Thanks for reading!!!

📌 As my subscriber you get totally FREE my Exclusive Premium Insights that I do and share only with you.

You won't find these materials shared by me on any other platform.

By subscribing you’ll join with thousands Investors, Economic Professors & Aspiring Finance Students who read Macro & Business Insights weekly!

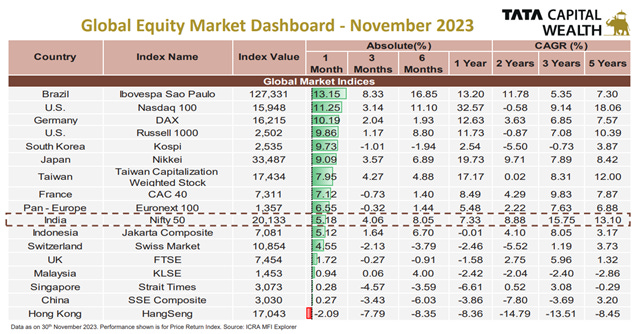

Indian equity markets rallied in November ‘23 as S&P BSE Sensex (4.5%) and Nifty 50 (5.2%) indices rose. For November23, Small cap indices fared better than both Midcap indices and Large cap indices.

Domestic equity markets was upbeat due to multiple factors such as U.S. Federal Reserve kept the rates unchanged for the third consecutive time, U.S. Treasury yields fell on hopes of no further rate hikes, buoyant corporate earning numbers for the quarter ended Sep 2023 from some key domestic corporates and fall in the crude oil prices even as war in the middle east continued.

Therefore, investors are suggested not to time the markets and focus on the medium to long term potential of the equity markets.

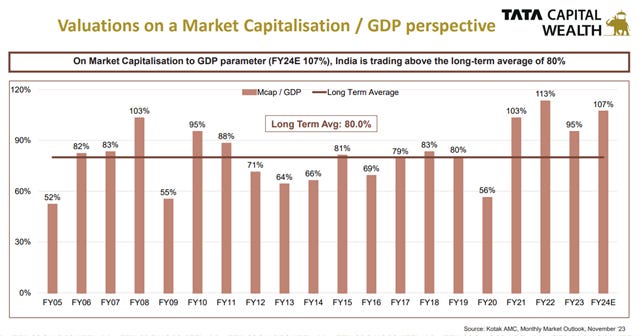

The important drivers for equity market are - global crude oil prices, global liquidity conditions, geopolitical tensions and global central banks actions. Looking at the sharp rally in the equity markets and the Nifty 50 crossing the 21,000 levels in early December, investors need to be cautious and invest in staggered manner and follow the prescribed asset allocation.

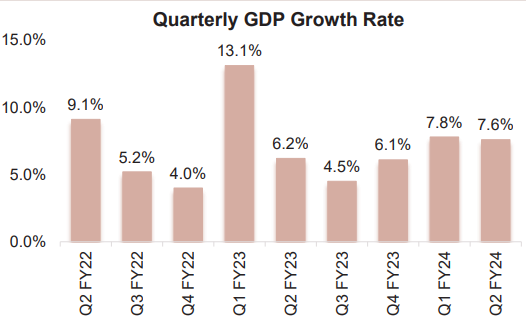

INDIAN ECONOMY VERY RESILIENCE

With the GDP for Q2FY24 (7.6%) coming in above the RBI expected number (6.5%) and RBI revising the full year FY24 growth numbers upwards to 7.0% from 6.5%, the Indian economy presents a picture of resilience and momentum, against unsettled global economic backdrop.

While the global economy is slowing, the domestic conditions remain favorable to bonds considering falling inflation as well as inclusion in JP Morgan Index. Inclusion in the JP Morgan EM Bond Index will likely lead to inflows of around $20-25 billion in FY25. Active FII flows have already started in the past few months.

🔍 READ THE FULL PAPER (DOWNLOAD)

💌 Sign up to my weekly email newsletter

🎙 PODCAST

Best regards,

Ale

Disclosure

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. This material has been prepared for informational purposes only. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.