is now saying there's a 90% probability that the Fed only cuts rates by 25 bps in November.

A week ago the market was pricing in another 50 bps cut.

👉 Macro Mornings Thoughts: The Fed’s cautious approach in response to robust employment figures reflects concerns about inflationary pressures, as wage growth remains elevated.

When labor markets remain tight, the Fed has been reluctant to cut aggressively, and this latest move in futures pricing suggests that traders are bracing for a more measured policy shift in the near term.

🔔 Total US Debt

For a few months there you'd almost think the US had learned a lesson and was slowing down its breakneck debt issuance. And then...

👉 Macro Mornings Thoughts: This surge in borrowing is reminiscent of 2020 when the US issued over $4 trillion in debt to manage the pandemic. As of now, total US national debt has soared past $33 trillion, a staggering 120% of GDP.

🔔 Eurozone manufacturing without recession since 1991

Manufacturing in Europe, mainly driven by German industrial suicide, is falling off the cliff during good times, imagine what will happen during next recession.

👉 Macro Mornings Thoughts: If these are the results during "good" times, the next recession could accelerate this decline, as we saw in 2009 when Germany’s industrial output plummeted nearly 17%.

The combination of energy issues, supply chain disruptions, and weakening demand could spell disaster for Europe’s manufacturing heart during the next economic downturn.

🔔 September Nonfarm Payrolls rise by 254,000

Anyone actually believe these numbers?

👉 Macro Mornings Thoughts: While the headline number is impressive, it's worth watching the revisions closely, as they often reveal a more balanced picture of the labor market.

🔔 Gold has hit new all-time highs

History shows this is a MAJOR warning signal

👉 Macro Mornings Thoughts: When gold surged, it signaled significant economic stress or uncertainty.

Fast forward to today, with gold surpassing $2,000 per ounce, it's reflecting concerns over persistent inflation, potential Fed rate cuts, and geopolitical tensions.

🔔 US job cut announcements are rising

US employers announced 72,821 job cuts in September posting a 53% year-over-year increase, according to Challenger, Gray and Christmas data.

The number of layoffs last month marked the third-largest September since the 2008 Financial Crisis.

👉 Macro Mornings Thoughts: This marks the third-highest September for layoffs since the 2008 financial crisis, when the economy shed over 750,000 jobs per month at its peak.

The last time we saw such a significant rise in layoffs was in 2020, at the onset of the pandemic, which led to over 20 million job losses within a few months.

Did you enjoy this extensive research by finding it interesting, saving you time & getting valuable insights? What would be appreciated? Sharing it around with like-minded people and hitting the ❤️ button. This will help me bringing in more & more independent investment research: from a single individual, not a bank, fund or so!

Disclosure

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. This material has been prepared for informational purposes only. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.