Hi all, and welcome back to The Macro & Business Insights!

What you’ll find in this episode:

Let’s try to shape 2023 road map

3 likely scenarios may happen this year

Asset Performance in the 3 scenarios

Expect the unexpected in 2023 and keep the Fed’s path top of mind.

2023 might have in store for investors, considering what the Fed may or may not do.

Real investment advice thinks there are three potential scenarios the Fed might follow in 2023.

The three scenarios determine the level of overnight interest rates and, more importantly, liquidity for the financial markets.

Liquidity has a heavy influence on stock returns.

The Road Map for 2023

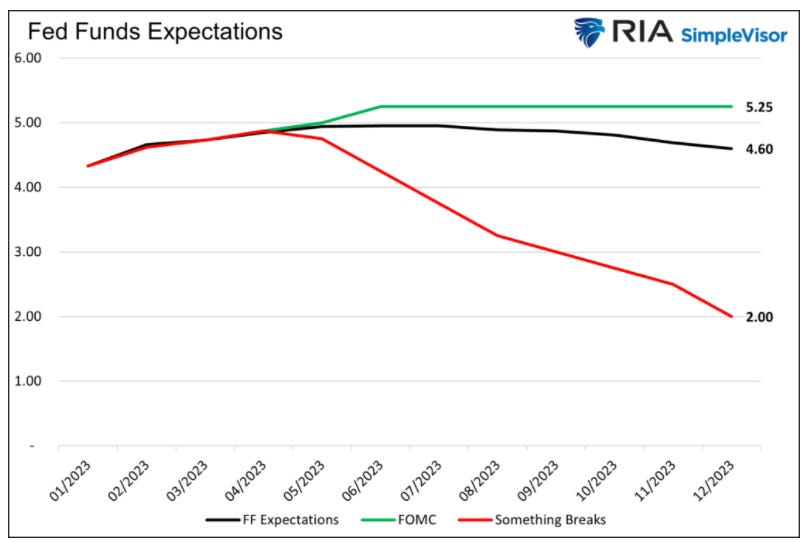

The graph above compares the three most probable scenarios for Fed Funds in 2023.

The green line tracks the Federal Reserve’s guidance for the Fed Funds rate. The black line charts investor projections as implied by Fed Funds futures.

Lastly, the “something breaks” alternative in red is based on prior easing cycles.

Scenario 1 The Fed’s Expectations

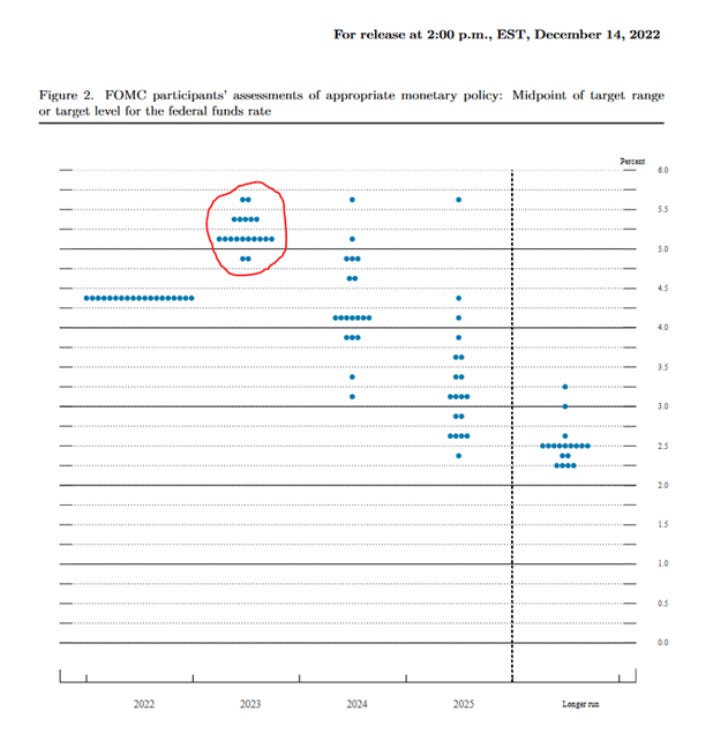

The dots represent where each member expects the Fed Funds rate to be in the future.

The range of Fed Funds expectations for 2023 is between 4.875% and 5.625%.

Most FOMC members expect Fed Funds to end the year somewhere between 5.125% to 5.375%.

Based on comments from Jerome Powell, the Fed seems to think Fed Funds will increase in 25bps increments to 5.25%.

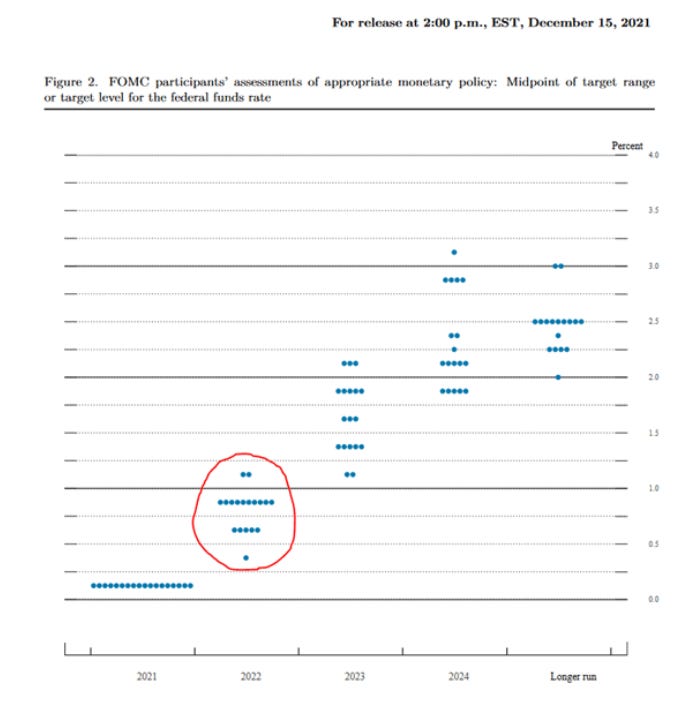

While investors place a lot of weight on the Fed projections, it’s worth reminding you they do not have a crystal ball. For evidence, we only need to look back a year ago to its 2022 projections from December 2021.

