Geopolitical Risks Intensify - (What to look in 2024 - 10 Viewpoints)

👇 Premium Exclusive Insights

Thanks for reading!!!

📌 As my subscriber you get totally FREE my Exclusive Premium Insights that I do and share only with you.

You won't find these materials shared by me on any other platform.

By subscribing you’ll join with thousands Investors, Economic Professors & Aspiring Finance Students who read Macro & Business Insights weekly!

2024 GLOBAL ECONOMIC OUTLOOK

Over the course of 2023, global economies have exhibited surprising resilience in the face of the sharpest tightening cycle experienced in decades.

Despite this impressive degree of strength in the global economy, and in the United States in particular, growth is nonetheless slowing.

INDUSTRIAL PRODUCTION STRUGGLING

Resilience has largely exhausted itself. Global trade volumes are outright contracting, and global industrial production is essentially flat on a year-over-year basis.

Services demand has held up much better as post-pandemic pent-up demand was satisfied with a lag, but there are signs of plateauing. Resilience does not equal immunity, especially when it is derived from unsustainable fiscal spending

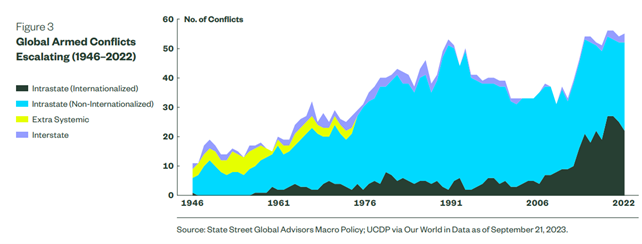

GLOBAL ARMED CONFLICTS ESCALATING (1946 -2022)

Armed conflicts and violence are rising rapidly. Disturbingly, this trend also applies to the sheer number of global conflicts, and they are becoming deadlier - confirms conflicts hovering near all-time highs.

This reflects an increasingly multipolar, unstable world, which suggests that interstate warfare is easier to imagine than in the past.

Harder to capture is that these conflicts have gradually moved from the periphery toward the center of the global economy.

Most notably, Russia’s war in Ukraine delivered a global macroeconomic shock via the commodity supply channel.

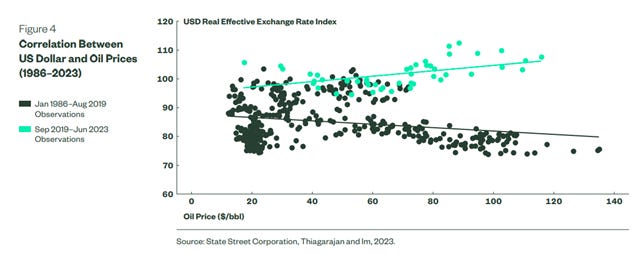

CORRELATION BETWEEN US DOLLAR AND OIL PRICES (1986 - 2023)

The United States has ceased being a net consumer and has emerged as a net energy exporter. This shift has flipped the historically modest negative correlation between the US dollar and oil.

The US dollar and oil correlation makes it worse for all importers (and better for exporters) as each boom/bust cycle is exacerbated. Relying on more recent data, the positive correlation is even more pronounced.

🔍 READ THE FULL PAPER (DOWNLOAD)

💌 Sign up to my weekly email newsletter

🎙 PODCAST

Best regards,

Ale

Disclosure

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. This material has been prepared for informational purposes only. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.