Thanks for reading!!!

📌 As my subscriber you get totally FREE my Exclusive Premium Insights that I do and share only with you.

You won't find these materials shared by me on any other platform.

By subscribing you’ll join over 700 people who read Macro & Business Insights weekly!

The strong November run was supported by favorable news in all the right spots: inflation continued to trend lower, the Fed signaled that it doesn't have to keep tightening policy from here, the economy continued to defy the gravity of high interest rates, and corporate earnings came in better than expected.

In other words, the November rally has a backbone.

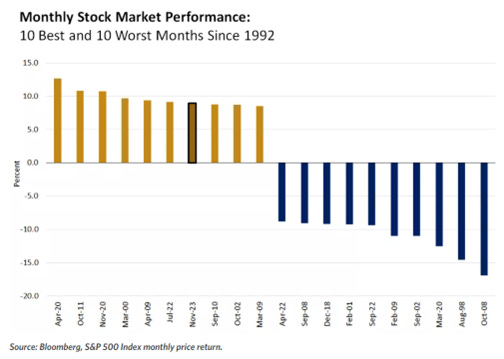

NOVEMBER PERFORMANCE WAS IN ELITE COMPANY

U.S. stocks gained 9% in November, the best month in nearly a year and a half, and the seventh-best monthly return in the last 30 years.

This was the second-best November performance during those three decades. The S&P 500 is up nearly 12% since the October 27 low.

A RUN AT NEW HIGHS?

With equities having touched a year-to-date high last week, the S&P 500 is now within 5% of the all-time high in January 2022.

We think the year ahead will bring some challenges (shifting Fed policy expectations, a potential economic growth scare, political and geopolitical uncertainties) that will spark periodic pullbacks, but a return to new highs is likely in the cards as we advance.

The upshot: Looking back at the recoveries since 1980, when the market finally reaches the previous peak, stocks have typically gone on to deliver a double-digit return in the ensuing year, reflecting, in our view, the progression of renewed economic, monetary-policy and earnings cycles.

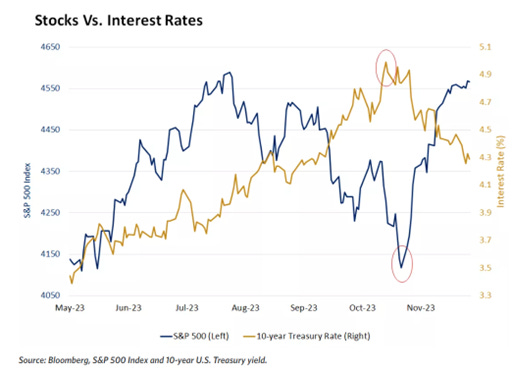

THE PEAK IN RATES JUMPSTARTED THE NOVEMBER RALLY

In late-October we believed rates could be peaking, which we believed would be a catalyst for a rally. One month an investment journey does not make, and we'll see if December can keep the momentum going.

But the forces that have supported the recent gains do have the potential to keep a wind at the market's back as we close out 2023.

🔍 READ THE FULL PAPER (DOWNLOAD)

💌 Sign up to my weekly email newsletter

🎙 PODCAST

Best regards,

Ale

Disclosure

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. This material has been prepared for informational purposes only. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.