💡 (7 Christmas Season Doubts) The consumer and their propensity to consume 👇

👇 Premium Exclusive Insights

Thanks for reading!!!

📌 As my subscriber you get totally FREE my Exclusive Premium Insights curated exclusively for you.

Please, if you wanna reward my work, support Macro & Business Insights with the link below.

It would means a lot for me and for this you’ll get totally FREE a 30 minute video call with me.

By subscribing you’ll join over 700 people who already read Macro & Business Insights weekly!

🎯 (7 Christmas Season Doubts) The consumer and their propensity to consume 👇

There are questions as to whether the consumer can continue to spend at the same robust pace

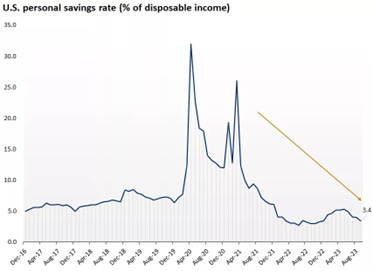

SAVINGS RATES HAVE DECLINED

According to the San Francisco Federal Reserve, households had accumulated about $2.1 trillion in excess savings in 2021. However, much of this may now be depleted, as consumers have spent on both goods and services over the past two years.

Household saving rates have also declined to near post-pandemic lows, as the chart below highlights, indicating that many consumers are spending much more than usual instead of saving.

While we haven't seen consumers pull back meaningfully on spending yet, if savings rates return to a pre-pandemic average of around 6% over time (from around 3.4% currently), consumption may naturally moderate as well.

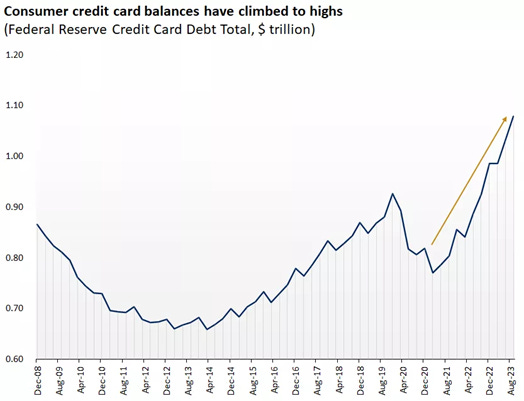

CREDIT CARD BALANCES HAVE INCREASED AND DELINQUENCIES ARE TICKING UP TOO

As personal savings rates have decreased, we have also seen consumers increase their overall credit card debt. The total credit card debt in the U.S. has risen to over $1 trillion as of the third quarter of 2023, its highest on record.

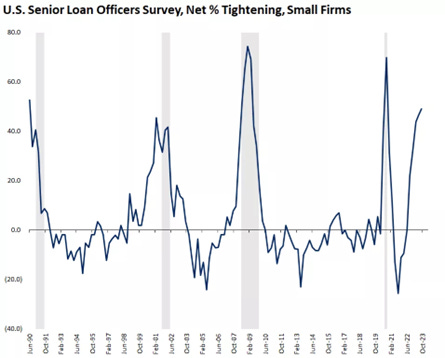

BANK LENDING STANDARDS REMAIN TIGHT

We know that consumers continue to face higher rates and tighter bank lending standards as well.

This naturally puts pressure on consumption, as those consumers and small businesses that could not qualify for a loan will not be pursuing the additional planned purchases, repairs, projects, etc.

As noted in the chart below, bank lending standards are elevated and in line with the standards seen in prior economic downturns.

💌 Sign up to my weekly email newsletter

🎙 PODCAST

Best regards,

Ale

Disclosure

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. This material has been prepared for informational purposes only. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.