🤯 Japan Might Be Triggering the Next Financial Earthquake

July 10, 2025 >> Nobody’s Talking About This

Dear all,

Something shifted this week. Quietly, without fireworks or breaking news alerts. The kind of tremor that tends to go unnoticed until it becomes impossible to ignore. Japan’s 30-year government bond yield rose above 3% - a level we haven’t seen since the year 2000. Meanwhile, the 40-year yield climbed to 3.36%, flirting with its all-time high since that bond was even introduced.

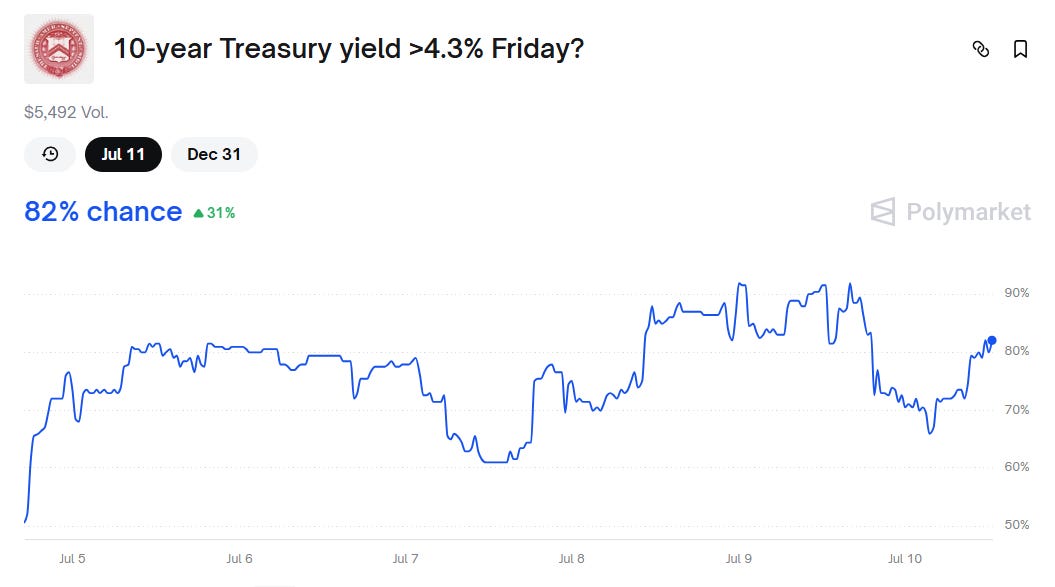

You wouldn’t know it from the headlines. But take a glance at Polymarket (The World's Largest Prediction Market) - where the probability of the U.S. 10-year yield breaking above 4.3% spiked dramatically this week - and you’ll start to see the outlines of a much larger story. It’s there in the betting lines, in the shifting bond curves, in the subtle tremors moving through foreign exchange desks and macro models alike.

For those of us who live and breathe macro, this is not just a ripple. It’s a red flare. Because Japan, for decades, has anchored the global rate structure - the gravitational center of the low-yield universe. When that anchor starts to lift, when Japanese long-term yields break out of a 20-year range, the impact radiates far and wide.

Let me walk you through what I see unfolding - not as a single event, but as a transition. A possible inflection point in the global financial regime.

⭐️⭐️⭐️⭐️⭐️ Special PROMO - Last 2 Spots Left

📝 Excellent score on TrustPilot

💡 New on Macro Mornings? Start here

🎯 This is part of a series designed for PRO investors who want real-time updates on macroeconomic news through my advanced insights. Feel free to catch up on previous emails here if you'd like to start from the beginning!

🎁 Got a macro topic you've been meaning to understand better? Something that could really impact your portfolio?

You can now book a FREE 30-minute call with me - focused entirely on your most important questions.

It’s not a generic session. It’s your chance to get personalized, research-backed insight on what matters to you. No cost, no pressure.

Let’s connect, talk openly, and help make your next move a smarter one.

🔄 A Carry Trade on the Brink

For most of the past two decades, Japan’s ultra-low interest rates made the yen the go-to funding currency for global investors.

Borrowing costs were near zero, sometimes negative.

