🚨 A Fed Trap: Are We Back in ’99?

June 29, 2025 >> $3 Trillion Unhedged: The Dollar Bet That Could Flip the Whole Market

💡 New on Macro Mornings? Start here

🎯 This is part of a series designed for PRO investors who want real-time updates on macroeconomic news through my advanced insights. Feel free to catch up on previous emails here if you'd like to start from the beginning!

🎁 If there’s a macro topic you’ve been meaning to understand better - something that could make a real difference to your portfolio and investments - this is your chance to explore it deeply.

You can now book a FREE 30-minute conversation with me, where we’ll focus entirely on the questions that matter most to you.

It’s not a generic call. It’s your opportunity to receive a personalized, research-based insight on the topic you care about, with no cost and no catch.

Let’s connect, talk openly, and make your next investment decision a more informed one.

Dear all,

Something has been tugging at my sleeve all week - a low‑key tension that the headlines glide over. Crude collapses while megacap tech levitates, the euro inches higher even as long bonds stay stubbornly bid, and risk capital migrates like a silent river carving a new channel at night.

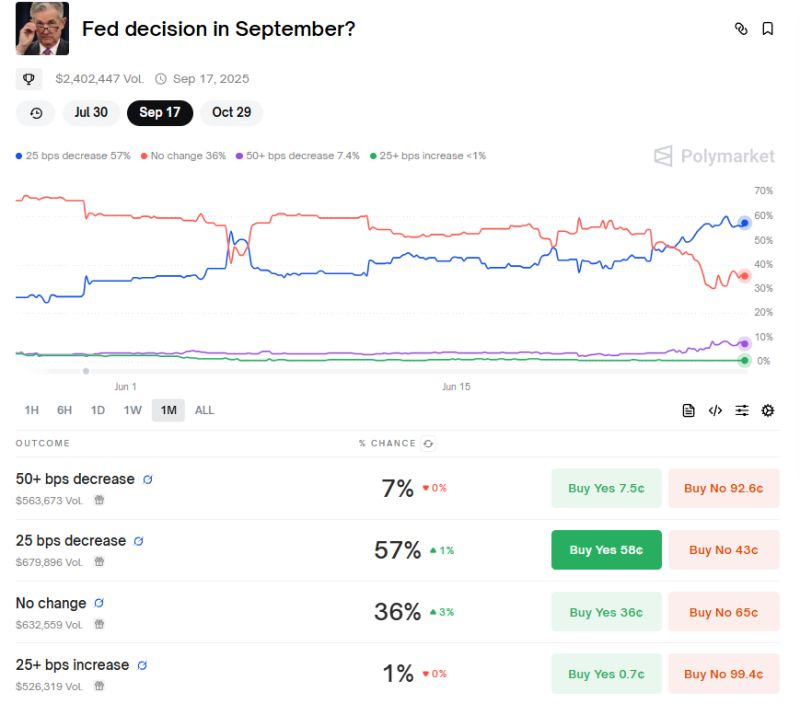

Polymarket now prices a 76 % chance the Fed stands pat in July and still assigns 57 % odds to a lone 25 bp cut in September, yet history warns that when expectations crowd to one rail of the boat the smallest wave can roll everything.

I’m convinced we’re standing at one of those macro thresholds where the surface narrative and the sub‑plot finally part ways. Each stray move - oil’s sudden swoon, the dollar’s measured slide, the hushed bid in emerging assets, the quiet glimmer in gold and silver - belongs to a larger story assembling just below the tape. My job, and yours, is to feel the pressure before the fault‑line slips, to position for the roar while the street is still whispering.

Here’s the shift I’m seeing, why it matters for valuations, inflation momentum, dollar hedging flows, and how I’m tilting the book before the crowd notices.

⭐️⭐️⭐️⭐️⭐️ Join Macro Mornings Premium

🔸 You’ll receive Exclusive, high-quality macro investment opportunities that focus on long-term growth, diversified risk, and the potential to outperform during various economic cycles.

🔥 Only 5 Spots Left - Lock in Your Lifetime Discount Now 🔥 [30% OFF for Life]

📝 Excellent score on TrustPilot

You can still start your 7-day FREE trial and explore everything Premium has to offer - full access.

