Hi all, and welcome back to The Macro & Business Insights!

What you’ll find in this episode:

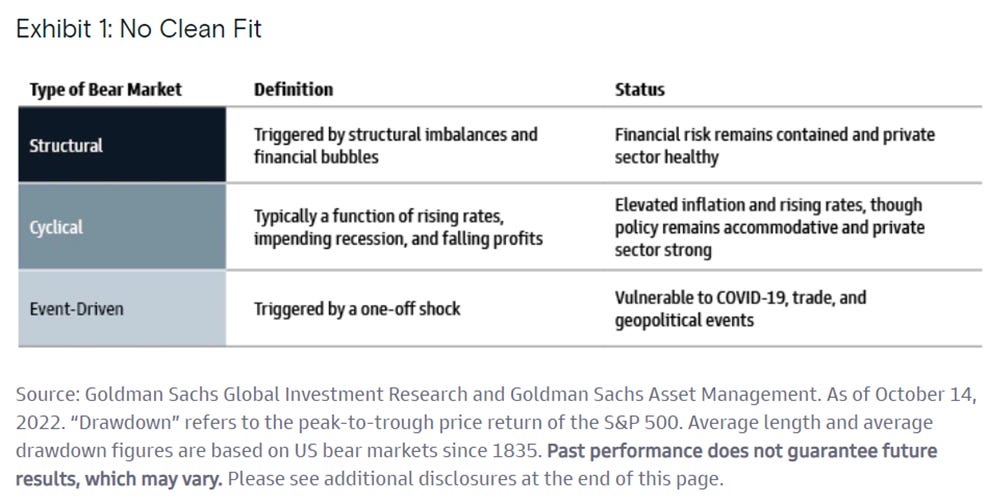

Why bear markets are extremely important in your valuations.

Why Higher Rates May Hurt the Economy More Than the Stock Market.

Discretionary Stocks Could Rebound Well Before Earnings Do.

Cheap Financials Valuations May Present an Opportunity.

I’ve read more than 50 books on value investing and business in general and what I understand from them is that you can do the big deals mainly during the bear markets.

Why?

Because during the bear markets we have high volatility in the markets and when there is high volatility usually it follows to create discrepancies between price and value in determined sectors/business and stocks.

And if you have the patience, the skill, the mindset to study and interpret well the bear markets, you can have a great probability to make great deal in the markets.

Now, moving to the sectors update, let’s go to see what could mean an aggressive Fed’s monetary policy against an high inflation, how the consumer discretionary could anticipate their eps and how the financials valuations has behaved in the past at today levels.

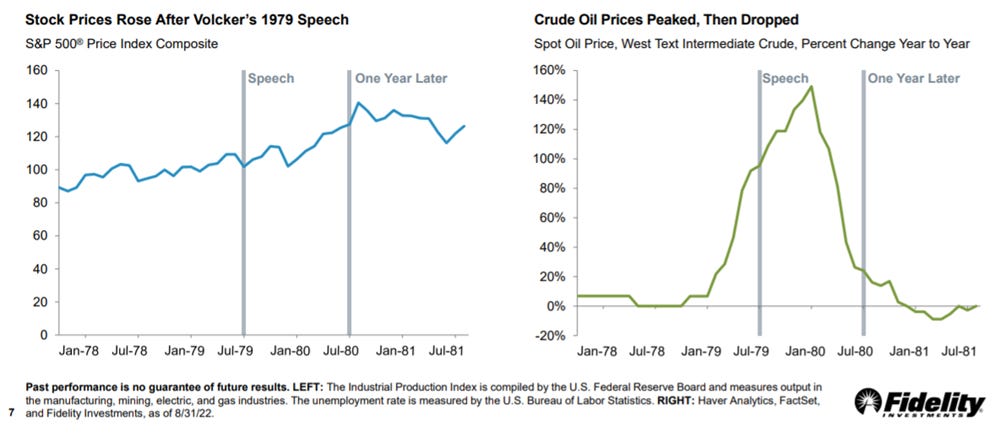

Fidelity Investments reviewed the last time the U.S. Federal Reserve went all-in against high inflation.