The mechanics were straightforward: you borrow yen, convert to dollars or euros, and invest in higher-yielding assets - from U.S. Treasuries to Indonesian bonds, from Australian real estate to Silicon Valley growth stocks.

It worked beautifully... until the fundamentals began to shift.

Since January 2025, the yen has appreciated over 8%.

Meanwhile, the long end of the Japanese yield curve has started to reprice aggressively.

A 30-year yield above 3% is not just a number - it’s a psychological shift, a structural change.

And the implications are profound.

We’ve already seen what a sudden unwind can do.

In August 2024, a partial disruption in the carry trade was enough to send the MSCI World Index down 5.7% in a single month.

USD/JPY, one of the cleanest reflections of this trade, fell 7.4% - not over a quarter, but in a matter of days.

But what’s happening now feels different.

It’s slower, more persistent.

A building pressure that could culminate in a far deeper repricing.

The unwind is no longer a risk. It’s a scenario that’s quietly playing out.

🌍 Capital Flows Are Changing Course

Japanese investors are not just passive players.

They are the largest foreign holders of U.S. government debt, with over $1.13 trillion in Treasuries.

For years, they had no reason to question that exposure.

Yields at home were too low, and the dollar offered both yield pickup and relative safety.

But now the calculus is changing.

With Japanese Government Bonds (JGBs) yielding over 3% and the yen strengthening, the incentive to repatriate capital is growing.

Why take on FX risk and geopolitical uncertainty when you can earn almost the same yield in your own backyard?

This is not hypothetical. U.S. 30-year yields are approaching 5% again, a level we haven’t consistently seen since before the Global Financial Crisis.

Meanwhile, market sentiment is shifting fast.

A few days ago, the odds of the 10-year yield crossing 4.3% were roughly 50/50.

Today, Polymarket (The World's Largest Prediction Market) has those odds at 82%. That’s a 31% jump in probability in under a week.

If you remember 2013, during the taper tantrum, yields jumped 130 basis points in four months as foreign investors began rotating out.

That was a shock - a market earthquake.

The setup now?

It’s eerily familiar.

But the source this time isn’t the Fed. It’s Tokyo.

💱 The Safe Havens Are Changing Shape

We’re in a moment of reassessment - not just of risk assets, but of where safety actually lives.

Gold is trading at $3,315/oz, holding its ground as global fiscal imbalances deepen.

But the real story is the Swiss franc, which has started moving in tandem with gold, not Treasuries.

Over the past year, CHF/USD is up 12%.

That might seem subtle, but it’s a profound shift in market psychology.

Investors are starting to reframe their definition of a "safe haven."

In 2011, during the U.S. debt ceiling crisis, gold surged 28% and the Swiss franc rose 18% against the dollar - as capital fled political dysfunction.

We’re seeing echoes of that now.

With sovereign debt levels ballooning and fiscal credibility eroding in G7 economies, markets are searching for neutral, liquid, and reliable alternatives.

Gold and CHF are increasingly fitting that role.

⚠️ Commodities Are Speaking, Too

There’s something poetic about commodities.

They don’t speak loudly.

They just move. And copper - the metal with a PhD in economics - is quietly flashing an alert.

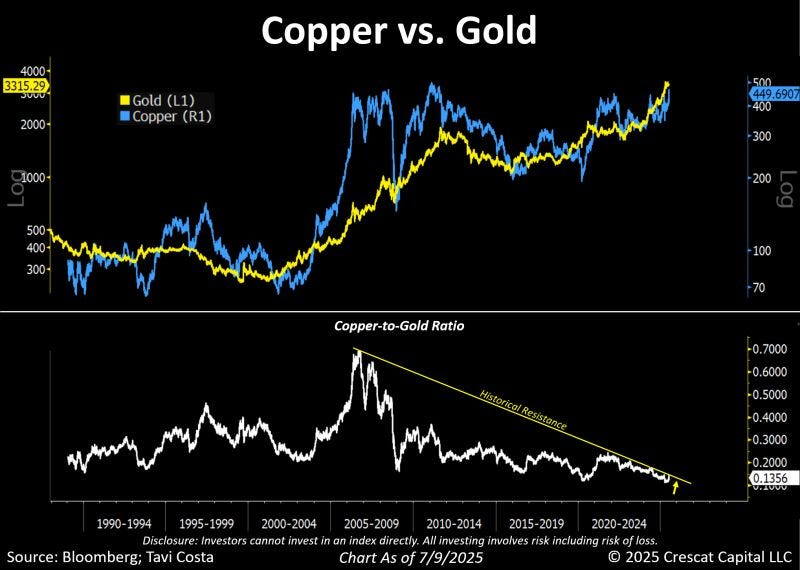

This week, copper hit $449 per pound.

