Thanks for reading!!!

📌 You won't find these materials shared by me on any other platform.

By subscribing you’ll join with thousands of Investors, Economic Professors and Aspiring Finance Student that reads weekly these insights.

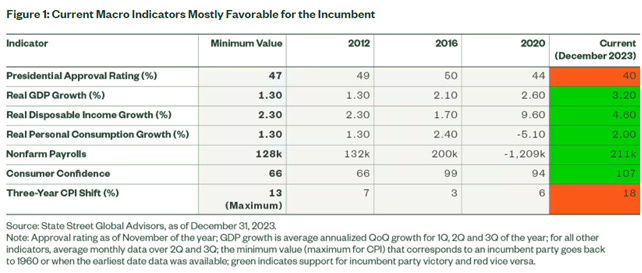

Macroeconomic performance has been a strong predictor of election outcomes, and it is still a good place to start.

At this point in the election cycle, the macroeconomic backdrop favors President Joe Biden more than what political polls suggest.

Most macroeconomic indicators date back only to the 1960s.

Most of these indicators measure economic well-being in real terms - so high inflation in 2021-2023 has negatively impacted these data points.

But with disinflation taking hold, these data points have been improving and typically the data from the first calendar half of an election year has the strongest predictive power.

INVESTMENT IMPLICATIONS

The most immediate impact of the election year will likely be on the budgeting process between the Republican House and the Democratic President, which means a slightly tighter fiscal policy will prevail over the course of 2024.

The FED start to cutting rates likely in the spring, driven foremost by disinflation but helped by election dynamics, which implies a slightly weaker US dollar compared to last year.

For US equities, presidential election years deliver an average annual price return of 6.8%, below the post-1948 average return of 8.8%.

This is a plausible outcome for 2024 in light of the late 2023 market rally having already brought many of the gains forward and the slightly weaker economic growth expected this year.

The bottom line is that this election season is likely to be a nail-biter, and markets could be in for a bumpy ride, both ahead of the election day as well as thereafter.

🔍 READ THE FULL PAPER (DOWNLOAD)

💌 Sign up to my weekly email newsletter

🎙 PODCAST

Best regards,

Ale

Disclosure

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. This material has been prepared for informational purposes only. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.