Thanks for reading!!!

📌 As my subscriber you get totally FREE my Exclusive Premium Insights that I do and share only with you.

You won't find these materials shared by me on any other platform.

By subscribing you’ll join over 700 people who read Macro & Business Insights weekly!

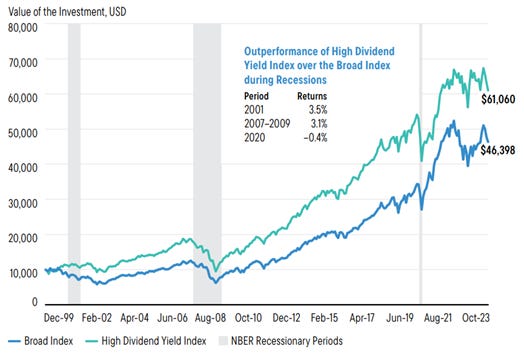

Dividends can provide stability and growth. Stocks with strong cash flows that support dividends become attractive when economic and growth uncertainty increases, which is likely to be the case if the economy slows in 2024.

Look for persistent income and emerging growth

HIGH DIVIDEND PAYING STOCKS ACCUMULATE MORE VALUE OVER THE LONG-TERM

Growth of $10,000 in MSCI US Index - Dividend Index versus Broad Index December 1999 - October 2023

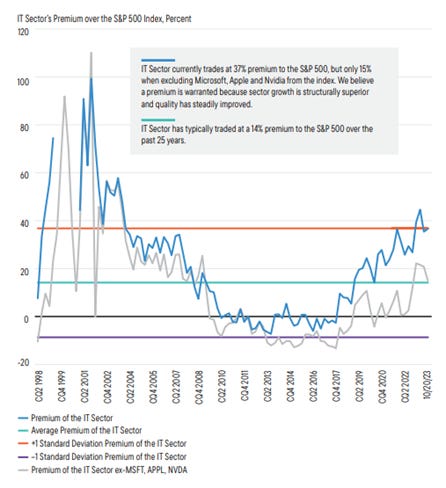

OPPORTUNITIES EXIST IN INNOVATION OUTSIDE OF THE LARGEST COMPANIES

A small number of high-performing companies continue to lead broad US indexes.

The promise of artificial intelligence, among other digital transformations in the economy, continue to propel these high-performing stocks.

However, the best future investment opportunities may lie in other technology companies, many of which appear more attractively valued relative to the largest names.

We believe research and security selection will be important to identify the best performers in 2024

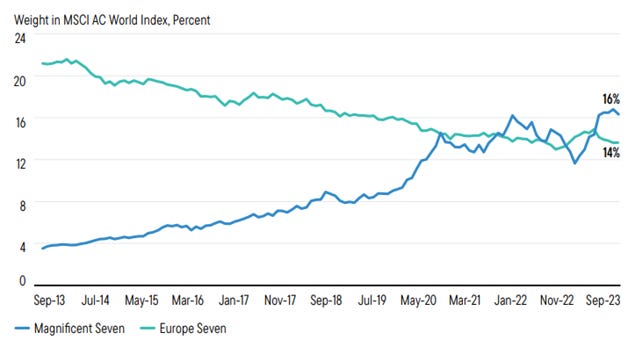

INTERNATIONAL OPPORTUNITIES ARE INCREASING AS GEOPOLITICS DRIVES RESHORING

The tendency toward more regionalized trade patterns and reshoring provides opportunities for countries like India and Mexico, which are direct beneficiaries of these trends.

Also, if the US dollar has peaked, its fall is likely to help global companies.

The fact that the “Magnificent Seven” stocks in the Unites States (Microsoft, Amazon, Meta, Apple, Alphabet, Nvidia, Tesla) have grown to be larger in aggregate than entire regions is in direct contrast to these trends and present an opportunity to diversify portfolios to better reflect economic reality.

🔍 READ THE FULL PAPER (DOWNLOAD)

💌 Sign up to my weekly email newsletter

🎙 PODCAST

Best regards,

Ale

Disclosure

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. This material has been prepared for informational purposes only. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.