After reviewing the latest data and market behavior over the weekend, I believe we’re entering a phase where optimism is being priced as certainty.

We’re looking at a combination of elevated valuations, a shift in inflation dynamics, and growing imbalances under the surface - all while market participants remain mostly calm.

This week’s update focuses on what I see as the key inflection points: stretched equity multiples in the U.S., the return of sticky inflation, increasing risks from FX hedging flows, and the deepening U.S. current account deficit.

These forces don’t operate in isolation. Together, they could trigger rotations in capital that matter to us all.

Let’s take a closer look at what’s unfolding.

📈 Valuations on a Knife‑Edge

There’s something dangerously elegant about how stretched the U.S. equity market has become.

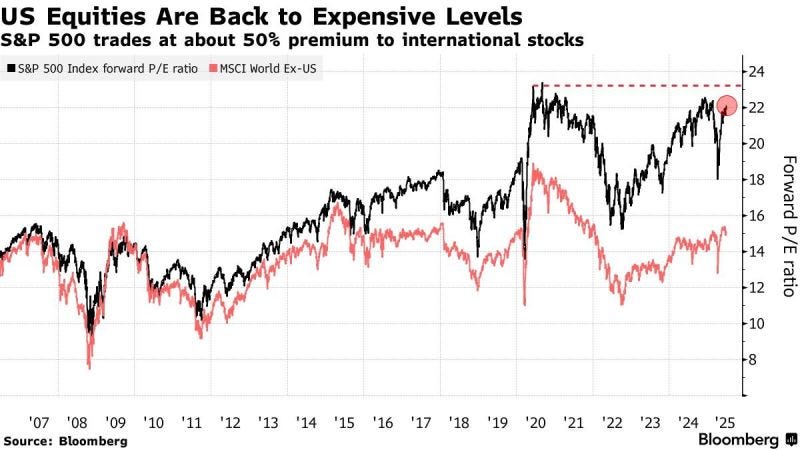

The S&P 500 is trading at 22.1× forward earnings, while developed markets outside the U.S. are quietly coasting at 14.7×.

That 50% premium isn’t just a footnote - it’s a warning label.

I’ve seen this movie before.

Three times in the last twenty years, to be exact: the dot-com frenzy of March 2000, the late-cycle euphoria of September 2018, and the stimulus-fueled high of December 2021.

Each time, U.S. equities looked unstoppable.

And each time, what followed was a humbling correction.

In 2000, the S&P fell more than 20% in twelve months.

In 2021, nearly the same. Even in 2018, which felt minor at the time, Europe and Japan beat the U.S. by almost ten points.

Today, the air is thinner, the crowd larger, and the safety nets fewer.

I’m not saying a crash is imminent. But when you’re standing at this kind of altitude, even a breeze can feel like a push.

🔥 Inflation’s Ember & September’s Gambit

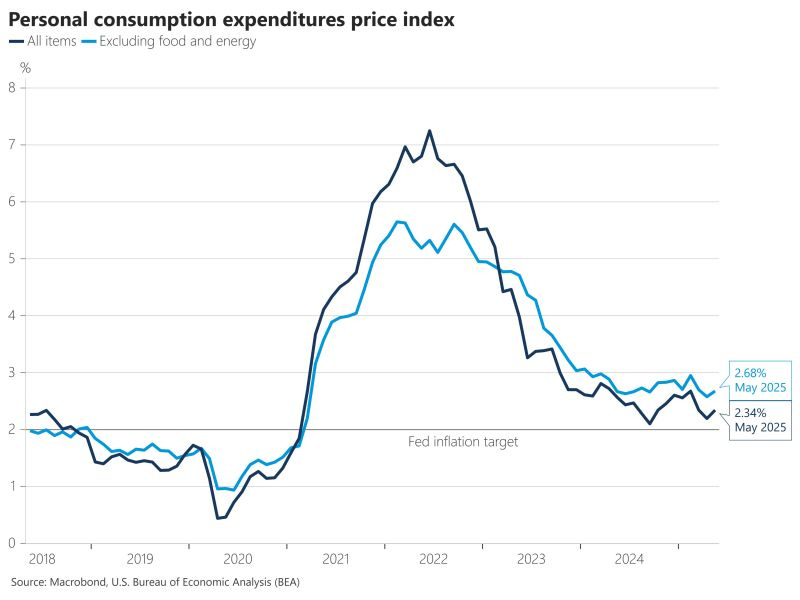

Then there’s inflation - quiet, but not dead. May’s PCE print showed a 2.3% Y/Y rise for the headline, with core inflation at 2.7%.

