Thanks for reading!!!

📌 As my subscriber you get totally FREE my Exclusive Premium Insights that I do and share only with you.

You won't find these materials shared by me on any other platform.

By subscribing you’ll join with thousands of Investors, Economic Professors and Aspiring Finance Student

GROWTH AND INFLATION EXPECTATIONS

The Fed pivot and Q4 disinflation fuelled expectations of aggressive easing in 2024, despite a soft landing for growth in 2023, and an economy close to full employment.

The ECB does not expect a recession in the Eurozone in 2024, despite lags in the impact of policy, making 2024 a higher recession risk.

Lowering inflation from 3% to 2% may prove challenging.

AVOID RECESSION GOAL IN 2024

The Eurozone economy is expected to avoid recession in 2024, according to the ECB and Consensus forecasts.

4. The ECB expects the region to grow by “an average of 0.6% in 2023, 0.8% in 2024, and 1.5% in both 2025 and 2026”.

Despite the US growing faster than the Eurozone in 2023, consensus forecasts show the differential narrowing in 2024, with US growth falling back towards 1% but avoiding recession.

INFLATION LEVELS

Inflation levels have eased sharply in most G7 countries, alongside much weaker growth.

The theory that the last 1- 2% of disinflation to 2% target levels has higher growth and employment costs than earlier disinflation, will now be tested in the US, Eurozone and Canada.

FED PIVOT TOWARDS EASING

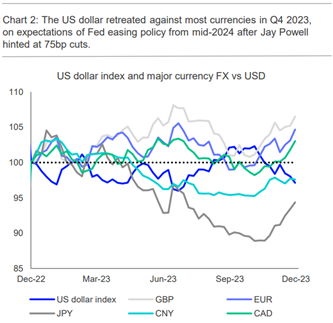

The US dollar fell in December after the Fed pivot towards easing, resulting in euro gains of about 1% for the month. The yen’s recovery gained momentum after the Fed pivot, as investors focused on the BoJ possibly moving away from negative rates in January. Sterling drew support from hawkish BoE signalling, though weak growth tempered gains.

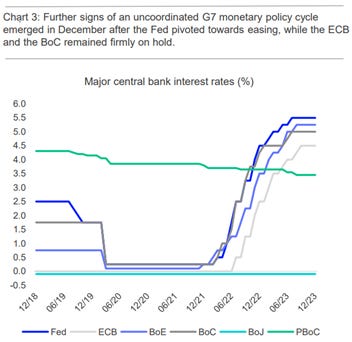

Central banks left rates unchanged in December at their last meeting for 2023, but only the Fed hinted at a pivot in 2024.

The ECB made no such claims and President Lagarde stressed it will be “data-dependent” and not “time-dependent”, as it watches for a softening of wage growth and core inflation, which at 3.6% y/y in November remains too high.

🔍 READ THE FULL PAPER (DOWNLOAD)

💌 Sign up to my weekly email newsletter

🎙 PODCAST

Best regards,

Ale

Disclosure

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. This material has been prepared for informational purposes only. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.