Hi all, and welcome back to The Macro & Business Insights!

What you’ll find in this episode:

Is the 7% the solution that will solve the inflation problem?

Why these days are different than the 70s

How could behave risky assets in 2023

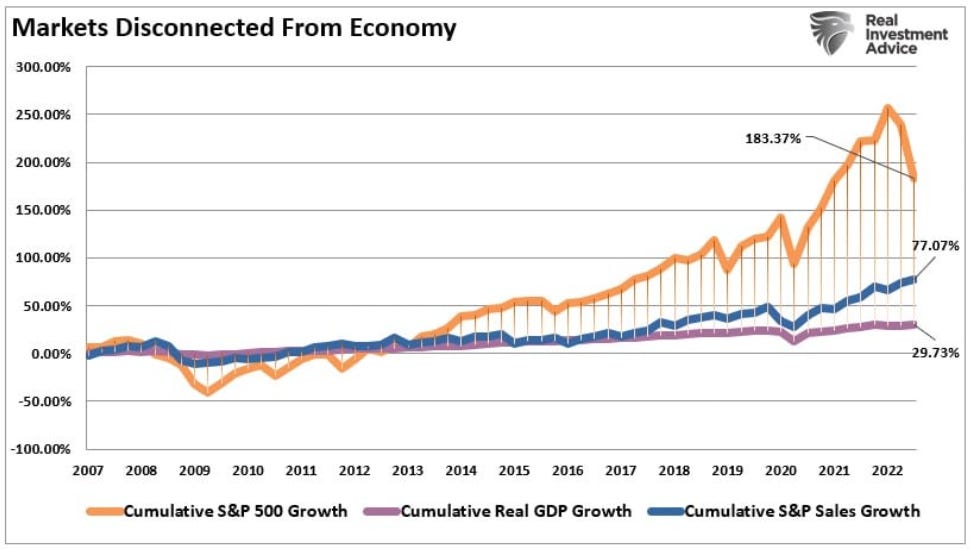

Through the end of Q3-2022, using quarterly data, the stock market has returned almost 184% from the 2007 peak.

The critical takeaway is that while the Fed’s policy of low-interest rates pushed capital into the financial markets, it did so at the expense of economic growth.

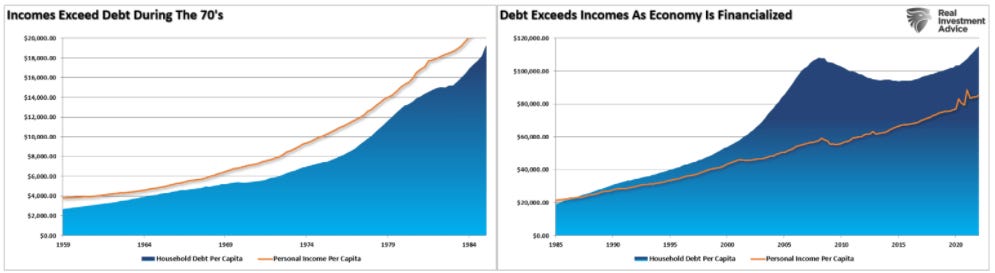

The debt accumulation needed to sustain a “living standard” has left the masses dependent on low rates to support economic activity.

Most likely, the Fed’s “7% solution” will solve the inflation problem caused by the massive stimulus injections following the pandemic.

Unfortunately, the medicine will most likely kill the patient in the process.

The enormous debt load is the most crucial difference between applying the “7% solution” today and in the 70s.

Today, consumers, businesses, and even the Government depend on low-interest debt to sustain an ongoing spending spree.

A “7% solution” could pop the massive “debt bubble,” leading to severe economic consequences.

Just recently, James Bullard, President of the St. Louis Federal Reserve, suggested the central bank might need to employ the “7% solution” to ensure the complete destruction of inflation.

As real investment advice has discussed previously, the fear is repeating the policy errors of the late 1970s that led to entrenched inflation.

While the “7% solution” is supported by the likes of Larry Summers and others, there are vast differences between the economy today versus then (as you can see at the first chart).

This time is different

The Government ran no deficit, and household debt to net worth was about 60%.

So, while inflation was increasing and interest rates rose in tandem, the average household could sustain their living standard.

The chart shows the difference between household debt versus incomes in the pre-and post-financialization eras.”

What happened in the 70s?

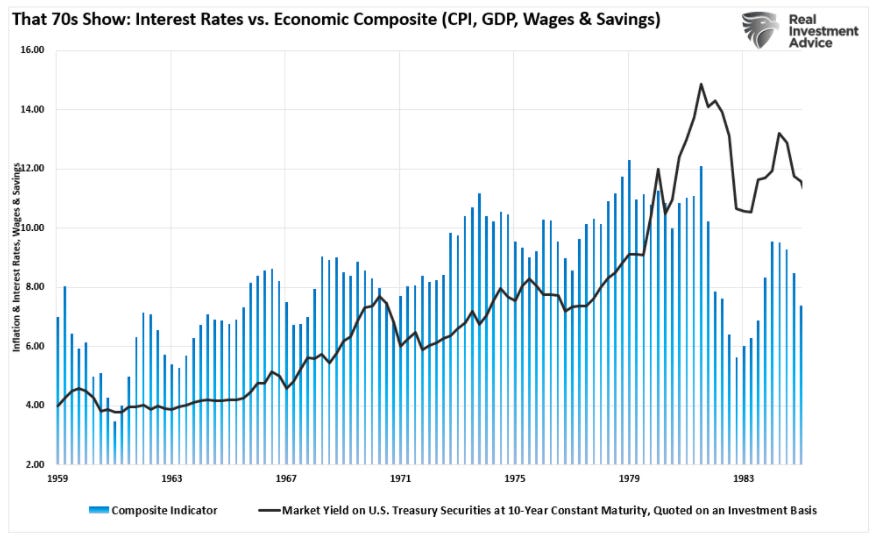

What was most notable is the Fed’s inflation fight didn’t start in 1980 but persisted through the entirety of the 60s and 70s.

As shown, as economic growth expanded, increasing wages and savings, the entire period was marked by inflation surges.

Repeatedly, the Fed took action to slow inflationary pressures, which resulted in the repeated market and economic downturns.

Stocks Set to Fall Near-Term as Economic Growth Slows

Source: Jp Morgan Global Research

The global economy is projected to expand at a sluggish pace of around 1.6% in 2023 as financial conditions tighten, the winter aggravates China’s COVID policy and Europe’s natural gas problems persist.

The global economy is not at imminent risk of sliding into recession, as the sharp decline in inflation helps promote growth, but the J.P. Morgan Research baseline view assumes a U.S. recession is likely before the end of 2023.

In the first half of 2023, the S&P 500 is expected to re-test the lows of 2022, but a pivot from the Fed could drive an asset recovery later in the year, pushing the S&P 500 to 4,200 by year-end.

If you had like this piece and you want to read the whole advanced article I invite you to go on my website www.scriptamanent.blog (you can find the link in the description), which you can find many more useful insights.

Best regards,

🔔 If you like my work, one simple thing that would make me very happy is if you’d bring only two friends/colleagues within our community - they might appreciate it and after all…it’s free!

Feel free to share my contents with anyone you think is might be interested with the link below!

🔍 We are a community of Macro & Business enthusiasts and lovers of Financial Markets.

💡 If you want even more free, valuable financial content you can also follow me on Twitter and visit my Website for more in deep analysis.

Disclosure

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. This material has been prepared for informational purposes only. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.