🕵️♂️ [Liquidity Trouble] FED just did it again

November 6, 2025 >> US Banking System

⭐ LIVE WEBINAR - FREE REGISTRATION ⭐

🌍 Macro 2026: Lessons and Opportunities for the Future

🗓 December 6th, 2025 - ⏰ 11:00 AM EST - 📍 Online

Global trends are rewriting the rules of investing. 🌍 From inflation to central banks, discover the key macro shifts for 2026 - and how to position your portfolio before it’s too late.

🎟️ Seats are limited - secure your free spot now!

Dear all,

I want to speak to you today in the same tone I would use if we were walking along a quiet street at the end of the day, when the light has softened and the world finally slows.

The kind of conversation that emerges naturally when the noise of the day has fallen away, and what remains is clarity, depth, and the steady awareness of what is unfolding beneath the surface.

I want to offer you not urgency or alarm, but presence.

Because something meaningful is moving through the markets right now - quietly, steadily, insistently - and it deserves our attention.

Everything looks triumphant.

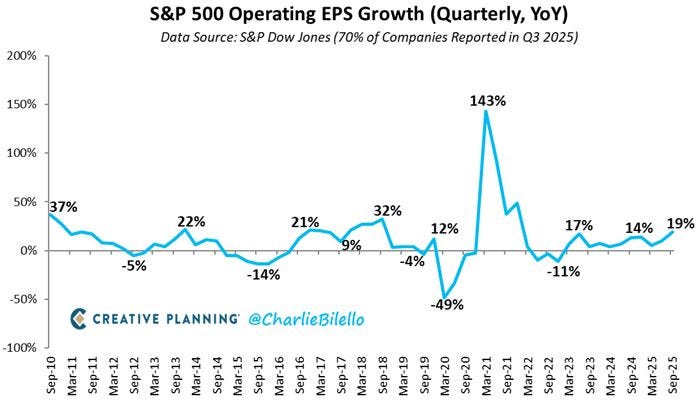

Roughly 70% of S&P 500 companies have now reported earnings, and operating earnings are up +19% Y/Y.

This marks the 11th consecutive quarter of positive earnings growth - the strongest expansion we have seen since late 2021, when reopening momentum was still fresh and conviction felt like oxygen.

It speaks to discipline, efficiency, and the enduring adaptability of American corporate structure.

These numbers carry pride. They carry narrative.

But markets don’t communicate in headlines.

They communicate in tensions, contrast and most of all communicate in what doesn’t quite align.

There is a difference between what is happening and how it feels when you sit inside the moment.

📈 The Thin Air at the Summit

We are living in a moment where the highest percentage of global equity indexes are sitting at all-time highs since December 1999.

That comparison is not merely historical - it is emotional.

Because 1999 wasn’t about numbers. It was about sentiment. It was about belief becoming identity and the feeling that progress was inevitable.

But markets are rarely that simple.

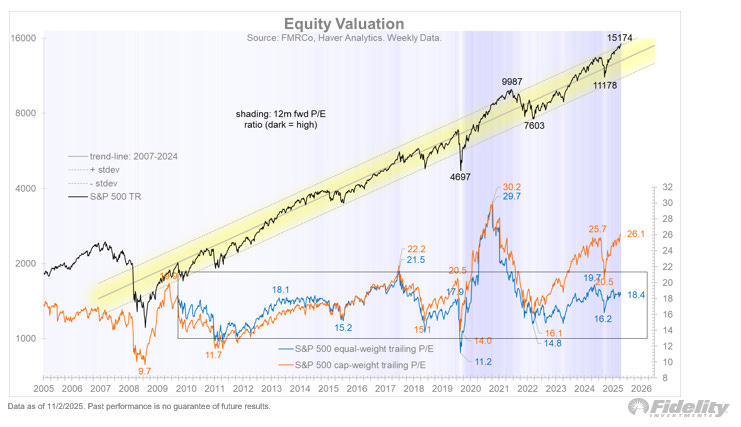

Today, the 5-year CAPE ratio stands at 31.5x, placing valuations back in the rarefied altitude of the dot-com peak.

And yet the median P/E ratio across the broader market sits at 18.4x - calm, reasonable, almost unremarkable.

The market is not broadly inflated. It is narrowly elevated.

A small constellation of giants has pulled the index skyward, while the majority of the market moves steadily but without exhilaration.

And this reminds me sharply of 1998-2000, when a handful of companies carried the dream of an era.

When the cycle turned, the cap-weighted S&P 500 fell over -40%, while the equal-weight index declined only about half as much.

The rise had been spectacular - but it had not been shared.

This is not a warning. It is simply a way of remembering that the summit is often quiet, thin, and strangely still.

🔥 Inflation Is Becoming the Landscape, Not the Event

The ISM Prices Paid index has begun to rise again, and historically it has led consumer inflation by roughly six months.

If this relationship holds, inflation is not disappearing.

It is simply settling into a new terrain - a place not high enough to feel shocking, but not low enough to be dismissed.

And yet, the Federal Reserve is preparing to cut rates.

This is not a contradiction. It is a shift in mandate.

With debt-to-GDP now around 120%, interest rates are no longer simply a policy tool.

They are a structural force. Every 1% increase in rates adds hundreds of billions of additional interest expense.

At some point, policy stops being about managing inflation and becomes about managing the sustainability of the system itself.

And history offers precedent when inflation becomes structural rather than transient:

From 1973 to 1981:

Gold rose +1,067%

Oil increased more than tenfold

And the S&P 500 declined nearly -39% in real terms

From 2003 to 2011:

Gold gained +370%

The U.S. Dollar Index weakened by ~22%

In both periods, capital moved not toward what promised return, but toward what protected value.

This shift is subtle at first. It doesn’t shout. But once it begins, it is difficult to reverse.

⭐️ This is a paid content, so scroll to read it…[🎁 #4 BONUS if you become a PRO] - Only 6 spots last

If you’re a PRO subscriber, make sure you’re logged in to access the full piece. And if you’re already Annual/Lifetime member 👉 Access to 🧠 Macro Mornings Family.

If you’re still a FREE reader, you have two exclusive options to unlock this special edition, all past PRO content and the App’s Special launch:

1. 👉 Pro Membership from 30% to 50% OFF - forever. Only 6 spots last:

⭐ PRO Membership - $285/year or $24/month (Regularly $570) [Click here]

👑 Lifetime - $798 one time only or $13/month (Regularly $1,140) [Click here]

👇 + 4 free bonuses 👇

🎁 BONUS #1 - These prices are locked forever and will never increase.

🎁 BONUS #2 - FREE access to the 🧠 Macro Mornings Family, our private community.

🎁 BONUS #3 - Full App access 📲 + all exclusive content, anytime, anywhere.

🎁 BONUS #4 - 🕵️♂️ Join a Monthly live mastermind where we answer the community’s most pressing questions, break down real-world cases, and share strategies.

👉 After payment, you’ll receive a Welcome Kit by email with all the material and instructions to join.

2. 👉 Or start your 7-day FREE Trial - exploring only the PRO analyses without any risk.

If you’re serious about understanding what comes next - and acting before the crowd - this email is your edge.

Keep reading with a 7-day free trial

Subscribe to Macro Mornings 💡 to keep reading this post and get 7 days of free access to the full post archives.