Thanks for reading!!!

📌 You won't find these materials shared by me on any other platform.

By subscribing you’ll join with thousands of Investors, Economic Professors and Aspiring Finance Student that reads weekly these insights.

Despite pushing higher last week, markets in 2024 thus far can best be described as subdued, and perhaps even a bit bumpy.

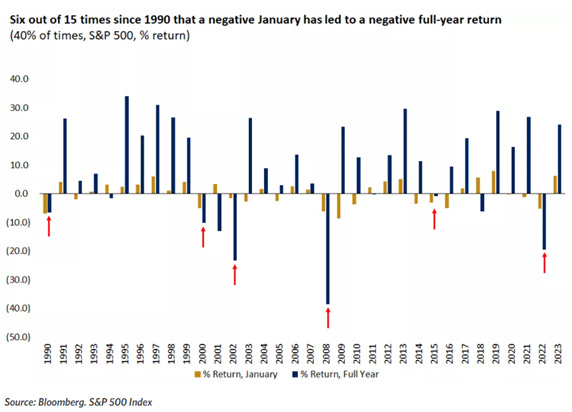

AS GOES JANUARY - SO GOES THE YEAR

This is an old market adage, implying that if markets were negative for the month of January, then there was a higher chance that they would be negative for the full year.

Recent history, however, confirms that this is not typically the case.

In fact, since 1990, there have been 15 years where S&P 500 returns were negative in January, and of these, only six have gone on to have negative full-year returns (40% of cases).

A negative or bumpy January certainly doesn’t have to be a precursor to a down year.

FED MEETING AND INTEREST-RATE DECISION

The FED will continue to remain a key driver for markets and the economy in 2024.

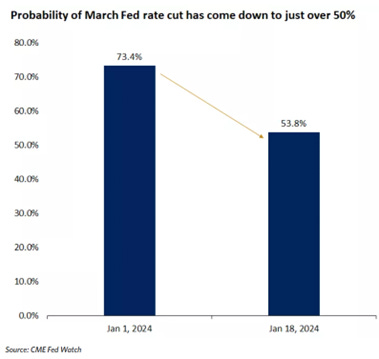

The expectation is for the Fed to keep interest rates on hold at 5.25% - 5.5% at the January meeting, but investors will be listening intently for any clues on whether the Fed is considering an interest-rate cut at the March meeting.

Markets are pricing in around six rate cuts in 2024, including the first one at the March 21 meeting - although the probability of this rate cut has declined in recent days as some Fed speakers have pushed back on a March cut.

FED will not likely cut rates in March, especially given that core CPI and PCE inflation remain well above the 2.0% target.

We’ll have three or four rate cuts this year, perhaps starting in mid-2024, as inflation likely continues to moderate, and the FED begins gradually moving rates toward a more neutral level.

🔍 READ THE FULL PAPER (DOWNLOAD)

💌 Sign up to my weekly email newsletter

🎙 PODCAST

Best regards,

Ale

Disclosure

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. This material has been prepared for informational purposes only. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.