💡 (13 Chinese Markets) - Chinese stocks volatility is likely to remain characteristic in 2024 👇

👇 Premium Exclusive Insights

Thanks for reading!!!

📌 As my subscriber you get totally FREE my Exclusive Premium Insights that I do and share only with you.

You won't find these materials shared by me on any other platform.

By subscribing you’ll join over 700 people who read Macro & Business Insights weekly!

China's stocks have been among the world’s worst performers in 2023, with a year-to-date loss of 9% for the MSCI China Index.

CORPORATE INVESTMENT IN CHINA

The popular notion that western businesses have been pulling back on their operations in China in 2023 seems mistaken, after taking a deeper look.

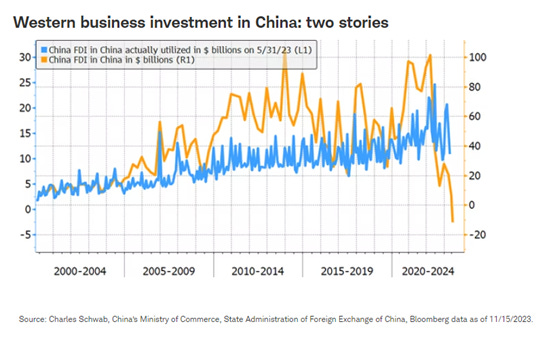

Foreign direct investment (FDI) into China has collapsed to a two-decade low, as measured by the balance of payments data depicted in the chart below by the orange line.

This broad measure of FDI includes not just investment in plants and equipment but also foreign firms' retained earnings (profits that are kept in China).

Fortunately, China's Ministry of Commerce publishes a separate measure of FDI that excludes retained earnings, focusing only on investment by foreign businesses utilized in production, shown as the blue line in the chart below.

IS CHINA INVESTABLE?

This year, investors may have feared that China was becoming un-investable.

ETF flow data from Blackrock shows U.S. investors have pulled back on their investment in Chinese stocks following this year's performance slump.

But at the same time, Western businesses have continued to invest in their China operations, Chinese policymakers have invested more in China's economic growth, and the Biden administration has invested in its relationship with China's leadership.

WHAT HAPPENED IN THE LAST >20 YEARS?

China emerged more fully on to the world's stage when the country entered the World Trade Organization in 2001.

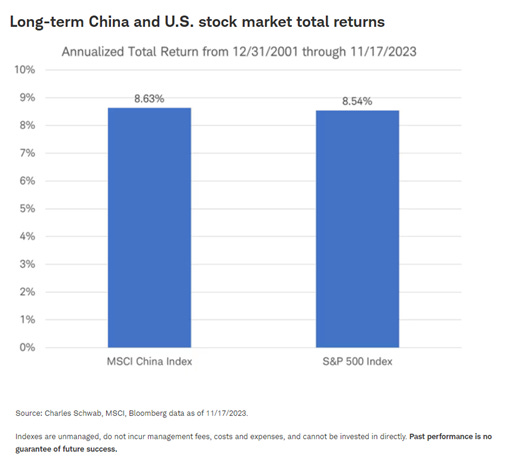

From the end of 2001 through the end of last week, the MSCI China Index has slightly exceeded the 8.5% annualized total return for the S&P 500.

But over those 22 years, China's stock market has been notorious for providing its gains in short surges of strong performance, amid longer stretches of underperformance that can give rise to concerns over investability.

An example of this was during the three-month period from the end of October 2022 to January 27 of this year, when the MSCI China Index jumped by 59.5%.

This makes attempting to time the investability of China's stock market very difficult, as well as timing investment in overall emerging market (EM) stocks since 30% of EM exposure is in China.

🔍 READ THE FULL PAPER

💌 Sign up to my weekly email newsletter

🎙 PODCAST

Best regards,

Ale

Disclosure

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. This material has been prepared for informational purposes only. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.