Hi all, and welcome back to The Macro & Business Insights!

What you’ll find in this episode:

Let’s introduce the quality and value resilient factor

What is the path forward with inflation & interest rates

How investors could behave in this challenging market

Quality resilient factor

Quality has historically been a resilient factor in uncertain and volatile environments.

It has also been shown that high-quality firms have historically fared well during market sell-offs in the growth and value segments of the EM, U.S. and international markets.

While quality underperformed in 2022 due to negative exposure to oil-related industries as well as positive exposure to software and services, it has also been considered as more resilient in deglobalization scenarios.

And value?

Value has generated positive active returns over extended periods of time, as witnessed from 1997 to 2010, with the decade between 2010 and 2020 puzzling both academics and practitioners.

However, above-average inflation and higher interest rates may continue to favor "shorter duration" assets and hence value.

What is the path forward?

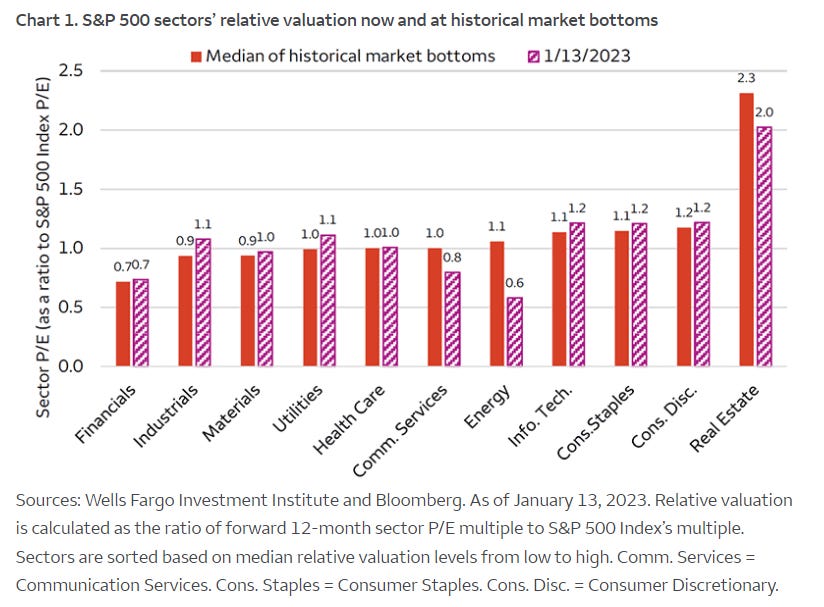

Looking across the past six major market lows between 1998 and 2021, cyclical sectors, including Industrials, Financials and Materials, had generally experienced valuation contractions at a level more significant than the broader S&P 500 Index.

This was driven by investors shying away from areas that are more negatively impacted by economic downturns.

As a result, based on the forward 12-month P/E multiple, cyclical sectors were priced below the S&P 500 Index at major market bottoms (that is, the below-1.0 relative valuations shown in Chart below).

On the contrary, defensive sectors (such as Consumer Staples) as well as high-growth sectors, including Information Technology and Consumer Discretionary, were typically more favored.

They enjoyed a higher relative valuation at market bottom in the past.

Chart above also indicates that 7 out of the 11 sectors’ relative valuations have currently reached or declined below their historical market bottom level.

This may mean that investors are currently pricing these sectors to a market bottom condition. However, despite recent losses in price, the Information Technology sector may be an exception and is still expensive by historical standard.

Interest rate and inflation environment

Wells Fargo Advisors believes that interest rate and inflation environment are important factors for valuation levels.

Higher inflation and interest rates can limit valuation’s upside potential.

In such periods, investors may desire a higher level of earnings yield and price return from stocks to offset the impact of higher inflation, as well as to compensate for the higher yield from bonds.

For example, in the 10 years from 1976 to 1985 when inflation and interest rates were elevated, the average trailing 12-month P/E ratio of the S&P 500 Index was 10x, whereas the P/E multiple averaged 18x during the low-rate and low-inflation 10-year period prior to the COVID-19 pandemic.

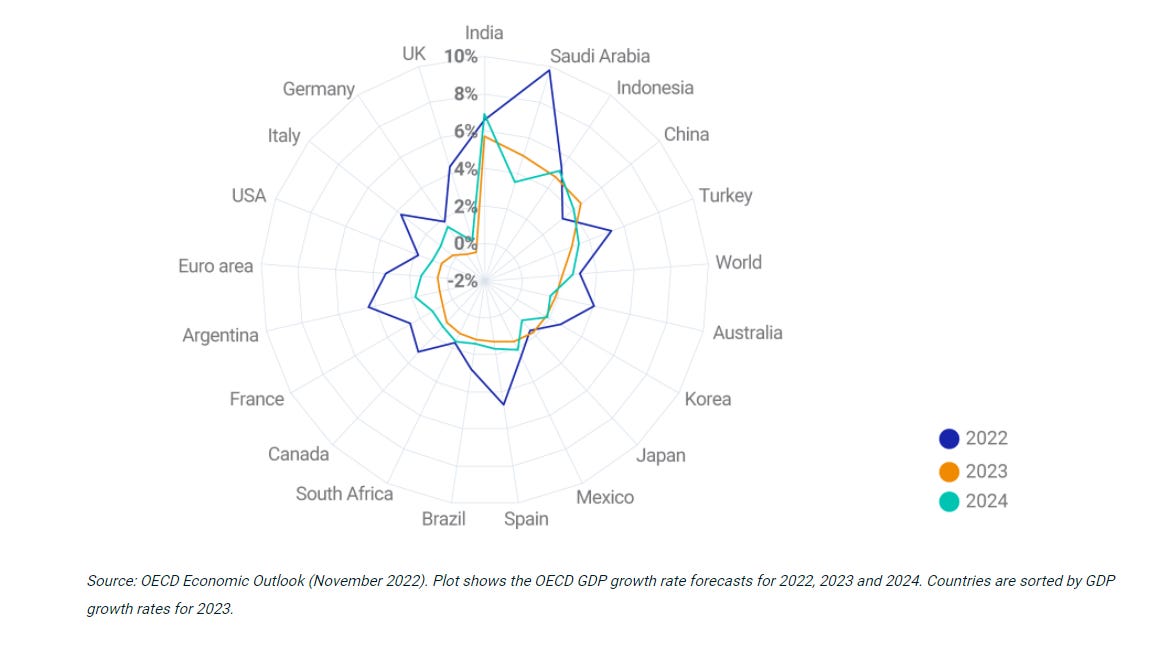

GDP Outlook

Despite challenges to global economic growth, investors looking to allocate towards secular trends may look to identify specific opportunities through thematic investing.

Thematic investing is characterized as a top-down investment approach that seeks to capitalize on opportunities created by macroeconomic, geopolitical and technological trends.

These are not considered to be short-term swings, but long-term, structural, transformative shifts.

If you had like this piece and you want to read the whole advanced article I invite you to go on my website www.scriptamanent.blog (you can find the link button below), which you can find many more useful insights.

Best regards,

🔔 If you like my work, one simple thing that would make me very happy is if you’d bring only two friends/colleagues within our community - they might appreciate it and after all…it’s free!

Feel free to share my contents with anyone you think is might be interested with the link below!

🔍 We are a community of Macro & Business enthusiasts and lovers of Financial Markets.

💡 If you want even more free, valuable financial content you can also follow me on Twitter and visit my Website for more in deep analysis.

Disclosure

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. This material has been prepared for informational purposes only. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.