Thanks for reading!!!

📌 As my subscriber you get totally FREE my Exclusive Premium Insights that I do and share only with you.

You won't find these materials shared by me on any other platform.

By subscribing you’ll join over 500 people who read Macro & Business Insights weekly!

🎯 (8 Investment Outlook) 3 Catalyst to look for 4Q23 👇

A PEAK IN RATES WOULD PRESENT A CATALYST FOR STOCKS TO RALLY

“The recent surge in interest rates has been the dominant driver across financial markets of late. This has been prompted primarily by a recalibration of expectations for upcoming Fed policy, with market sentiment getting sapped by Fed commentary suggesting monetary-policy settings will remain restrictive for longer than investors previously anticipated.”

The 10-year Treasury yield jumped above 4.6% at one point recently, its highest since 2007. After a decade and a half of ultra-low interest rates, this has come with some discomfort. However, we've seen these episodes of surging rates produce attractive catalysts for stock-market rallies over the last year and a half. Previous peaks in the 10-year yield in June and October of last year, as well as March of this year, were followed by healthy gains in equities in the ensuing months.

“If inflation continues falling and economic momentum softens in the coming months as we expect, then a drop back in rates could set the stage for a year-end rebound.”

Rising rates have weighed on stock returns, but peaks in 10-year yields have been a catalyst for stock-market rallies

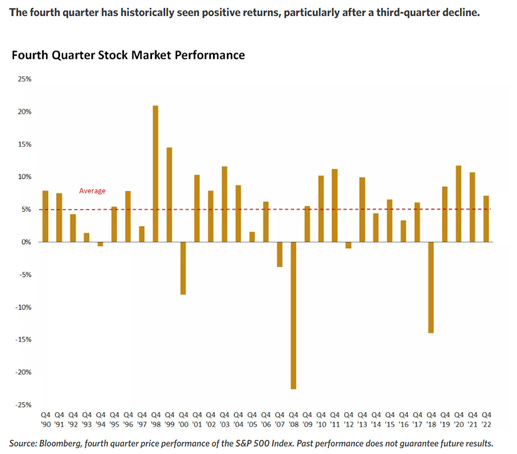

THIRD-QUARTER'S PAIN IS OFTEN FOURTH-QUARTER'S GAIN

If history is any guide, the market's story gets better from here, as weak third quarters have often been followed by a strong encore.

Since 1990, in the 11 years when stocks fell in the third quarter, the S&P 500 rebounded with a gain in the subsequent fourth quarter nine times, averaging an impressive return of 10.6% in the final three months of the year.

Small-cap stocks did even better in those years, averaging an 11.4% gain for the final quarter. 2000 and 2008 were the two instances in which the market fell in both the third and fourth quarters.

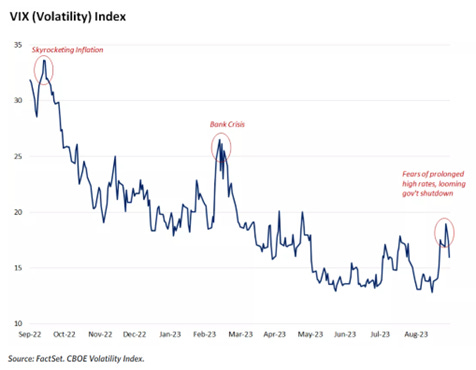

VOLATILITY INDEX INDICATES PESSIMISM, BUT NOT PANIC

After hitting a post-pandemic high in July, the stock market has pulled back by nearly 7% through August and September.

This is the third such dip in the last year, with stocks falling 7.8% in February-March and 7.3% last December.

However, after the Feb-March dip, the market rallied by 7.5% in the subsequent one month, and then rallied by 7.6% in the month after the December dip, highlighting the opportunities that can come from short-term pullbacks.

Despite the market pullback, volatility has remained below previous sell-offs

📢 If you are here I'm sure you already know these 10 lessons. My goal is to create a financial community that is passionate like you about investing and financial markets, and this guide is just one gift for beginning to master the financial markets.

⚡ I'm sure that you'll have a person in your life that has need to know these 10 investing lessons, so please I'd appreciate a lot if you can share it with them my premium and totally FREE newsletter curated only for you for get your definitive investing guide 🙏👇👇👇

💌 Sign up to my weekly email newsletter

🎙 PODCAST

Best regards,

Ale

Disclosure

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. This material has been prepared for informational purposes only. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.