🔑 China: From Stimulus to Strategy (Special Report)

Special **PRO** Release >> December 13, 2024 #MacroTrends #ChinaEconomy #InvestmentOpportunities #MarketInsights #GlobalFinance

💡 New on Macro Mornings? Start here

🔑 This is part of a series designed for advanced investors seeking deep dives into pivotal macroeconomic themes. Each report offers actionable insights and detailed analysis to refine your understanding and enhance your strategy. Feel free to catch up on previous emails here if you'd like to start from the beginning!

A Numbers-Driven Narrative

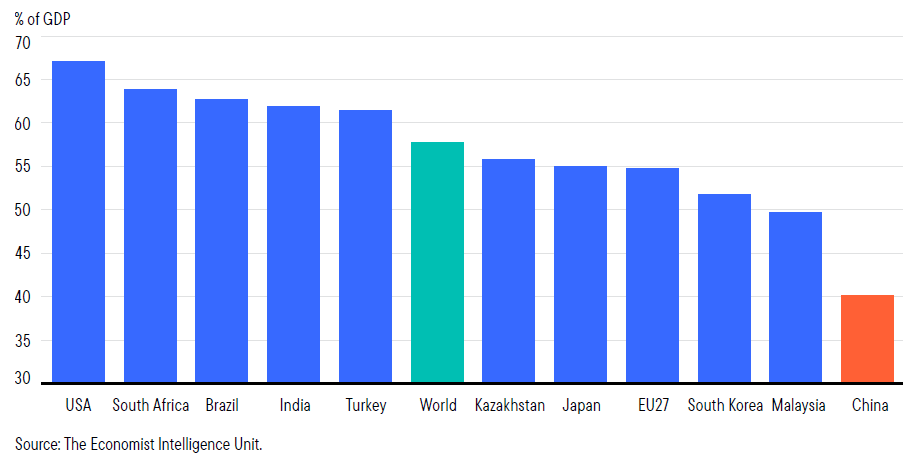

China’s private consumption rate has averaged 40% of GDP over the past three decades, starkly contrasting the global average of 58%.

By comparison, in 1979, when Singapore’s GDP per capita was similar to China’s today, its consumption rate was 54%.

This historical gap reflects the structural challenges China faces but also highlights the immense potential for growth.

China’s Consumption Below Global Peers - Average Annual Private Consumption, % of GDP - 1994-2023

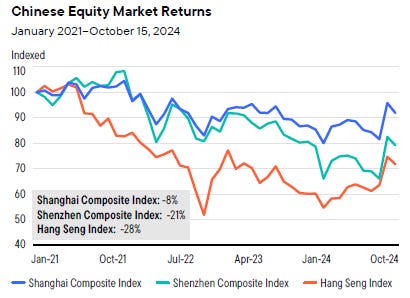

Interestingly, as China’s policies evolve, the Hang Seng Index rallied by 16% in a single week following stimulus announcements in September 2024, demonstrating how quickly markets can react to policy shifts.

Equity markets in China have shown a strong correlation with fiscal interventions, with the Shanghai Composite gaining 29% in a similar rally during the 2008 stimulus period.

For Macro investors, such trends underscore the importance of staying attuned to macroeconomic shifts.

Decline in Equity Prices Impacting Wealth - Chinese Equity Market Returns - January 2021-October 15, 2024

Policy Tailwinds and Market Signals

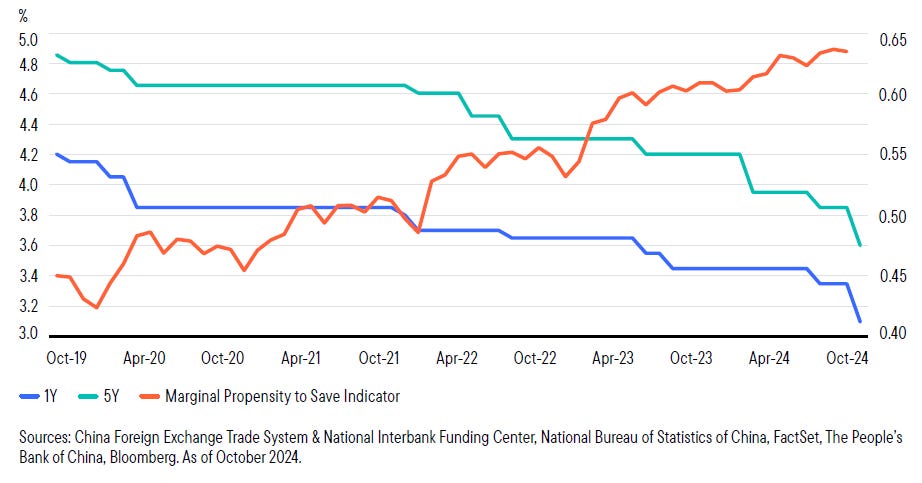

The government’s recent 50bps cut in mortgage rates aims to revitalize consumer confidence and stabilize real estate markets.

This comes at a time when 10-year Chinese government bond yields fell to 2.6% in October 2024, their lowest in five years, signaling both investor caution and opportunities in fixed-income instruments.

Declining yields have correlated with higher equity valuations, a pattern seen in China during previous periods of monetary easing.

