💡 (6 Impressive Readings) - How Thanksgiving impacts the markets? 👇

👇 Premium Exclusive Insights

Thanks for reading!!!

📌 As my subscriber you get totally FREE my Exclusive Premium Insights that I do and share only with you.

You won't find these materials shared by me on any other platform.

By subscribing you’ll join over 700 people who read Macro & Business Insights weekly!

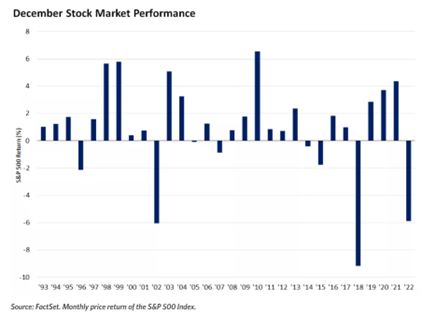

The stock market has historically done well after Thanksgiving. Over the last 30 years, the average return in December has been roughly 1%, with the market logging a post-holiday gain roughly three-quarters of the time.

When the market rose between Thanksgiving and year-end, it went on to deliver a positive return the next year 77% of the time, with an average return the following year of 11%.

The stock market comes into Thanksgiving this year on an upswing, adding to a strong year-to-date gain. Looking back to 1950, the market has come into the holiday season with a year-to-date gain of 20% or more 19 times. The average return in the following year was 17%.

IS SUSTAINABLE THE STOCK MARKET RALLY?

After a 10% correction in the S&P 500 through October, the month of November has been favorable for stock markets.

In fact, the S&P 500 is up over 7% for the month thus far, the Nasdaq is up over 9%, and even the Russell 2000 (small-cap stock index) has rebounded over 6%.

As we prepare our favorite Thanksgiving recipes, we also highlight three key ingredients that we think could help sustain the market rally through the typically seasonally stronger fourth quarter:

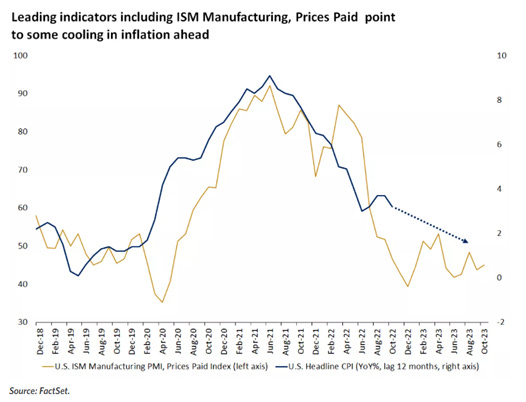

Ongoing moderation in inflation

A Fed that is stepping to the sidelines

A pinch of cooling in economic growth

A key ingredient to the rally has been easing inflation, which may continue to moderate

🔍 READ THE FULL PAPER

💌 Sign up to my weekly email newsletter

🎙 PODCAST

Best regards,

Ale

Disclosure

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. This material has been prepared for informational purposes only. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.