On October 6, 1979, Fed Chair Paul Volcker gave a watershed speech detailing aggressive anti-inflation measures.

Industrial production fell 6%, and unemployment jumped to 7.5% over the subsequent 12 months.

But stocks gained 25%, helped by a plunge in crude prices—a good reminder that the economy is not the market.

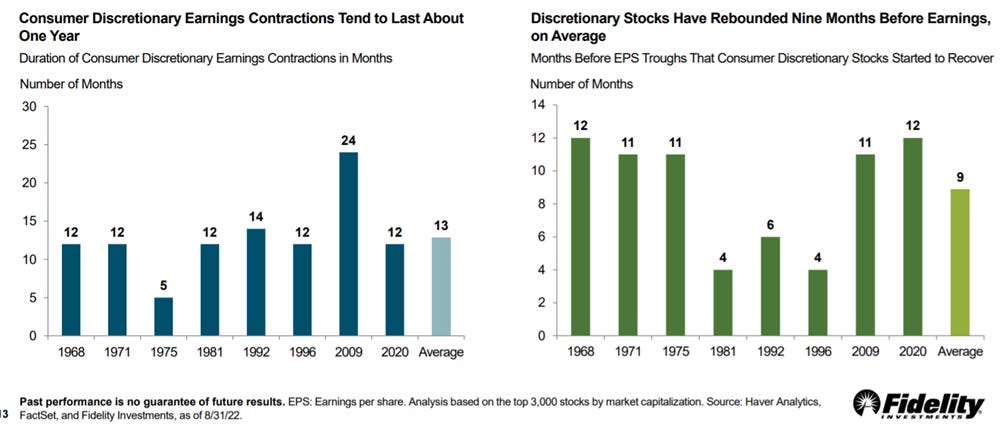

Consumer discretionary companies’ earnings have suffered since February.

Historically, the sector’s earnings slumps have tended to last about a year, and its stocks have started recovering an average of nine months before then.

Based on these precedents, discretionary may already have bottomed.

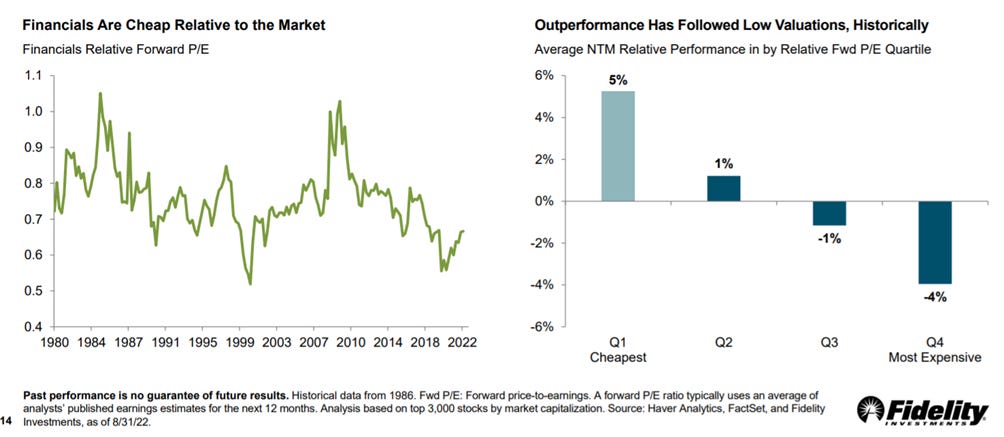

Financials’ relative valuations are extremely low versus their history.

In the past, the cheaper the sector’s valuation compared with the rest of the market, the better its average relative performance the following year.

When financials have been in their cheapest quartile, they’ve outperformed the market by 5% over the next 12 months, on average.

Best regards,

🔔 If you like my work, one simple thing that would make me very happy is if you’d bring only two friends/colleagues within our community - they might appreciate it and after all…it’s free!

Feel free to share my contents with anyone you think is might be interested with the link below!

🔍 We are a community of Macro & Business enthusiasts and lovers of Financial Markets.

💡 If you want even more free, valuable financial content you can also follow me on Twitter and visit my Website for more in deep analysis.

Disclosure

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. This material has been prepared for informational purposes only. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.