At the same time, the copper-to-gold ratio is attempting to break out of a 15-year downtrend, according to a chart from Crescat Capital that I’ve been studying closely.

This ratio matters.

In the 2009-2011 cycle, gold gained 80%, followed by a 90% rally in copper.

The sequence wasn’t random. Gold moved first, reacting to monetary instability.

Copper came next, reflecting the return of real growth and demand.

Today, the pattern may be repeating.

Gold is rising on fears about debt and currency credibility.

Copper is responding to the idea that despite all the fragility, a new investment cycle is underway - in energy, in infrastructure, in defense.

When those two rise together, it’s not just inflation. It’s transformation.

🌐 Currencies Are Telling a Bigger Story

EUR/USD is holding at 1.1723, but beneath that surface lies something more impressive: the trade-weighted euro index has reached a record high of 130.07.

That may seem technical - until you realize what it means.

The euro’s strength isn’t just about ECB policy.

It’s being amplified by the global structure of exchange rates.

Many EM currencies are still pegged to the U.S. dollar.

So when the dollar weakens, and the euro strengthens, the trade-weighted effect becomes supercharged.

We saw this in 2007-2008.

The euro soared, and it imported deflation into Europe.

German exports slowed. The ECB tightened too far.

Then came the reversal. History may not repeat perfectly, but it often rhymes.

Right now, that rhyme is getting louder.

🎯 Where Does This All Lead?

This isn’t just a local yield story.

It’s a macro regime shift.

A pivot away from a world where money was abundant, rates were suppressed, and capital was frictionless.

What Japan is signaling - through its bond market, through its currency, through the quiet decisions of its institutions - is that the old world is gone.

The new one will be more volatile, more selective, more macro-driven.

We’re witnessing a global reshuffling. Of capital. Of risk. Of what matters.

I’ll be watching every piece of this unfold, and I’ll keep you ahead of it - not after it happens, but as it’s taking shape.

Alessandro

Founder of Macro Mornings

What You’ll Get by Joining Macro Mornings Premium

🔸 Regular deep dives into economic indicators and geopolitical developments shaping today’s markets.

🔸 Exclusive, high-quality macro investment opportunities that focus on long-term growth, diversified risk, and the potential to outperform during various economic cycles.

⭐️⭐️⭐️⭐️⭐️ Special PROMO - Last 2 Spots Left

📝 Excellent score on TrustPilot

Becoming a Macro Investor Premium, You’ll Gain Access to:

Well-researched insights help you make smarter and more informed decisions .

All the tools you need right at your fingertips to build, track, and grow a resilient portfolio - helping you retire earlier and live life on your own terms.

Stop guessing, start investing with confidence, and enjoy a life free from financial constraints.

👋 Read my Financial Story

🙏📝 TrustPilot - Leave your review and share your experience - I’d means a lot for me!

✍ FREE

📚 Get your E-book FREE 👉 10 Simplified Strategies for Investors

🏆 PRO

🔏 Become a Macro Investor here | 💰 30% Off for Life - [🔥 Only 5 Spots Left! 🔥]

📚 The Art of Financial Freedom 👉 51 Macro Lessons to Success Your Future

💻 SOCIAL

🎙 PODCAST

Disclosure

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. This material has been prepared for informational purposes only. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

No Europe will.

A financial earthquake from Japan could come from the JGB market — it's one of the biggest and most illiquid bond markets in the world

Any loss of confidence there could lead to severe repricing. Imagine the spillover into U.S. Treasuries, EM debt, or even carry trades

Investors might be underestimating how interconnected these risk channels are….