Thanks for reading!!!

📌 As my subscriber you get totally FREE my Exclusive Premium Insights that I do and share only with you.

You won't find these materials shared by me on any other platform.

By subscribing you’ll join with thousands of Investors, Economic Professors and Aspiring Finance Student

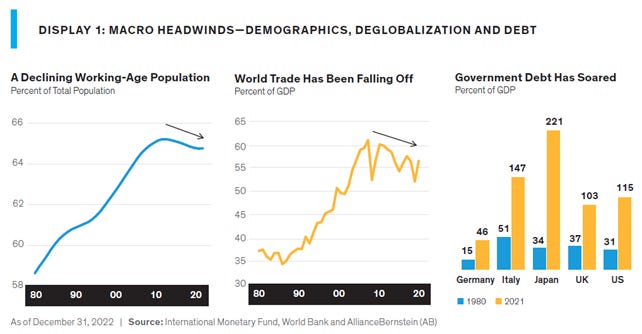

A challenging macro mix is set to make investing a lot more challenging in the years ahead: the share of the world’s population that’s of working age seems to have peaked.

Growth in world trade, a huge economic tailwind since the mid-1980s, has flattened.

And the global debt burden is nearing 140% of gross domestic product (GDP) - it’s well documented that levels above 100% can create economic headwinds.

Collectively, these factors will likely yield lower growth and higher inflation, creating a challenging environment for investors.

SECULAR FORCES WILL CHALLENGE REAL RETURNS

While the power of higher bond yields is certainly a welcome development for income investors, the path forward will likely feature plenty of volatility.

It will also feature the convergence of three macro headwinds that will pressure inflation-adjusted returns.

First, demographics are changing, with the global working-age population declining.

Second, globalization seems to have peaked and pivoted into deglobalization, as evidenced by declining levels of world trade.

And third, a growing debt burden is diverting otherwise productive investment in order to cover debt-servicing costs.

Collectively, these three forces are likely to drive economic growth lower and inflation higher, making it harder for investors to generate returns that outpace rising prices.

That challenge calls for enhancing yields while bolstering diversification to protect against the inevitable market downturn.

🔍 READ THE FULL PAPER (DOWNLOAD)

💌 Sign up to my weekly email newsletter

🎙 PODCAST

Best regards,

Ale

Disclosure

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. This material has been prepared for informational purposes only. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.