That’s not panic territory, but it is the first sequential uptick since February.

And that matters.

Because when inflation turns back up after cooling off, markets don’t just adjust - they recalibrate.

History gives us four clear episodes: 1997, 2004, 2018, and 2023.

In each case, Treasury yields jumped by around 40bps within six months.

Equities? They didn’t love it. A median 3% drawdown followed, with volatility clustering in ways that left scars.

And yet the market wants to believe.

Polymarket’s Reaction

Right now, investors are placing a 57% chance on a single 25 bp cut at the Fed’s September meeting.

That one cut has become the emotional anchor of the entire second-half equity narrative.

But in 2001, 2007, and 2020, when inflation was elevated and the Fed finally blinked, the real damage had already happened.

Equities were down 7-13% before the first cut.

Credit spreads had widened 60-80bps.

The first cut wasn’t a rescue - it was an obituary.

🌊 The Dollar Domino & an Oversized Deficit

Meanwhile, quietly and without fanfare, the FX market is setting up for a scene change.

The 120-day correlation between EUR/USD and the S&P just flipped negative - now at -0.19.

That’s a rare signal.

In the past twenty years, we’ve only seen it three other times: during the early days of the GFC, following the massive ECB QE announcements in 2015-16, and in the bond yield turmoil of 2019.

Each time, the euro rallied - often by 6 to 11% - and U.S. equities faltered.

It wasn’t always dramatic, but it was always directional.

Why does this matter now?

Because foreign pensions and asset allocators are still sitting on an estimated $3-4 trillion in unhedged dollar exposure.

That’s not a rounding error - it’s a structural imbalance.

And if they decide to hedge, even partially, that’s hundreds of billions in dollar outflows.

At the same time, the U.S. current-account deficit has surged to $450 billion in Q1, or 6.0% of GDP - levels we haven’t seen since 2006.

At an annualized $1.8 trillion, the U.S. is now absorbing the bulk of the world’s surplus savings.

If the music stops, those flows reverse.

What happened last time we had these kinds of deficits?

The broad dollar lost around 7% in the following year. This time, it could be more.

The macro floor beneath the dollar is crumbling.

🌠 Closing Reflection

All of this brings me back to the last time we saw this kind of cocktail: high valuations, sticky inflation, and twin deficits.

It was late 1999. The S&P eked out a 1.4% return over the next two years. Meanwhile, the MSCI World ex-US gained 15%.

Markets don’t repeat, but they do rhyme. And right now, the melody feels familiar.

Alessandro

Founder of Macro Mornings

What You’ll Get by Joining Macro Mornings Premium

🔸 Regular deep dives into economic indicators and geopolitical developments shaping today’s markets.

🔸 Exclusive, high-quality macro investment opportunities that focus on long-term growth, diversified risk, and the potential to outperform during various economic cycles.

⭐️⭐️⭐️⭐️⭐️ Special PROMO - Almost SOLD-OUT

⏳ Only 5 Investors Can Have Access

📝 Excellent score on TrustPilot

Becoming a Macro Investor Premium, You’ll Gain Access to:

Well-researched insights help you make smarter and more informed decisions .

All the tools you need right at your fingertips to build, track, and grow a resilient portfolio - helping you retire earlier and live life on your own terms.

Stop guessing, start investing with confidence, and enjoy a life free from financial constraints.

👋 Read my Financial Story

🙏📝 TrustPilot - Leave your review and share your experience - I’d means a lot for me!

✍ FREE

📚 Get your E-book FREE 👉 10 Simplified Strategies for Investors

🏆 PRO

🔏 Become a Macro Investor here | 💰 30% Off for Life - [🔥 Only 5 Spots Left! 🔥]

📚 The Art of Financial Freedom 👉 51 Macro Lessons to Success Your Future

💻 SOCIAL

🎙 PODCAST

Disclosure

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. This material has been prepared for informational purposes only. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.