Hi all, and welcome back to The Macro & Business Insights!

What you’ll find in this episode:

How is going on relations between US & China

What could change with the new BOJ leadership

My complete research covered another important points to the same field:

Why credit card transactions also point to a solid start to the year

How Japan’s inflation could impact their status quo

But I invite you if interest in it to go to my website, which you can find a deeper research and analysis in a few weeks.

News stories have been filled with geopolitical developments, including Chinese balloons, the ongoing war in Ukraine, trade disputes, and the U.S. debt ceiling standoff to name a few.

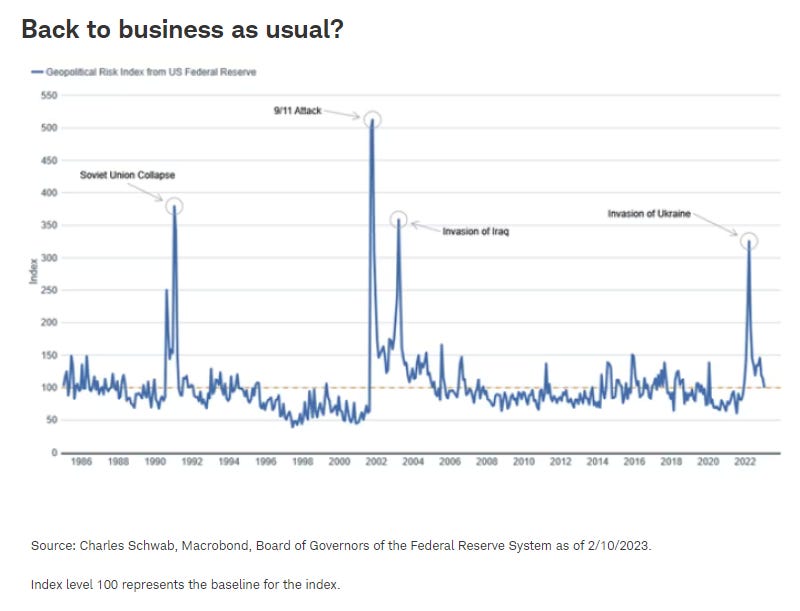

Yet, the Federal Reserve's Geopolitical Risk Index has eased, moving back to its long-term average, as you can see in the chart below.

So, should investors be concerned about these geopolitical developments? Or is it business as usual?

Charles Schwab believes the answer is both.

Relations US & China

Last November at the G20 conference, Presidents Joe Biden and Xi Jinping pledged to stabilize the tense U.S.-China relationship.

Thus far, an easing of tensions has been elusive.

The purpose of Secretary of State Blinken's trip that was cancelled in the wake of the incidents involving Chinese spy balloons earlier this month was to establish a floor in deteriorating U.S.-China relations.

The postponement of Blinken's trip was not welcome news for Beijing, whose focus for 2023 is a domestic economic recovery, rather than international relations.

In contrast, the U.S. administration may seek some improvement in relations so the Blinken trip could be rescheduled.

There is a short window to do so before the start of China's National People's Congress in early March.

This setback will likely make it harder for them to manage potential upcoming flashpoints - events at which trouble, such as violence, flares up - in the coming weeks and months that have potential impact to financial markets.

BOJ leadership change

Speculation is rising on what a BOJ leadership change in April will mean for policy.

Kuroda’s last meeting as governor will be March 10. But always Blackrock thinks who succeeds is less important than the fundamental issue: a nearing shift in policy.

Regardless of who takes over, they think the wage and inflation dynamics at play mean the current policy stance has likely run its course.

Policy changes could come in different forms.

The BOJ could widen the band on its 10-year bond yield target again – market pricing not impacted by the cap is already up to 0.5% higher than that limit.

They also think the BOJ could abandon its yield curve control at any moment.

That would push yields higher and stoke interest rate volatility. It would put the BOJ on track to stop bond purchases – it owns over half of outstanding Japanese government bonds – potentially let its balance sheet shrink as bonds mature and push up policy rates.

If you had like this piece and you want to read the whole advanced article I invite you to go on my website www.scriptamanent.blog (you can find the link button below), which you can find many more useful insights.

Best regards,

🔔 If you like my work, one simple thing that would make me very happy is if you’d bring only two friends/colleagues within our community - they might appreciate it and after all…it’s free!

Feel free to share my contents with anyone you think is might be interested with the link below!

🔍 We are a community of Macro & Business enthusiasts and lovers of Financial Markets.

💡 If you want even more free, valuable financial content you can also follow me on Twitter and visit my Website for more in deep analysis.

Disclosure

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. This material has been prepared for informational purposes only. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.