Hi all, and welcome back to The Macro & Business Insights!

What you’ll find in this episode:

Approach to real assets

Consumers currently are spending more of their incomes than usual

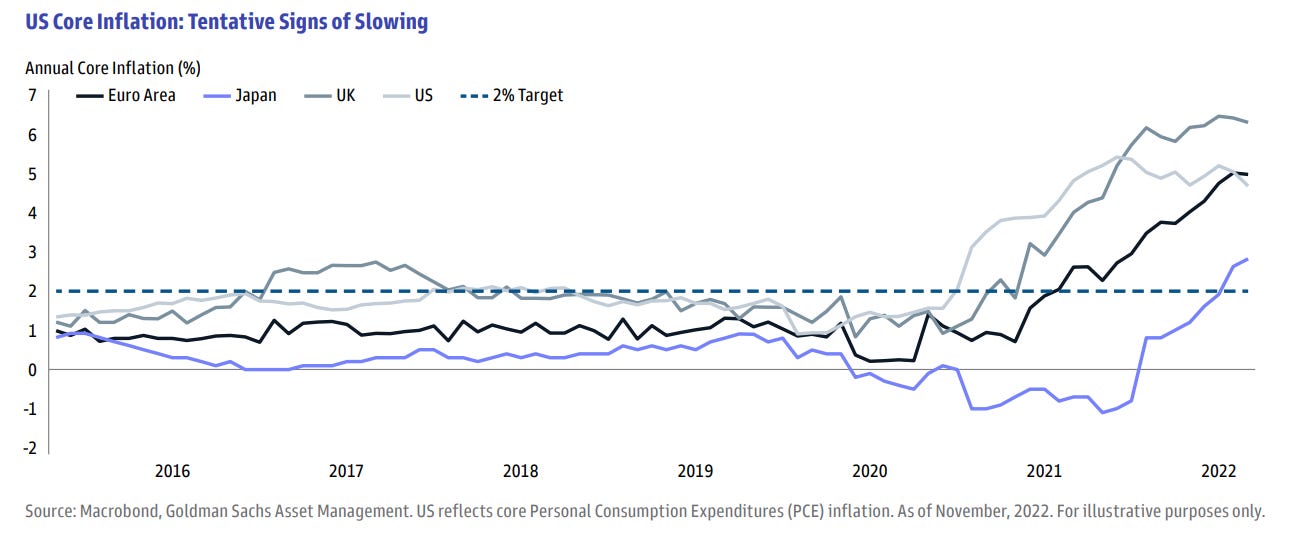

In 2023, the focus may shift from rapidly rising inflation to slowing economic growth.

But while recession risk and geopolitical tensions should keep markets volatile, Goldman Sachs believes the new year is also likely to present opportunities.

Bond yields are finally offering attractive real income potential.

My complete research covered another two important point to the same field:

What the markets are pricing

What is changed to the fixed income?

But I invite you if interest in it to go to my website, which you can find a deeper research and analysis.

A Strategic Approach to Real Assets

Real assets, such as real estate and infrastructure, have historically offered unique attributes - relatively attractive yield and predictable growth, inflation-hedging benefits and lower volatility than broad equities.

But inflationary pressures could remain elevated in the medium term due to deglobalization trends, reshoring supply chains back to developed markets, higher commodity prices and a tighter labor market.

The inflationary environment encourages businesses to invest in innovative solutions to reduce costs and increase efficiency, in turn serving as a deflationary force, while companies offering innovative products also tend to exert considerable pricing power, making it easier for them to pass on higher input costs to customers.

Moving down in Cap

Small caps have historically performed well when inflation has been high and falling.

There have been 20 years since 1950 when starting inflation began above 3% and ended the year lower.

The median small cap return in these years was 21%. Relative to large-cap stocks, the median return was 5%.

In addition, small caps have historically outperformed following two consecutive quarters of GDP contraction, a common, though not universal, definition of recession, and in periods after the Federal Reserve (Fed) stops raising rates.

Macro take

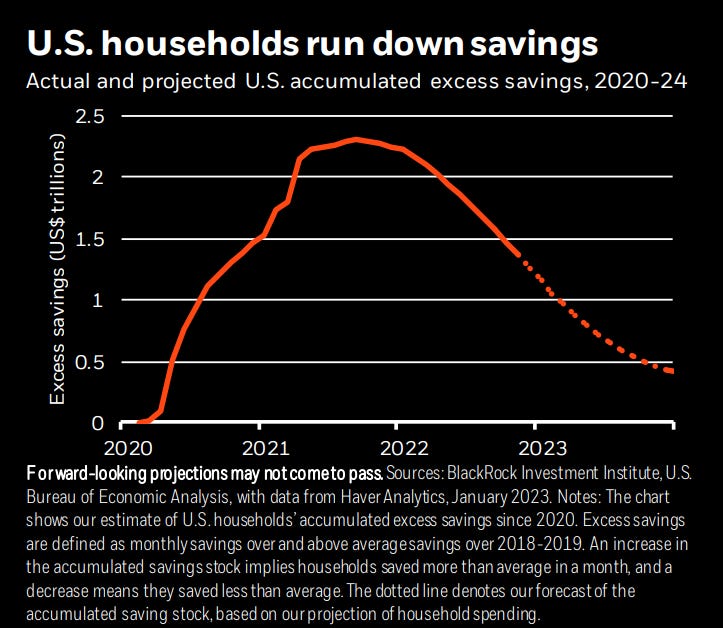

Blackrock expects a mild recession in the U.S. later this year as continuing rate hikes and the lagged effects of past hikes collide with consumers depleting their pandemic savings.

Many people built up extra savings in the pandemic when they stopped spending on things like restaurants and travel, and also received extra income from the government in the form of stimulus checks.

See the chart above.

As a result, U.S. consumers are currently spending more of their incomes than usual, saving just 2.4% of their total disposable income compared with a pre-pandemic average of 7.6%.

But those savings are running out – and if they keep being used up at the same rate, we estimate they will be close to depletion by the second half of this year.

If normal savings behavior then returns and the savings rate moves up closer to its pre-pandemic average, as they expect, consumer spending could start to contract by the end of the year.

Blackrock thinks that blow to GDP, plus rate hikes, will be enough to push the U.S. into recession.

If you had like this piece and you want to read the whole advanced article I invite you to go on my website www.scriptamanent.blog (you can find the link button below), which you can find many more useful insights.

Best regards,

🔔 If you like my work, one simple thing that would make me very happy is if you’d bring only two friends/colleagues within our community - they might appreciate it and after all…it’s free!

Feel free to share my contents with anyone you think is might be interested with the link below!

🔍 We are a community of Macro & Business enthusiasts and lovers of Financial Markets.

💡 If you want even more free, valuable financial content you can also follow me on Twitter and visit my Website for more in deep analysis.

Disclosure

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. This material has been prepared for informational purposes only. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.