Hi all, and welcome back to The Macro & Business Insights!

What you’ll find in this episode:

China has a potential growth path

Why China is different vs other Major Economies?

How the China’s corporate profits will potentially behave in 2023?

Let’s begin

We have understood that all the world will slow during 2023 and instead China’s economy should grow to 3.3%.

Moreover, if they’ll reopen their economy, what could be the real potential in 2023 for this country?

In this research we try to focus and answer to these questions, looking at their business and consumer confidence.

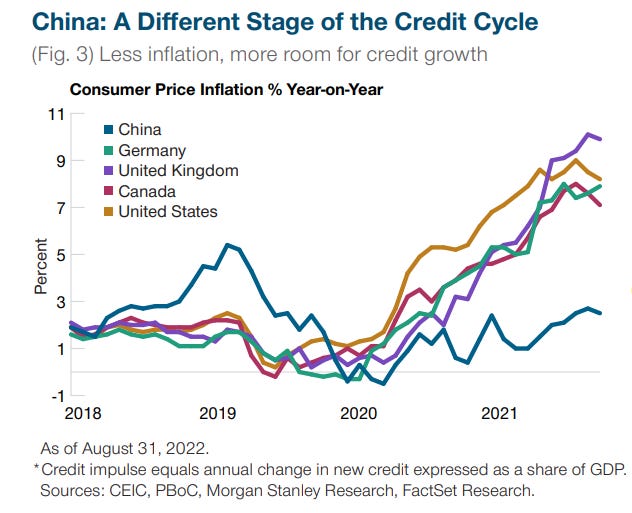

First thing above all, China is different vs other Major Economies. You see immediately with the chart below.

Inflation will begin to settle down, but it will settle at a higher number than we had pre-pandemic.

China is at a different stage of its business cycle compared with other economies and has room to ease policy as inflation remains low.

Investors will have to be more careful about what they are willing pay for future earnings and demands for profitability will come sooner.

All of this means that companies that can’t deliver earnings are more likely to see the market take down their valuation.

China has a potential growth path

T. Rowe Price believe China is ready to move on from its zero-COVID policy and has embarked on the path to reopening, though the journey could be disruptive and chaotic, with possible zigzags on the way.

They also think the issue is likely to be largely behind us a couple of quarters from now, enabling China to return to its potential growth path.

Higher-frequency data should be the first to improve.

In October, domestic flights were down 62% year on year, subway passenger revenues fell 20% year on year, and cinema takings were down 72% year on year.

China’s property market declined sharply in 2022, with sales down 33% from their peak in the fourth quarter of 2020 and housing new starts down 37.8% in the first 10 months of 2022.

Among China’s top 100 developers, over 90% are in a distressed situation, with bonds trading below 70 cents on the dollar.

China’s corporate profits

China’s corporate profits were suppressed in 2022 due to COVID and the property decline. However, it might have troughed.

Consensus is expecting China’s 2023 earnings per share (EPS) growth to accelerate to 10% from 2% in 2022.

On the other hand, global EPS growth (MSCI ACWI) is expected to decelerate from 7.5% in 2022 to 3.7% in 2023.

If you had like this piece and you want to read all the article I invite you to go on my website www.scriptamanent.blog, which you can find many more useful insights.

Best regards,

🔔 If you like my work, one simple thing that would make me very happy is if you’d bring only two friends/colleagues within our community - they might appreciate it and after all…it’s free!

Feel free to share my contents with anyone you think is might be interested with the link below!

🔍 We are a community of Macro & Business enthusiasts and lovers of Financial Markets.

💡 If you want even more free, valuable financial content you can also follow me on Twitter and visit my Website for more in deep analysis.

Disclosure

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. This material has been prepared for informational purposes only. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.