Scenario 2 Implied Market Expectations

The market thinks the Fed will raise rates to just shy of 5% in May and hold them there through July.

After that, the market implies increasing odds of a Fed pivot. By December, the market believes the Fed will have cut interest rates by about 40bps.

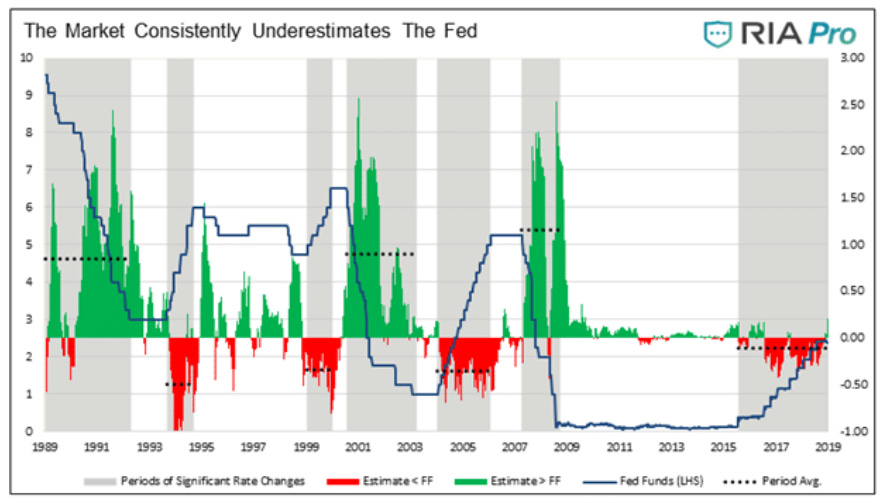

Like the Fed, the Fed Funds market can also be a poor predictor of Fed Funds.

During the last three recessions, excluding the brief downturn in 2020, the Fed Funds market misjudged how far Fed Funds would fall by roughly 2.5%.

Implied Fed Funds of 4.6% today may be 2% by December if the market similarly underestimates the Fed and the economic and financial environment.

Scenario 3 Something Breaks

There is a significant lag between when the Fed raises rates and when the effect is fully felt.

Economists believe the lag can take between nine months and, at times, over a year.

In March 2022, the Fed raised rates by 25bps from zero percent. Since then, they have increased rates by an additional 4%.

If the lag is a year, the first interest rate hike will not be fully absorbed into the economy until March 2023.

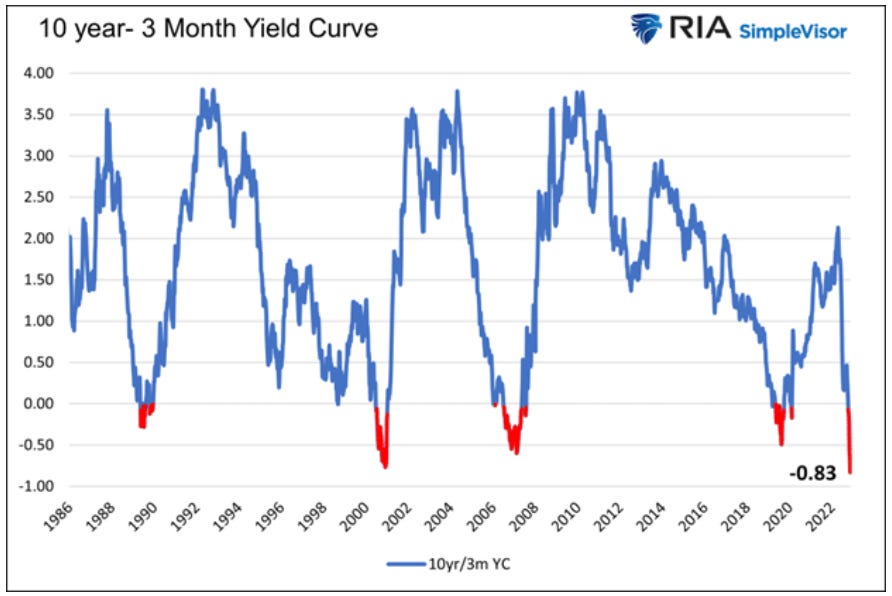

The yield curve is currently inverted to a level not seen in over 40 years.

It will un-invert; the only question is when and how quickly.

If you had like this piece and you want to read the whole advanced article I invite you to go on my website www.scriptamanent.blog (you can find the link button below), which you can find many more useful insights.

Best regards,

🔔 If you like my work, one simple thing that would make me very happy is if you’d bring only two friends/colleagues within our community - they might appreciate it and after all…it’s free!

Feel free to share my contents with anyone you think is might be interested with the link below!

🔍 We are a community of Macro & Business enthusiasts and lovers of Financial Markets.

💡 If you want even more free, valuable financial content you can also follow me on Twitter and visit my Website for more in deep analysis.

Disclosure

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. This material has been prepared for informational purposes only. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.