Households Continue to Save Amid Financial Insecurity - Loan Prime Interest Rates and Marginal Propensity to Save Indicator in China October 2019-October 2024 (for interest rates); October 2019-September 2024 (for savings indicator)

On the currency front, the renminbi’s trajectory reflects the delicate balance of policy and global dynamics.

From September to November 2024, USD/CNY moved from 7.30 to 7.15, supported by stimulus measures and capital inflows into equity markets.

This movement aligns with China’s efforts to bolster domestic growth, with the currency often serving as a barometer of global investor sentiment toward the country.

Historical Context and Future Outlook

In the early 2000s, China’s equity markets were a key beneficiary of its rapid industrial expansion, with the MSCI China Index returning an average of 18% annually between 2001 and 2010.

Today’s shift toward consumption presents a new narrative.

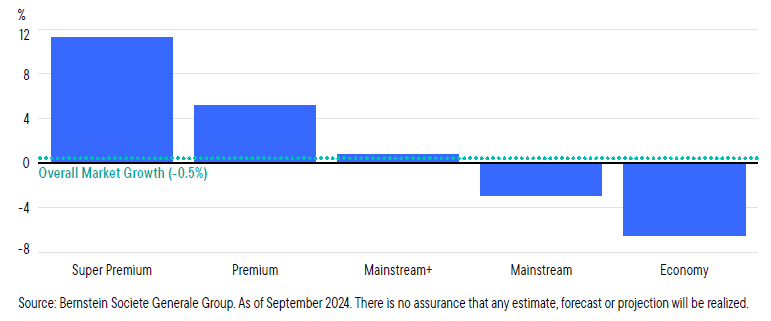

While challenges like an aging population and income inequality persist, sectors like e-commerce, premium consumer goods, and online gaming are poised to lead the next wave of growth.

Premium beer consumption, for example, is expected to rise significantly, with affordability for premium brands projected to reach 70% of the population by 2032.

Similarly, the e-commerce market, which grew 26% annually in recent years, continues to outpace overall retail sales, underlining its resilience.

The World’s Leading Beer Market - China Beer Volume Compound Annual Growth Rate (CAGR) by Segment 2023–2028 (estimate)

✍ Special Opportunities for Macro Investor

1. The Premiumization Trend in Consumer Staples

Looking at China’s beer market, the shift from mass-market to premium brands reminds me of the U.S. craft beer boom in the early 2010s.

Between 2010 and 2015, craft beer sales in the U.S. grew at a CAGR of 12%, outpacing the broader beverage market. Similarly, as disposable incomes rise in China and affordability for premium beer climbs from 40% to a projected 70% by 2032, there’s a clear opportunity here.

My take? Watch for investments in companies leading the premiumization wave, not just in beer but across consumer staples.

Parallels suggest annualized returns of 8-10% for dominant brands in markets experiencing such transitions.

2. Equity Market Rebounds in Response to Policy Stimulus

The 21% rally in the Shanghai Composite Index following September 2024’s stimulus package reminded me of China’s 2008 response to the global financial crisis.

Back then, the $586 billion fiscal stimulus sparked a 52% rise in the CSI 300 Index within 12 months, particularly benefiting sectors tied to infrastructure and domestic consumption.

For the current cycle, I see potential in sectors like e-commerce, financial services, and consumer discretionary, where policy support could lead to double-digit gains.

Select ETFs tracking Chinese equities might also offer diversified exposure to these themes with less volatility.

3. Opportunities in Bonds Amid Falling Yields

With 10-year Chinese government bond yields at 2.6% their lowest in five years - I see parallels to Japan’s bond market in the late 1990s.

During that period, as the Bank of Japan pursued aggressive monetary easing, 10-year Japanese bonds delivered annualized returns of 6% in USD terms for global investors due to currency gains and falling yields.

The RMB’s recent stabilization (moving from 7.30 to 7.15 against the USD) suggests similar opportunities could emerge in Chinese government bonds.

A weakening dollar scenario, combined with easing policies in China, might further enhance returns for foreign investors.

4. The Digital Economy: Resilient and Expanding

The e-commerce sector continues to shine. With a projected CAGR of 5.6% through 2028, digital platforms are consolidating their dominance.

This reminds me of the early 2010s in Southeast Asia, where companies like Sea Group (NYSE: SE) saw their revenues skyrocket by over 30% annually, rewarding early investors with multi-fold returns within a decade.

China’s domestic leaders in this space are similarly positioned, especially as they expand internationally.

Consider targeted exposure to companies with robust growth in e-commerce, cloud computing, and digital payments.

These are often resilient even during broader economic downturns.

Best regards,

Alessandro

Founder of Macro Mornings

Discover the Trends That Matter - VIP One-on-One Session for My Insiders

📈 As a valued member of my community, gain exclusive insights and a direct discussion with me to stay ahead of market moves. This is your chance to fully utilize your knowledge!

🏆 Don’t miss this unique opportunity: let’s discuss the latest macro developments and how to leverage them. What does this mean for you? Being part of a select group turning insights into action.

🚀 Don’t miss the chance for tailored guidance. In a dedicated session, we’ll analyze the macroeconomic landscape together, highlighting what really matters for your investment decisions.

📅 Reserve your session here → https://calendar.app.google/DFNQvEkH9C6k8Wfu6

I’M EXCITED TO HAVE YOU ON BOARD, BECOME MY FRIEND

💎 Get your Mentorship FREE here

🎙 PODCAST

Disclosure

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. This material has been prepared for informational purposes only. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.